Last Updated October 2, 2025

Turn your unpaid invoices into working capital for your business

Despite diesel fuel prices decreasing in recent years, fuel remains one of the costliest expenses for carriers in 2025. And while you can’t avoid fuel purchases, you can certainly streamline them with fuel cards.

Designed for fleet businesses, fuel cards benefit truckers by making it easier to manage fuel expenses and reduce waste.

While they come with several well-known advantages, there are a couple potential pitfalls to consider before deciding whether fuel cards are worth it for your trucking business.

In this article, we’ll break down how fleet fuel cards work, weigh their pros and cons, and offer a simple guide to help you decide whether fuel cards are worthwhile for your trucking business.

Key Takeaways

- Fuel cards streamline trucking expenses with real-time tracking, centralized billing, and discounts that boost fleet profitability.

- Are fuel cards worth it? For medium and large fleets, yes, savings and convenience outweigh the costs. Smaller carriers may see fewer advantages, though they can still benefit.

- Pros and cons include better expense control, discounts, and easier accounting, balanced against fees, fraud risk, and limited station acceptance.

- Carriers can pilot a fuel card program first to test whether savings and visibility into fuel costs justify the added complexity.

How Do Fleet Fuel Cards Work?

A fuel card is a type of payment card businesses use to manage truck fuel expenses. It works like a credit card, but you can only use it to pay for fuel and other vehicle-related expenses. Instead of asking your drivers to pay for gas and submit for reimbursement, the company pays for everything upfront through the fuel card.

When drivers need to buy gas, they scan the fuel card like a credit card. The fuel card logs information about the transaction, such as the date, time, amount purchased, and price per gallon. You or your administrator receives this information, which makes it much easier to monitor fuel consumption and spending. If you suspect fraud, fuel cards also make it easier to spot inappropriate use of company funds.

Ultimately, many trucking businesses use fuel cards because they add a layer of visibility to fuel costs. They aren’t a perfect solution, but they can help you better understand your costs and effectively plan for the future.

