Last Updated February 3, 2026

Turn your unpaid invoices into working capital for your business

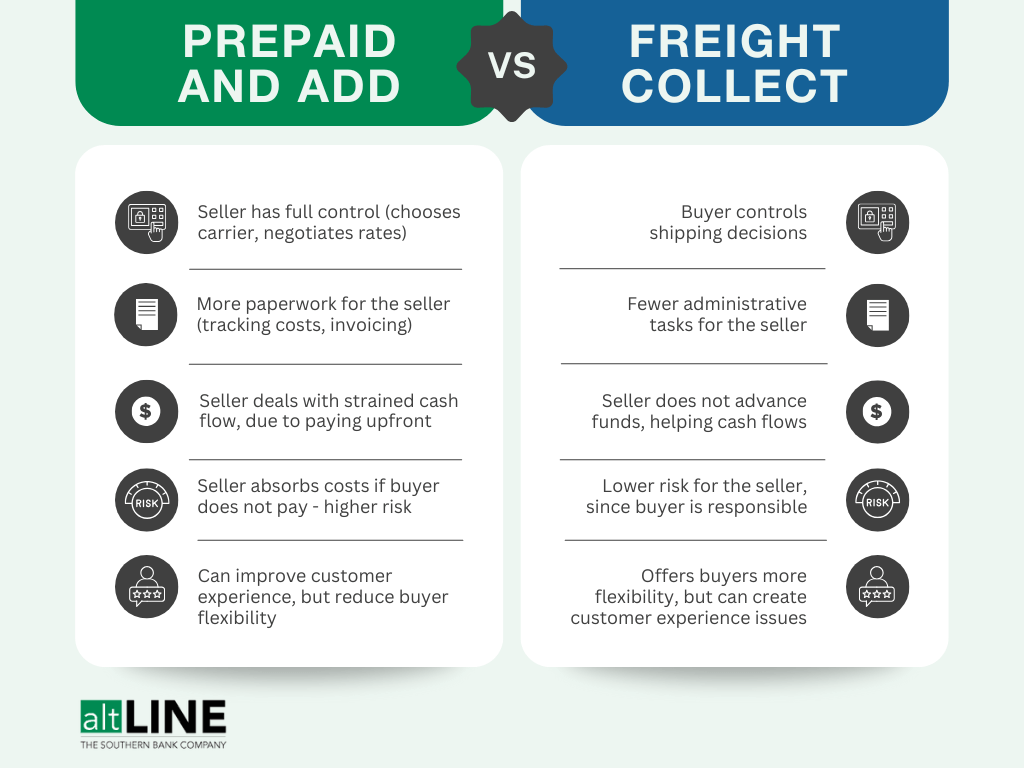

Coming to an agreement on freight terms can be one of the more difficult aspects of forging a new partnership with a buyer. Freight charges can be billed in many ways, two of the more common of which include prepaid and add and freight collect.

If you own a small trucking business or you are an aspiring owner-operator and you’ve yet to educate yourself on these terms, they have the potential to add another layer of complexity to the negotiation process. However, if you understand the meaning of prepaid and add and freight collect terms, you will uncover which situations call for which terms to be used.

Read on as we explain both prepaid and collect freight terms, their pros and cons, and what to consider when weighing prepaid and add vs. freight collect.

Prepaid and Add Terms: What Do They Mean?

Freight prepaid and add, also referred to as PPD & add (prepaid and add), is used in shipping contracts to clarify the party responsible for paying freight charges.

When freight terms read “prepaid and add,” that means the seller pays for the initial freight charges and then adds the charges to the buyer invoice. In other words, the shipper handles the logistics and shipping payment upfront, then passes on the total costs to the buyer. It’s important to note that this is different from when terms read just “prepaid,” which signals that charges won’t be added to the buyer invoice.

Freight Collect Terms: What Do They Mean?

Freight collect terms puts the onus on the buyer (often referred to as the consignee) to pay for the freight charges directly. The costs are paid (or collected) from the buyer at the time of delivery. With freight collect shipping, the buyer agrees to take on full responsibility and cost of shipping.

Freight collect terms are the opposite of prepaid and add shipping, where the seller pays for the shipping costs upfront and charges the buyer later. Whichever terms are agreed upon, it’s imperative that both the buyer and seller clearly understand who is responsible for the shipping costs to avoid potential disputes.

Prepaid and Add: Pros and Cons

When deciding between freight prepaid vs. freight collect or prepaid and add vs. freight collect, it’s critical to understand the benefits and drawbacks of each.

Prepaid and add includes several potential advantages and disadvantages for the seller:

Pros | Cons |

| Complete Control | Added Paperwork |

| Improved Customer Service | Potential Disputes |

| Streamlined Billing | Delayed Reimbursement |

| Potential For Added Profit | Non-Repayment Risk |

| Reduced Risk | Reduced Flexibility |

Prepaid and Add – Pros:

Complete Control. Opting for PPA gives the seller complete control over the shipping process. You choose your preferred carrier, negotiate the rates, and ensure your product is shipped and handled to meet your standards.

Improved Customer Service. As the seller, you simplify logistics for your buyer because you have full autonomy pertaining to the shipping process. It is an additional service your buyer will likely enjoy, which improves the overall customer experience and satisfaction.

