Net 30 Payment Terms: What Are They and How Do They Work?

Last Updated May 31, 2024

As a first-time business owner or someone new to handling accounting procedures, you’re going to come across a plethora of new terminology, such as “payment terms” and “Net 30,” both of which pertain to the invoicing process.

Since properly managing your accounts payable (AP) and accounts receivable (AR) processes is necessary to achieve long-term success and profitability, you should prioritize learning the various invoice payment terms to consider when writing an invoice.

Net 30 is one of the most common standard invoice payment terms, so let’s explore the meaning behind Net 30, how Net 30 works, and when Net 30 starts.

What Does Net 30 Mean On An Invoice?

Net 30 payment terms on an invoice means the customer has 30 days to pay the full balance of the invoice.

Invoices contain the date of sale, goods or services purchased, payment terms and conditions, etc. The payment terms refer to the conditions under which a buyer has to pay-off the full value of the invoice.

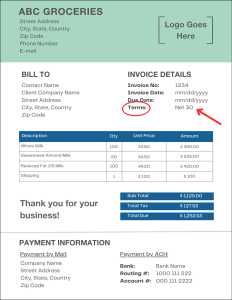

Take a look below at an example of an invoice with Net 30 payment terms:

Invoice Payment Terms Net 30 Example

Payment terms (in this case, Net 30) are located near the top of the invoice – although invoice layout varies by business – along with items such as the invoice number, invoice issue date, invoice due date, and description of both businesses. Knowing what items belong on an invoice and laying it out on a professional invoice template will ensure your business maintains a professional reputation to your customers.

When Do Net 30 Payment Terms Start?

Any successful business owner knows that consistent, polite communication between buyer and seller is key in a healthy B2B or B2C relationship. When it comes to invoicing, it’s no different. Establishing clear terms before a contract is signed is one of the easiest ways to improve customer payment, as misunderstandings about specific term details could jeopardize the partnership.

One of those details that should be discussed prior to the transaction is when Net 30 payment terms start. Conceivably, the first day could be any of the following:

- The date the invoice was issued to the buyer

- The date the invoice was received by the buyer (if invoicing by mail)

- The date the goods or services were shipped to the buyer

- The date the goods or services were received by the buyer

For example, say a small grocer forms a new partnership with a vendor on Net 30 payment terms. The store receives its first shipment of products from the vendor on April 7 and is invoiced for the products on April 14.

The grocer’s accounts payable handler has a lot on their plate at the time, so they put off submitting payment until a few weeks later. They submit invoice payment on May 11, thinking that date is within Net 30, but the contract states that Net 30 terms begin once the product is delivered (April 7), not upon issue of the invoice (April 14). Thus, the invoice would be overdue, and the business owner may now owe late fees to the vendor.

A one-off overdue invoice might not seem like a huge deal in the grand scheme of business, but small businesses in particular can be heavily affected by unpaid invoices or late payments as it can halt cash flow and threaten the working relationship between the two parties. Plus, that late invoice usually isn’t just a one-off, as a staggering 49.7% of all invoices become past-due.

Net 30 Payment Terms: Pros and Cons

Net 30 payment terms are one of the longer payment terms you’ll regularly find (although longer terms do exist, such as Net 60).

Not every business should look to set Net 30 payment terms. If you’re running a startup or small business and selling a product, you may find that Net 7 or Net 15 terms are necessary to increase cash flow. However, for small businesses buying a product or service while operating on thin margins, these longer payment terms can be very beneficial as it provides extra time to come up with the cash.

Looking into the pros and cons of Net 30 should give you a better idea of if Net 30 makes sense for your business.

| Net 30: Pros | Net 30: Cons |

| Typically helps avoid bad debt – Net 30 is ample time for the buyer to pay the full value of invoice | Can negatively impact cash flow for the seller, especially if payments aren’t made on time |

| Fulfills customer expectations – seller providing long payment terms can improve the relationship between the seller and buyer | Prolonged payment cycles typically lead to decreased short-term working capital |

| Offering longer payment terms can help attract new customers and retain existing customers | Customers unfamiliar with net payment terms can be confused on exact due date |

| Can be beneficial for building a revenue pipeline and streamlining operations | Takes longer to become debt free |

| Longer payment terms (like Net 30) are ideal for purchasers with cash flow problems | Typically not ideal for small businesses or startups acting as the seller, as the long payment cycle can reduce already limited working capital |

What Are Other Common Invoice Payment Terms?

Net 30 is the payment term you’ll come across the most, but there are several other net payment terms you’ll often find businesses using.

Other net payment terms include:

- Net 7 Payment Terms: A buyer has 7 days to pay an invoice

- Net 15 Payment Terms: A buyer has 15 days to pay an invoice

- Net 60 Payment Terms: A buyer has 60 days to pay an invoice

Theoretically, any number could come after “Net” as this is determined via an agreement between the buyer and the seller before the contract is signed. However, some of the most common payment terms include Net 7, Net 15, Net 30, and Net 60.

