Owner-Operator Expenses for Running a Trucking Company

Last Updated July 9, 2024

As a new or soon-to-be owner-operator, having a comprehensive knowledge of the expenses that lie ahead of you will prevent unexpected costs that could potentially threaten your cash flow. Especially if you’re just starting your trucking business, understanding these costs is key to managing your finances and ensuring the profitability of your business. From insurance to fuel costs and from truck maintenance to business taxes, each expense has a significant purpose in the daily operations of an owner-operator.

This guide provides a comprehensive overview of owner-operator expenses, also offering additional funding tips to help you effectively manage your budget. With this knowledge in hand, you can take a positive first step toward a successful and sustainable trucking business.

12 Owner-Operator Expenses

As an owner-operator, you should carve out a large portion of your budget for the following 12 expenses.

1. Trucking Insurance

Insurance is one of the most significant expenses for any business owner. For owner-operators, insurance costs can vary widely based on factors like coverage limits, vehicle type, fleet size, and whether you lease-on or operate under your own authority. For example, according to Schneider Owner-Operators, those who lease-on tend to pay $300-$400 per month per truck in insurance, while those that operate under their own authority tend to pay $1,200-$1,800 per truck per month. While this trucking expense can sound pricey, it’s not just about compliance but about protecting your investment and business continuity.

