Last Updated April 9, 2025

Key Points:

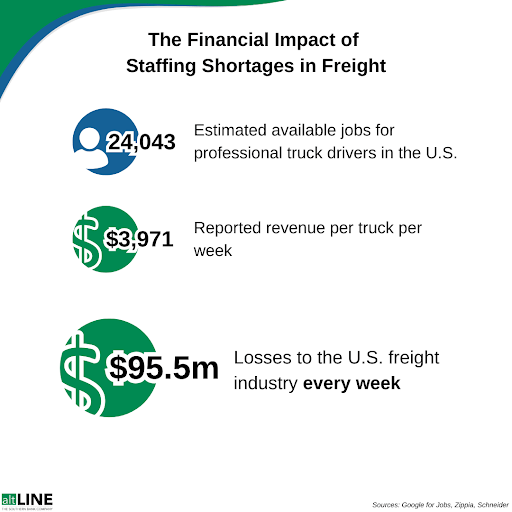

- The U.S. has a staffing shortage of an estimated 24,000 professional truck drivers.

- Because of this, the U.S. freight industry misses out on $95.5 million every week.

- The industry’s theoretical potential is $50 billion higher than its current revenue.

- Missouri has the highest demand for truckers in the country.

- Nebraska has the readiest supply of truckers – where trucking jobs can be filled fastest.

Every day in America, hundreds of thousands of tons of goods fail to be delivered due to a labor shortage in the trucking industry. Delays in freight delivery have knock-on effects across nearly every sector of the American economy, but the costs of missed business opportunities in the freight industry due to staffing gaps are enormous. We set out to investigate how much the trucking staffing crisis is costing the U.S. economy every single week.

The True Cost of an Empty Seat

How much money is lost due to understaffing in the trucking freight industry? To answer that, we need to know how many truckers are missing from the workforce at any given moment. By understanding and analyzing the job market across America, the gap between supply and demand in freight staffing can be observed, and the economic losses can be estimated.

At any given moment, there are thousands of truck driver roles available in America, many of which are advertised online on job listing websites. However, the online job market isn’t the full picture. According to the online job search site “Zippia,” the number of jobs found on these sites is only slightly more than 1/4 of the actual number of available jobs. 70% of jobs are never posted online at all, instead being advertised through in-person connections and other services such as staffing agencies.

We scraped the largest job listing aggregate on the web and found 7,213 truck driver jobs being advertised each day, suggesting a potential continuous deficit of 24,043 truckers.

Multiply this by the reported $3,971 revenue per week for every truck that is not being manned, and we arrive at the true cost to the freight industry – $95.5 million every single week.

Unrealized Potential: What Full Utilization Could Deliver

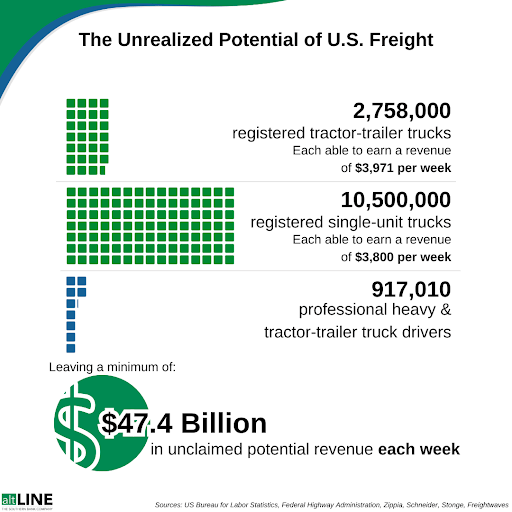

Imagine if cargo and drivers were in abundance, and every registered truck in the U.S. was in good condition and operating at capacity – what could this upper limit of the freight industry look like? We used census data to reveal the economic potential of the industry with the current number of trucks registered for freight.

