Last Updated October 21, 2024

If you’ve already determined that invoice factoring is a good fit for your business, the next step is to identify the best factoring company for you. There are many different providers to choose from – so how do you know which is the best?

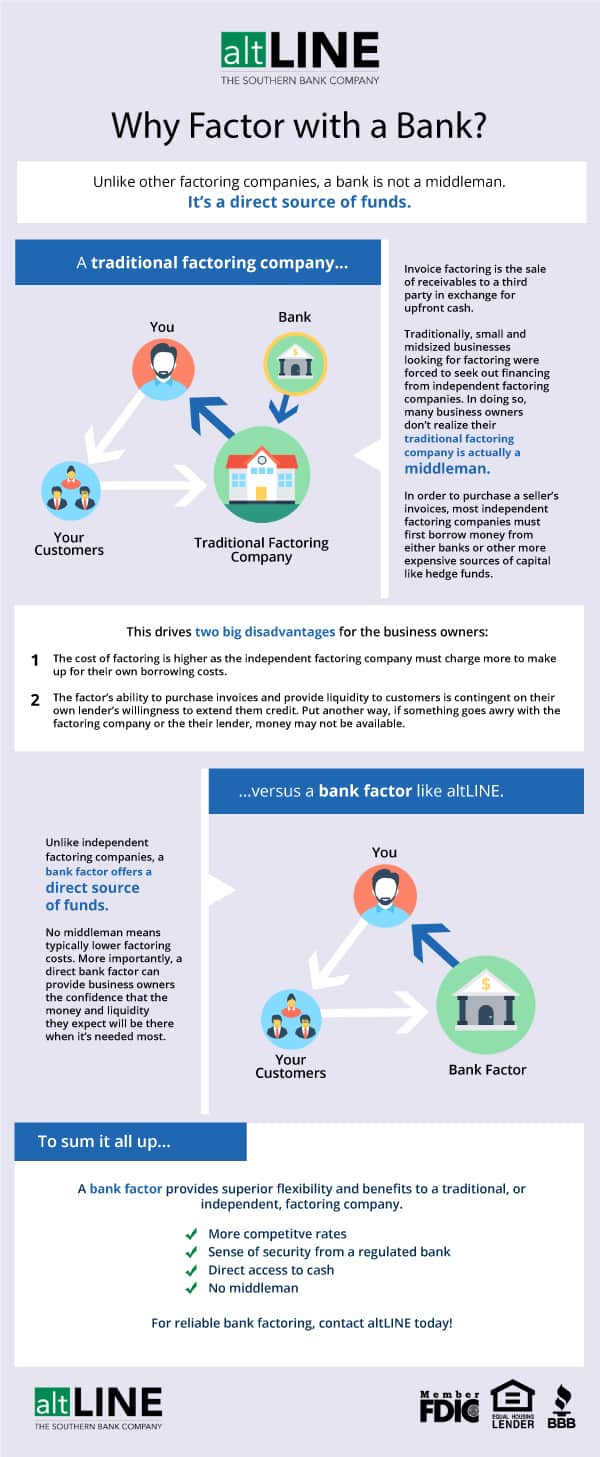

There are two types of factoring companies: independent factors and bank factors. This article will describe the differences between the two, along with why most small business owners choose bank factors.

But first, here’s a snapshot of what the invoice factoring process will look like for your business.

What Is Invoice Factoring?

Invoice factoring is a transaction between a business and a third-party factoring company (a “factor”) where a business sells outstanding invoices in exchange for cash advances (up to 90% of each invoice value).

By way of a Notice of Assignment, the business notifies their debtors that moving forward, they will submit payments on all factored invoices to the factor, rather than the business. Then, once the factoring company receives payment from the debtor, the remaining value of the invoice is released to the business, minus a small factoring fee.

Why Do Companies Factor Invoices?

Businesses (particularly small, growing, or seasonal businesses) factor invoices for a variety of reasons.

1. Funds are advanced to your business before clients pay the invoice for goods received, providing an immediate working capital boost.

2. Factors provide credit control – the collection of funds is managed by the factoring entity which reduces your A/R responsibilities.

3. Factoring provides capital while your business still has open invoices.

4. Factoring is not a loan since the invoices/accounts are purchased by the factoring entity. They do not show on your books as a liability, reducing potential balance sheet debt.

5. Businesses that experience seasonal fluctuations in their business have periods of insolvency; factoring is a means of acquiring cash flow based on money owed by clients.

