Last Updated February 12, 2026

Business owners should always seek out ways to leverage their assets. One way to do so is by utilizing debt factoring, which is a specific form of alternative financing designed to help businesses quickly boost cash flow without incurring debt.

Sometimes referred to as invoice factoring, debt factoring is based on selling receivables to a third-party debt factoring company that pays a fee for those accounts receivables.

We’ll talk more about how debt factoring works in a bit, but essentially, it enables businesses to obtain convenient access to funding without having to wait for their customers to pay for the services or goods they received.

Continue reading to learn more about the parties involved and their respective roles in the debt factoring process, which types of businesses can benefit most, and benefits and drawbacks to consider.

Key Takeaways

- Debt factoring, also known as invoice factoring, is a financing solution where businesses sell accounts receivable to a third party for immediate cash.

- The debt factoring process involves a factoring company advancing 80–90% of an invoice’s value upfront, then releasing the full balance once they collect payment from the debtor.

- Debt factoring boosts working capital, stabilizes cash flow, eliminates the need for collateral, reduces accounts receivable stress, and is accessible even with poor credit.

- Businesses should consider the cost of debt factoring costs (0.75-3.50%) and potential risks using a factoring company without a bank affiliation.

What Is Debt Factoring and How Does it Work?

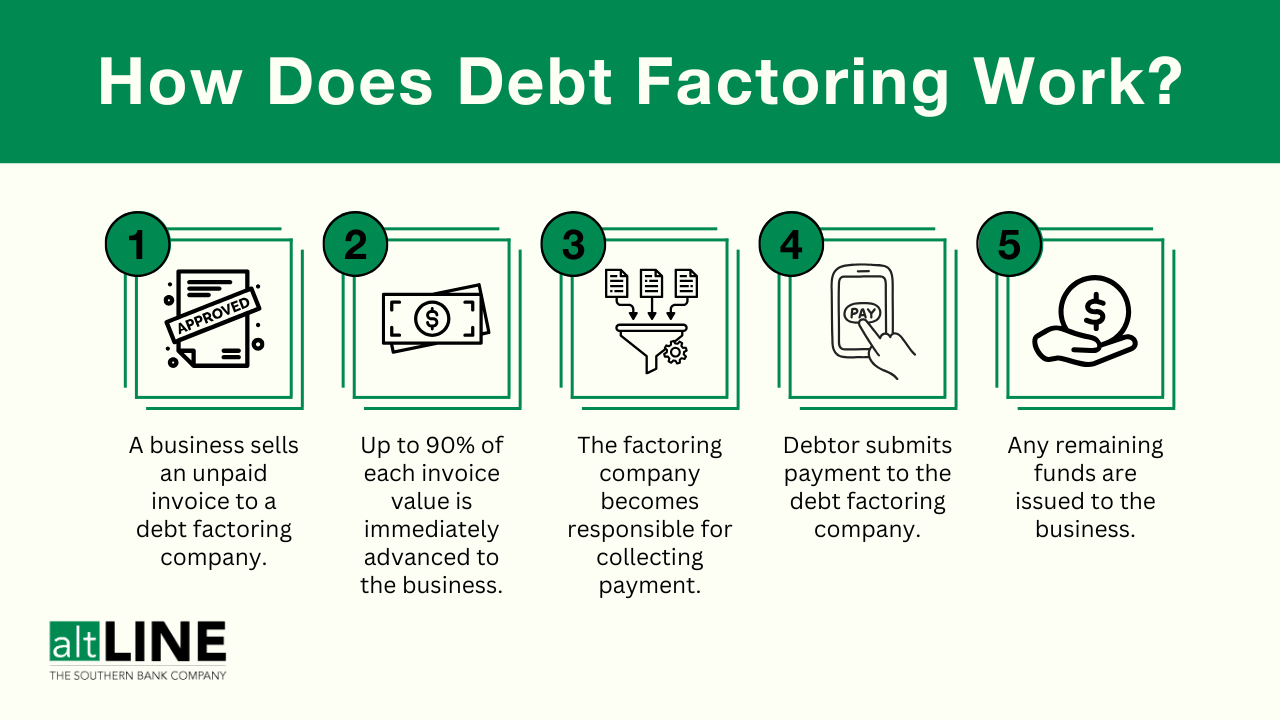

The debt factoring process is relatively straightforward:

- You sell your outstanding invoice to a debt factoring company.

- After the invoice is processed, the debt factoring company immediately advances 80-90% of the value of the invoice.

- Your debt factoring company assumes collection responsibilities on the invoice moving forward.

- Your customer submits payment to the factoring company.

- Once payment is processed, the factoring company releases the remaining value of the invoice to your business, minus a small factoring fee (0.75-3.50%).

