Invoice Payment Terms: What Are They and Which Should You Work On?

Last Updated July 18, 2024

As a new business owner, learning different invoice payment terms before setting up your invoicing system is crucial. You don’t want to sign a contract with a supplier or buyer without knowing all of your payment term options, because you might be missing out on terms that are more suitable for both your business and your customer.

Before discussing some of the most common terms, let’s briefly review what invoice payment terms are, why they’re so important for dictating your cash flow, and where you can find them on an invoice.

What Are Invoice Payment Terms?

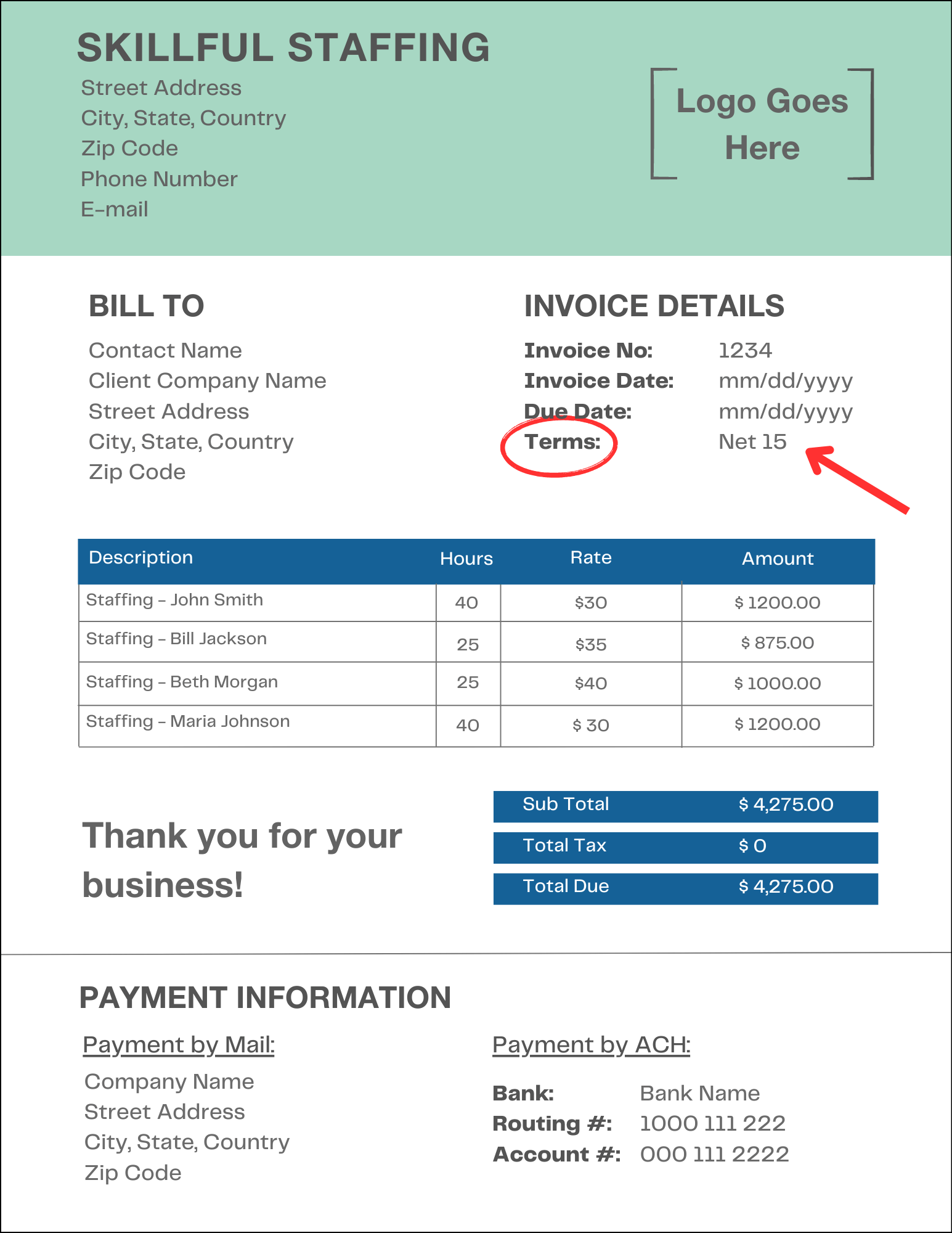

Invoice payment terms lets your customer know when they are expected to pay off the invoice balance. A customer can find the payment terms on the invoice itself, alongside the invoice issue date, invoice due date, and amount due.

It’s vital to discuss payment terms with prospective customers before signing off on a deal, because regardless of what you both decide on, it will have an impact on your business’s cash flow.

Blake Rutledge, CFO at Kruze Consulting, urges business owners to be proactive when it comes to invoicing.