Streamlined Billing. When the seller includes shipping costs in the customer invoice, it simplifies the payment process and ensures that no party overlooks payment for shipping fees.

Potential For Added Profit. With prepaid and add, you can negotiate a good rate with shipping companies or get an account with discounted rates. You can then add a margin to the shipping fees charged to the buyer, although transparency and business ethics should always be considered.

Reduced Risk. If a customer refuses to pay at delivery under collect terms, carriers often return the goods to sellers at the seller’s expense. Prepaid shipping removes this risk by ensuring that the carrier is paid upfront.

Prepaid and Add – Cons:

Added Paperwork. Choosing PPA means that your business must take on more administrative tasks, including arranging shipping, arranging payment, and billing the buyer. It also requires tracking and documenting shipping costs to invoice your customers accurately.

Potential Disputes. If your buyer believes they could get cheaper shipping or they have issues with the timeliness or shipping quality, you could face conflicts with your customer.

Delayed Reimbursement. Because you pay the initial freight charges, you will likely experience a delay before recovering these costs from the buyer. This delay could impact your business cash flow, especially if you are an owner-operator or you run a small trucking business with limited margins.

Non-Repayment Risk. If your customer fails to pay the invoice, you will be out of pocket for the shipping costs. When dealing with new customers or less financially stable customers, this can prove risky.

Reduced Flexibility. Some customers prefer to leverage their own logistics services and control the shipping process for various reasons, such as consolidating shipments or managing delivery times. You may unintentionally inconvenience these buyers by enforcing prepaid or prepaid and add terms, which could hurt customer satisfaction and business relationships.

Freight Collect: Pros and Cons

Freight collect might be a better fit depending on your business and customer needs. When the buyer is responsible for the shipping costs, it has certain advantages for sellers.

Here are some of the benefits and drawbacks of freight collect terms:

Pros | Cons |

| Fewer Administrative Tasks | Buyer Complications |

| Improved Cash Flow | Lack Of Control |

| Reduced Risk | Payment Issues |

| Flexibility | Customer Experience Issues |

Freight Collect: Pros

Fewer Administrative Tasks. With freight collect terms, your business (if the seller) isn’t required to pay upfront shipping costs or add them to the buyer invoice. It can help streamline your operations and reduce the time and investment in administrative tasks.

Improved Cash Flow. Paying for shipping upfront can impede cash flow. Since your business doesn’t pay freight charges upfront with freight collect terms, there’s no waiting period to recoup the costs. This can help improve your cash flow, especially if you have a new business or large shipping volumes.

Reduced Risk. If your buyer fails to pay the invoice, your business isn’t at risk of losing money on paid shipping costs.

Flexibility. If your buyers prefer or benefit from arranging their own shipping, offering them the option of freight collect terms would help enhance their buyer experience.

Freight Collect: Cons

Lack of Control. When your buyers are responsible for shipping charges, you have less control over the shipping process. It might impact the shipping quality, such as the packaging or handling, reliability, and delivery timing. Plus, if the buyer does not arrange shipping promptly, it could delay delivery and pickup. These delays could impact your inventory management and customer satisfaction.

Buyer Complications. Using freight collect could complicate the purchasing process for your buyers, especially if they don’t have a preferred carrier or are not experienced in shipping logistics. It might lead to a less satisfying customer experience.

Payment Issues. If your buyer fails to pay the freight charges, the shipping company may seek payment from you, or the goods might not be released to the buyer, leading to more complications.

Customer Experience Issues. If your customer encounters issues with the shipping carrier or the carrier loses or mishandles the product, it will negatively affect your business, even though you have no control over the shipping process.

In Summary: Prepaid and Add vs. Freight Collect

Choosing between prepaid and add and freight collect ultimately comes down to control, cash flow, and customer expectations. Prepaid and add offers sellers greater control over shipping and the potential for added profit, but it also introduces more administrative work and financial risk. Freight collect shifts responsibility to the buyer, improving seller cash flow and reducing upfront risk, though it can limit control and affect the customer experience.

By understanding the pros and cons of each option, both buyers and sellers can select freight terms that align with their operational needs, financial goals, and long-term business relationships.

Interested in Factoring?

Turn your unpaid invoices into working capital so you can keep growing your trucking business.

Prepaid and Add vs. Freight Collect FAQs

What does PPA mean in shipping?

“PPA” stands for “prepaid and add.” It’s a term that describes a freight payment situation where the shipper (typically the seller) initially pays for the freight charges but then adds the charges to the buyer invoice. It is a common term in various trade and shipping agreements.

What does PPD mean in shipping?

The acronym “PPD” stands for “prepaid.” The PPD term indicates that the seller (or shipper) accepts the responsibility of paying the freight charges. The shipping costs are paid before the shipment is sent.

What are FOB terms?

FOB means “free on board.” FOB terms are common in international trade to determine responsibility for products at each point in the shipping process and who will pay for freight and insurance.

There are two types of FOB:

- FOB shipping point (or FOB origin). This type is when the buyer takes ownership when they leave the seller’s premises or a specified location.

- FOB destination. In this type, the seller takes ownership and responsibility for the products until they reach the buyer’s location.

FOB terms are often used in conjunction with a physical location to note when the responsibility for the product changes from the seller to the buyer, such as FOB Factory or FOB New York.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.