Freight factoring is one of the most popular trucking business financing options. In fact, factoring has proven to be just as, if not more, effective than a standard bank loan or line of credit for carriers.

This guide will reveal why that is, while also answering the following questions:

- What Is Freight Factoring and How Does It Work?

- What Are the Benefits of Factoring Trucking Invoices?

- How Do Factoring Rates, Fees, and Funding Limits Work?

- What Do You Need to Qualify for Factoring?

- What Should You Look Out for When Choosing a Factoring Company?

Once you finish reading, you should be able to determine if your trucking company is a good fit for freight factoring.

What Is Freight Factoring?

Freight factoring, sometimes referred to as “load factoring” or “truck factoring,” is a popular alternative financing solution for small business owners. This involves business owners selling outstanding accounts receivable to a third-party factoring company (also known as a “factor”) in exchange for an immediate cash advance.

Factoring is available for use across many industries, but freight factoring is specifically tailored toward trucking business owners looking more for consistent, reliable cash flow and quick working capital boosts.

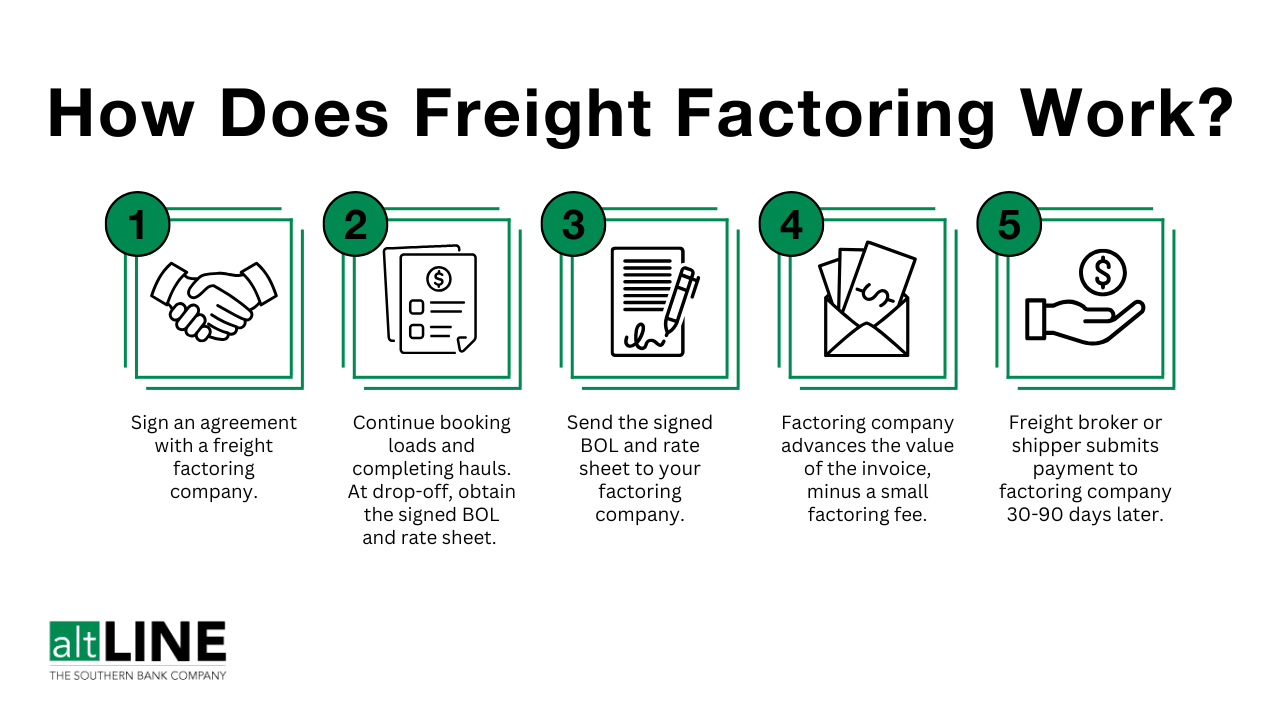

How Does Freight Factoring Work?

Freight factoring can be best described as trucking companies selling unpaid invoices for cash, allowing them to get paid for work much more quickly.

Here’s an overview of how the load factoring process works:

- After contract details are ironed out and approved, you can get to booking loads as you normally would. When finding loads, you’ll still need to get a rate sheet, and both parties will have to sign a Bill of Lading (BOL).

- Complete a haul.

- Send all the paperwork from the load, including the invoice, rate confirmation, and BOL to your factoring company or freight broker.