When only tractor trucks are considered – the heaviest weight class of trucks – the vehicles already outnumber professional truckers by more than 3-to-1. Add in the roughly 10.5 million other heavy trucks, and the amount of vehicular hardware going unused in the U.S. starts to hit home. Straight trucks generate slightly less revenue per week compared to their heavier counterparts, but the sheer number of them going unused adds a whopping $39.9 billion to the tractor trucks’ potential $7.3 billion, giving a total potential loss of almost 50 billion USD every week.

This number is merely hypothetical, but it is powerful in demonstrating the huge discrepancy in truck availability between truckers and drivers. Millions of trucks sit idle in the U.S. every day, and each one represents a missed opportunity and losses for the freight industry and many more losses further down the supply chain.

In the grand scheme of things, these theoretical losses reveal a broader systemic issue: the underutilization of an infrastructure vital to economic stability.

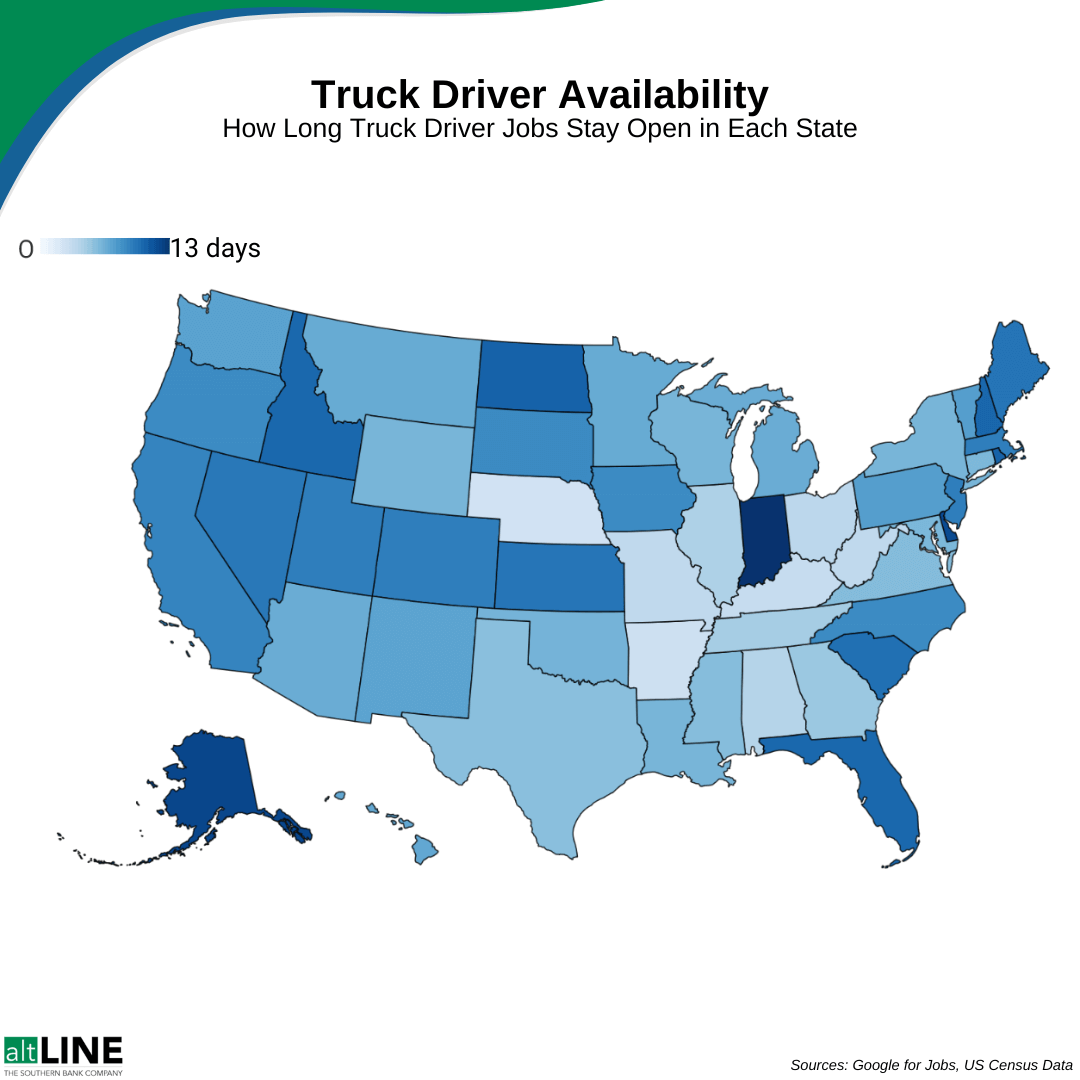

Mapping the Missing Drivers

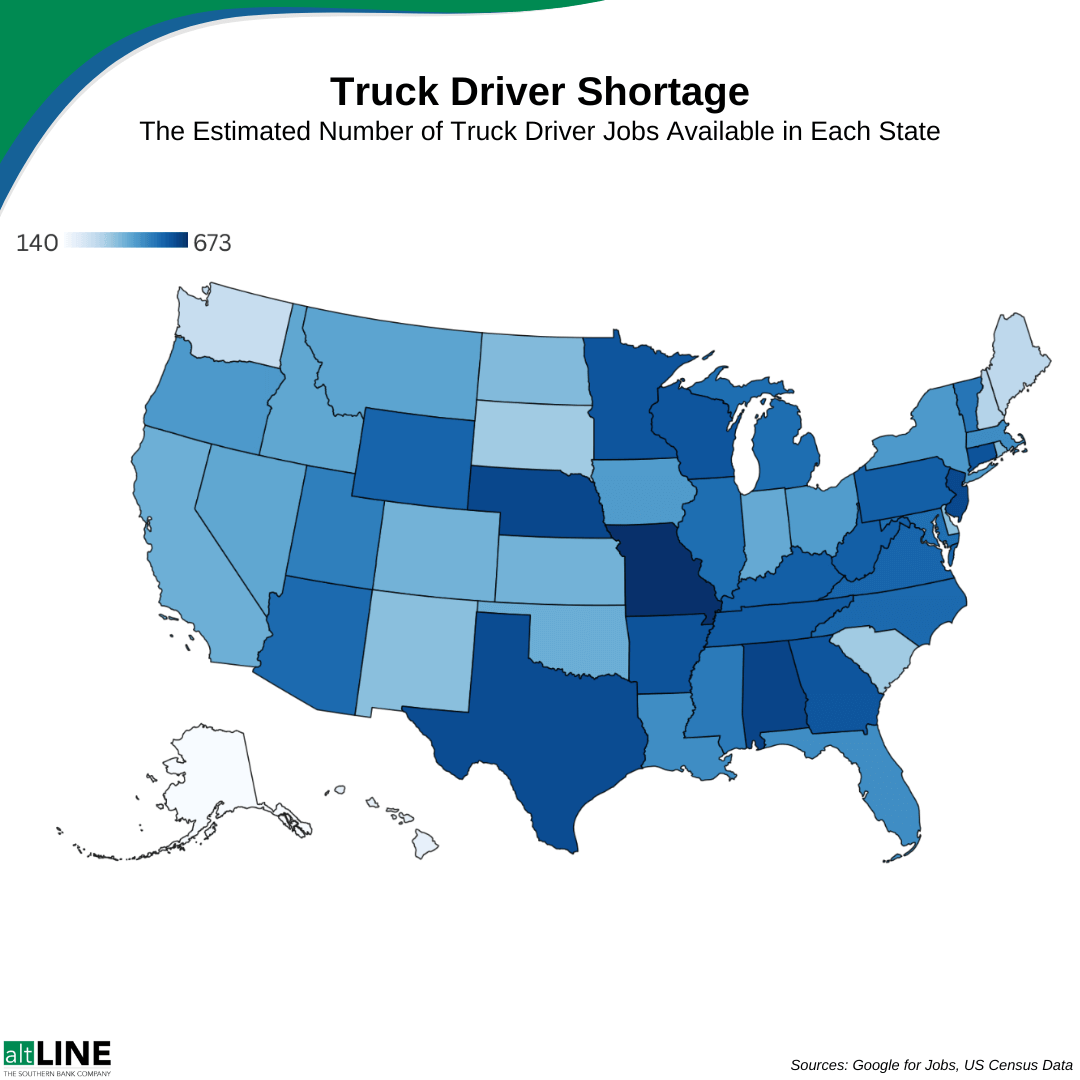

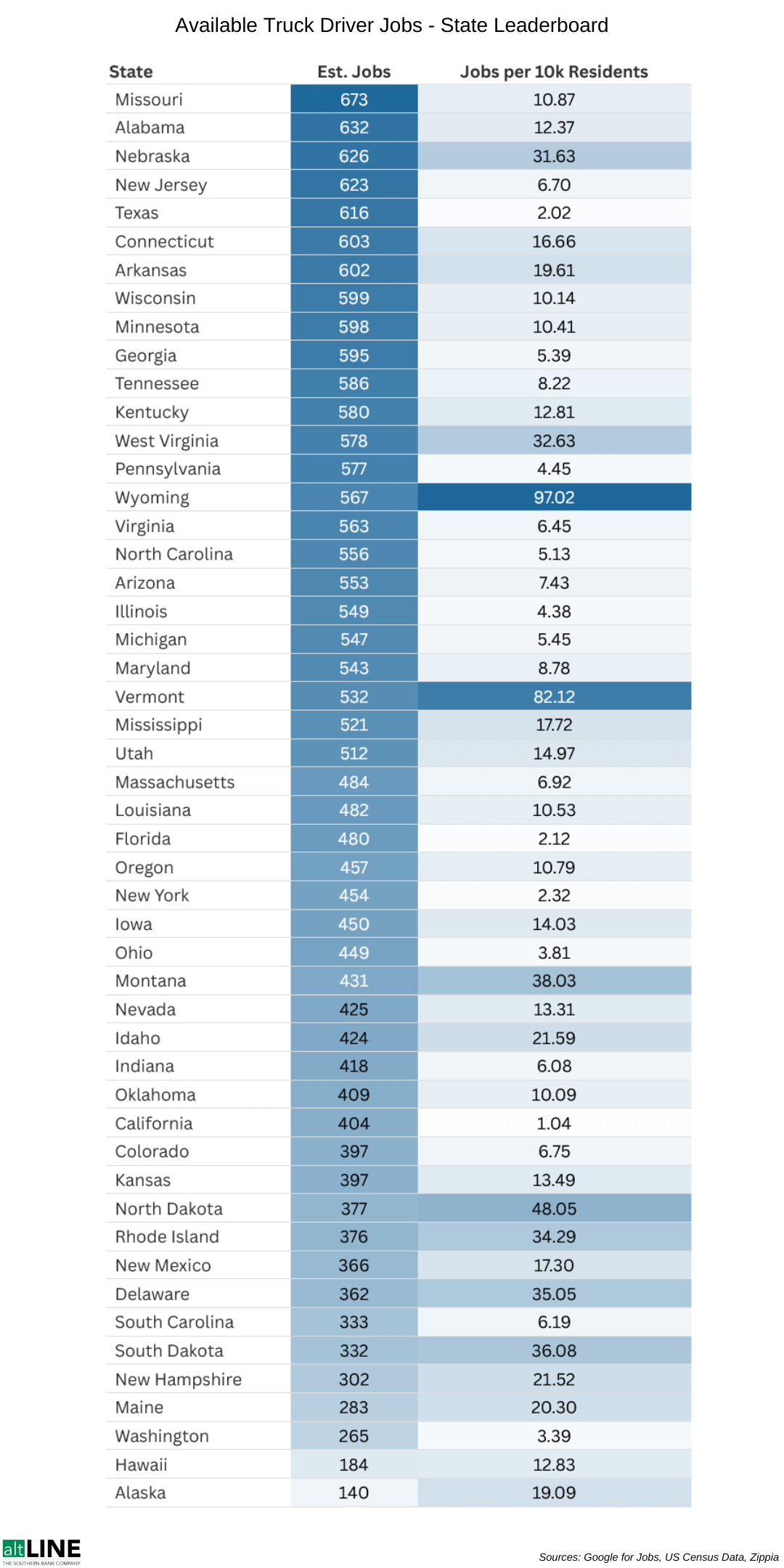

While freight is needed across the country, the supply and demand for drivers varies from state to state. By tracking the locations of the jobs being advertised online, we can build a map of demand for truckers and showcase where the industry is struggling the most.

