Invoice Factoring Advantages and Disadvantages

Last Updated May 29, 2024

Invoice factoring can help business owners fill the gap between when an invoice is created and when the customer actually pays. Obtaining cash to invest back into your company sooner rather than later is one of the main advantages of factoring, though you’ll want to be aware of potential disadvantages of factoring as well, such as extraneous fees and sneaky policies that some factoring companies might induce before sealing the deal.

In this guide, we’ll break down all of the benefits of factoring, so you feel confident you’re making the right decision when deciding whether or not to factor your invoices.

What Is Invoice Factoring & How Does It Work?

Invoice factoring is the process of selling unpaid client invoices to a factoring company in exchange for an immediate cash advance.

Factoring can be condensed into a few simple steps:

1. A business reaches a deal with a third-party factoring company (known as a “factor”) via a factoring agreement to sell existing and future outstanding accounts receivable to the factor.

2. Once the business invoices their customer, the business sends a copy of the invoice to their factoring company and is immediately advanced 80-90% of the value of the invoice.

3. When ready and able, the customer submits invoice payment to the factoring company (not their supplier).

4. Once payment is received and processed, the factor releases the remaining value of the invoice to the business, minus a small factoring fee.

Most companies factor receivables because a client takes too long to pay, disrupting cash flow. However, some businesses with reliable customers still choose to factor their receivables to increase working capital without sacrificing much in the long-term.

What Are the Advantages of Factoring?

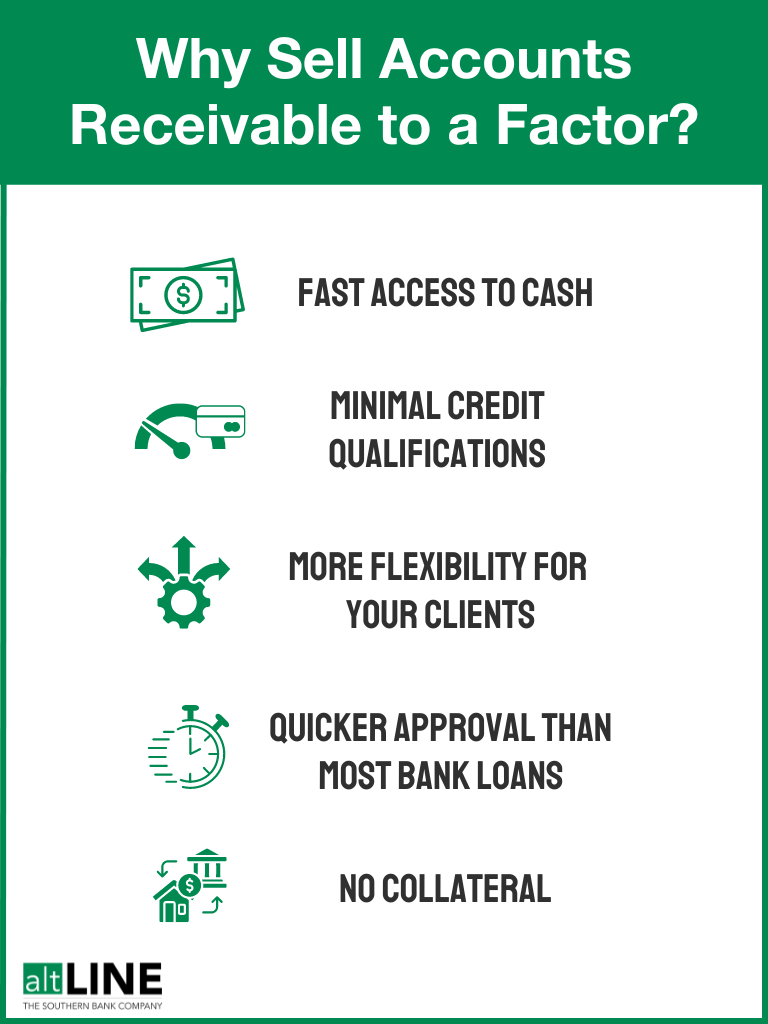

Whether you’re a small business owner or manage a large operation, factoring invoices can be a major asset for your B2B strategy. It offers benefits that other traditional lending options can’t provide, plus it is a more accessible solution for many businesses.

Below are some of the biggest advantages of factoring for B2B businesses.

Quick Cash for Your Business

Perhaps the most obvious reason why people turn to invoice factoring: it provides fast cash to keep processes running smoothly.

With invoice factoring, you receive a cash advance, while other alternative financing options such as invoice discounting provides a loan that you must repay.

There are legitimate reasons why a business owner would need to get access to the fast cash, such as:

- Paying employees

- Settling monthly bills

- Bringing in fresh inventory

- Expanding to a new location

- Helping manage overdrafts

In general, keeping cash on hand means you can say “yes” to a new opportunity, instead of passing it up because you’re waiting for funds to come through.

Easier Approval Than a Traditional Loan

Getting a loan can prove out-of-reach for businesses with limited collateral and a short financial history. However, invoice factoring companies pay the most attention to the credit scores of your customers. That means a faulty or nonexistent track record won’t matter as much when you apply.

According to altLINE Vice President of Operations Kelley Burnett, this is one of the most common reasons small business owners choose invoice factoring.

“Factoring offers an unprecedented opportunity to start or grow an existing business by focusing more on the creditworthiness of a client’s customer base,” Burnett said. “A factor knows that invoices purchased from strong, creditworthy customers will be paid back. A factoring facility relies on the strength of a client’s accounts to enable growth. This way, the only thing standing in the way of growing your business, is your ability to solicit and service new, creditworthy customers.”

The fact that almost any business – regardless of credit score or credit history – can get approved for invoice factoring is one of its main benefits and is why it’s such a popular financing method for new business owners and small business owners in particular.

