Payroll Funding for Staffing Companies

Payroll funding unlocks opportunities for staffing agency growth, immediately boosting cash flow and allowing you to make payroll on-time without stress.

tailored Cash Flow Solution

What is Payroll Funding?

Payroll funding, also known as invoice factoring, is an alternative financing solution in which staffing companies sell outstanding receivables in exchange for an immediate advance against each invoice.

This flexible funding solution is tailored specifically for staffing agencies that struggle with slow-paying customers or long payment terms. With payroll funding, you don’t have to wait weeks to get paid for your work. Instead, get paid within 1 to 2 days and have immediate access to working capital so that you can always make payroll on-time.

Convert Unpaid Invoices into cash

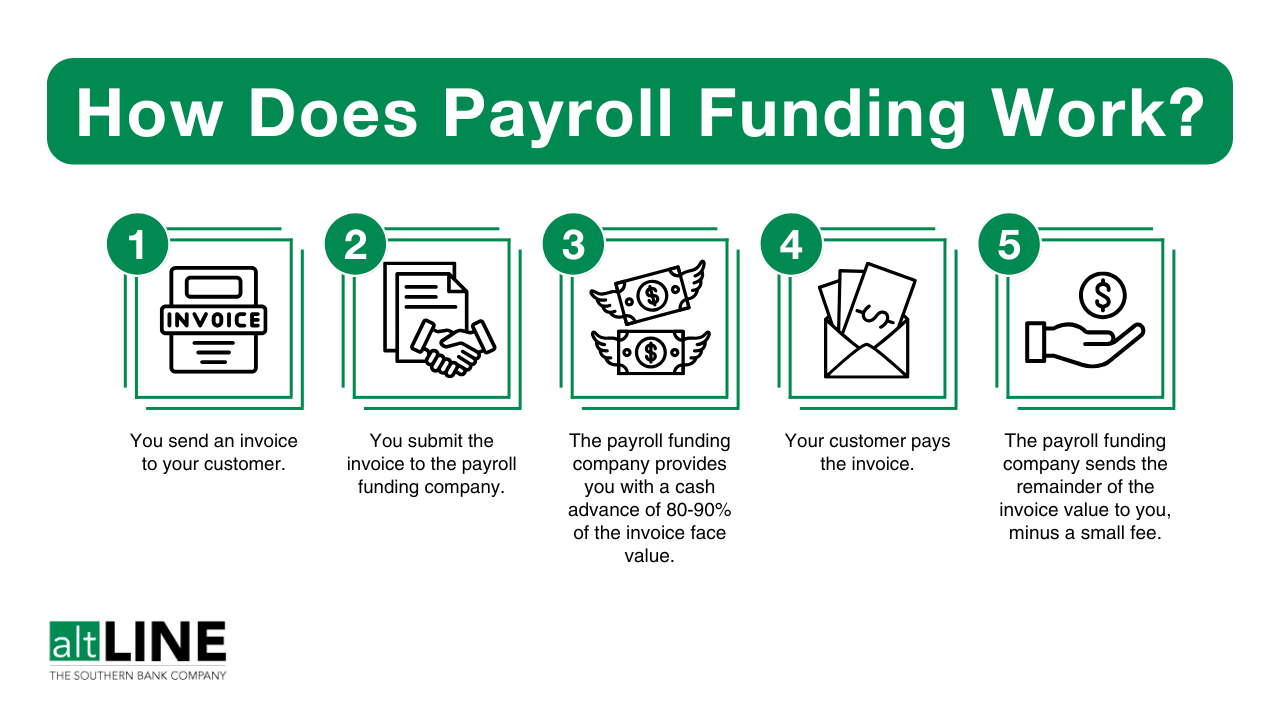

Our Payroll Funding Process

- Step One: Invoice your customer as you normally would.

- Step Two: Submit the invoice to altLINE.

- Step Three: Receive an immediate cash advance of 80%-90% of the invoice’s value.

- Step Four: altLINE collects the invoice payment from your debtor.

- Step Five: altLINE releases the remaining invoice value, minus a factoring fee (typically 1.0-3.5%).

Benefits of Payroll Funding for

Staffing Companies

Qualifying for most traditional financing solutions requires strong business credit, which many small staffing agencies do not have. However, altLINE focuses on your debtors’ credit more than your own, meaning you can qualify for payroll funding easier than traditional options.

GROW YOUR AGENCY

Take on new contracts, bring on more staff, and grow your company how you’d like.

BOOST WORKING CAPITAL

Increase working capital with a funding solution that grows with you.

get BACK OFFICE support

Our team will credit check your customers and aid in invoice collection.

access funds quickly

Once you’re set up in our system, you can receive funding in less than 24 hours.

enjoy fLEXIBLE financing

Our industry experts can create a tailored payroll funding solution for your business.

Client Success Story

See How altLINE Helped a Client Grow 1000%

Why Work with altLINE?

Discover What Makes altLINE Unique

FDIC-Regulated

Lender

Transparent Rates

WORK WITH A Dedicated Account

Manager

Smooth Customer

Onboarding

Complimentary

Customer Vetting

Same Day Funding

Available

Frequently Asked

Payroll Funding for Staffing Companies FAQs

How much does payroll funding cost?

The cost of payroll funding for staffing agencies can range from 1.0-5.0% of the invoice face value, depending on several criteria. In general, the faster your debtors tend to pay, the better rate you will receive. With altLINE, factoring fees are typically 1.0-3.5% of the invoice face value, if paid within 45 days.

Is payroll funding common for staffing companies?

Yes! Payroll funding is a common solution for staffing companies and temp agencies. Because invoice payment terms are typically 30 to 60 days, but payroll is usually paid on a weekly or bi-weekly basis, many agencies turn to this tailored solution. Payroll funding provides working capital to staffing companies to make payroll before receiving payment on their outstanding invoices. This additional working capital can help business operations run more smoothly and reduce the stress of running a small business, all while growing your staffing company.

What types of staffing companies use payroll funding?

Because payroll funding is a scalable financing solution, it’s useful for a variety of staffing companies, from small startup agencies to well-established and mature companies. Payroll funding is used most commonly by staffing agencies that keep employees on their payroll, such as temporary staffing and temp-to-hire staffing firms. Agencies that may not benefit as much from altLINE’s payroll funding services include direct hire placement and executive search firms.

Is a payroll financing service worth it for staffing companies?

Using a payroll funding provider is more beneficial for some staffing agencies than others. For example, staffing companies that need to make payroll before receiving payment on their outstanding invoices are well positioned to use a payroll financing service. However, if your staffing company already has the working capital in place to make payroll easily and grow your business without worry, you might not need it.

If you are unsure if payroll funding is the right solution for your staffing agency, fill out our quote form or speak with an altLINE representative by calling +1 (205) 607-0811. Our representatives will discuss your financing needs with you and make a recommendation on the best funding option for your business.

Is payroll funding different than invoice factoring?

No. Payroll funding and invoice factoring are one in the same. The term “payroll funding” is used most commonly in the staffing industry because factoring funds are almost always used to help make payroll on-time.

Highly Rated on Trustpilot

Explore More

Payroll Funding Resources

A Guide to Payroll Funding

In this article, learn even more about how payroll funding works, how much it costs, its pros and cons, and how to get started.

Payroll Funding vs. Payroll Loans

Payroll funding and payroll loans may sound similar initially, but these financing options are quite different.