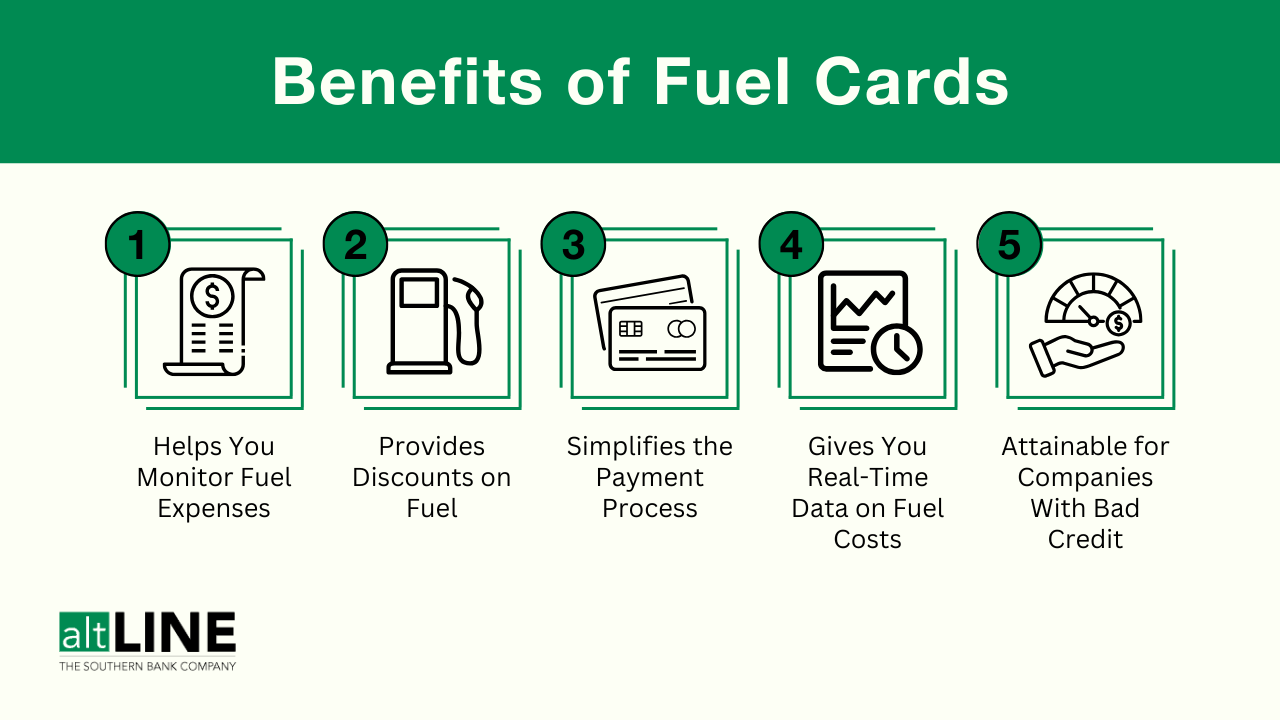

Fuel Card Benefits

So, what are the benefits of having a fuel card? Fuel cards offer advantages in terms of financial savings, control, and operational efficiency.

Monitor Fuel Expenses in Real-Time

Fuel cards log every transaction, providing detailed information on fuel usage. With better visibility, you have more control over your fuel spending. Fuel cards automatically monitor and control costs if you’re concerned about your fuel budget. You can set spending limits, restrict purchases to specific fuel types, or even limit transactions to certain times.

Score Fuel Discounts

Some fuel cards give you access to discounted fuel and other deals. This is more common with large fleets, but even a discount of a few cents a gallon can add up over time. The downside is that these discounts usually only apply to specific fuel providers, so make sure your fleet’s fueling pattern matches the fuel card’s discount guidelines.

Streamline Accounting

Fuel cards simplify the entire payment process by eliminating the need for drivers to pay out of pocket. Instead, your company pays all fuel costs directly, streamlining expense management. Your team will spend less time playing catch-up with accounting and have the time to focus on more value-added tasks.

Calculate Accurate Surcharges

Many trucking companies charge fuel surcharges to cover the increasing costs of fuel. But what’s a fair surcharge? You don’t want to charge too much and risk running off your customers—but charging too little could cut into your profits.

One of the benefits of fuel cards is that you get up-to-the-minute data on fuel costs. You don’t have to rely on benchmarking or national averages; you have real-time data from your own fleet. Use this information in your fuel surcharge calculator to charge fair, reasonable surcharges that keep you in the black.

Attainable Despite Bad Credit

One more fuel card benefit is that they are generally attainable for all types of carriers, even those with poor credit.

If you’re looking for a fuel card with low credit, you can explore prepaid fuel cards and fuel debit cards. With prepaid fuel cards, you don’t need to worry about credit checks because you’re simply topping off the card in advance, similar to a credit card.

Still, it’s important to do your research into fuel card providers before diving headfirst into a fuel card program. Also note that borrowing limits will tend to be lower if you have bad credit.

Fuel Card Disadvantages

Whether you oversee a large fleet or want to become an owner-operator, fuel cards offer plenty of benefits. However, they aren’t perfect. Consider potential fuel card disadvantages to make an informed decision for your business.

Expensive Fees

Some fuel credit cards have annual fees, transaction fees, and discount fees. On average, fuel cards charge anywhere from $3 to $10 per card per month, plus interest rates and other fees. These fees can quickly eat into promised discounts if you aren’t careful. Carefully review your fuel cards’ terms and conditions to ensure the costs don’t outweigh the benefits.

Added Layer of Complexity

Some fleet managers feel it’s more time-consuming to sift through the rules and data that come with using fuel cards. Tracking multiple cards, monitoring transactions, and reconciling statements certainly adds a layer of complexity to running a trucking business.

While fuel cards can give you more control over fuel costs and streamline accounting specifically, setting up a fuel card program requires diligent planning and oversight, adding more on your plate, especially if your company is in its early stages and you don’t have a lot of administrative resources.

Limited Availability

Many cards are widely accepted across fuel stations, but others are only available in specific networks. That can be inconvenient for drivers, who have to carefully plan their fueling stops so that they’re only going to in-network fuel stations. If they’re in a pinch and need to go to an out-of-network fuel stop, drivers have to pay out of pocket and ask for reimbursement after the fact, which negates the convenience of using a fuel card in the first place.

