Last Updated November 21, 2025

With Small Business Saturday approaching, there is no better time to look at small business statistics from the past year to gauge current economic conditions and overall performance for SMBs.

These statistics show just how vital small businesses are to the national economy. They also provide insight into the challenges SMBs face today and highlight potential trends to watch for in 2026.

Key Takeaways

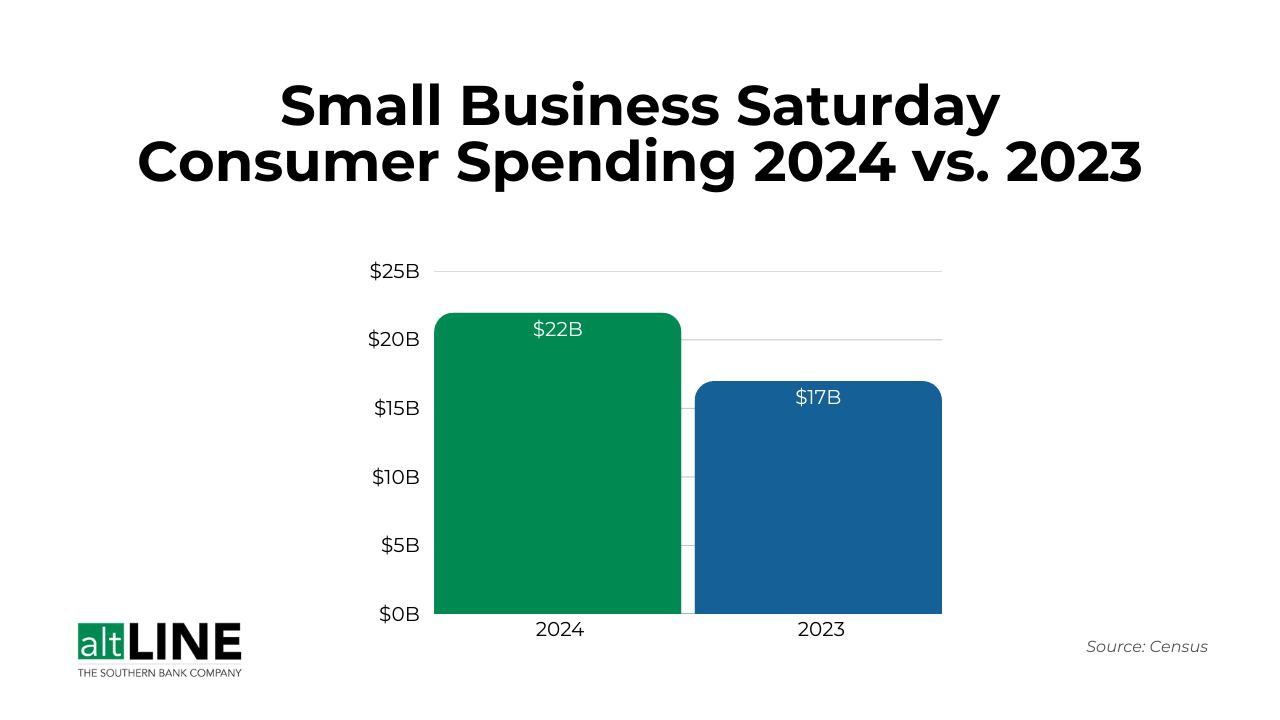

- Small Business Saturday continues to be a major revenue driver, with $17 billion spent in 2023 and more than $200 billion since the event began.

- Small businesses make up 99.9% of all U.S. firms and employ over 62 million people, showing just how central they are to the economy.

- Job creation remains strong, but rising costs, uneven cash flow, and growing bankruptcy filings are creating a tougher environment for many owners.

- Access to capital is still a challenge, and more businesses are leaning on credit cards and alternative financing as traditional lenders pull back.

- Even with uncertainty in the market, small business owners remain cautiously optimistic, supported by steady business formation and growing diversity in ownership.

