Last Updated May 31, 2024

As a business owner, knowing your finances like the back of your hand is crucial during important decision-making processes.

Among the most important financial metrics that help business owners analyze their trajectory are gross profit and gross margin. Often, these two terms are used interchangeably and sometimes get confused with terms such as net profit margin and operating margin. Continue reading to find out how to calculate these metrics, learn the differences between gross profit vs. gross margin, and understand how they will help you evaluate the efficiency of your business’ operations.

What Is Gross Profit?

Gross profit, also referred to as sales profit or gross income, is the difference between revenue and cost of goods sold (COGS). One of the most important determiners for the financial success of a business, gross profit measures profitability and appears in any business’ income statement.

A high gross profit demonstrates an efficient business that is making good use of its materials and direct labor. Given 78% of business owners are preparing for a recession and its impacts in 2023, there is no better time to maximize profitability.

How to Calculate Gross Profit

To calculate gross profit, you will need your total revenue and cost of goods sold. The equation is as follows:

Gross Profit =

Revenue – Cost of Goods Sold (COGS)

When calculating, it’s important to know that “cost of goods sold” (COGS) refers only to costs directly related to production or shipping (also known as “variable costs”). Fixed costs such as rent, advertising, insurance, and office supplies are not taken into the equation.

Some examples of COGS include:

- Materials

- Direct labor

- Sales commissions

- Credit card fees

- Equipment, including depreciation

- Production site utilities

- Shipping

Gross Profit vs. Gross Margin

Both gross profit and gross margin (also known as gross profit margin) are calculated using the same two variables – revenue and cost of goods sold. They are equally useful in measuring a company’s efficiency in manufacturing activities and can help reveal areas in need of working capital.

The primary difference is that, while gross profit calculates a dollar amount, gross margin is expressed as a percentage.

How to Calculate Gross Margin

The formula for gross margin is as follows:

Gross Margin = ((Revenue – Cost of Goods Sold)/Revenue) x 100

For example, if a company has $1,000,000 in revenue and $500,000 in goods sold, the calculation reads as follows:

((1,000,000 – 500,000) / 1,000,000) x 100 = 50%

Gross Profit vs. Gross Margin Example

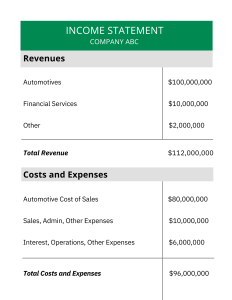

Below is an example of an income statement that shows a company’s total revenues, costs, and expenses.

This income statement would let the business owner easily calculate gross profit and gross margin.

First, you would need to calculate the gross profit by subtracting the COGS from the revenue. In this case, the COGS is the same as the “Total Costs and Expenses” found on the income statement above.

Gross Profit: 112,000,000 – 96,000,000 = $16,000,000

To calculate gross margin, you would need to divide the gross profit by the revenue and multiply that number by 100.

Gross Profit Margin: (16,000,000) / 112,000,000) x 100 = 14.28%

What is a Good Gross Profit Margin?

You might now be wondering – what is a “good” gross profit margin?

Well, it depends. For example, businesses within the manufacturing industry may find it easier to obtain a high gross profit margin than those in other industries, as they have more control of input costs and often specialize in a specific product, which lets them command a higher price for that product.

Since sectors vary, there is no one-size-fits-all “good” gross profit margin. However, one NYU study did show that the average across all industries lies at 36%. Highlighting the variance by sector, this study found that firms within the food wholesalers business had an average gross margin of 14.39%, while businesses within the healthcare products sector had an average gross margin of 57.74%.

What Factors Can Impact a Business’ Gross Profit and Gross Margin?

If you’re struggling with a less-than-ideal gross profit margin, you probably want to know why and how to improve it.

There are many contributing factors that can alter a business’ gross profit, but a few common causes include:

- Increase in product cost

- Increase in labor cost

- Change in accounting expenses

- Macroeconomic factors (interest rate fluctuations)

How Does Measuring Gross Profit and Gross Margin Help Businesses?

Calculating your gross profit and gross margin is a good business practice as knowing these metrics can help you identify opportunities to make your business more profitable. Below are a few items to consider when evaluating your gross profit and gross margin.

Pricing Decisions

An income statement showing revenue and COGS may clarify changes a business needs to make regarding pricing its products. If a business is selling high volumes but its revenue is too low, the gross margin will reflect that and make clear that the seller may need to rethink their pricing.

Cost Reduction

Examining gross profit and gross margin also tells business owners where or when they need to reduce costs. If the cost of goods sold is too high, resulting in a low margin, maybe you need to renegotiate prices with your suppliers.

Financial Planning

Whether drafting an income statement, calculating cash conversion cycles, or learning how to create a business cash flow statement, any form of financial planning helps business owners succeed. Understanding gross profit and gross margin are no different. Through measuring your company’s gross profit and gross margin, you can budget wisely and make more informed investment decisions.

Gross Profit Margin vs. Net Profit Margin

Now that we’ve learned gross profit vs. gross margin, we can briefly analyze the difference between gross profit margin and net profit margin. Both measures help business owners better understand their profitability, but net profit margin is a better measure of overall profitability, whereas gross profit margin is more limited and can be mostly relied upon to measure manufacturing profitability.

Why is this? Well, net profit is revenue minus all expenses, including interest, taxes, overhead fees, and operating expenses. Remember, gross profit margin only factors in variable costs, excluding fixed expenses such as rent and insurance.

The formula for net profit margin is as follows:

Net Profit Margin = ((Revenue – Cost of Goods Sold- Operating Expenses – Interest – Taxes/Revenue) x 100)

In-Summary: Gross Profit vs. Gross Margin

Gross profit differs from gross margin (or gross profit margin), which differs from net profit margin. Though they have just a few slight differences, learning these business metrics will help business owners in the long run.

- Gross profit is a defined dollar amount, while gross margin is calculated as a percentage.

- Gross profit and gross margin calculations do not include fixed costs such as rent, advertising, insurance, and office supplies.

- Net profit margin includes all operating expenses, including both cost of goods sold and fixed costs, such as overhead fees, taxes, and interest.

- Gross profit and gross margin help measure a business’ profitability related strictly to the manufacturing process.

- Net profit margin measures a business’ overall profitability.

As a reminder:

- Gross Profit Formula = Revenue – Cost of Goods Sold

- Gross Margin Formula = ((Revenue – Cost of Goods Sold/Revenue) x 100)

- Net Profit Margin Formula = ((Revenue – Cost of Goods Sold- Operating Expenses – Interest – Taxes/Revenue) x 100)

Gross profit and gross margin ultimately help business owners paint a picture of their financial health. These metrics help understand areas of improvement or success and allow business owners to make better-informed business decisions.

Looking to Grow Your Business by Improving Cash Flow? Give altLINE a Call

For some businesses, late customer invoice payments leave a lower net profit margin than desired. This is where an alternative financing method such as invoice factoring can help. With invoice factoring, businesses sell unpaid invoices to a factoring company, like altLINE, in exchange for a cash advance. This is a particularly common method of financing for small businesses who need an influx in working capital or are looking for a cash flow boost.

If you’re looking to improve your cash flow, give altLINE a call at +1 (205) 607-0811 or fill out our online factoring quote form. We have factored over $1B in invoices, and take pride in helping our customers reach their business goals.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.