Last Updated November 21, 2024

For business owners, investors, and really any business stakeholder, staying on top of assets is pivotal in order to obtain a holistic understanding of a company’s finances. A business’s assets are considered anything that can be converted into cash (or cash equivalents).

Assets are, however, a bit more complex than this definition might sound, as there are two different types: fixed and current assets. It’s crucial not to confuse them with one another or think they’re interchangeable. Doing so will cause financial reporting errors and other accounting errors that could prove difficult and time-consuming to reverse.

We’ve put together this article to help you better understand the differences between fixed assets vs. current assets, so continue reading so you avoid mistaking one for the other.

What Are Fixed Assets?

Any tangible item that a business owns and uses to generate income is considered a fixed asset, also sometimes called a long-term asset. By definition, any asset that is guaranteed to last at least one year would be considered a fixed asset. However, fixed assets have varying depreciation cycles, the length of which depends on the type of physical asset.

What Are Some Examples of Fixed Assets?

Most fixed assets fall under the categories of property, plant, or equipment (PP&E), which can be found on a business balance sheet. To help you remember that PP&E are fixed assets, understand that the common denominator among property, plant, or equipment assets is that they are all tangible assets—they are all physical objects or properties that can be touched.

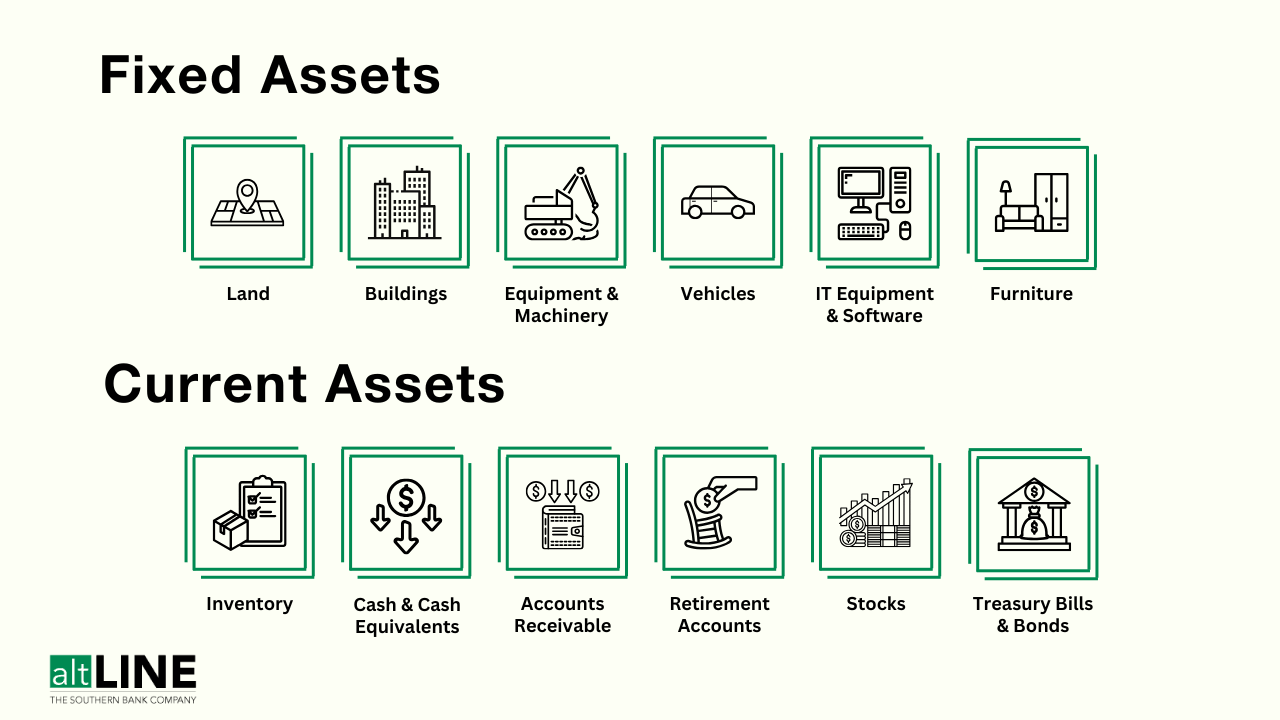

The most common examples of fixed assets include:

- Land

- Buildings

- Equipment and machinery

- Vehicles

- Software

- IT equipment (computers, monitors, etc.)

- Furniture

What Are Current Assets?

Unlike fixed assets, which are intended to last for at least one year before eventually depreciating, current assets are those that can be converted into cash or cash equivalents within one year. Also found on a balance sheet, current assets are equally important as fixed assets, given that the amount of current assets a business has obtained is a good indicator of said business’s liquidity and ability to pay-off short-term debt.