- Once you’ve sent the invoice, your factor will immediately advance your business the near-full invoice amount, minus the small factoring fee.

- Your broker or shipper submits payment to the factoring company, with timing depending on your payment terms (usually 30 to 90 days later).

What Does a Freight Factoring Company Do?

Trucking factoring companies do more than just purchase businesses’ outstanding invoices. They also assume collection responsibilities for all invoices that have been factored. This takes a significant amount of accounting responsibilities off business owners’ plates.

Freight factoring companies even perform free credit checks on owner-operators’ business partners. They do this with the intent to ensure brokers or shippers can be relied upon to pay their invoices. These complementary credit checks are another reason why many trucking businesses appreciate working with factoring companies.

Representatives from a good factoring company will work hand-in-hand with owner-operators to make the onboarding process as smooth and straightforward as possible, answering any questions or concerns throughout the partnership.

Turn your unpaid invoices into working capital for your business

Benefits of Factoring Your Trucking Invoices

The benefits of freight factoring vary based on a carrier’s needs and intentions behind factoring. For instance, one might look into factoring because they’re in a constant cycle of negative cash flow, while another might simply want a third party to shoulder some of their accounting load to take some work off their plate.

With that being said, below are some of the most common benefits of factoring invoices.

You Can Qualify Despite Bad Credit or Lack of Credit

Factoring is known for its easy, fast approval process.

Factoring companies focus more on your customers’ credit than your own. They simply want to ensure your customers are reliable to pay the invoices. Therefore, as long as your debtors have a solid credit history and haven’t shown a pattern of poor payment behavior, there’s a good chance you’ll qualify for freight factoring, even if you possess a subpar credit score yourself.

Get Paid Quicker

The most straightforward benefit of freight factoring is that it allows owner-operators to get paid quicker. Instead of waiting 30, 45, 60, or even 90 days for their business partner to pay for the services provided, factored freight bills are paid almost instantly, usually within 24 hours of submitting an invoice for funding.

You also won’t have to worry about being at home to collect physical checks for your load deliveries. Instead, you can opt for an ACH or wire transfer to get access to funds while on the road. Given truckers spend so much time away from home, this is a unique perk.

Improve Cash Flow

Getting invoices paid quicker improves cash flow for your trucking business. This is a critical benefit for small trucking businesses as 60% of small business owners have highlighted cash flow issues as one of their most pressing challenges.

Enable Growth

Maybe you want to expand your business operations, but you’re unable to do so because you never know when you’re going to get paid, so you can’t predict future cash flow.

This is where the cash flow predictability that freight factoring provides would especially come in handy. It allows you to take on that new customer, hire that new driver, or cover those operating costs because you know exactly when you’re going to be paid.

Back Office Accounting Support

Your factoring company will assume collection responsibility for the invoices you factor. This is a welcome aspect of freight factoring for owner-operators who already have a lot going on.

Representatives from your factoring company can also assist with other oversight responsibilities, like ensuring invoices are paid in full, payment is processed successfully, and your customers aren’t engaging in shady or fraudulent activity.

Factoring Is Not a Loan

Many owner-operators find that the most advantageous aspect of factoring is that it’s not actually a loan. This means you don’t have to file all the invoices you’ve factored under your list of liabilities. You also don’t have to fork over collateral (aside from the invoices themselves).

This is a perk that’s a rarity in the trucking industry, as the majority of financing solutions require significant collateral to be put up against loans, such as your truck, that you simply can’t afford to lose.

Free Client and Freight Broker Credit Checks

Not every funding method comes with a complementary credit check on your business partners, but factoring does. Carriers appreciate that factors will perform a credit check on their existing and potential brokers and shippers to determine reliability.

One altLINE customer noted that the credit check on her customers was actually her favorite part of factoring.

How Freight Factoring Fees Work

Freight factoring fees, terms, and funding limits will vary by the factoring company. In general, you can expect to pay 0.90% to 3.50% of the invoice value in factoring fees with altLINE.

You should expect the following fees included in every contract, regardless of your provider:

- Factoring fee: Covers all costs associated with factoring your invoices. This acts as the percentage of the invoice amount charged by the factoring company for providing immediate cash to your company.

- Initial filing fee/origination fee: Covers the time it takes the factoring company to devise your contract, set you up in their portal, and help you get started.

- Early termination fee: If you want to back out of your contract before it ends, a fee will be applied.

- Renewal fee: A small fee will be applied each time you renew your agreement.

