Last Updated December 16, 2025

If your business isn’t achieving its financial goals, the first thing you should consider is whether you’re optimizing your working capital. A recent study revealed that U.S. businesses are sitting on an astonishing $1.76 trillion of untapped working capital.

Maximizing working capital is a common challenge for new business owners, but one that can be mitigated by implementing necessary practices.

Effective working capital optimization improves liquidity and frees up cash that you can use to cover short-term debt or put right back into your business. While measures such as profit and revenue are important, the significance of net working capital shouldn’t be overlooked.

You might not be aware of existing tools and methods at your disposal to instantly optimize your working capital. So, where can you look within your business to maximize your funds? Let’s dive in.

Key Takeaways

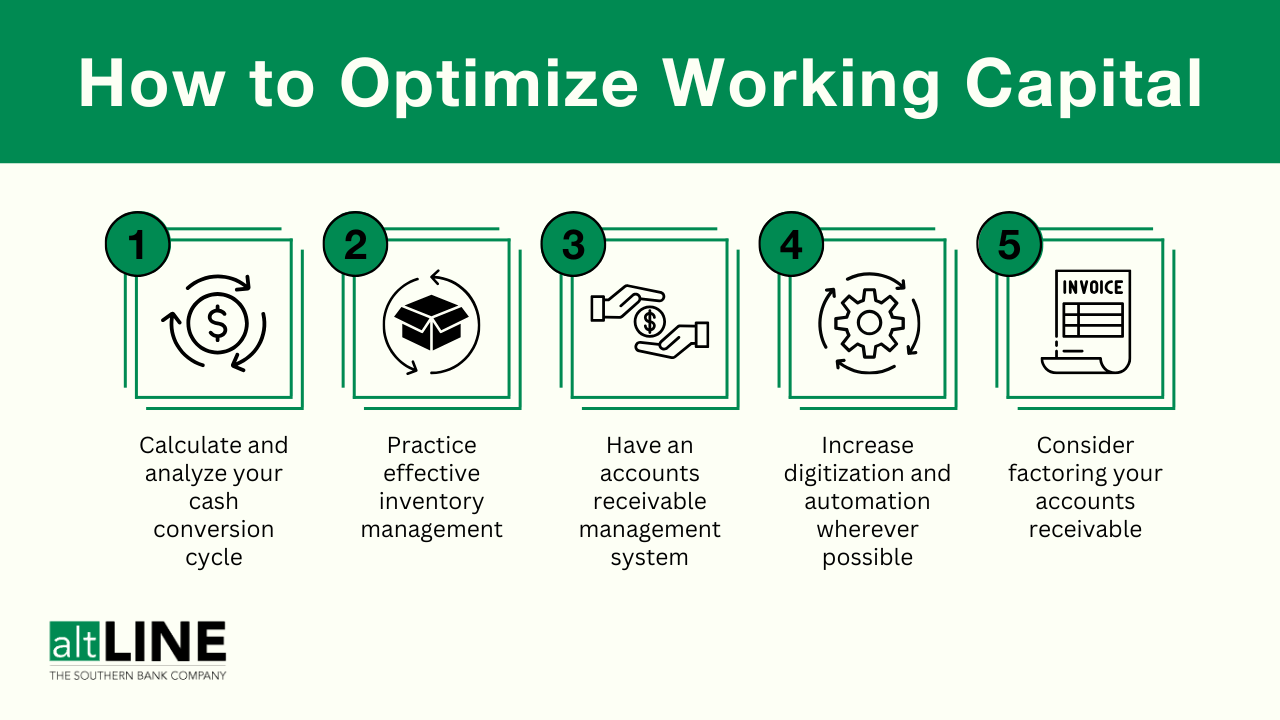

- Calculate and analyze your cash conversion cycle to identify inefficiencies in inventory, sales, and collections that affect working capital.

- Improve accounts receivable management with software or processes that reduce errors and accelerate invoice payments.

- Practice effective inventory management to prevent excess stock from tying up cash and focus on high-demand products.

- Explore automation, e-invoicing, and factoring options to boost cash flow and maximize available working capital.

How to Optimize Your Working Capital

There are many ways to ensure you’re optimizing working capital. Sending invoices quicker, leasing equipment, or utilizing trade credit insurance can all raise working capital.

However, we’re going to walk you through working capital optimization via a more strategic approach. We’re going to show you how to use the cash conversion cycle (CCC) to improve your accounting and inventory management practices, which are both instrumental in dictating whether or not you’re making the most of your working capital.

Calculate and Analyze Your Cash Conversion Cycle

The cash conversion cycle might not be as recognizable as a balance sheet or profit & loss statement, but when it comes to optimizing working capital, there’s no financial statement more important.

The cash conversion cycle formula is as follows:

Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO)

By calculating your cash conversion cycle, you’ll uncover how quickly your inventory is selling and where improvements can be made regarding your collections processes. In turn, you can lower your CCC, which almost always coincides with an improvement in net working capital.

