Last Updated November 24, 2025

There are two key metrics at the forefront of financial analysis and decision-making in the business world: EBITDA and cash flow. While both offer valuable insights into a company’s financial health, they serve different purposes and paint distinct pictures of its fiscal status.

Understanding the nuances between EBITDA vs. cash flow is essential for business owners, investors, and financial professionals who want to make informed, strategic decisions.

Continue reading to find out how these two financial terms differ from one another, along with how to analyze each effectively in order to best measure your company’s performance.

Key Takeaways

- EBITDA measures a company’s operational profitability, while cash flow shows the real money moving in and out of the business.

- Cash flow includes working capital changes and actual cash activity, making it essential for understanding liquidity and day-to-day financial health.

- EBITDA is useful for comparing performance across companies and industries because it removes the effects of taxes, interest, and non-cash expenses.

- Cash flow analysis is more detailed and helps business owners plan for expenses, manage growth, and ensure the company can meet financial obligations.

What Is Cash Flow?

Cash flow, in its simplest form, represents the amount of money moving in and out of a business. It’s a crucial metric that reflects the company’s ability to generate and use cash effectively.

Cash flow can be positive, indicating that a business has more money coming in than going out, or negative, where expenses outpace earnings. These metrics are essential for daily operations, paying expenses, and funding new investments.

It’s often said that “cash is king,” and in the business world, that adage holds particularly true. Efficient cash flow management ensures that a business can meet its obligations and invest in growth opportunities.

How to Calculate Your Operating Cash Flow

Operating cash flow (OCF) is a measure of the cash a company generates from its regular operating activities. To calculate OCF, you start with net income, add back any non-cash expenses like depreciation and amortization, and adjust for changes in working capital. This formula can be summarized as the following:

OCF = Net Income + Non-Cash Expenses + Changes in Working Capital

This calculation gives a clearer picture of a company’s operational efficiency and its ability to generate cash through its core business activities.

Why Is Finding and Managing Your Cash Flow Important?

Effective cash flow management is the cornerstone of a healthy business. It enables a company to maintain solvency and flexibility, ensuring it can meet its financial obligations–such as paying suppliers, employees, and creditors.

Moreover, understanding cash flow helps businesses plan for future growth, make informed investment decisions, and identify potential financial challenges before they become critical.

Where to Find Your Cash Flow on a Financial Statement

Cash flow is detailed in a company’s cash flow statement, one of the three primary financial statements. The cash flow statement is divided into three parts: cash flow from operating activities, investing activities, and financing activities. It provides a comprehensive view of how a company generates and uses cash over a specific period.

What Is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a measure used to evaluate a company’s operational performance without the impact of financial and accounting decisions. Essentially, EBITDA provides a clearer picture of a company’s profitability from its core business operations by removing the effects of non-operating factors like investment sources, tax rates, and large non-cash expenses.

How to Calculate Your EBITDA

To calculate EBITDA, you start with the company’s net income, then add back interest, taxes, depreciation, and amortization expenses. The formula is as follows:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

This calculation shows the profitability of a company’s operations before the influence of accounting and financial obligations. It’s a great tool for comparing companies with different capital structures and tax strategies.

Why Is Finding Your EBITDA Important?

EBITDA is an important metric because it focuses on the financial outcomes of operational decisions, excluding the effects of financing and accounting practices. It allows stakeholders to assess a company’s operational efficiency and compare profitability across companies and industries where these external factors may vary significantly.

EBITDA is often used by investors to determine a company’s ability to generate profit from its core business. It can influence investment decisions, valuations, and lending considerations.

Where to Find Your EBITDA on a Financial Statement

EBITDA isn’t usually listed as a separate line item on standard profit & loss statements. Instead, it needs to be calculated using data from the income statement and, sometimes, the cash flow statement.

Typically, you’ll start with net income from the income statement, then add back the interest, taxes, depreciation, and amortization figures found in the same statement or notes accompanying the financial statements.

How to Analyze Your Cash Flow

Analyzing cash flow involves more than just looking at the numbers on your cash flow statement. It requires understanding the sources of your cash flow and how it’s being used.

There are numerous cash flow modeling techniques. Here is what to keep in mind to effectively analyze your cash flow.

- Review Cash Flow from Operations: This is a key indicator of how well your business generates cash from its core activities, such as a sales ratio. Consistent positive cash flow from operations suggests a healthy, viable business.

- Examine Cash Flow Trends: Look for trends over several periods. Are your cash reserves growing, or are they consistently being depleted? Identifying trends helps in forecasting, planning, and cash flow management.

- Understand Cash Flow Timing: Timing can have a big impact on cash flow. Analyze when cash comes in from customers and when it goes out for expenses. This can help identify periods of potential cash shortages.

- Assess Capital Expenditures: Review the cash used for investing in assets. While significant capital expenditures can strain short-term cash flow, they might be necessary for long-term growth.

- Evaluate Financing Activities: Look at how loan repayments, invoice factoring, equity injections, or dividends are impacting your cash flow. This will help you understand how financing decisions affect your business’s liquidity.

How to Analyze Your EBITDA

Analyzing EBITDA requires understanding its components and what they reveal about your business.

- Compare EBITDA Across Periods: Look at how EBITDA changes over time. Consistent growth in EBITDA is generally a positive sign, indicating improving operational efficiency.

- EBITDA Margin Analysis: Calculate your EBITDA margin (EBITDA divided by total revenue). A higher EBITDA margin suggests better operational efficiency and profitability.

- Benchmark Against Industry Standards: Compare your EBITDA and EBITDA margin with industry averages. This will give you an idea of how your business performs relative to competitors.