And just like that, you have completed the process of debt factoring.

There are many reasons a business can benefit from choosing this form of financing.

Advantages of Debt Factoring

Learning the following benefits of debt factoring will provide insight as to why so many small businesses are using it to help fund their business operations.

Immediate Increase in Working Capital

Fast access to operating capital is the primary advantage of debt factoring. Accounts receivables are transformed into cash quickly: businesses do not have to wait for customers or clients to pay for goods or services. Small business owners often say that one of the major benefits of this newfound capital is an ability to make payroll without worry.

Improved Cash Flow and Overall Cash Flow Stability

An additional advantage of debt factoring is streamlined cash flow. This is particularly relevant to small business owners, given nearly one-third of business owners say they aren’t comfortable with their cash flow.

By improving cash flow, businesses can purchase equipment and supplies or focus on paying expenses related to wages, taxes, and inventories, and overall, use the new capital to increase productivity.

No Collateral Required

Yet another advantage of debt factoring is the freedom from having to put up collateral for a loan or overdraft. Loans typically require the debtor to assign rights to collateral to a third-party lender. Being free from these security interests will enable a business to operate in a more spontaneous manner.

Lightened AR Responsibilities

As a small business owner, you’re likely juggling numerous responsibilities, perhaps handling or overseeing your own accounts receivable tasks.

A factoring company will take a few stressors off your plate pertaining to customer payment. The cash advance gives you peace of mind so that, if for whatever reason your customer doesn’t pay on-time, you won’t have to spend time drafting emails to request payment or playing phone tag, which otherwise could prevent you from making payroll on-time or keeping operations running smoothly.

Qualification Not Dependent on Your Credit Score

Lenient qualification requirements are another feature of debt factoring that makes it particularly popular for owners of small, growing businesses. If you have subpar credit or minimal credit history, you’ll likely find it difficult to qualify for traditional forms of lending. This is why debt factoring is a fantastic alternative. Factors will inspect your customers’ credit history and overall business background, but they aren’t as interested in yours. As long as your customers have been fairly reliable with paying for goods or services in the past, you shouldn’t have an issue qualifying for debt factoring.

Plus, debt factoring is considered a no-doc business loan. While there will be some paperwork required when applying and onboarding, it’s significantly less demanding and time-inducing than what’s required of most traditional bank loans.

Disadvantages of Debt Factoring

The factoring fees are the biggest drawback to using this form of financing as a cash flow tool for businesses. The debtor’s credit score and the extent of the contractual relationship are factors that will influence the price of the arrangement.

The fee for debt factoring can be as low as 0.51% of the total value of all the accounts receivable associated with the transaction. If the invoice remains unpaid then the fee will increase over a particular interval of time.

Debt factoring brokers can also charge a flat fee to perform factoring arrangements. This flat fee will depend on various factors:

- Business stability

- Quarterly or annual sales volume

- Payment terms and late fees

- Customer creditworthiness

These factors will contribute to the actual number the debt factoring broker uses to calculate the flat fee arrangement. Business managers and officers should compare the costs associated with using debt factoring brokers.

No company is guaranteed to collect unpaid invoices. The factor may demand that the business purchase all the unpaid invoices or replace them with other invoices of equal value.

The factor will collect the invoices and it is not guaranteed that they will use ethical practices when attempting to collect their money from customers. Businesses may need to investigate the factor to make sure the company abides by the best practices standard.

In-Summary: Advantages and Disadvantages of Debt Factoring

To recap, this table provides a quick scope into whether debt factoring makes sense for your business:

| Pros | Cons |

| No collateral required | Not ideal for large businesses |

| Lenient qualification process, including no minimum credit score | Small factoring fee (0.5-5%, depending on the business) |

| Increase in working capital | Risk of customer not paying invoice remains, and depending on factoring agreement, you may be held liable |

| Immediate cash flow boost | Some independent factoring companies (those not affiliated with a bank) have a history of predatory behavior |

| Reduces stressors that come with managing accounts receivable | Your customers may be wary of working with a third-party |

Need Cash Quickly?

Is Debt Factoring Right for Your Business?

Small business owners are more likely to use debt factoring out of necessity if they are unable to obtain operating capital through a bank loan or a line of credit. Larger companies may have access to reserves of capital. Many different businesses can benefit from this type of financing, but small and medium-sized businesses will be prime candidates for using it as a regular component of their business operations.

If you think your business might be a good fit for debt factoring, feel free to reach out to an altLINE representative at +1 (205) 607-0811 or fill out our free factoring quote form.

Grey was previously the Director of Marketing for altLINE by The Southern Bank. With 10 years’ experience in digital marketing, content creation and small business operations, he helped businesses find the information they needed to make informed decisions about invoice factoring and A/R financing.