What Is Small Business Saturday?

Small Business Saturday is a yearly event that encourages people to shop at local small businesses. It began in 2010 and has since taken place every Saturday after Thanksgiving.

The goal of Small Business Saturday is to give small businesses an extra boost during the busy holiday season and highlight how important they are to local communities. For many owners, it provides a chance to connect with new customers and drive revenue at a critical time of year. Supporting these businesses on this day and throughout the year helps sustain jobs and keeps the economy moving forward.

Key Small Business Saturday Statistics

Small Business Saturday has been an important revenue driver for local businesses. In 2023, consumers spent about $17 billion during the annual event. Since it began in 2010, total spending is estimated at $201 billion, revealing just how much of a difference-maker this single day can have on local business revenue.

Key facts:

- Small business owners estimate, on average, that almost 20% of their yearly revenue will come from this year’s (2025) Small Business Saturday sales (American Express).

- There was an estimated 29.4% increase in Small Business Saturday consumer spending, rising from $17 billion in 2023 to $22 billion in 2024 (Census).

- $201 billion has been spent on Small Business Saturday since 2010 (Census).

- 20% of holiday shoppers plan to participate in Small Business Saturday, with Gen X expected to participate the most (Deloitte).

The Big Picture: How Many Small Businesses Are There?

According to the SBA’s Office of Advocacy, there are 36.2 million small businesses in the country as of 2025, employing 45.9% of the private-sector workforce (62.3 million people). Small businesses represent 99.9% of total businesses.

These numbers highlight just how vital SMBs are for the overall health of the U.S. economy.

Key facts:

- There are 36.2 million small businesses in the U.S. (SBA).

- 99.9% of all U.S. firms are small businesses (Kaplan Collection Agency).

- About 62.3 million people are employed by small businesses (SBA).

SMB Growth, Bankruptcies, and Job Creation

Small businesses have continued to drive U.S. job growth. The most recent year-over-year data reveals that 1.2 million net new jobs (88.9% of all net new jobs nationwide) were created by small businesses.

However, small business bankruptcies are persisting. While many new businesses open each year, a comparable number close, resulting in steady turnover. Small business Subchapter V filings (essentially a streamlined version of Chapter 11 filings) rose substantially from October 2024 to October 2025, along with a 12% increase in overall bankruptcies.

Still, there have been significantly fewer small business bankruptcies in recent years compared to the historical highs seen in the early to mid 2000s, with bankruptcies dropping about 74% since 2004.

Key facts:

- Small businesses in the U.S. opened 1.1 million new establishments and created a net increase of 1.2 million new jobs (SBA).

- Business bankruptcy filings rose 12% from October 2024 to October 2025 (Epiq Global).

- Small business Subchapter V filings in October 2025 were 248, up 35% from October 2024 (Global News Wire).

- Projected business formation numbers were 28,834 in December 2024, dropped to 24,574 in January 2025, and rebounded to 27,090 in February 2025 (Census).

These small business statistics show that while bankruptcy filings are rising, new businesses are still forming to create new opportunities, reflecting resiliency within the small business sector. With strong job creation, continued business formation, and typical levels of bankruptcy, SMBs remain a key driving force of the U.S. economy, even when market conditions and interest rates remain uncertain.

Common Small Business Challenges

Small businesses today are dealing with a uniform set of challenges, with recent data showing several common pain points.

According to the 2025 Small Business Credit Survey, 75% of small firms cite rising costs of goods, services, or wages as a top financial challenge. About 56% say paying operating expenses is difficult, and 51% struggle with uneven cash flow.

Furthermore, a report from Q1 2025 found that 35% of small business owners are most worried about declining revenue, while 58% see inflation as a top concern.

Labor quality has also been a common small business challenge. The National Federation of Independent Business (NFIB) reported that 19% of small business owners call labor quality their “single most important” issue, overtaking inflation, which the same report highlights as the No. 2 concern.