For example, a contract with net 7 payment terms means your customer owes payment to your company within 7 days of when you sent the invoice. A contract with net 30 terms means your customer doesn’t owe payment for a whole month. That’s 23 additional days without cash in your pocket! For small business owners especially, this can greatly affect cash flow.

Cash flow is vital to the success of every small business – it’s the No. 1 reason why small businesses fail – so this isn’t something you should take lightly. Carefully review the following terms before noting which will work best for your future partnerships.

The 24 Invoice Payment Terms Every Business Owner Should Know

There are many different payment terms you’ll come to recognize once you start doing business. While some are far more common than others, here are the 24 invoice payment terms that every business owner should be familiar with before doing business:

1. Net D

Net D payment terms are some of the most widely used invoice payment terms on the market. In this case, the “D” is a variable that stands for days and designates how many days a customer has to pay off their outstanding invoice. Common net D terms include net 7, net 15, net 30, net 45, net 60, and net 90.

Below is a description of how a few net D payment terms work.

Net 15

An invoice with net 15 terms requires payment within 15 days of the invoice date, including holidays and weekends. The only difference between net 15 and other net D invoice payment terms is the number of days before payment is due.

Net 30

Net 30 terms are one of the most common invoice payment terms you will see. With net 30 terms, the business is paid 30 calendar days after the invoice date. If you must supply a service or product, these payment terms mean that your client would typically receive your invoice and pay it after 30 days.

Businesses with large overheads which need time to manage their cash flows before paying invoices will often use this payment method.

Net 60

Net 60 payment terms has a payment due date of 60 calendar days after the date it was issued. When you supply a service or product, these payment terms mean that your client would typically receive your invoice and pay it within 60 days.

The extended time allows your clients more flexibility than net 30 terms while still giving them enough time to manage their cash flow effectively. The most typical types of businesses that use net 60 are manufacturing companies, charities, or organizations that are 100% business funded. Small businesses and startups don’t often work on terms as extended as net 60.

Related: Invoice Factoring for Manufacturing Companies

Businesses with longer payment terms (net 30 to net 90) often turn to invoice factoring to boost cash flow.

2. PIA

Payment in advance, or PIA, are invoice terms in which the client pays for your service or product upfront before you provide it. Freelancers, self-employed consultants, and other independent contractors who are often paid at the beginning of a project or once they meet specific milestones use these payment terms. PIA lets them know exactly how much money they’ll receive, even if their work takes longer than expected.

3. CIA

CIA, or cash in advance, is similar to PIA since the seller receives payment prior to providing goods. However, CIA payment terms are associated with products that must be shipped to their final destinations, so they are more common in trade agreements and online marketplaces.

CIA payment terms are very secure for the seller but riskier for the buyer. Because the customer must pay in advance, the seller does not have to worry about working with uncreditworthy customers.

4. CWO

Cash with order, or CWO, is another name for payment in advance (PIA). This type of agreement requires the buyer to pay at the time of placing the order.

5. EOM

An End of Month (EOM) invoice is typically paid at the end of each month or when a contract finishes. This allows you to invoice your clients once per month rather than every two weeks, which can be more convenient for both parties. If you supply a service, EOM payment terms mean that payment for this service gets collected at the end of each month.

It’s typical to use EOM invoice terms when you’re supplying a product as well as a service. In other words, if your client contracts you to produce monthly financial statements as an accountant or create website content as a freelancer, it’s common practice to issue an End of Month invoice.

6. 15 MFI

With 15 MFI payment terms, “MFI” stands for Month Following Invoice. The number that precedes “MFI” (in this case “15”) designates the day of the month following the invoice issue date on which a customer’s payment is due. So, for example, if an invoice is issued on May 22nd with 15 MFI payment terms, that would mean that payment is due by June 15th.

However, while 15 MFI is typically interpreted as payment being due on the 15th of the month following the invoice issue date, you may run into an instance in which the invoice is due the same month. Sometimes, if sellers issue the invoice prior to the 15th, the invoice payment may be due the same month. For example, if an invoice is issued with 15 MFI payment terms on May 3rd, payment could be due May 15th or June 15th. It is best to clarify with the seller prior to doing business with them to ensure you make on time payments.

7. 50 Upfront

50 upfront, also known as “50 percent upfront payment” is an invoice payment term where the buyer must pay 50% of the total invoice before work begins on a product or service. For long projects that take months to complete, 50 upfront is a great way to improve your cash flow and gain access to immediate working capital.

8. COD

COD stands for cash on delivery. With COD payment terms, the buyer is expected to pay for their purchase once they receive it.

While it’s technically called cash on delivery, most businesses that offer COD also accept electronic payments. Businesses may choose to offer COD to attract new customers since this can be a way to make customers feel more secure in buying from a new company.