What Are Some Examples of Current Assets?

Examples of current assets, or short-term assets that can be converted into cash or cash equivalents, include:

- Cash

- Cash equivalents

- Accounts receivable

- Inventory

- Retirement accounts

- Stocks

- Treasury bills and bonds

- Any other liquid assets

Fixed Assets vs. Current Assets: What’s the Difference?

The following table can help summarize and visualize the differences between fixed assets vs. current assets:

| Fixed Assets | Current Assets |

| All fixed assets must be tangible | Not all current assets are tangible |

| Fixed assets are long-term assets that will last at least one year | Current assets are shorter-term assets (less than one year) |

| Includes non-liquid assets, but not all non-liquid assets are considered fixed assets | All liquid assets are considered current assets |

| Are not intended for immediate sale | Are intended to help finance day-to-day operations |

| Are expected to depreciate over time | Are typically valued at the current market value |

There are just a couple of the similarities between fixed assets vs. current assets:

- Both are found on a business balance sheet

- Both are important for current and prospective investors and principals (owners, part-owners, founders, or CEOs of a company) to evaluate a business’s financial standing

Fixed Assets vs. Liquid Assets

There’s another subcategory of assets: liquid and non-liquid assets. Liquid assets can be converted into cash quickly and easily (similar to current assets), while non-liquid assets cannot (similar to fixed assets).

Therefore, the main difference between fixed assets vs. liquid assets is that the latter can be converted into cash quickly, while fixed assets cannot and are instead designated for long-term use. Additionally, liquid assets get reported based on current market value, while fixed assets are more to do with long-term value, being reported based on depreciation over time.

We can point to checking accounts and most savings accounts as common examples of liquid assets. Many investments and investment accounts are considered liquid as well. Though for an investment to be considered a liquid asset, individuals must be able to easily withdraw funds from that investment without fees or penalties.

The Importance of a Balance Sheet

A balance sheet has been referred to multiple times throughout this article. If you’re a new business owner and are still in the earliest stages of developing your business blueprint, ensure you understand the importance of a balance sheet, which is one of the three main financial documents all businesses should have readily available. The other two main business financial documents are a profit and loss statement and a statement of cash flow.

A balance sheet lays out all of a business’s assets, liabilities, and owner equity on a single financial document. It is used to assess a company’s financial health and provide a quick overview of what the company owns, its debts, and its shareholder investments. The balance sheet is extremely important for existing and prospective principals, investors, and lenders when making financial decisions concerning the company.

In-Summary: Fixed Assets vs. Current Assets

Learning the differences between fixed assets vs. current assets is essential for effectively managing a company’s finances or running a business. Knowing how to properly categorize your assets and distinguish one group from the next, such as the examples shown above, is required because it provides a clearer picture of a company’s financial standing. It also reveales exactly which assets can be converted into cash quickly if a company is suddenly short on funds.

Fixed Assets vs. Current Assets FAQs

Is accounts receivable a current asset?

Yes. On a business balance sheet, you would find accounts receivable listed under current assets.

The reason for this is that accounts receivable is a part of a business’s short-term liquidity, as they are expected to be collected and then converted into cash within one year, which is how current assets are defined.

Is accounts payable a current asset?

Accounts payable is not considered a current asset because it is a liability rather than an asset.

Accounts payable is the money a business owes to its suppliers or lenders for goods or services received. Since accounts payable is almost always expected to be settled within one year, it is instead considered a current liability.

Is equipment a current asset?

Equipment is a fixed asset, not a current asset. Since current assets are expected to be sold and converted into cash within one year, that leaves anything meant for long term use—such as property, plant, and equipment (PP&E)—as fixed assets.

Are fixed assets considered current assets?

No. Fixed assets and current assets are not the same. Current assets are short-term assets that contribute to a business’s liquidity, meaning they can be converted into cash or cash equivalents. Fixed assets are acquired for long-term investment and are not expected to be converted into cash quickly.

Are office supplies considered a current asset?

Whether office supplies should be considered a current or future asset comes down to one question: Are they currently being used?

If the answer is yes, they can be considered a current asset in your financial statements. If they are for future use, they would not be a current asset, and if they have already been used, they should be considered costs or expenses. Because there are some differing opinions on whether office supplies are considered current assets, it’s important to meet with your business accountant or accounting team for clarification and consistency.

You might find that some individuals don’t consider office supplies assets at all, regardless of when or if they are used. Rather, office supplies are sometimes categorized as expenses. Because office supplies have value, they can be considered an asset, but if you’ve purchased them from a supplier, they can be considered an expense.

As a business owner or member of the accounting team, you or your team should work together to determine which category office supplies fall under. Whether an asset or expense, do ensure that you’re being consistent. Also, make sure not to confuse office supplies with inventory, as inventory is included as an asset.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.