Last Updated July 10, 2025

Running a small business can be as much about timing as anything else. Cash comes in. Cash goes out. Payroll loans and payroll funding (also known as payroll factoring) provide important ways to balance these occasionally unpredictable flows of money.

Getting the timing of your financing right can become crucial to keeping your small business going. Say you experience a sudden hiccup in income exactly at the time when you need to fund payroll. It can lead to serious problems.

To avoid these consequences, you should have a backup plan in place. Understand your financing options, so you can meet your employee payroll on time and in full.

To do this, you should understand the difference between payroll loans and payroll funding. Here’s a detailed guide to let you know your best choice when you reach a cash crisis at payroll time:

The Importance of Payroll Management

Payroll days represent hard deadlines. You can often fudge other expenses. Your office won’t plunge into darkness if you miss the due date on your electricity bill. Similarly, you won’t lose your internet connection if that payment sits in your bank account a little too long.

However, miss a payroll, and you might never recover. Even in a one-off situation, it dampens the mood in the office. If the experience repeats, you could suffer unrecoverable talent loss as top employees head for more reliable employers.

Here are a few consequences that you could face by missing payroll:

- Declining Employee Morale: When paychecks are delayed, people tend to get (justifiably) upset. Even a hold-up of a day or two can create permanent suspicion in your employee’s minds. This could make it more difficult to motivate them.

- Loss of Business Reputation: A missed payroll might seem like an internal matter. But word often leaks out. A series of problems might start to impact your overall business reputation. Over time, this could cost you revenue.

- Mass Employee Departures: You won’t hold your employees long if you can’t pay them. Workers can forgive a few difficulties. But a significant cash crunch or repeated payroll disruptions could send people towards the door.

Remember: your best workers have the most options. Any sense of uncertainty will have your most talented employees updating their resumes. Even one delayed payroll, even by a day or two, can cause a ripple effect that could dramatically undermine your ability to compete.

Defining the Problem

Yes, a missed payroll represents a serious problem. But there are steps you can take to avoid this dire situation. Have contingency plans in place and know your options if you run into a difficult situation.

Ideally, you should just dip into your savings if a problem arises. If possible, hold enough cash on hand to create a buffer. Then, even if you hit a streak of bad luck, you have enough spare funds to cover the payroll checks.

However, that’s not often possible. Startups and small businesses often operate on a shoestring. (And size doesn’t always matter; some big companies sweat out payroll days as well.) You might not have the luxury of holding a payroll-sized wad of cash in reserve.

Say you’re facing a missed payroll. What can you do? Before looking at your options, you need to define the problem. Why do you need short-term cash? Knowing this information will help you determine the best course of action.

Cash Burn

If you’re operating at a loss, you have bigger problems to worry about than a financing mismatch. Neither a payroll loan nor payroll factoring will save you from an unsound business plan. In fact, the expense associated with these processes could make things worse over the medium term.

Unpaid Invoices

You should have the money you need. But your customers have let you down. Currently, you have enough outstanding invoices to cover the payroll. However, you haven’t been able to collect delinquent payments. In these cases, payroll management strategies, like loans and factoring, become a valuable bridge.

Unexpected Expenses

You never know when an emergency will happen. That’s part of the nature of emergencies. If you face an unexpected expense, you might find yourself short of cash at a crucial moment. Again, in this case, your business supports your payroll levels. You just need a little help in the short term.

What Are Payroll Loans?

The name here pretty much sums up the product. You receive a short-term loan to cover your payroll. Like any borrowing situation, the deal comes with a repayment structure. You’ll need to repay the cash (plus the agreed-upon interest) by a predetermined date.

Given that this is an unsecured loan, the interest rates can get pretty high. Think of it as the corporate equivalent of a payday loan. You get a short-term injection of cash, but it comes at a cost. In this case, rates can run in the 15%-30%. On the high end, that tops most credit card rates.

Pros of a Payroll Loan

- get cash quickly

- you keep 100% of revenue owed

Cons of a Payroll Loan

- rigid repayment requirements

- high-interest rates

- might need to pass a credit check

What Is Payroll Funding (Factoring)?