More Flexibility for Your Clients

Increased cash flow for your company means you’re able to allow customers more leeway when it comes to settling on invoice payment terms. Instead of requiring immediate payment, you can give clients a month or more to complete the invoice, without worrying about the strain it’ll place on your own business.

Limited Risk for Your Business

Unlike a traditional loan, which requires collateral, invoice factoring is unsecured. Therefore, you won’t need to worry about valuable assets being seized if the customer fails to pay.

If the customer does fail to pay, most factoring companies such as altLINE will work with you to find a fair and sensible solution. This, however, is where factoring with recourse vs. factoring without recourse becomes relevant.

Highly Accessible

After you initially set up an account with an invoice factoring company, you should be able to receive cash within hours of submitting an invoice. Most factoring companies, including altLINE, allow business owners to manage this entire process online.

What Are the Disadvantages of Factoring?

Factoring isn’t always the best option for every business, particularly large companies. Be sure to weigh the potential drawbacks before determining what’s best for your business.

Here are some of the potential disadvantages of invoice factoring:

Potential Stigma Around Factoring

While invoice factoring is, at its core, a business practice like any other, some might find that it has a dark past. Certain lenders have been known to take advantage of clients with confusing language and dodgy practices, though industry standards have since evolved for more transparent transactions.

Reduced Profit Margins

The factor company basically takes a cut out of each invoice. Even though it can be as low as 1-3%, you’re still losing a bit of income in the long run which may affect your company’s monthly budget.

Customers’ Credit Scores Could Thwart Financing

Though the pressure to have good credit is off your shoulders, a factoring company will need to verify your customers’ creditworthiness before taking the invoice. If the rating isn’t up to snuff, your invoice factoring request might be denied.

Collection Isn’t Guaranteed

Just because the factoring company buys the invoice doesn’t mean the customer is guaranteed to pay. In some cases, you might be required to settle the bill if the invoice isn’t cleared. However, if you’re using non-recourse factoring, you won’t be responsible for any missed company payments; rather, the factoring company will accept responsibility.

Hidden Costs and Fees from Shady Providers

Not all factoring companies are the same, as some might try to take advantage of you. Application fees, processing fees, a credit check, and late payment fees can add up quickly. Even if you’re OK with the quoted factoring rate, be wary of additional costs and be sure to conduct thorough research before signing on. Make sure to read the fine print and ask questions up front.

Invoice Factoring vs. Invoice Financing: What’s the Difference?

The main difference between invoice financing and invoice factoring is how your invoices are treated. With invoice financing, you put them up as collateral for a loan. Meanwhile, in factoring, you sell invoices to the factoring company for a cash advance.

Factoring is generally quicker and easier to qualify for because the company will review your clients’ financial profiles instead of yours. However, invoice financing generally has lower fees than factoring.

Business Loans vs. Invoice Factoring: What’s the Difference?

While they are both viable financing methods for your company, business loans and invoice factoring have their own uses.

Business loans can take weeks to provide funding, meaning they are better for buying capital goods like equipment and office space. Meanwhile, factoring provides cash advances within 1 or 2 days, which makes it good for solving cash flow issues when clients are slow to pay.

In Summary: Advantages vs. Disadvantages of Factoring

The main advantages of factoring will be most applicable for small, B2B businesses for a few reasons. Firstly — because cash flow can get particularly tight for new companies attempting to grow — the cash flow boost provided by a factoring company can be extremely useful. Plus, smaller businesses can have a hard time qualifying for traditional bank loans. Factoring is a very accessible alternative financing option with much easier approval than those bank loans.

With that being said, here’s a recap of the advantages and disadvantages of factoring:

| Advantages of Factoring | Disadvantages of Factoring |

| Reliable access to quick cash | Potential for slightly reduced profit margins (typically 1-5% factoring fee) |

| Easier approval than most traditional bank loans, including for businesses with low credit or lack of credit history | Stigma surrounding invoice factoring or related alternative financing methods |

| Added flexibility for client payment terms | Low customer credit score could make your business ineligible to qualify |

| Limited risk for your business compared to most traditional financing methods | Collection isn’t guaranteed (when using non-recourse factoring) |

| Highly accessible – most factoring companies allow business owners to manage entire process online | Certain factoring providers can add hidden costs and fees, requiring need for due diligence related to finding a truthful provider |

Like any business practice, invoice factoring comes with pros and cons. Carefully consider the why behind your choice. Will it help your company grow and expand? Are you planning on investing the money back into your merchandise or employees?

If your answer is yes, the advantages of factoring likely outweigh the disadvantages. If you’re interested in learning how factoring can benefit your business, request your free factoring quote from altLINE.

Advantages of Factoring FAQs

Below are some of the most commonly asked questions about factoring your accounts receivable.

What is the main advantage of factoring?

Invoice factoring has several advantages, but the main advantage of factoring is the immediate cash flow boost it provides a business. Unlike many financing options, factoring does not require the borrowing business to tie collateral to the funds. For many business owners, this is the most enticing aspect of invoice factoring.

How much do factoring companies charge?

Generally, a factoring company will charge 1-5% (this is considered the “factoring fee”) of the total invoice value, depending on variables such as your factoring volume, invoice size, risk profile, and client credit. If your company factors many invoices and works with trustworthy clients, your fees will generally be lower.

What type of business typically utilizes invoice factoring?

At altLINE, we encourage small to medium-sized businesses to look into invoice factoring, as typically these are the businesses that would benefit most from quick cash flow boosts. It’s important to explore and weigh your options, so if you’re a business owner with questions about the factoring process, feel free to give altLINE a call at +1 (205) 607-0811.