2. Fuel Costs

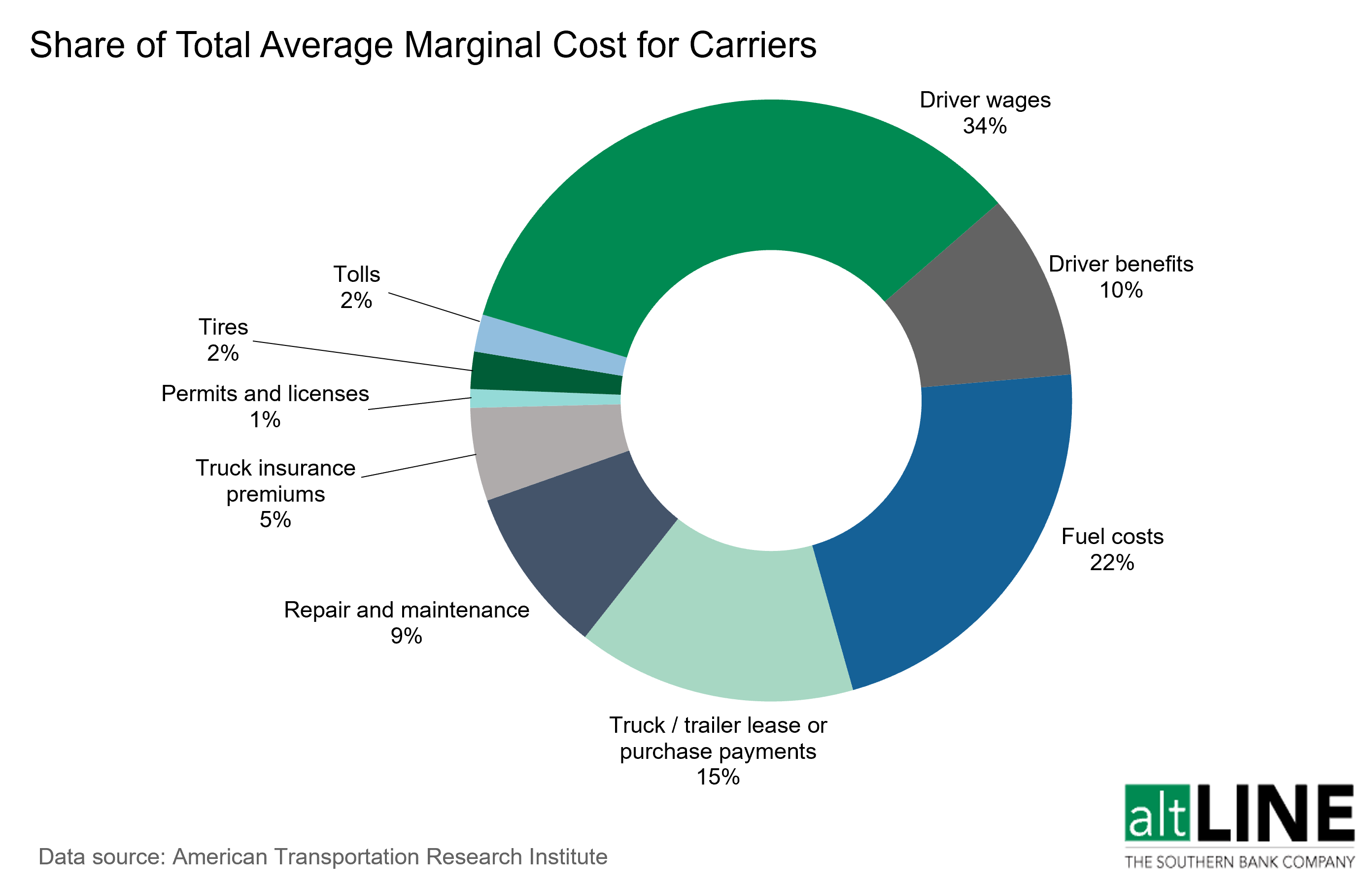

Fuel is a major recurring expense for any trucking operation, and in 2022, it accounted for an average of 22% of all operational costs of trucking, the second highest cost behind paying drivers.

These costs fluctuate based on factors such as market prices and your routes. In 2021, owner-operators spent, on average, $45,605 on fuel, which is about 48 cents per mile. Efficient route planning and fuel management can help in controlling these costs, but they remain a substantial part of your budget regardless.

3. Annual Licenses, Registration, and Permits

Operating a trucking business legally requires keeping up with licenses, registration, and permits. Individually, these costs are usually minor, but they can add up, especially when operating across state lines. According to the American Transportation Research Institute, permits and licenses cost truckers, on average, $0.016 per mile. You can regularly review and budget for these annual expenses to avoid any operational hiccups.

4. Buying (or Leasing) a Truck

The decision to buy or lease a truck is an important one and will influence the direction you take your business.

Leasing requires a lower upfront cost but potentially higher long-term expenses than buying a truck; however, these monthly payments are predictable and shouldn’t drain your working capital like buying a truck might. New owner-operators might not qualify for a loan to buy a truck, so leasing is often the required alternative.

The cost of buying a new semi-truck can run tens of thousands of dollars, but if you’re making a one-time purchase, you won’t have to worry about ongoing payments moving forward. However, hidden costs such as maintenance and repairs could come back and bite you if you don’t have sufficient capital to cover these costs.

Because of the cheaper upfront cost, many owner-operators find that leasing provides a more manageable entry point into the industry.

5. Truck Maintenance and Repairs

As an owner-operator, you’ll be in charge of maintaining your truck, repairing damage, and ensuring it abides by safety protocols. The average cost of truck maintenance and repairs in 2021 was $0.175 per mile, but these costs can vary quite a bit. Setting aside a portion of earnings for these expenses is a wise strategy to avoid larger financial burdens down the line.

6. Business Taxes

Understanding and planning for business taxes is essential. These costs can vary based on your business structure, income, and other factors. It’s advisable to consult a tax professional to ensure you’re saving where you can and paying what you owe. Reading guides on taxes for owner-operators can be helpful too.

7. Food, Drink, and Lodging

On the road, expenses like food, drink, and lodging can accumulate. If you’re an owner-operator, you will be expected to pay for these costs, but you will also be eligible for per diem tax deductions, which allow you to deduct 80% of your per diem come tax time.

8. Registering for Load Boards

Load boards are essential for finding work, but they do come at a cost. Registering for load boards is a must, especially when spot rates are high or you are a new owner-operator finding loads to haul. However, you’ll have to pay monthly subscription costs ranging from $35 to $150 per month. Budgeting for these expenses is important.