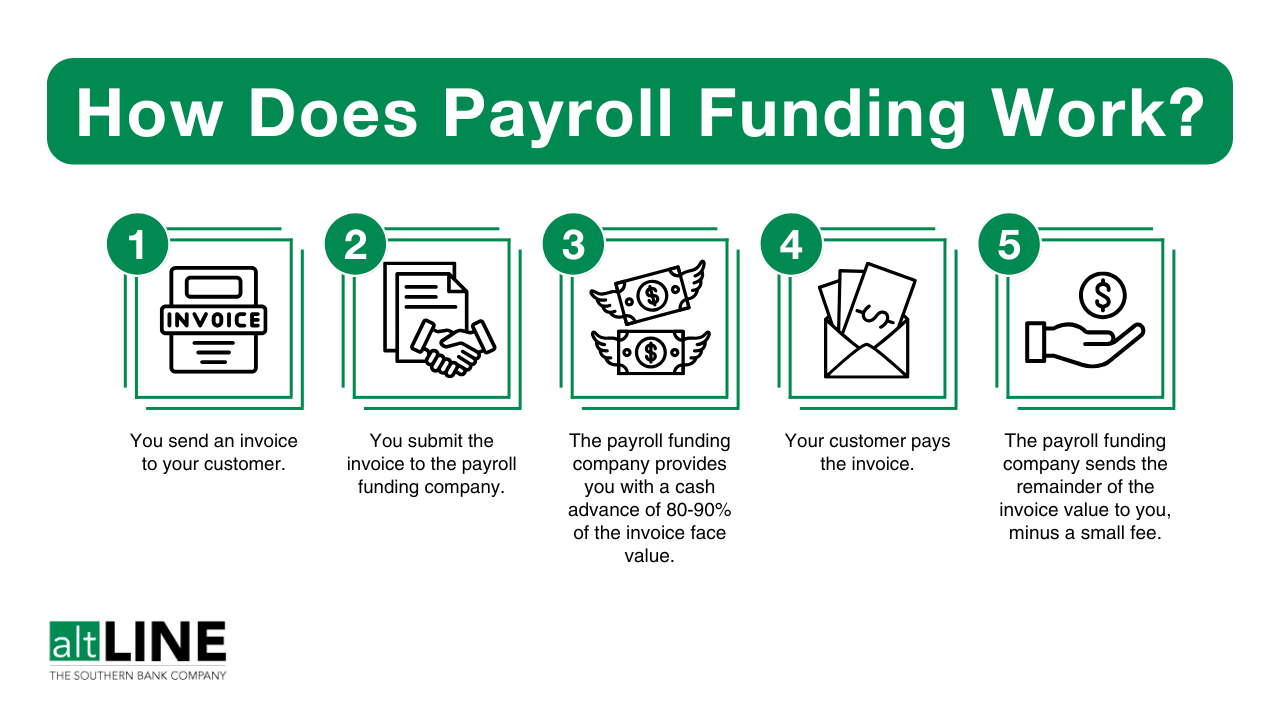

The payroll funding route has a different structure. You don’t receive a loan. Instead, you effectively sell a portion of your uncollected invoices via a factoring agreement.

Your customer owes you cash. They are late in paying, which means you don’t have the money you need for payroll. You strike a deal with a payroll factoring firm, or factoring bank, that turns that unpaid invoice into cash.

In effect, you turn over the invoice to the factoring firm. They will pay you in advance some fraction of the amount due (often in the 80%-95% range). Now they will collect the debt.

Pros of Payroll Funding

- no loan to repay

- often an option even with bad credit

- factoring companies will help you collect delinquent invoices

Cons of Payroll Funding

- giving up potential revenue

Smooth the Business Cycle Through Payroll Loans or Payroll Funding

Every business comes with peaks and valleys. Sometimes sales are rolling in. Sometimes the process stalls. Payroll management strategies allow you to smooth out these bumps in the business cycle.

To stay as efficient as possible, you need to know your options. Deciding between payroll loans or payroll funding depends on your particular situation. Still, by using the right strategy, you can show stability and reliability to your employees. You can do this despite the fact that the external reality remains unpredictable.

Grey was previously the Director of Marketing for altLINE by The Southern Bank. With 10 years’ experience in digital marketing, content creation and small business operations, he helped businesses find the information they needed to make informed decisions about invoice factoring and A/R financing.