The length is typically decided by factors such as:

- The size of the job – how much labor goes into completing the sale?

- The cost of the job – how expensive is the sale?

- The size of the business selling the products or services (smaller businesses selling a product while operating on tight budgets likely require quicker payment terms).

- How long you and your customer have been working together

To better understand which payment terms are appropriate for your business, consider the following examples:

If a hospital utilizes a large healthcare staffing agency’s services to find nurses and doctors in bulk, Net 30 payment terms or longer makes sense given that it’s likely an expensive undertaking and the staffing agency probably won’t be short on cash while awaiting payment.

On the contrary, if the owner of a startup hires a contractor to develop content for their website, Net 15 might be more appropriate, as it’s likely a cheaper job, requiring just one person.

Other payment terms you might see include:

- Due upon receipt: Payment is due immediately after the customer receives the invoice.

- Payment in advance: The customer pays the full value of the invoice before the project begins.

- End of month (EOM): Payment is due at the end of the month, regardless of when the invoice was sent.

Net 30 Payment Terms With an Early Payment Discount

You may also come across Net 30 terms alongside an early payment discount, which are more complex payment terms. Net 30 with an early payment discount might read as follows: “1/10 net 30”.

To simplify, you can view this as, “1%/10 days, Net 30 terms”. This means that if the invoice is paid within the first 10 days after it’s issued, a 1% discount is applied. Otherwise, the customer has 30 days to pay.

Payment terms with an early payment discount can vary. Other Net 30 payment terms with an early payment discount can include:

| Early Payment Discount | Description |

| 1/5 Net 30 | 1% discount if paid within the first 5 days |

| 1/10 Net 30 | 1% discount if paid within the first 10 days |

| 2/10 Net 30 | 2% discount if paid within the first 10 days |

| 1/15 Net 30 | 1% discount if paid within the first 15 days |

How Can Your Business Invoicing On Net 30 Payment Terms Be Impacted By Late Payment?

If you’re a business owner regularly sending invoices, you should be aware of how payment terms – and the ability of the buyer to meet the terms – can impact your business’s finances.

Now, let’s take a look at how slow-paying customers who fail to meet Net 30 terms can impact a business.

Cash Flow Struggles

When a business doesn’t receive payments on-time, growth goals can be hindered or entirely impossible due to cash flow problems, especially for small businesses or startups.

Late invoice payments increase the risk of businesses falling into negative cash flow, which can ultimately jeopardize a small business’s chance of survival if that becomes sustained negative cash flow. This is why it’s so important to analyze which payment terms are right for your business.

Failure to Meet Payroll

Once your business begins dealing with cash flow struggles, the first domino has fallen, and other problems begin to arise. One of the most common problems is the potential to miss payroll.

If your business misses payroll on just one occasion, it can have irreversible effects regarding employee morale. Even if your crisis management skills are strong and you manage to get back on track relatively quickly, how can your employees still have faith going forward that they will be paid on time?

As a business owner, your people are your greatest asset. You don’t want late customer payments to be the reason they lose faith and jump ship.

Inability To Pay Suppliers On Time

Slow-paying customers not only negatively impact the seller’s cash flow, but they can also impact the seller’s other commercial relationships. If you don’t get paid on time, it could put you at risk of paying others late.

Your suppliers won’t like being paid late, just as you don’t like being paid late. Having to chase customers who don’t pay on time is never fun, and you should try to avoid becoming one of those customers that can’t be relied upon to settle invoices on time.

Related: How To Politely Ask For Customer Payment

If you’re finding that slow-paying customers are impacting your business growth, an invoice factoring company like altLINE can help. If you’re looking to improve your cash flow, give altLINE a call at +1 (205) 607-0811 or fill out our online factoring quote form. We have factored over $1B in invoices and take pride in helping our customers reach their business goals.

Net 30 FAQs

Does net 30 include weekends?

It can be assumed that when an invoice reads “Net 30”, it means a customer has 30 calendar days to pay the full balance of their invoice, including weekends. However, it’s possible the seller and the buyer have agreed to not include weekends, highlighting the importance of ironing out these details during contract negotiations.

What are common payment terms for invoices?

The most common invoice payment terms include Net 7, Net 15, and Net 30. Other commonly used terms include payment in advance – in which a customer pays in advance of project completion – or due upon receipt – in which a customer owes payment immediately once they receive the invoice.

How do I offer net 30 payment terms?

Net 30 payment terms appear on an invoice and notify customers that they have 30 days to pay the invoice balance, but there can be different ways to offer Net 30:

- 30 calendar days (most common)

- 30 business days

- Net 30 End of Month (Net 30 EOM)

Net 30 EOM means payment is due 30 days after the end of the month the invoice was issued or received. For example, if an invoice is issued on April 23, payment would be owed by May 31.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.