6. Quick access to funds with invoice factoring – funds available within 48 hours after an invoice is generated.

7. Relief from debt collection.

8. Factoring is a rare example of a financing solution that incurs no debt for users, since the factoring company purchases your outstanding AR.

What Is a Bank Factoring Company?

A bank factoring company is exactly what it sounds like, a federally regulated bank that factors invoices for clients. A bank factoring company like altLINE is member FDIC, or FDIC-insured, meaning altLINE must abide by state and federal regulations, thus you have forms of protection when it comes to your money.

This isn’t the case for independent companies, with loose regulations that have tended to give this alternative financing solution a bad rap.

What Is an Independent Factoring Company?

Independent factoring companies also work with businesses that need to accelerate cash flow and may have been turned down by a bank. However, an independent factor borrows funds from a third party in order to fund your invoices. That can significantly increase risk and the overall costs of factoring for your business. Because these types of factoring companies are unregulated, it’s generally not advised to work with an independent factor.

What Services Do Bank Factoring Companies Offer?

The answer will vary depending on the factor you choose to work with. There are many nuances and differences between traditional financing companies and banks that offer factoring. Each provider has its own way of defining the types of factoring available.

At altLINE, we break out our receivable-based products into two structures:

- Invoice factoring: The more popular financing solution of the two, where businesses sell invoices to the third-party (the factor, such as altLINE). We provide the business a percentage of the total value of invoices and collect invoice payments from the business’ client. After the client pays the invoice, we pay the business the remainder of the money collected minus a small transaction fee (factoring fee).

- Accounts receivable financing: A business sells the value of its invoices to a third-party factor such as altLINE at a discount. Once the invoice is processed, the business receives funds based on the expected money due from their client (the debtor). The AR financing structure operates similarly to a line of credit.

As a bank factoring company, altLINE offers various invoice factoring and accounts receivable financing structures to fit the varying needs of a business.

Bank Factoring Companies vs. Independent Factoring Companies

While the overall goal of invoice factoring is the same, choosing the right provider is critical. Let’s summarize the differences between an independent factor and a bank factor.

| Bank Factoring Company | Independent Company Factoring |

| FDIC-insured and regulated at the state and federal level | Significantly less regulated |

| Uses its own funds for your invoices | Borrows from a third-party to fund your invoices |

| Offers competitive rates | Significantly less competitive rates due to the need to cover financing costs |

| Provides an easier transition to a bank loan | Won’t help significantly with transitioning to a bank loan |

Advantages of Bank Factoring Companies

A bank factor provides the same flexibility and benefits as an independent factor, but also offers additional advantages.

Easier Transition to Bank Loan

A bank factor works with many businesses who are considered outside of the traditional credit box. Many of these businesses have been told “no” by a bank for a commercial loan, but they are still very strong candidates for working with a bank that offers factoring, or accounts receivable financing. Businesses that work with a bank owned factoring company may also have an easier time transitioning to a commercial loan at a later date.

Greater Security

Banks are more secure and provide a sense of financial stability for the business. A business’s clients are very valuable relationships, and a bank offers a level of comfort not found in independent alternative financing companies. Clients feel better about interacting with a bank than an unfamiliar or unknown business entity.

Competitive Rates

In addition, since the bank has its own funds, it can offer the business very competitive rates. Unlike many independent factoring companies that work with multiple funding sources, a bank acts as a direct source of funds and eliminates the middleman.

Factoring is a common solution to cash flow and is best used during growth periods or when the account receivables are large. The business benefits since the time between delivery of goods and funds realized is short. The business is relieved of the burden of chasing debt and can focus on other pertinent issues.

In-Summary: Why Factor with a Bank?

Since there are limited barriers to entry, anyone can start a factoring company. Therefore, as you would expect, some factoring companies are better than others. Take the time to research and get comfortable with your factoring partner.

Kelley Burnett, altLINE Vice President of Operations, further highlighted the advantages of working with a bank factor.

“An independent factoring shop is usually borrowing the funds they provide to clients from another institution, typically a bank,” Burnett said. “They must then charge their clients a high enough rate to cover their financing costs. A bank/direct lender is supplying its own money to its client base, giving it the ability to be much more flexible on fee structures, and provide greater value for the client base.”

“Banks are also regulated at the state/federal level,” Burnett added. “With a large number of rules, regulations, and laws to comply with, a bank factoring provider offers a more secure, trustworthy, reliable, and transparent client experience.”

Contact us today at (+1) 205-607-0811 or fill out our free factoring quote form to see how factoring with a bank can help your business grow.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.