Last Updated April 29, 2025

It’s no secret that America has endured a significant labor shortage since the height of the COVID-19 pandemic. While many employees that lost their jobs have been able to get back on track, the national labor outlook reveals that overall, jobseekers have had a tough time compared to pre-pandemic figures.

As for the staffing industry, hiring expectations and trends have shifted drastically. And as the landscape continues to reshape, it is important to stay on top of staffing trends to better understand how to be competitive.

With that said, below is a roundup of some of the most important (and surprising) statistics in the staffing and recruitment industry in 2025. By the time you’ve wrapped up, you’ll have a better idea of general staffing industry statistics, the challenges that pose a threat to the industry, the trends across niche staffing industries, the current cost of hiring, and whether the staffing market is growing or shrinking.

Staffing Market Size in 2025

The staffing market is a massive industry, evidenced by the below statistics:

- The US staffing industry is a $198.7 billion industry entering 2025 (Workwell Global)

- The US healthcare staffing market size was more than $20.5 billion in 2023 (Grand View Research), while the US IT staffing market size was more than $41.5 billion in 2023 (Arizton)

- There are nearly 26,000 staffing and recruiting agencies in the US, and about 57% of those companies are in the temporary and contract staffing sector (American Staffing Association)

- 91% of staffing leaders believe their firms will grow in 2024 with the majority having 10-20% growth goals (Sense)

Working in Staffing and Recruiting

Below are some of the most common trends seen when working in the staffing and recruiting industries:

- The top priorities for recruiting firms in 2023 were (Bullhorn):

- Winning new clients (40%)

- Digital transformation (34%)

- Candidate acquisition (33%)

- Candidate experience (28%)

- Client relationships (27%)

- Over half of staffing firms fill roles with existing candidates in their database less than 30% of the time (Bullhorn)

- 48% of staffing firms are in the early stages of digital transformation, while 29% are in the advanced adoption of it (Bullhorn)

- The staffing processes that are most frequently being automated include (Bullhorn):

- Payroll and billing (42%)

- Sourcing (42%)

- Screening (34%)

- Reporting (33%)

- Onboarding (33%)

- 73% of companies in the US use talent acquisition software (Zippia)

- The average temporary and contract employee tenure in 2022 was 10.0 weeks (American Staffing Association)

- 75% of staffing firms are using AI in some capacity (Sense)

- 37% of hiring managers said they have used contracted talent to assist specifically with AI-related tasks (Robert Half)

- 54% of hiring managers said that AI and other automation tools have led to candidates needing different skillsets (Robert Half)

