Last Updated May 28, 2025

Tax forms and employment classifications are a headache, right? Not if you’re prepared. For staffing agencies, it’s a tricky environment – as most organizations juggle multiple types of employment with a large pool of workers. If you’re looking to start your own staffing agency (and make sure it’s successful), you’re going to need to understand the nuances.

Here, we provide information on how to handle 1099s vs. W2s, employees vs. independent contractors, and other pieces of tax knowledge a staffing agency might need to know.

What Is a 1099 Form?

A 1099 form is a tax document used in the United States to report various types of income other than wages, salaries, and tips. It’s most commonly used among independent contractors, freelancers, and self-employed individuals.

There are multiple types of 1099 forms, each designed for specific income types. For instance, the 1099-NEC reports income from non-employee compensation, while a 1099-G reports money received from the government, such as unemployment compensation.

Essentially, these forms serve as a record that an entity or person – not your employer – has provided you with income. For staffing agencies, understanding the 1099 form is important for correctly categorizing and reporting income for the diverse talent pool they manage. Temp agencies in particular will regularly be dealing with 1099 forms.

Why Are 1099 Forms Important?

1099 forms are required for staffing agencies that hire temporary employees such as independent contractors. The form is significant for both the agency and the employee.

For the employee (the recipient of the form), such as an independent contractor or freelancer, the 1099 form is a detailed record of income received from a source. This information is critical for accurately reporting annual income to the IRS.

For staffing agencies, issuing 1099 forms is a mandatory compliance measure to accurately report payments made to non-employees. This ensures transparency in financial transactions and assists the IRS in tracking income that might not be subject to regular payroll taxes.

Staffing agency owners need to understand and utilize 1099 forms correctly to maintain compliance with tax laws while managing payments to their diverse pool of workers – from temporary employees to independent contractors.

What Does a 1099 Form Look Like?

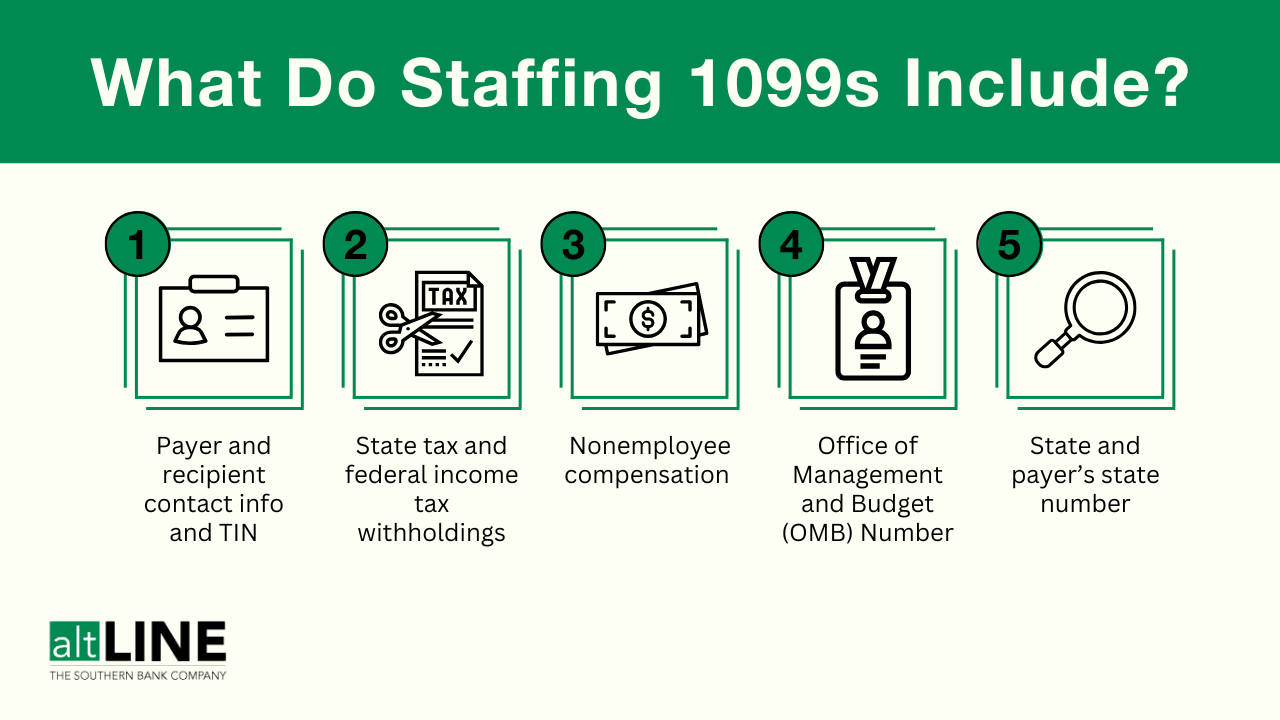

A 1099 form might look complex at first, but it’s a standard tax document that includes the following:

- Payer information (name, address, phone number, TIN)

- Recipient information (name, address, contact info, TIN)

- Federal income tax withholdings

- Nonemployee compensation

- OMB Number

- State tax withholdings

- State/payer’s state number

“TIN” stands for “Taxpayer Identification Number,” used by the IRS for tax law purposes, and “OMB” stands for “Office of Management and Budget,” with the number being intended for governmental use.

The Importance of Tax Classification for Staffing Agencies

Properly classifying workers as either employees or independent contractors determines the type of tax forms used and the nature of tax liabilities.

For employees, staffing agencies must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid. These employees are reported via W-2 forms.

Conversely, for independent contractors, agencies are not required to withhold taxes. Instead, contractors handle their own tax obligations. Staffing agencies use 1099 forms for these workers.

Misclassifying an employee as an independent contractor can (and most likely will) lead to significant legal and financial repercussions. Staffing agencies must maintain compliance with these classifications out of legal necessity and ethical responsibility. You must ensure fair treatment and proper tax reporting for all parties involved.

Related: Payroll Funding for Staffing Agencies

The Difference Between an Employee and Independent Contractor

The distinction between an employee and an independent contractor hinges on the degree of control and independence in the work relationship. Employees typically work under the employer’s control – with specific instructions about when, where, and how they work. They often receive benefits like health insurance, have taxes withheld from their paychecks, and are covered by labor laws and workers’ compensation.

On the other hand, independent contractors have more freedom regarding how they complete their work. They often use their own tools, work on a project-to-project basis, and are not subject to the same degree of control by the staffing agency. They are responsible for their own taxes and are not entitled to the same benefits and protections as employees.

Correctly categorizing workers is a fundamental aspect of business operation that defines the nature of the working relationship and respective responsibilities.

Consequences of Misclassification

Misclassifying workers can lead to serious consequences for staffing agencies. If an employee is incorrectly classified as an independent contractor, the agency could face penalties from the IRS – including back taxes, fines, and interest. This misclassification can also lead to legal challenges, including claims for benefits, overtime, and other employee rights.

It’s a complex area, often scrutinized by tax authorities and labor law regulators. Ensuring accurate classification mitigates legal risks, maintains regulatory compliance, and upholds the integrity of the staffing agency’s operations.

In Summary: Staffing Agencies and 1099s

Staffing agencies – typically intermediaries connecting temp workers and contractors with businesses – find themselves in a unique position regarding 1099s.

Whether a staffing company issues a 1099 to a worker is dependent on whether that worker is classified as an employee or independent contractor, as mentioned above. Specifically, if a worker is considered an employee, even a temporary employee, they would receive a W-2, and if they are considered an independent contractor, they would receive a 1099.

Some may be wondering if staffing agencies ever receive 1099s. If a staffing agency itself provides services to a client as an independent contractor, the agency may receive a 1099 form from their client. This situation underscores the dual role that a staffing agency plays – as both the employer who issues 1099s to contract workers and as the service provider who may receive 1099s from their clients.

Staffing Agencies & 1099s FAQs:

What is the difference between a 1099 Form vs. a W-2 Form?

The key difference between a 1099 form and a W-2 form lies in the employment status of the individual receiving the income. A 1099 form is used for independent contractors or freelancers who are responsible for paying their own taxes, including Social Security and Medicare taxes. On the other hand, a W-2 form is used for employees whose employers withhold payroll taxes from their earnings and also pay a portion of taxes on the employees’ behalf. W-2 forms are issued to both temporary and permanent employees.

What are the legal requirements for starting a staffing agency?

There are several legal requirements for starting a staffing agency, including obtaining a business license, setting up a tax identification number, and adhering to employment laws. Additionally, it’s essential to establish clear contracts and agreements with both clients and workers, outlining terms of employment, payment, and responsibilities. Compliance with labor laws and tax regulations, particularly regarding worker classification and tax withholdings, must also be done.

What’s the difference between contract and temporary employment?

Contract and temporary employment differ mainly in terms of duration and scope. Contract employment usually refers to a fixed-term employment agreement for a specific project or period, often with a clear end date. Temporary employment, while also for a limited period, is generally shorter and can be more flexible, often used to cover periods of increased workload or to fill in for absent regular employees.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.