On average, Missouri had the most available trucker jobs being advertised, with an average of 202 jobs listed on online job boards each day. Following the “70% of jobs aren’t posted online” rule, this suggests that Missouri alone has 673 trucking jobs waiting to be filled at any given moment.

However, it is Wyoming that has the highest demand for truckers relative to its population – there is an empty trucking position available for every 1,031 residents of the state.

Texas, known for its massive interstate import/export volume, is 5th on the table for the sheer number of empty seats, but once compared to the state’s large population, it interestingly has one of the lowest demands for truckers per person in the country. Understandably, this makes it one of the states where truckers will face the highest amount of competition, despite the demand for more staff.

However, the sheer number of empty driver seats doesn’t show the full picture.

Vacancies Per Hour: How Long it Takes to Fill a Role

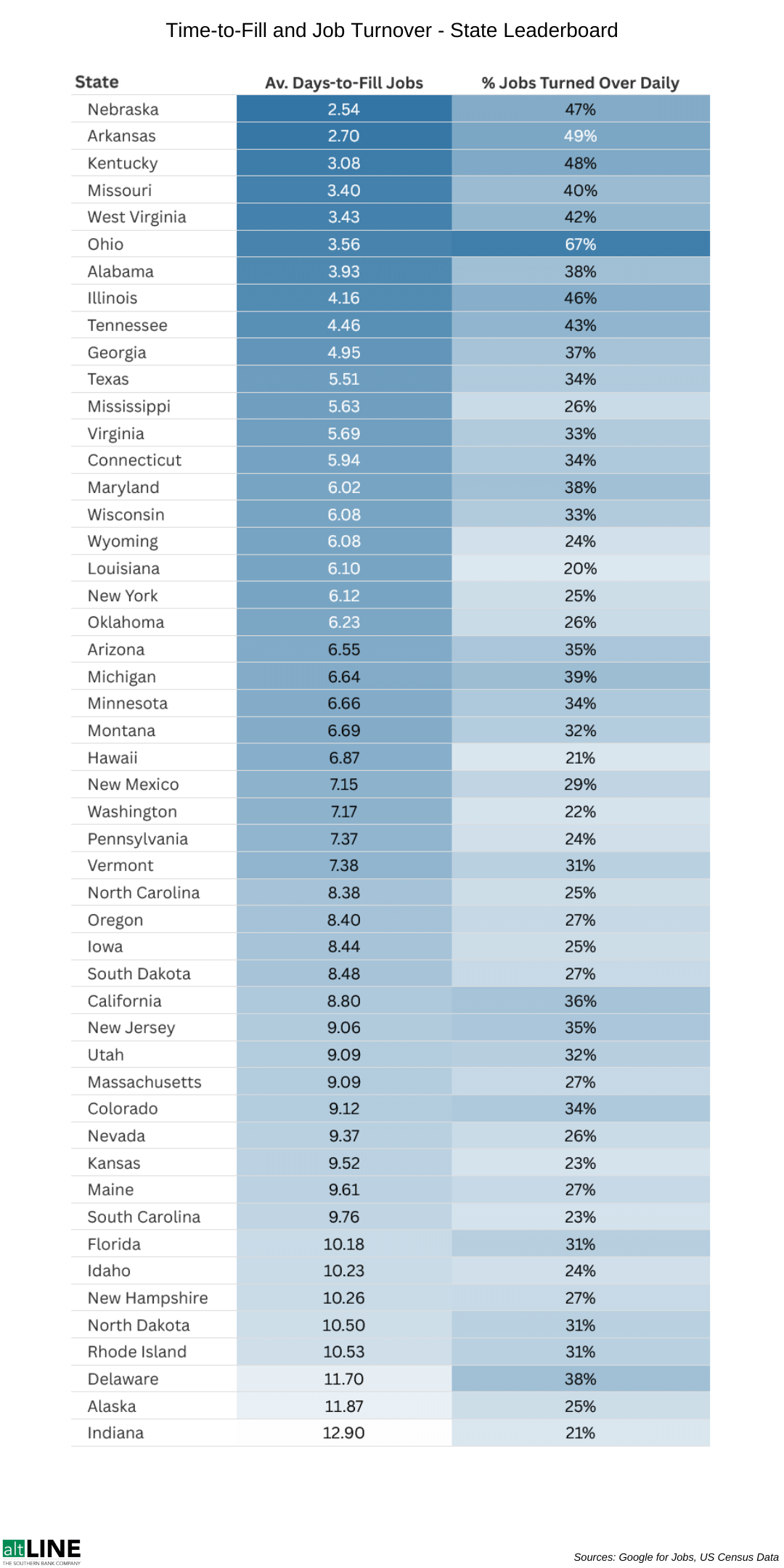

The map of missing drivers shows the equilibrium for sourcing staff – that is, the number of empty driver roles the local industry has settled at, with jobs being created and filled at the same rate. However, the speed of this job turnover is another strong indicator of the health of the local freight industry. We tracked the daily job turnover (the rate at which advertised jobs are filled & created) and the average recruitment time to analyze the patchwork of efficiency over the trucking job economy.

Outside of D.C., Ohio sees the most turnover, with around 2/3 of its truck driving jobs being filled and replaced each day, leading to an average recruitment time of just 3.6 days. The other state topping our charts is Nebraska, which has the lowest average recruitment time of just 2.5 days. However, its turnover is 47%, which, while well above average, suggests several older, stagnant openings in the region are not being filled.

Indiana sees the least active job economy for truckers by both metrics. With a daily turnover of only 21% and an average recruitment time of almost 2 weeks, it is here that employers are most struggling to find staff.

Conclusion