9. Freight Brokers (if Applicable)

If you work with freight brokers, their fees are an additional cost. Freight brokers will help you find loads, so you should consider using them despite the fees they charge, which regularly range from 15 to 20% per haul.

10. Accounting Software

Investing in small business accounting software can save you time and money in the long run, even though it adds to your expenses. Many business owners use accounting software to streamline mundane, time-consuming accounting tasks, allowing them to shift their focus toward finding new business. Consider how much accounting software costs against its benefits in streamlining your financial management.

11. Payroll

If you operate a trucking business and have employees on payroll, you can expect to pay them salaries and benefits. Payroll is the #1 most expensive cost of operating a trucking company, but owner-operators that function as solo entrepreneurs do not have to worry about this expense. According to the 2022 report on the Operational Costs of Trucking, driver wages and benefits account for 44% of the expenses associated with running a trucking business. On average, they cost owner-operators $0.809 per mile; however, this cost is 9% lower for those that operate small fleets (100 or fewer power units), costing $0.738 per mile.

12. Freight Factoring

Freight factoring is a financial solution through which owner-operators sell their unpaid invoices to a factoring company at a discount in exchange for immediate cash. This arrangement helps in managing cash flow, especially if your customers have long payment terms.

Using freight factoring means you get the majority of the invoice value upfront (up to 99%), typically within 24 hours, in exchange for a small fee. While not all trucking companies use freight factoring, it is a common type of financing for trucking companies, especially when they are getting started in the industry. The rates for factoring can vary, but the average fee for freight factoring in 2022 was 3%. However, with altLINE, rates are as low as 0.50% of the invoice value.

Owner-Operator Financing Options to Help Cover Expenses

Exploring financing options is essential for managing the array of expenses faced by owner-operators. Traditional trucking business loans include bank loans and lines of credit, which can provide significant cash infusion but require good credit and often collateral. Government grants and specialized programs for small businesses can also be viable options. But more innovative solutions, such as freight factoring, offer more flexibility and quicker access to funds.

Don't let customers stall your cash flow

The No. 1 cause of cash flow issues for businesses is not getting paid on time. Your business's growth doesn't have to be hindered by late payments

Get Paid More Quickly With Freight Factoring

Freight factoring addresses the common challenge of delayed payments, providing immediate liquidity to owner-operators. Rather than chasing down your customers to pay their outstanding invoices to access cash, you can factor your unpaid invoices to get paid the same day you drop off your load.

When you factor with altLINE, you can get up to a 99% cash advance with no application fees and same day funding. If you’d like to learn more about our factoring options, please call 205-590-9471 or fill out our freight factoring quote form.

Owner-Operator Expenses FAQs

Here are some common questions from owner-operators regarding their expenses.

What is the per diem rate for truckers?

In 2023, the standard daily per diem rate for meals for U.S. truckers was $69 per day. The specific rate can vary and is subject to IRS regulations, so it’s advisable to check the current year’s rate for accurate figures.

What funding options are available to help cover my owner-operator expenses?

Owner-operators can explore various funding options, including traditional bank loans, lines of credit, equipment leasing, government grants, and freight factoring. Each option has its benefits and requirements, and the choice depends on your specific business needs and financial situation.

Where can I find a spreadsheet of owner-operator trucking expenses?

You can create a detailed owner-operator trucking expenses spreadsheet using accounting software or manually in Excel or Google Sheets. These spreadsheets can help track various expenses, including fuel, maintenance, and insurance, providing a clear picture of your financial health. Some industry-specific resources may also offer templates tailored to trucking businesses. For example, Spreadsheet Point offers a free trucking expenses spreadsheet.

How much do owner-operators make after expenses?

The average owner-operator earns well over $300,000 per year with specific income varying based on numerous factors like region, freight type, type of routes (i.e. local vs. long haul), and operational efficiency. Generally, after accounting for all expenses, owner-operators can expect a diverse range of profitability leading to a potentially lucrative career with careful management being key to maximizing earnings.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.