Challenges in the Staffing and Recruiting Industry in 2025

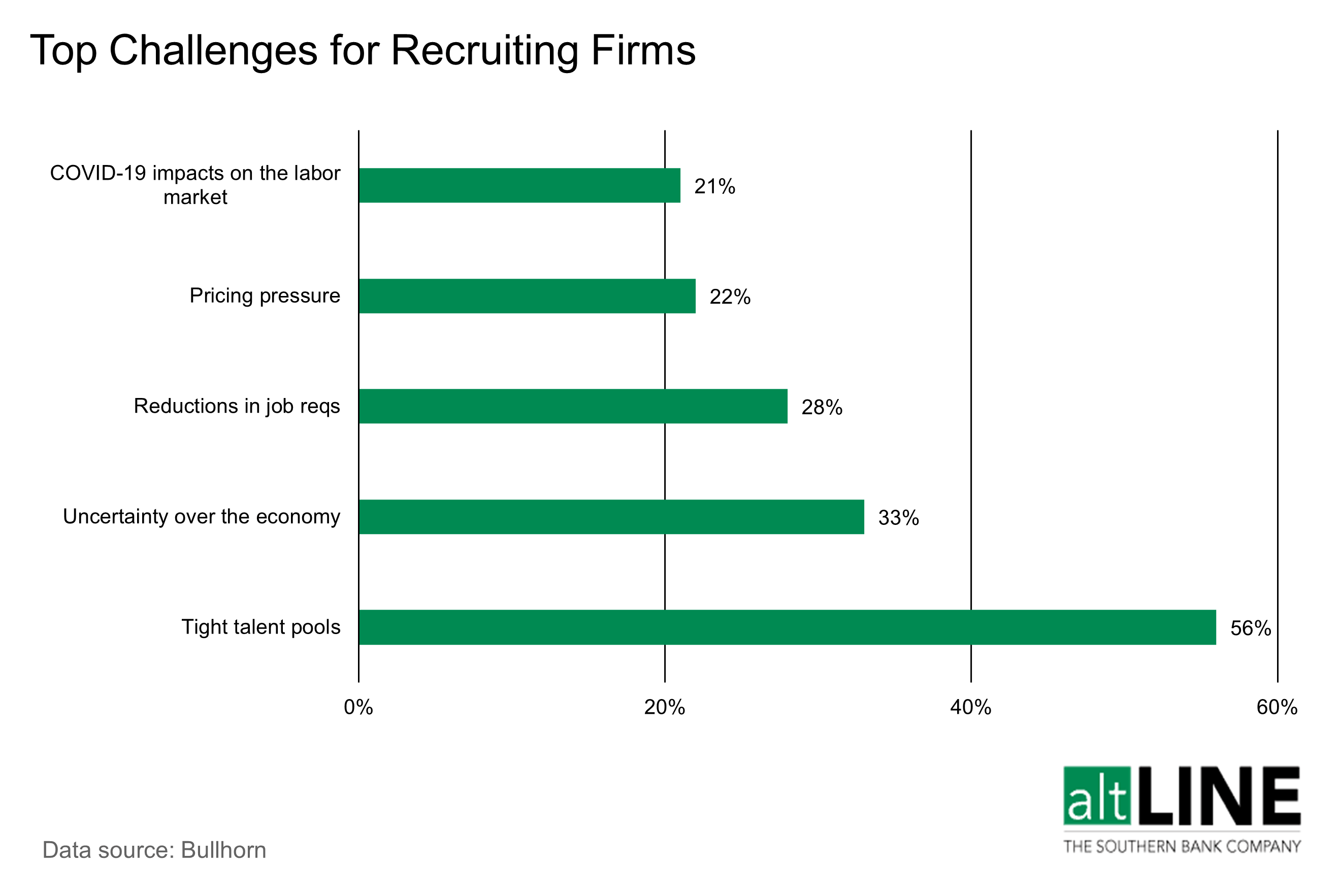

- The top challenges for recruiting firms are tight talent pools (56%), uncertainty over the economy (33%), and reductions in job requisites (28%) (Bullhorn)

- Concerns regarding the talent shortage has continued to increase since 2021 with 10% more respondents citing it as a top concern in 2023 compared to 2022 (Bullhorn)

- The top challenge for winning new clients is increased competition (25%), followed by hiring freezes/lack of budget from prospective clients (23%) (Bullhorn)