Identify Areas of Improvement

Calculating your cash conversion cycle will give you an understanding of areas where your business is inefficient.

For instance, you might be working on long payment terms with customers, and they’re waiting until the end of payment cycles to pay for your services. This causes a heightened average for days sales outstanding (DSO), leading to a worse cash conversion cycle and, in turn, less working capital at any given time. If this is the case, you should work on lowering invoice payment terms—or perhaps provide early payment discounts or introduce late payment fees to add incentives to pay earlier. A fix as simple as this could lead to an increase in working capital.

You should always prioritize working with vendors and customers who habitually pay on time. You might be surprised at how often slow-paying customers are the root cause behind major working capital challenges for small business owners.

Practice Effective Inventory Management

Perhaps your items in stock are going too long unsold, leading to a high days inventory outstanding (DIO).

It’s critical to always have an understanding of how much of an item you need, how much you have, how much you owe your suppliers, and how much your customers owe your business. Managing your inventory effectively will prevent you from wasting precious working capital when you need it most.

Aside from the basics (tracking your sales), take note of which items or services are in high demand vs. which items take a long time to sell. If a certain product or service isn’t selling how you’d like, it’s time to reevaluate. Maybe you’re pricing it too high.

Have an Accounts Receivable Management System

One of the secrets to optimizing working capital is knowing how to effectively manage your accounts receivable. A recent study showed that 90% of business owners routinely deal with invoices paid by their customers after the due date.

If you’re working on net 30 terms with a customer, the difference between being paid on day 5 vs. day 30—or even worse, after day 30—can truly be the reason behind your working capital problems. That’s why staying on top of your AR is so critical to optimizing working capital.

The average small business owner is constantly juggling numerous responsibilities daily, which makes it difficult to give the required time and attention to collections. Therefore, most choose to invest in accounts receivable management software to assist.

AR management systems are beneficial in several ways; they reduce manual labor, enhance efficiency, and improve accuracy. But most importantly, an AR management system prevents you from losing out on cash.

Accounting errors are common—even professional accountants make errors daily! Reducing these errors is one of the simplest ways to avoid minimizing working capital. AR management software prevents these errors by tracking statuses of owed invoice payments, verifying invoices and reconciling invoices, and notifying you of late payments that you otherwise may have forgotten about.

The proof is in the data—90% of companies that utilize software to manage AR and AP found that it reduced their accounting errors.

Some of the most popular accounting software include:

- Quickbooks

- Freshbooks

- Zoho Books

- Xero

Each software has its own unique features and pricing, which is worth exploring. Regardless of which accounting software you choose, it will enhance your accounts receivable (and payable) processes. If sales aren’t booming, this is one of the best ways to maximize working capital.

Increase Automation and Digitization Wherever Possible

Investing in accounting software isn’t the only way you can use technology to ensure working capital optimization. It’s only one component of a broader strategy of increasing automation and digitizing processes wherever possible.

E-invoicing is a necessity in this day and age. While e-invoicing has many benefits, the most relevant to working capital is how much it can accelerate the payment process.

You should also set up automated payment options for your customers. Accounting software like Quickbooks offers automated payment features, which are generally affordable for the average business owner. Consider it from your customer’s perspective: If your supplier makes it quick and easy to pay them, you’ll likely be more apt to pay invoices quicker rather than putting it off until a later date.

Explore Factoring Your Accounts Receivable

If you feel as if you’ve done everything right and you’re still struggling with low working capital, it might be time for a substantial cash injection. For many small business owners, this can be achieved through financing their accounts receivable by the process of invoice factoring.

Factoring is relatively simple. It involves selling your unpaid invoices to a third-party factoring company in exchange for an immediate cash advance against the value of each invoice (up to 90%) within 24-36 hours.

The factoring company then assumes collection responsibilities for the factored invoices. Once your customer submits payment to the company, the remaining value of each invoice is released to your business, minus a small factoring fee.

So, if you’re working on net 45 payment terms, for example, factoring prevents you from having to wait weeks to get paid. Rather, you’re paid 80-90% of the invoice value within 24-36 hours of sending the invoice to your customer, providing an immediate working capital boost. Business owners who use factoring also see a noticeably improved cash flow.

In Summary: Working Capital Optimization

Working capital optimization isn’t a one-time project that you start and finish. Instead, you should constantly be considering ways to maximize your funds.

If this step-by-step formula doesn’t make a difference for your business, you can read our article on how to improve your working capital. If you’re in a more pressing situation where you can’t wait any longer and need an immediate working capital boost, you can also look into invoice factoring.

If you have questions about the factoring process or would like to determine if it’s the right fit for your business, feel free to reach out to altLINE at +1 205-607-0811 or by filling out our free factoring quote form.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.