Last Updated August 27, 2025

If your business has cash flow problems, one option that can provide an immediate cash infusion into your business is to sell your accounts receivable.

Selling receivables is called invoice factoring, an alternative financing solution aimed primarily to improve a company’s cash flow and liquidity.

But factoring, as with other alternative lending options, is not as commonly understood as your typical business loan. So let’s talk more about why so many business owners—particularly small business owners—choose to sell their accounts receivable.

How Does Selling Receivables Work?

When selling receivables, you’re sending outstanding invoices to a third-party factoring company (also known as a “factor”) in exchange for an immediate cash advance of up to 80-90% of the value of each invoice. Your customer then pays the factor, rather than your business, when they are ready to pay the invoice.

Once the invoice is paid and processed by the factor, the remaining value of the invoice is released to your business, minus a small factoring fee. This process is known as invoice factoring.

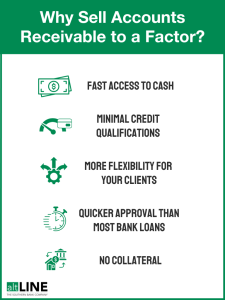

Why Companies Sell Accounts Receivable for Cash

The main reason for selling your accounts receivable is to provide your business with more predictable cash flow and to help make your business cash flow positive overall, especially if your company is struggling to stay afloat due to long payment terms. Selling accounts receivable also protects your cash flow from being hindered by slow-paying customers. With instant funds via the cash advance, you can settle other urgent business expenses.

Selling accounts receivable is a great alternative if you need funding but have been declined by a bank traditional loan. A company struggling with nonexistent business credit, poor credit or problems in their financial history, like bankruptcies, should view selling accounts receivable as a great alternative too.

If your business does receive a bank loan, but it’s not enough to solve your working capital problems, you can also turn to factoring for additional capital. And for businesses that do not want to incur any additional debt, selling your receivables is a smart option to get cash fast without creating future problems.

Pros and Cons of Selling Your Accounts Receivable

Selling your accounts receivable to further finance your business can be extremely beneficial, particularly for small business owners or those whose businesses are undergoing rapid change or dynamic growth. Let’s take a look at the advantages and disadvantages of selling your receivables.

| Pros of Selling Receivables | Cons of Selling Receivables |

| Quickly Improves Cash Flow | Fees Will Slightly Lower Profits |

| Flexible Form of Financing | Risk of Customer Non-Payment Remains |

| Minimal Restrictions for Usage of Funds | Debtors Must Have Sufficient Credit Score to Qualify |

| Not a Loan – So Does Not Incur Debt | Stigma Surrounding Invoice Factoring |

| No Collateral Required |

Pros of Selling AR

There are some significant benefits for those who choose to sell their A/R.

It Rapidly Improves Your Cash Flow

The primary purpose of factoring is to improve your cash flow. You don’t have to wait for clients to pay their invoices to earn a profit. Instead, the factoring company purchases your business’s invoices at a discount, sends you an advance payment for the invoices, and collects their payment when your customers pay.

The cash flow is predictable, too, so it takes away much of the worry you experience waiting for your customers to pay.

Flexible Form of Financing

Factoring works well for growing companies because you can adjust the volume of invoices sold as your business expands. Plus, you get to choose which invoices to sell, so you can focus on selling and earning from slow-paying customers while retaining the total profits from your clients that pay quickly.

Minimal Restrictions for How You Can Use the Funds

Once you receive capital from the factoring company, you can use it in nearly any way that you would like (with the exception of purchasing expensive equipment), whether you need it to finance payroll, inventory, rent, or any other business expenditures you have.

Does Not Incur Additional Debt

Invoice factoring is not a loan, as factoring companies simply purchase your AR at a discounted rate, so selling receivables adds zero debt to your business’s records. Therefore, you can earn instant cash flow without worrying about how it will affect your finances years later.