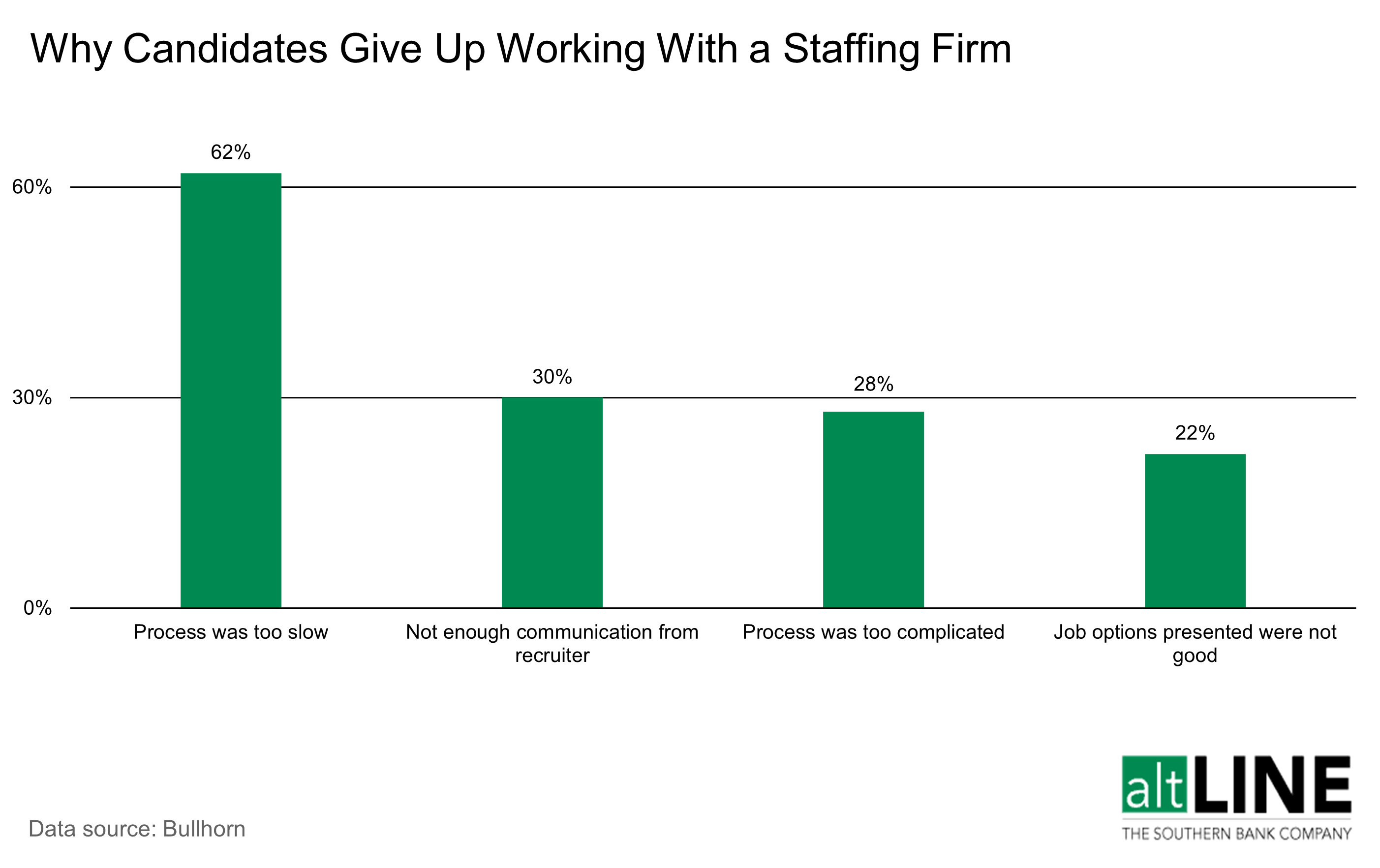

- The top reason why candidates give up on working with a staffing firm is because the process is too slow (Bullhorn)

- The top reason for high turnover is long hiring processes (Robert Half)

- One-third of candidates believe the process breaks down because the credentialing / licensing was complicated or improperly handled, while nearly a quarter of candidates believe it was because the recruiter matched them with jobs that were not a good fit (Bullhorn)

- The top recruitment lifecycle challenge continues to be sourcing (28%), followed by screening/validating (12%) (Bullhorn)

- 52% of recruiters say there has been a decline in job board effectiveness (Sense)

Candidate Insights

Here are some statistics surrounding candidates’ feelings toward employment trends, such as remote work and the need to seek out supplementary income:

- Despite the increase in interest in remote work over the last few years, 70% of US adults still prefer in-person job interviews (American Staffing Association)

- 56% of US adults agree that those working in-office have an advantage than those working remotely when it comes to getting raises, bonuses, and promotions (American Staffing Association)

- Younger Americans are more likely to seek out supplementary income with 72% of Gen Z looking for ways to supplement compared to just 30% of Baby Boomers (American Staffing Association).

- 85% of Gen Z say the entire job search and placement process is outdated (Bullhorn).

- 63% of candidates want to work in the office three days or fewer (Robert Half)

Contract and Temporary Work Trends in 2025

Contract and temporary work make up a huge portion of the staffing industry. Here are some findings on these sectors:

- 64% of staffing employees work in temporary or contract roles to fill the gap between jobs or to help them land a job. This is compared 20% of temporary and contract employees saying schedule flexibility is the reason for choosing this type of work (American Staffing Association)

- 73% of staffing employees work full time (American Staffing Association)

- 64% of employers plan to increase their use of contract professionals in 2024 (Robert Half)

Staffing Trends Broken Down by Industry

Staffing industry statistics broken down by niche industry can be particularly beneficial since each industry has its various challenges, trends, and outlook. For example, below is the outlook for the light industrial staffing sector, healthcare staffing field, and nursing staffing field in particular.

Light Industrial Staffing Trends

- 57% of light industrial staffing firms reported year-over-year revenue growth in 2022, though this is slightly behind the average for all industries (62%) (Bullhorn)

- Light industrial staffing agencies are more likely to invest in technology than staffing firms in other industries (Bullhorn)

- The top priorities for light industrial staffing firms in 2023 were (Bullhorn):

- Automating and optimizing key processes through digital transformation (45%)

- Winning new clients (44%)

- Candidate acquisition (39%)

- Tight talent pools (71%) was the top challenge for light industries staffing agencies, followed by uncertainty over the economy (34%) and reductions in job reqs from clients (25%) (Bullhorn)

- 49% of light industrial staffing firms are in the early stages of adoption in their digital transformation journeys (Bullhorn)