Here is what will determine your exact trucking factoring rates and total cost for factoring:

- Length of time in business

- Total monthly revenue

- Business stability

- Duration of the factoring agreement

- Your debtors’ creditworthiness

- How long it takes your customers to pay

Freight Factoring Advance Rate

The factoring advance rate for carriers will fall between 99% and 100%. This means that nearly the entire value (if not all) of your outstanding receivables will be sent to you immediately once your factoring company receives each invoice. This is much higher than other industries because factoring companies like altLINE understand that margins are particularly thin in the freight world. Trucking companies need cash as fast as possible.

Tips for Reducing Your Rates and Fees

To ensure you get the best freight factoring rates, consider the following best practices:

- Do your research: The first factoring company that you hear about or come across in your Google search for best freight factoring companies might not be the ideal fit for your business. Don’t start and end with the first provider you hear about or come across.

- Don’t be afraid to negotiate: By doing your research and talking to multiple companies, you can compare rates, negotiate with providers, and then weigh which option makes the most sense for your business.

- Prioritize companies backed by a bank: Freight factoring companies with a bank affiliation not only are more regulated and less risky than independent companies, but they usually offer more competitive rates. Plus, you’re getting more value out of what you’re paying for.

- Read contracts diligently: Don’t just gloss over the finalized contract. Keep an eye out for things that you may not have discussed with your factoring partner so you aren’t caught off guard or charged extra.

- Take note of the window of notification: Companies have a window of notification for when you can notify them that you don’t plan to renew your contract. If you don’t notify them, they’ll assume you’re going to renew. Don’t miss the window, as you’ll avoid getting charged an early termination fee.

How altLINE’s Freight Rates Work

At altLINE, we determine freight factoring rates based on how much you plan to factor and how long your customers take to pay. Generally, we’ll offer lower factoring rates when you factor higher amounts and have customers that have a history of paying on-time. We also consider other things like your company’s age and overall customer credit profile.

Additionally, altLINE does not incur certain types of fees that many other factoring companies charge for, including debtor credit checks, invoice processing fees, and monthly access fees (regarding accessing your online customer portal).

Since altLINE is backed by a bank, we can offer competitive rates. We will work with you and offer the lowest, fairest rates possible when setting up your factoring agreement.

What You’ll Need to Qualify for Freight Factoring

Qualifying for load factoring isn’t nearly as difficult as for traditional business loans. Freight factoring is considered a no-doc business loan, which is a financing option that requires little to no documentation when applying.

However, there are a few steps when applying for factoring. Here’s a look at what carriers need to apply and quality for factoring freight bills.

1. Complete a Factoring Application

After you’ve filled out a quote form and spoken with a representative from a freight factoring company to ensure you’re a good fit, the first step is completing the freight factoring application. The following items are to be submitted:

- Business ownership identification

- Personal identification

- Employer identification number (EIN)

- Customer contract

- Articles of incorporation

2. List Existing and Potential Customers Whose Invoices You Plan to Factor

Since lenders are relying on your customers to pay their invoices, they’ll need some information about them.

Note that you might be required to factor your whole ledger. Still, some factors will allow you to be selective with the invoices you sell for cash. A lot of this depends on whether or not you meet their monthly funding minimum.

Regardless, you’ll need to submit a list of your customers. A freight factoring company like altLINE will review your customers and perform a credit check on each of them to determine eligibility.

3. Provide Your Accounts Receivable Aging Report

An accounts receivable aging report lists out all of your outstanding invoices by due date. Along with submitting a list of customers, owner-operators will pass this along to the factoring company, who will review aspects such as the length of payment terms and customer payment habits to determine freight factoring rates and fees.

An example of an AR aging report can be found below. It shows an account where 50% of customers are paying on-time.

| Days Past Due | Amount Due | % Total Accounts Receivable Value |

| 0 days | $60,000 | 50% |

| 1-30 days | $40,000 | 10% |

| 31-60 days | $70,000 | 30% |

| >60 days | $30,000 | 10% |

| Total: | $200,000 | 100% |

altLINE will work with owner-operators who have outstanding invoices up to 30, 60, or even 90 days. However, customers have to show a willingness and ability to pay.

Bank Freight Factoring Companies vs. Independent Freight Factoring Companies

The best factoring companies for truckers are those that are regulated, transparent, and fair. Factoring trucking receivables requires a bit of research and planning, particularly because there are two types of lenders that can fund your invoices: bank factors and independent factors.

Bank factors are almost always FDIC-insured, and they must abide by local and federal regulations. Independent factors are not affiliated with a bank, meaning they aren’t FDIC-insured and are far less regulated.

Independent factors might use third-party funds to finance your invoices, which can result in additional risk and higher factoring rates.