The trucking shortage isn’t an isolated labor issue; it’s a national economic challenge. Billions in potential revenue are being lost in just the freight industry, and the consequences for businesses and consumers further down the chain are immeasurable but undeniably significant. Some parts of the country are struggling more than others to find drivers, but the impact can and will affect local businesses wherever you are.

Freight factoring offers one avenue to mitigate the immediate challenges. By providing financial stability, factoring allows trucking companies to focus on solving their labor issues while maintaining operations. Partnering with a reliable freight factoring provider can be a critical part of the solution, ensuring that the trucking industry remains the backbone of the American economy and businesses of any size continue moving forward at full speed.

Methodology

Between the 22nd of November 2024 and the 5th of December 2024, we gathered 28,515 trucker driver jobs from Google For Jobs. Google For Jobs sources job postings and salary data from LinkedIn, Indeed, Glassdoor, ZipRecruiter, Monster + many other public job sites. To do this, we searched for “Truck driver in {State}, USA” for all 50 states.

To find the number of jobs closed/opened, we searched for jobs that didn’t appear in searches one day before/after each other. The time to fill for these jobs was calculated by the difference between the date the job was posted and the day the job was removed from the job boards.

When mapping the maximum potential loss, we calculated the difference in number between the number of employed heavy and tractor-trailer truck drivers and the number of tractor-trailer trucks to find the number of trucks that are guaranteed not to be operational. For our calculations, we also assumed that the employed drivers were driving tractor-trailer trucks.

Jennifer Lockett is the Freight Factoring Operations Manager at altLINE, the factoring division of The Southern Bank Company. Jennifer joined altLINE to spearhead the launch of the company’s new freight factoring program, bringing with her eight years of experience in the factoring industry and 18 years in the general trucking industry. Her firsthand experience working closely with drivers over the years has allowed her to carefully evaluate situations from a carrier’s point of view and navigate challenges effectively.