- Payroll and billing (53%) is the top task that these firms are automating, followed by screening / validating (47%) and onboarding (46%) (Bullhorn)

- Light industrial agencies that saw the largest revenue growth in 2022 were more likely to have prioritized digital transformation, particularly automated payroll, billing, and talent sourcing (Bullhorn)

Healthcare Staffing Trends

- Employment in the healthcare industry is expected to grow 13% from 2021 to 2031 (U.S. Bureau of Labor Statistics)

- 50% of healthcare clinicians in the US are considering leaving their role within the next 2 – 3 years (Elsevier)

- Amongst allied healthcare professional graduates, radiologic technologists (38%) and physical therapists (36%) are the most in-demand (AMN Healthcare)

- Digital transformation (46%) was the top priority for healthcare staffing firms in 2023, followed by improving the candidate experience (35%) and candidate acquisition (34%) (Bullhorn)

- Tight talent pools (45%) was the top challenge for healthcare staffing agencies, followed by pricing pressure (30%) and COVID-19 impacts on the labor market (27%) (Bullhorn)

- The top challenge that healthcare staffing firms have with onboarding and credentialing is that it is too manual / time-consuming (38%), followed by the fact that onboarding and credentialing technology is not tailored to healthcare (28%) (Bullhorn)

- Nearly half of healthcare staffing firms are in the early adoption stages of their digital transformation journeys, while a quarter are in the advanced adoption stages (Bullhorn)

- 88% of healthcare facilities use locum tenens physicians or other locum tenens providers (AMN Healthcare)

- Locum tenens physicians and other healthcare providers are most commonly used to fill in until a permanent provider is found (70%) (AMN Healthcare)

- The top three benefits of using locums tenens physicians are (AMN Healthcare):

- They allow for continual treatment of patients (66%)

- They provide immediate availability (56%)

- They prevent existing staff burnout (35%)

- The top three downsides of using locums tenens physicians are (AMN Healthcare):

- The cost (85%)

- The lack of familiarity with the department/practice (53%)

- Credentialing issues (46%)

- 70% of healthcare executives and managers of healthcare facilities say that locum tenens physicians are worth the cost (AMN Healthcare)

Nursing Staffing

- A quarter of US nurses are considering leaving healthcare altogether in the near future (Elsevier), and 30% say they are likely to leave their careers due to the pandemic (AMN Healthcare)

- 70% of US healthcare clinicians see tackling the nursing shortage as a top priority (Elsevier)

- There are 3.2 million registered nursing jobs in the US with a median salary of $81,220 (U.S. Bureau of Labor Statistics)

- Travel nurse staffing made up the largest segment (39.6%) of healthcare staffing market in 2022 (Grand View Research)

- Search interest in [what does a travel nurse do] grew 70% YoY (via Google Trends)

- 66% of nurses feel like their experiences during the pandemic have caused them to consider leaving nursing (American Association of Critical-Care Nurses)

- 92% of nurses believe the pandemic has depleted nurses at their hospitals (American Association of Critical-Care Nurses)

- Almost 9 out of 10 nurses say the nursing shortage is worse than 5 years ago (AMN Healthcare)

How Big Is the US Labor Force?

The U.S. labor force is ever-changing, especially post-COVID. Here’s how it looks entering 2024:

- The US labor force consists of 167.5 million civilians (U.S. Bureau of Labor Statistics)

- Of those in the labor force, 161.2 million are currently employed, a 96.3% employment rate (U.S. Bureau of Labor Statistics)

- 37.5% of the civilian noninstitutional population is not a part of the labor force; of those not in the labor force, 5.6% currently want a job (U.S. Bureau of Labor Statistics)

- The U.S. Department of Labor defines the civilian noninstitutional population as “Persons 16 years of age and older residing in the 50 states and the District of Columbia, who are not inmates of institutions (e.g., penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces.”

How Long Does It Take to Hire Someone?

If you work in staffing, you know that certain roles are easy and quick to fill while others are painstakingly challenging.