When factoring trucking receivables, it’s wise to partner with bank factors for added protection.

Interested in Factoring?

Turn your unpaid invoices into working capital so you can keep growing your trucking business.

Freight Factoring Contracts

A freight factoring contract, or a factoring agreement, is the final step of the application process. Before signing on the dotted line, it’s important to understand how these contracts work and what you should look out for.

Read the Fine Print and Know Your Obligations

While many factors won’t require you to include all of your outstanding AR in the agreement, you must be willing to submit information about your business and your clients. This will benefit you, since the factor can then work with you to understand your exact funding needs so that you’re not factoring too much or too little.

Note that many factors will have a monthly minimum that you’ll be expected to meet. In the case you believe your agreed-upon monthly minimum needs to change, you can discuss with your factoring company and potentially renegotiate the contract.

Avoid Long-Term Freight Factoring Contracts

One tip for carriers in the market for a factoring company is to keep an eye out for contracts that lock you in long-term. The standard freight factoring contract is 12 months. Shorter or longer contracts can be offered on a case-by-case basis, but if you’re offered a contract 2 years or longer, you should be given a valid reason or look for a shorter contract elsewhere.

You don’t want to get locked into a contract that’s too long. Unexpected shifts in sales and revenue can happen to even the most successful carriers, so it’s crucial to avoid multi-year contracts in the case of major working capital changes for your business.

Understand How to Get Out of a Factoring Contract if Needed

Early termination fees will be included in any factoring contract. These are necessary fees to protect the factoring company. Keep an eye out for the exact variables of an early termination fee to be outlined in your invoice factoring agreement.

Getting out of a freight factoring contract will involve different procedures on a case-by-case basis, depending on the factoring company you’ve partnered with.

Note the Window of Notification Prior to an Auto-Renewal

Make clear the window of notification when finalizing your contract. This is the period of time where you can send a letter of release and back out from a factoring agreement prior to your contract automatically renewing without any fees.

If you’re in a position where you want to back out, you’ll need to do so within the window of notification or else the contract will typically auto-renew. This is often the date your contract was signed the following year (for example, if you sign a one-year contract on June 24, 2023, auto-renewal is June 24, 2024).

How to Determine If Your Trucking Company Is a Good Fit for Freight Factoring

Any trucking business struggling with negative cash flow or insufficient working capital that qualifies can benefit from factoring their loads. But there are some carriers that may be a better fit than others.

Solo owner-operators who are still in the startup or small business phase of their company can be a perfect fit for factoring freight bills. Many of these startup trucking business owners cannot qualify for traditional bank loans due to factors that are often out of their control, such as insufficient credit history or revenue. Since freight factoring eligibility isn’t solely determined by aspects such as credit score or business revenue, it becomes an ideal alternative.

Trucking business owners who are looking to fund expansion efforts can also greatly benefit from factoring their invoices. Unlike most lending solutions, factoring doesn’t require collateral (aside from the invoices themselves). This means that trucking companies in the growth phase don’t need to sacrifice valuable equipment, trucks, or other assets in order to receive funding assistance.

Alternatively, large, established trucking businesses may have needs that surpass funding limits enforced by most trucking factoring companies. These larger businesses, with increased financial needs, might have to turn to more traditional options with higher limits.

| Scenario | Is your business a fit? |

| New owner-operator with only one truck but few funds | ✅ |

| Small trucking business in a growth period looking for a cash flow boost to provide a financial safeguard | ✅ |

| Medium to large, established trucking companies with greater funding needs than a factoring company can provide | ❌ |

| Trucking companies with brokers or customers who aren’t reliable to pay on-time (or pay at all) | ❌ |

Questions to Ask Every Freight Factoring Company Before Signing an Agreement

Trucking factoring has proven an incredibly effective funding solution for owner-operators, but it’s vital to do your due diligence before signing a contract. This involves knowing the right questions to ask.

You should know the answers to the following four questions when weighing top freight factoring companies against each other:

1. “Are You a Bank Factoring Company or an Independent Factoring Company?”

A bank factoring company vs. independent factoring company is a crucial distinction that you should make clear from the beginning of your communications with a factor. The differences between the two are significant.

For example, a bank factor like altLINE is FDIC-insured and heavily regulated at the local and federal levels. This means more reliable funding on your end, since it’s known where that money is coming from. An independent factoring company, on the other hand, typically isn’t nearly as regulated as bank factors. An independent factor’s funds often come from third parties, and since they aren’t as regulated, there can be less transparency in the factoring process.

2. “Will I Have to Factor My Entire Ledger?”

