Last Updated June 8, 2023

Rido // Shutterstock

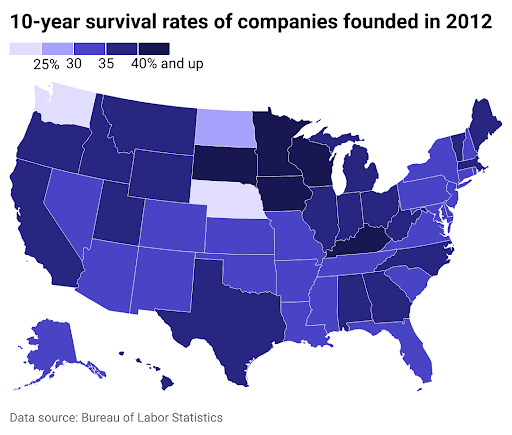

If you’re thinking of starting a business, you might want to give some consideration to location. In which state would you have the best chance of success? Iowa tops the list, followed by Wisconsin, South Dakota, Kentucky, and Minnesota.

And the worst? The state of Washington.

The vast majority of small businesses survive the first 12 months—about 80%, according to the Small Business Administration and other agencies. But once they pass the one-year mark, the picture starts to change. By the fifth year, about half are still operating; by the 10-year mark, only a third remain.

Using data from the Bureau of Labor Statistics, altLINE explored state-by-state business survival rates over the past decade. The data looks at private sector establishment survival rates in March 2022 among those that opened in the year ending March 2012.

Entrepreneurs must know who their competition is, how to price what they’re selling, identify demand for their goods or services, and have enough capital to thrive, whether from a loan, investors, sales, or other income. Post-pandemic adjustments to the supply chain, labor supply, and work-from-home arrangements have changed the economic landscape.

Even so, business survival rates have stayed consistent over time. Despite the economic upheaval, approximately 4 in 5 businesses founded in 2021 survived their first year, according to BLS data. That statistic jibes with data going back to 1994, showing one-year survival rates ranging from about 75% to 85%. Among the household names of the survivors from that year are Amazon and Dreamworks Pictures.

What business types have the best chance of surviving? Manufacturing ranks #1, followed by health care and social assistance, educational services, finance and insurance, and real estate, rental, and leasing.

States in the Midwest had the highest 10-year survival rates

Overall, the highest survival rates for small businesses are in the Midwest. One reason might be due to the changes that have occurred in the economy of rural America. Farming now accounts for less than 5% of its workforce, manufacturing for 15%, and small businesses for most jobs, according to a Brookings study.

The study notes that rural communities have been encouraging the growth and development of small businesses through revitalization strategies for their downtowns. Local leaders often have the skills and the knowledge to help new businesses.

Some other advantages presented by the Midwest? The costs are lower than the East and West Coasts, especially for real estate. Also in the plus column are 50 million potential consumers, and several Fortune 500 companies can offer assistance.

Washington, on the other hand, has the highest rate of failure. The Washington Policy Center, a think tank focused on the free market, blames state policies, from local taxes to rules and mandates. However, when looking at one-year survival rates, Washington comes in at #1.

Nebraska and North Dakota are other states where small businesses fail at high rates. A study by the Nebraska Business Development Center faulted the culture of “Nebraska Nice,” an aversion to risk, and a lack of early support for entrepreneurs. North Dakota suffers from above-average costs of living and labor costs and difficulty finding labor.

Written by: Aine Givens