No Collateral Required

No need to stress over sacrificing and potentially losing valuable assets. When selling your receivables, a factoring company like altLINE won’t require collateral.

In the rare instance your customer never ends up paying the invoice, a good and honest factoring company will work with you to the most ideal, fair solution for both parties.

Support for Your A/R Department

After you finish the onboarding process with a factoring company, they will assist your A/R department with management and collections. This assistance allows your business to focus on its core goals. However, this support may also become a disadvantage because you give up some control of your business’s customer relations.

Cons of Selling AR

As with any financing option, factoring has a few potential downsides that you need to consider before you commit to it.

Additional Fees That Slightly Affect Profit Margin

There are two types of fees you will encounter in factoring: invoice-dependent factoring fees and administrative fees.

A factoring company determines your invoice-related fees based on the number of invoices you are selling and the credit of your clients. You agree upon these fees at the start of your relationship with the factoring company.

Risk of Customer Non-Payment Remains

Selling your accounts receivable doesn’t necessarily alter the chances that your customer pays on-time – or pays at all. Unless you’re utilizing non-recourse factoring, you’ll be held liable for failed customer payment, just as you would if you hadn’t factored the invoice.

Factoring companies understand this is out of your control, and you should expect them to do their best to work with you to find the best solution going forward, but it’s something to be aware of. Since they provided you an advance for the invoice, they expect to receive payment from your customer.

Ability to Qualify Reliant on Customer Credit Score

If your customers have poor credit history, a factoring company may not want to take on the risk of relying on them for payment and your application might be denied.

The Invoice Factoring Stigma

If you’re considering selling receivables, it’s crucial to understand that there’s a difference between selling accounts receivable to a bank vs. an independent company. Because independent factors are unregulated and have a stigma of being predatory, this has affected the perception of the financing option as a whole.

Remember that financial institutions are far more regulated than independent companies and have to abide by certain rules and restrictions. This is why most choose to factor with a bank.

In-Summary: Selling Accounts Receivable

Through the sale of accounts receivable, businesses unlock immediate funds that otherwise wouldn’t be available. These funds, provided by a factoring company, can fund expansion efforts, be used to make payroll, make rent, increase inventory, and more.

Accounts receivable factoring is an especially useful alternative for small businesses, new businesses, or seasonal businesses who can’t qualify for a standard business loan. In some cases, selling receivables could even make sense for businesses that can qualify for those traditional loans.

If you have any questions about selling receivables or think your business might be a good fit for factoring, feel free to reach out to altLINE at +1 (205) 607-0811 to discuss with one of our representatives or fill out our free factoring quote form.

Selling Accounts Receivable FAQs

Can I sell someone my accounts receivable?

What is selling receivables to obtain short-term funds called?

The sale of receivables in return for a cash advance is an alternative financing solution called invoice factoring.

Who might receivables be sold to?

Receivables are sold to invoice factoring companies. These companies buy accounts receivable to help business owners improve cash flow, particularly small business owners who might not be able to qualify for a traditional business loan.

Why would a company sell receivables to another company?

Many small business owners sell receivables to third-party invoice factoring companies because an immediate cash advance is provided of up to 80-90% of the value of each individual outstanding invoice. This cash advance can greatly assist businesses maintain healthy cash flow and fund expansion efforts without having to worry about long payment terms or slow-paying customers causing financial distress.

What is recourse as it relates to selling receivables?

As it relates to selling receivables, recourse refers to the type of debt; more specifically, which party between the borrower and the lender (factoring company) is liable for lost funds in the case a debtor fails to submit invoice payment. Under a recourse agreement with a factoring company, the borrower is liable. Under a non-recourse agreement, the factoring company is liable.

Grey was previously the Director of Marketing for altLINE by The Southern Bank. With 10 years’ experience in digital marketing, content creation and small business operations, he helped businesses find the information they needed to make informed decisions about invoice factoring and A/R financing.