9. PPD

Professional Payment Due (PPD) payment terms vary depending on your country and your industry. In general, you can use PPD when you work with larger companies that want to pay invoices over some time rather than paying all invoices within 14 days of receiving them.

However, the exact time allowed for PPD can vary from 35-45 days between invoice date and due date, so ensure you find out the specifics of each contract before signing it.

10. CAD

Cash against documents, or CAD, is a common form of payment in international trade. Essentially, the shipping documents, such as the bill of lading, are not released to the importer until the payment has been made to the exporter. CAD, also known as documents against payment (D/P), is typically facilitated by a financial institution, which manages the release of the documents to the importer and the release of payment to the exporter so that both parties receive their respective items at the same time.

11. CND

CND, or cash next delivery, is used for recurring deliveries from the same business. CND means that the buyer’s payment is due prior to receiving the next delivery.

12. CBS

Cash before shipment (CBS) are payment terms that require the buyer to pay for the goods, in part or in full, prior to their shipment. You may see CBS used when ordering custom-made products, in international trade, or during quick turnaround orders.

13. Due Upon Receipt

The invoice payment terms “due upon receipt” are exactly what they sound like – the buyer is expected to pay the amount due upon receiving the invoice. Due upon receipt can improve cash flow for the seller since they would receive payment much more quickly compared to other standard payment terms, such as Net 30. However, many small businesses are unable to pay upon receipt, so if you choose to use these payment terms, use them strategically and with good reason.

14. Line of Credit

Using line of credit payment terms allows a buyer to purchase goods or services on credit from the seller and pay off the balance due on an agreed upon payment schedule. Offering a line of credit can be risky if you are unsure if your customers are creditworthy, but on the flipside, it can create loyalty and encourage them to place larger orders, which can lead to a more successful long-term partnership.

15. Net 10 EOM

In the invoice payment terms Net 10 EOM, “EOM” stands for “end of month”. With these types of terms, the invoice payment is due in full within 10 days after the end of the month that it was issued. To see this in action, consider an invoice that is issued on April 22nd with Net 10 EOM payment terms. This invoice would be due within the first 10 days of the next month, so the invoice due date would be May 10th.

16. Open Account

Open account payment terms are common in international trade and often favor the importer far more than the exporter. With open account terms, the goods are shipped and delivered before the exporter receives payment. Oftentimes payment is not due for 30, 60, or even 90 days after receiving the invoice. While open accounts are not very favorable to exporters, sellers often use them to stay competitive in the international market.

17. 50/40/10

While not common, 50/40/10 invoice payment terms can have a few different meanings. Be sure to clarify prior to doing business with these terms to ensure on time payments are made. Below are the primary two definitions we’ve seen associated with 50/40/10 payment terms, but there may be other variations, depending on what has been negotiated between a buyer and seller:

- 50% of the invoice is due at the time of purchase, 40% is due at the time of shipping, and 10% is due at the time of delivery

- 50% of the invoice is due at the time of purchase, 40% is due 2 weeks before delivery, and the remaining balance uses Net 10 payment terms

18. 25/25/50

Similar to the 50/40/10 invoice payment terms noted above, 25/25/50 typically references that 25% of the invoice is due at the time of order, 25% is due at the time of shipping, and 50% is due at the time of delivery. However, because these are uncommon payment terms, we recommend checking with the seller to confirm these expectations.

19. T/T

While not technically a set of invoice payment terms, T/T stands for telegraphic transfer, and you may see this term when working with overseas suppliers. A telegraphic transfer is a type of payment method that is similar to a wire transfer, and it is used to transfer international funds.

20. EOAP

EOAP, or end of accumulation period, is a phrase sometimes used when setting invoice payment terms. When using EOAP, there is an accumulation period and the payment terms associated with that accumulation period. The seller should define when the accumulation period is (for example, from the 5th of one month to the 4th of the next month), and all invoices that were accrued during that period would follow the defined payment terms.

EOAP is typically followed by a number (i.e. EOAP 60), which sets the payment terms. For example, if the accumulation period is from the 5th of one month to the 4th of the next month and the payment terms are EOAP 60, then the total invoice value that accumulated during the period would be due within 60 days of the end of the period, following traditional Net 60 terms.

21. 5th 3rd Prox

Some of the least common invoice payment terms, 5th 3rd prox can be a bit confusing at first glance. With 5th 3rd prox, invoice payment is due by the 5th day of the 3rd month after the invoice issue date. For example, if an invoice is issued on February 16th with 5th 3rd prox terms, then the invoice due date would be May 5th.

22. CWO

CWO, or “Cash With Order,” means the customer is required to pay upon placing an order, before the goods or services are produced and delivered.

23. Contra Payment

When a business that invoices a receiver already owes payment to the receiver from a previous transaction or product, the two parties can arrange a contra payment. This means that the money owed to the receiver can be made up in the form of products or services rather than cash.