One aspect of a factoring agreement that differs between companies is whether or not you’ll be required to factor your entire ledger. This is often the case because a certain freight factoring company might have a monthly minimum that you would only be able to meet if you factored all of your invoices. Another company might have a lower minimum and allow you to factor select invoices.

3. “Do You Offer Recourse Freight Factoring, Non-Recourse Freight Factoring, or Both?”

There are two types of freight factoring: recourse factoring and non-recourse factoring.

If working on a factoring agreement with recourse, you will be held responsible for any funds that your customer fails to pay in the case of missed payment. With non-recourse factoring, the lender will be liable for any non-payments.

Most bank factoring companies implement recourse factoring. Confirm with your provider prior to signing a factoring contract and read said contract thoroughly.

4. “What Are Your Monthly Minimum and Maximum Funding Limits?”

A freight factoring company is likely to have monthly minimum and maximum funding limits in place for their customers. It’s imperative that you know what these are before signing a freight factoring agreement. Failure to abide by the minimum can eventually lead to a penalty, or the eventual end of a factoring partnership.

If you have any questions at all before signing a factoring agreement or about the process in general, feel free to reach out to our team at (205) 540-9471. Jennifer Fink, altLINE freight factoring operations manager, would be happy to advise you during your search and ensure that factoring is the right fit for your company.

Freight Factoring With altLINE – How We Can Help You Achieve Your Trucking Business Growth Goals

altLINE by The Southern Bank is a factoring company with more than 80 years of experience serving clients. We pride ourselves on our customer service, attention to detail, and transparency when working with business owners.

If you run a trucking company and need funding, you can fill out our free quote form or call one of our representatives at 205-590-9471 to get further details.

Even if you are unsure if load factoring is the best option for your freight company, our representatives are happy to discuss the option further to help you make the best decision for your business.

Freight Factoring FAQs

Below are some of the most commonly asked questions about freight factoring.

Is freight factoring considered a loan?

No, freight factoring is not a loan. Freight factoring involves a third-party factoring company actually purchasing your invoices at a discounted rate. In return, trucking businesses are advanced the majority of each invoice’s value.

What are average freight factoring rates?

Average freight factoring rates will vary by factoring company. Generally, you should expect to pay 0.90-3.50% of the value of each invoice in freight factoring fees. The exact number will vary based on a few aspects, such as your brokers’ or customers’ creditworthiness, how much of your ledger you’ll be factoring, and the age of your business.

Do freight factoring companies perform credit checks on my customers?

Yes, freight factoring companies will perform credit checks on your brokers and customers. This is an essential step of the qualification and onboarding process. A credit check mitigates risk for factoring companies, ensuring they aren’t buying invoices with payments owed by unreliable customers who regularly fail to pay for goods or services.

What is the difference between freight factoring and Quick Pay?

Both freight factoring and Quick Pay are aimed to improve cash flow for trucking businesses, but freight factoring services actually provide owner-operators with funds even faster (usually within 24 hours) than Quick Pay (usually 2 to 5 business days).

One main difference is that Quick Pay involves brokers fulfilling invoice payments, whereas with factoring, it’s a third-party factoring company advancing the value of each invoice, not a broker. Additionally, brokers can only offer Quick Pay for their own loads, while factoring companies can offer services for invoices from any broker or customer. This allows for greater flexibility.

Plus, factoring companies assume collection responsibilities for all of the invoices factored, and they even assist with accounting-related tasks for those payments.

How do you switch factoring companies?

The simplest way to do so is by notifying your existing factoring company before your window of notification ends and your contract is auto renewed.

If you must switch factors immediately, this will likely prompt an early termination fee. But if you find better pricing elsewhere with a better level of service, or perhaps increased industry knowledge, this could be worth it. Before ending a factoring agreement, it’s best practice to be transparent with your provider to discuss options.

What is the difference between recourse and non-recourse freight factoring?

With recourse freight factoring, the business utilizing a third-party factoring company’s service is responsible for any customer non-payment. With non-recourse factoring, the factoring company is financially responsible for the lost funds in the situation in which a customer fails to make payment.

What are some of the most common trucking business funding options for new owner-operators?

Some of the most popular options include freight factoring, accounts receivable financing, equipment financing, and business lines of credit. Freight factoring is a common solution for new owner-operators, as qualification isn’t wholly dependent on creditworthiness, revenue, or collateral.

How do carriers use cash advances from factoring?

Carriers can use their freight factoring cash advances in many ways! Some use it to hire more drivers, others use it to pay overhead costs, while others use it for business expansion purposes.