With that said, below is some data on how long it takes to fill positions:

- The median time to hire can vary by 1 – 2 weeks, depending on the job function (LinkedIn)

- Research shows that engineering roles have the longest time to hire than any other analyzed discipline with a median time to hire of 49 days; however, the slowest 10% of engineering hires waited 82 days from application submission to day one at the job (LinkedIn)

- Administrative and customer service jobs have the shortest time to hire of analyzed disciplines with 33 days and 34 days, respectively (LinkedIn)

| Job Function | Median Time to Hire (in days) |

|---|---|

| Engineering | 49 |

| Research | 48 |

| Project management | 47 |

| Business development | 46 |

| Finance | 46 |

| Information technology | 44 |

| Management | 41 |

| Marketing | 40 |

| Healthcare provider | 40 |

| Human resources | 39 |

| Design | 39 |

| Sales | 38 |

| Accounting / auditing | 37 |

| Customer service | 34 |

| Administrative | 33 |

Data Source: LinkedIn

The Costs of Hiring in 2025

The costs of hiring vary just as much as how long it takes to fill positions since it’s always changing based on the role, industry, and experience level. Some staffing agency statistics regarding the costs of hiring include:

- It takes 36 to 42 days to fill an average position in the US (note that the time to fill a position and time to hire are measured differently) (Zippia)

- The average vacancy cost of an open position is about $98 per day (The Johnson Group)

- The average cost per hire is $4,683 (SHRM)

- The average cost per hire for an executive role is 505% more expensive than the average cost per hire overall (SHRM)

- The average cost of training a new employee at a small company is more 98% more expensive than at a large company ($1,433 per year vs. $722 per year) (Investopedia)

- It takes 12 weeks, on average, for a new employee to be fully productive at work (Zippia)

Employee Benefits Trends in 2025

Benefits need to be prioritized by hiring managers and business owners as good benefits are crucial to attract the best candidates.

- 83% of HR managers say that their companies have offered new perks in response to the current market; however, many companies continue to prioritize benefits and perks that are lower priority to employees (Robert Half)

- 46% of employers plan on increasing recognition efforts to keep top performing employees (Robert Half)

Related: Small Business Revenue Statistics

Remote Work Trends in 2025

Remote work has taken off in the post-COVID era. But how much, and what are the feelings toward remote work? Take a look at the remote work trends in 2024 below.

- 74% of managers say their department offers remote work options (Robert Half)

- Currently, 60% of employees work on a full remote or hybrid schedule (Robert Half)

- Managers report seeing increased retention (48%) and better morale and work/life balance (41%) with their remote and hybrid teams (Robert Half)

- 69% of employed adults feel positively about remote work, and 61% say they work better remotely compared to working in the physical workplace (CareerBuilder)

- 52% of employees want more flexibility when determining their work schedules (Robert Half)

- 63% of candidates want to work in the office three days or fewer (Robert Half)

- 66% of employers are willing to pay more to get candidates to work in the office more (Robert Half)

Employer Salary Trends in 2025

Salary is typically the end-all be-all for candidates, so it’s crucial for those in the staffing and recruiting agency to stay on top of salary trends. Here’s how employees are feeling about their salary and employers are feeling about paying their workers in 2024:

- 89% of employed adults expect an annual pay increase from their employers (CareerBuilder)

- 66% of employed adults prefer a 10% pay increase over an additional week of PTO (CareerBuilder)

- 82% of senior managers have given salary increases to workers who have expressed salary concerns (Robert Half)

- 34% of employers currently offer signing bonuses to attract skilled candidates (Robert Half)

Diversity, Equity, and Inclusion in Staffing

DEI in staffing is incredibly important for both employees and employers. Some data on DEI in staffing in 2024:

- 69% of working adults are optimistic about their employers’ DEI efforts (CareerBuilder)

- 80% of executives believe investing in DEI efforts will lead to tangible benefits, including better recruitment and retention (Robert Half)

- 83% of professionals say that flexibility allows for a more diverse and inclusive workforce (Robert Half)

- 91% of employers expect their focus on DEI efforts to attract employees will become permanent (WTW)

- 72% of US adults say that employee resource groups (ERGs) play a significant role in supporting DEI efforts (CareerBuilder)

Staffing Industry FAQs

Is the staffing industry dying?

No, the staffing industry is not dying by any means as it is a massive industry worth dozens of billions of dollars. However, Staffing Industry Analysts expect the U.S. staffing market to diminish by 3% from 2023 to the end of 2024.

Is remote work here to stay in 2025?

Resume Builder interviewed 1000 business decision makers to find out the future of remote work. And while remote work reached new heights after COVID-19, the results show that it might not be here to stay. 64% of respondents said they currently offer some version of remote work, but only 20% plan for that to be the case by the end of 2024 and just 11% plan to by the end of 2025 or later.

Angela is the VP of Marketing at altLINE where she manages content production, marketing and sales operations, and digital PR. Angela joined altLINE in 2022 after several years of working in digital marketing across various industries including financial services and B2B. Angela loves creating content that helps readers better understand their financing options and helps them make informed decisions about factoring. Her work has been featured in publications like Search Engine Journal and Moz.