Key facts:

- 75% of small firms say rising costs for goods, services, or wages are a top financial challenge (2025 Small Business Credit Survey).

- 56% struggle to cover operating expenses (2025 Small Business Credit Survey).

- 51% face uneven cash flow (2025 Small Business Credit Survey).

- 58% worry most about inflation, while 35% are concerned about declining revenue (US Chamber).

- 19% identify labor quality as their single most important issue, surpassing inflation (NFIB).

Small Business Lending Statistics

Another concern for small business owners? Access to capital.

This is nothing new, as access to capital has been a common reason small businesses fail for years.

As a result, many are turning to credit cards and short-term financing to cover operating expenses, which provides flexibility but can create higher costs over time.

Small business owners are also using a mix of traditional and alternative financing to manage operations and overcome capital shortages. Credit cards, online lenders, merchant cash advances, invoice factoring, and lines of credit all play a role in helping businesses access capital, though some options carry higher costs.

Key facts:

- 50% of small businesses used business credit cards for financing in July 2024, double the rate from July 2023 (Intuit QuickBooks Annual Report, 2025).

- In 2024, credit card interest payments among U.S. small businesses jumped 14% (Intuit).

- 37% of small employer firms applied for a loan, line of credit, or merchant cash advance in the past 12 months (Federal Reserve).

- 23% of those firms applied through online or fintech lenders in 2023 (Federal Reserve).

- 36% of applicants received only part of the financing they requested, and 24% received no funding at all (2025 Fed Small Business Credit Survey).

- Invoice factoring is a particularly common source of alternative funding for SMEs, who make up 67.9% of the U.S. factoring market (Mordor Intelligence).

How Do Small Business Owners Feel About Economic Conditions?

There’s been a heightened level of uncertainty regarding general economic conditions for businesses. Per the NFIB report, more entrepreneurs said they were “uncertain” or “don’t know” about how the overall outlook is trending for SMBs.

At the same time, the year began with much more optimism than in previous post-COVID years.

The combination of uncertainty with increased optimism suggests a “cautiously optimistic” mindset. While interest rates have dipped and there’s a clearer picture regarding tariffs, it’s natural for small business owners not to get too overconfident given the unpredictability that has plagued them since COVID.

Small Business Ownership and Diversity Statistics

Small businesses are diverse in ownership. About 22% are minority-owned, per the SBA Office of Advocacy’s 2025 report with women owning nearly 45% of all U.S. small businesses. These women-owned nonemployer firms generate $411 billion annually.

This data demonstrates that small businesses offer opportunities to a wide range of hopeful entrepreneurs and play an important role in an inclusive economy.

Key facts:

- Women own 44.6% of all U.S. small businesses (SBA).

- Racial minorities (non‑white) own 22.1% of small businesses.

- Hispanics own 16.5% of small businesses, making up the largest share of minority-owned small businesses.

- Veterans own 5.3% of small businesses.

Small Business Success, Failure, and Longevity

Small businesses face significant risk. About 20% of new businesses fail within their first year, and only 35% of businesses launched in 2013 were still operating past 2023. Between 1994 and 2021, the overall five-year survival rate was 49.2%.

These figures highlight why consumer support initiatives, such as Small Business Saturday, are important for sustaining local businesses.

Key facts:

- 20% of new businesses fail in their first year (NerdWallet).

- 35% of businesses survive 10 years (NerdWallet).

- Since 1994, 49% of businesses survive five years in business (SBA).

In-Summary: Small Business Saturday Statistics

Small Business Saturday serves as a reminder of the impact small businesses have on the economy and within our communities. These statistics show that while small businesses face real risks, they also create millions of jobs, provide opportunities for diverse entrepreneurs, and contribute significantly to local economies.

Supporting small businesses, whether through this one day or year-round, helps keep jobs, neighborhoods, and communities thriving.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.