24. Stage Payment

Stage payments occur when a predetermined amount of money is paid at certain stages throughout the course of a project. These are very common in the construction industry, where contractors working on large-scale, long-term projects are paid at predetermined milestones or intervals.

Early Payment Discounts

Suppliers often offer early payment discount terms, in which the buyer receives a discount if the invoice is paid early. There are a few variations of these types of invoice payment discounts with the most common being 1/10 net 30 and 2/10 net 30. To get an idea of how these invoice terms work, see the chart below:

| Early Payment Discount | Terms Meaning |

| 1/10 net 30 | The buyer receives a 1% discount if the invoice is paid within 10 days. If the invoice is not paid within the first 10 days, then the full invoice payment is due within 30 days. |

| 2/10 net 30 | The buyer receives a 2% discount if the invoice is paid within 10 days. If the invoice is not paid within the first 10 days, then the full invoice payment is due within 30 days. |

| 2/10 net 60 | The buyer receives a 2% discount if the invoice is paid within 10 days. If the invoice is not paid within the first 10 days, then the full invoice payment is due within 60 days. |

| 2/15 net 30 | The buyer receives a 2% discount if the invoice is paid within 15 days. If the invoice is not paid within the first 15 days, then the full invoice payment is due within 30 days. |

While perhaps not as common as your standard invoice payment terms, early payment discounts can be an incredibly beneficial alternative to both parties.

Mark Stewart, CPA at StepbyStepBusiness, encourages exploring not only these typical early payment discounts, but custom and even more creative alternatives.

“One particularly effective strategy I employed was implementing a tiered incentive system for early payments, coupled with clear, consistent communication,” Stewart said. “This approach involved offering small discounts for payments made well before the deadline and a sliding scale of incentives as the payment date approached.”

Have Systems in Place to Track Progress According to Payment Terms

The work doesn’t end once you’ve agreed upon terms; nor once you’ve invoiced your customer. Just as important to how long your customer has to pay is whether or not they actually abide by the agreement. Studies show that nearly half of all B2B invoices become overdue.

Because of this, it’s imperative to have organized, automated systems in place to track payment. According to Blake Rutledge, CFO at Kruze Consulting, this means investing in software.

“You can try tracking payments offline, but once you reach a certain number of customers, it is just not feasible to maintain an Excel spreadsheet with all of your customers and all of your invoices,” Rutledge said. “I would absolutely recommend some sort of invoicing software. There are so many products out there and so many platforms that make that process easy that there’s no point trying to reinvent the wheel.”

Per Stewart, it’s equally vital to know how to effectively communicate with your customers when mishaps do occur.

“When customers delayed beyond the agreed terms, I initiated personal, empathetic conversations to understand their situation, offering flexible payment plans when feasible,” Stewart said. “This dual strategy improved cash flow and strengthened customer relationships.”

In-Summary: Standard Invoice Payment Terms

There are clearly many different invoice payment terms available, some of which may differ in commonality depending on your industry. While there’s no universal “best” payment term to implement, there are terms that are more sensible than others depending on your financial standing, such as your cash flow. So, before creating an invoice and sending it to your client, make sure you identify which terms make most sense to you, and to your customer, to give yourself the best chance to have your invoice paid promptly without any unnecessary hold-ups.

Invoice Payment Terms FAQs

How many types of invoice payment terms are there?

There are 24 types of invoice payment terms that are commonly used in business transactions.

What are the most common payment terms?

The most common payment terms include net 15, net 30, PIA (payment in advance), CIA (cash in advance), COD (cash on delivery), and due upon receipt.

What are the best payment terms?

The answer to this question is relative, as every business has different cash flow needs and working capital needs. Typically, small businesses tend to work on short payment terms, such as net 7. Businesses in the wholesale and manufacturing industries, however, often work on long payment terms, such as net 60 or even net 90.

What should I do if my customer fails to meet their payment terms?

If your customer misses their payment deadline, you should be proactive by reaching out to them and incurring the late payment fees that you included in your contract or agreement. Additionally, you should have email templates for politely asking for payment to save time in case it’s a recurring issue.

How can I get my invoices paid faster?

A few tips to help get your invoices paid faster include:

- Offer early payment discounts

- Create an email template to politely remind customers about payment

- Ask your customer if they’d be willing to shorten payment terms

- Offer automated payment

- Implement late payment fees

- Try invoice factoring

Can you change payment terms with existing customers?

Changing payment terms on a contract with existing customers is possible, but it requires ample communication to avoid misunderstandings or potential legal disputes. You cannot change payment terms without letting your customers know or change terms on an outstanding invoice. It’s imperative that if you wish to change payment terms, you communicate with your customer and get verbal and signed confirmation to officially put the new terms into effect.