This could be one of the few benefits of using a credit card over a fuel card.

Fraud Risk

Fuel cards can cut down the risk of fraud, but it’s still a possibility. If drivers don’t follow company policies or someone steals the card, you could be on the hook for fraudulent purchases. Not all fuel cards will stop purchases that fall outside your guidelines, so you need to stay on top of purchasing data to reduce the incidence of fraud.

Are Fuel Cards Worth It?

Applying for a fuel card makes sense in many situations, but not all trucking companies use them. It depends on your fleet size, drivers’ spending habits, and administrative resources.

Many trucking companies say fuel cards are worth the extra effort of tracking and monitoring spending data. They streamline expenses and give owner-operators access to discount programs that improve profit margins. These savings, coupled with the convenience of centralized billing and streamlined expense management, make fuel cards an attractive option.

However, some companies say fuel cards are a bad fit for small companies without an administrative team. They also don’t make sense if the fees outweigh the discounts.

Fuel cards are likely a good fit for you if:

- You want to pay for gas directly instead of asking drivers to submit reimbursements.

- You want discounts and rewards.

- You need detailed tracking and reports on fuel costs.

- You have a medium to large-sized fleet that buys a lot of fuel.

- You have administrative staff to manage and monitor card usage.

Consider alternatives to fuel cards if:

- You have a small fleet with minimal fuel expenses.

- You’re concerned about fees.

- Your fleet operates in an area that doesn’t accept fuel cards.

- You don’t have the staff to monitor fuel card data trends or monitor for fraud.

Ultimately, you have to weigh whether better expense tracking and accountability make up for the increased workload and potential for fees. Since every fuel card is different, read the fine print to consider whether it’s worth the effort. You can always roll out fuel cards on a pilot basis to see if it makes a difference before rolling them out to your entire fleet.

Interested in Factoring?

Turn your unpaid invoices into working capital so you can keep growing your trucking business.

In-Summary: Are Fuel Cards Worth It?

Fuel cards can be beneficial if you have a medium or large-sized fleet. However, they come with a few drawbacks that could negate the benefits of using fuel cards in the first place.

| Fuel Card Advantages | Fuel Card Disadvantages |

| Includes detailed tracking and reporting features | Fees can reduce overall savings |

| More control over expenses | Not all fuel stations accept fuel cards |

| Offers discounts or rewards on fuel purchases | Adds complexity to your administrative processes |

| Centralizes billing and reduces errors | Comes with a risk of fraud or misuse |

| Eliminates the need for drivers to pay out of pocket | Could lead to cash flow issues or debt |

Understanding the benefits of fuel cards along their limitations is essential for making an informed decision about whether they’re right for your business.

Need to Improve Trucking Business Cash Flow? Consider Freight Factoring

There are obviously many other ways for carriers to save some dollars or finance a trucking business. If cash flow is a hurdle for you, certain options like freight factoring might be an optimal solution as it prevents you from taking out loans or accumulating debt.

Freight factoring is a form of invoice factoring, where you sell outstanding accounts receivable to a third-party factoring company, such as altLINE, in exchange for an immediate cash advance against the value of each invoice. You can receive more than 95% of a factored invoice up front, helping you battle long payment cycles and unexpected costs without missing a beat. It allows you to focus on what you do best—keeping your trucks on the road without the stress of chasing down payments.

Plus, altLINE or another freight factoring company will take on many of the time-consuming responsibilities that come with managing AR, such as overseeing collections from your debtors.

If you have any questions about how freight factoring works or whether it’s the right fit for your business, feel free to contact one of our representatives at (205) 607-0811 or fill out our free freight factoring quote form here.

Jennifer Lockett is the Freight Factoring Operations Manager at altLINE, the factoring division of The Southern Bank Company. Jennifer joined altLINE to spearhead the launch of the company’s new freight factoring program, bringing with her eight years of experience in the factoring industry and 18 years in the general trucking industry. Her firsthand experience working closely with drivers over the years has allowed her to carefully evaluate situations from a carrier’s point of view and navigate challenges effectively.