- Understand Limitations: Remember that EBITDA doesn’t account for capital expenditures or changes in working capital. It should be analyzed in conjunction with other financial metrics for a complete picture.

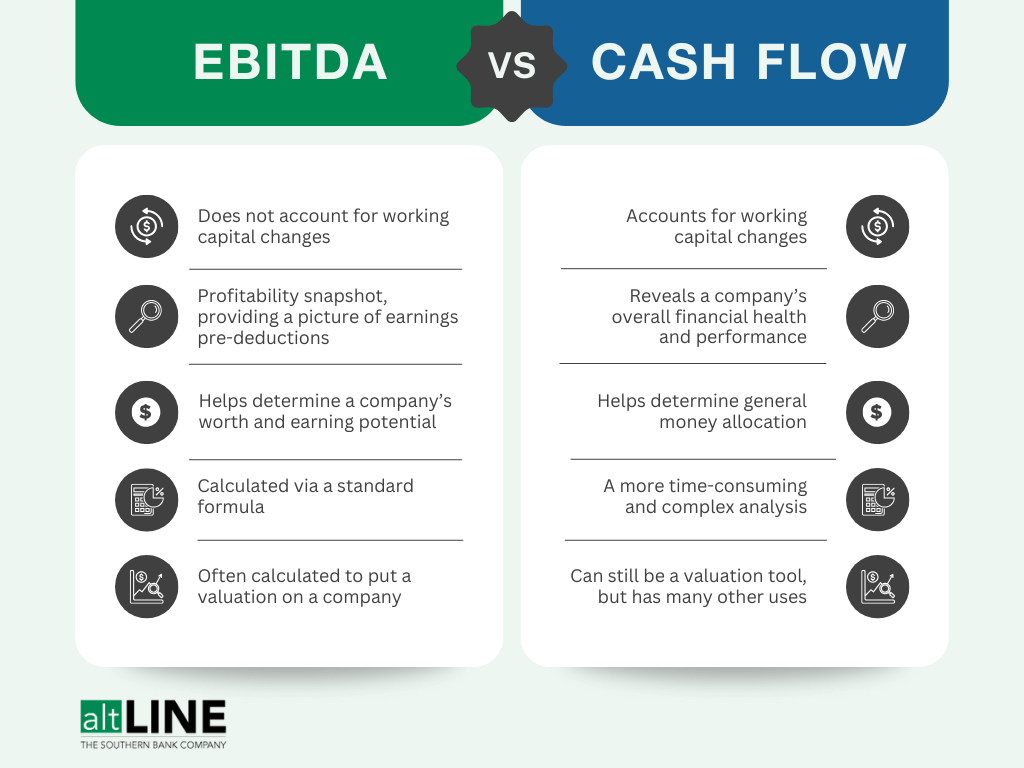

In Summary: Differences Between EBITDA vs. Cash Flow

EBITDA and cash flow are both important financial metrics, but they serve different purposes and provide different insights into a company’s financial health.

- EBITDA offers a view of a company’s operational profitability before the impact of financial decisions, tax environment, and accounting practices.

- Cash flow reflects the actual amount of cash being generated and used by the business, crucial for understanding liquidity and operational efficiency.

Cash Flow Includes Working Capital Changes; EBITDA Does Not

Cash flow accounts for changes in working capital, reflecting real cash movement. EBITDA, however, does not factor in these changes, focusing solely on earnings before interest, taxes, depreciation, and amortization.

EBITDA Is a Profitability Snapshot; Cash Flow Is About Overall Financial Health

EBITDA gives an immediate picture of earnings before deductions, while cash flow reveals a company’s financial health, including its ability to manage assets and cover expenses effectively.

EBITDA Helps Determine Company Worth; Cash Flow Helps Determine Money Allocation

While EBITDA helps ascertain a company’s earning potential, cash flow shows how a company’s earnings are actually being used, indicating available money for owners and business needs.

EBITDA’s Calculation Is Simple; Cash Flow Analysis Can Be Very In-Depth

Calculating EBITDA is relatively straightforward and widely used for quick business valuation. In contrast, developing an accurate cash flow report is more complex but offers detailed financial insights.

EBITDA vs. Cash Flow FAQs

Here are common questions surrounding EBITDA vs. cash flow.

Are cash flow from operations and EBITDA the same thing?

No, they are not the same. Cash flow from operations includes changes in working capital, while EBITDA excludes these changes. EBITDA focuses on profitability from core operations before interest, taxes, depreciation, and amortization.

What does EBITDA stand for?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

What are the different types of cash flow?

The different types of cash flow include the following:

- Operating Cash Flow: Cash generated from a company’s regular business operations.

- Investing Cash Flow: Cash used for or generated from investments like buying or selling assets.

- Financing Cash Flow: Cash flow related to financing activities such as issuing shares or debt repayments.

- Free Cash Flow: Cash available to the company after accounting for capital expenditures.

- Incremental Cash Flow: The additional cash flow a company receives from taking on a new project or making a new investment.

Each type of cash flow provides insights into different aspects of a company’s financial health and operations.

How do I create a cash flow statement?

A cash flow statement is created by adjusting net income for changes in balance sheet items like accounts receivable, inventory, accounts payable, and including cash spent on investments and financing activities.

How can I improve my cash flow?

Improving cash flow can involve strategies like optimizing billing processes, managing inventory efficiently, extending payables, reducing costs, and utilizing effective financing options like invoice factoring.

What is the difference between operating profit and EBITDA?

Operating profit, or operating income, is calculated as revenue minus operating expenses (including depreciation and amortization), while EBITDA adds back interest, taxes, depreciation, and amortization to net income.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.