Last Updated January 30, 2026

Need Cash Quickly?

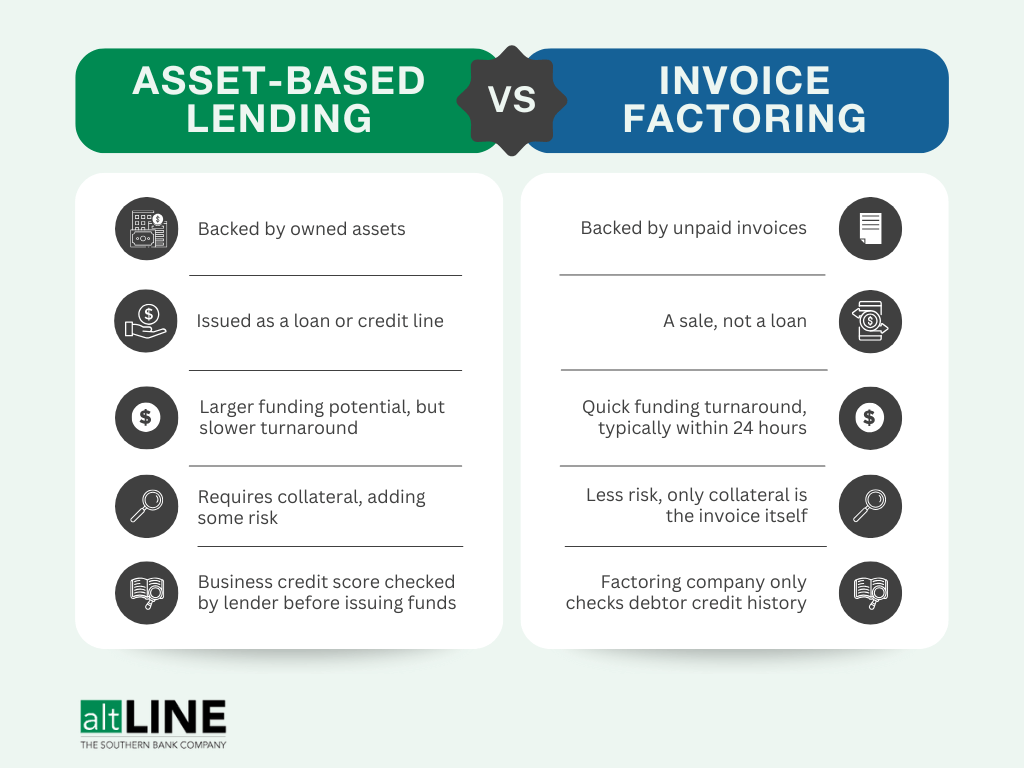

Startup owners and others who would be considered high-risk borrowers often struggle to qualify for traditional bank loans that meet their business needs. Instead, many business owners opt for one of two types of alternative financing: asset-based lending or invoice factoring.

These two funding solutions are more attainable for all types of businesses, regardless of credit profile. While asset-based lending and factoring both offer a way to get a cash infusion for your company, they operate very differently.

By understanding how these business funding options work, you can decide which one is better for your specific situation.

Key Takeaways

- Asset-based lending works best when you need a bigger lump sum and have solid assets to borrow against.

- Factoring is ideal when cash flow is tight and you need quick funding without taking on debt.

- ABL can offer higher limits but also comes with fees, monitoring, and the risk of losing the asset if things go south.

- Factoring skips the credit hurdles and leans on your customers’ payment strength instead of your own.

- Choosing between factoring and asset-based lending comes down to how fast you need the money and what resources you already have to leverage.

What Is Asset-Based Lending?

Asset-based lending includes any type of loan that uses business assets as collateral. This allows businesses to obtain a secured loan to improve cash flow or fund expansion opportunities.

How Asset-Based Lending Works

Asset-based lending (ABL) allows businesses to obtain a loan or line of credit that is borrowed against an owned asset. This can include equipment, inventory, and other property. The high value of these assets usually enables businesses to qualify for a much larger loan than they normally could.

Lenders will underwrite the loan based on the fair market value of the assets that will be used as collateral. Lenders typically won’t provide a loan that is worth the full value of these assets, subtracting a set amount based on their expected cost to convert the assets into cash if the business cannot repay the loan.

In addition to an annual interest rate, most lenders charge monitoring fees, unused line fees, and commitment fees based on the size of the loan and the cost of monitoring the asset.

Benefits of Asset-Based Lending

As with other alternative lending solutions, asset-based loans allow businesses to obtain financing that they might not otherwise qualify for. Asset-based loans can be particularly useful because they can give businesses access to very large loan amounts—even loans of several hundred thousand dollars or more.

Who Uses Asset-Based Lending?

Asset-based lending is primarily used by businesses that need a large loan amount. These funds are usually used for expansion opportunities, such as opening a new location or introducing a new product or service. Because the amount of the loan is linked with the value of the assets being used as collateral, businesses can obtain very large loans needed to fund these activities.

While fees and interest rates can result in high repayment expenses (similar to other high-risk business loans), a business that can turn its loan into a new resource for generating income can make great use of these funds.

What Is Invoice Factoring?

Although the terms “asset-based lending” and “invoice factoring” are sometimes used interchangeably, invoice factoring isn’t a loan. Instead, invoice factoring allows businesses to obtain funding by selling their unpaid accounts receivable to a factoring company.

How Factoring Works

With invoice factoring, factoring companies buy your company’s unpaid invoices. They provide a cash advance, typically worth 80-90% of the value of the invoice, and then the factoring company takes over the responsibility of collecting payments from your clients.

Once the invoice has been paid in full, the factoring company provides the rest of the value of the invoice, minus a fee. This factoring fee is usually a small percentage of the total value of the invoice.

Rather than looking at your company’s credit score, factoring companies will check the creditworthiness of your clients before deciding whether to buy the invoice and provide funds.

Benefits of Factoring

One of the main advantages of factoring is that it allows businesses to get cash quickly. Approvals are often determined the same day, providing much faster funding than bank loans. Because factoring isn’t a loan, factoring companies don’t look at your company’s credit score and instead check the credit score of your clients.

Factoring’s unique setup also means that your business doesn’t have to put up any collateral. You aren’t taking on debt with interest that will need to be repaid later. Instead, you quickly get the cash you need to continue funding your business operations, at a low cost of 0.5-3% of the value of your invoice.

Who Uses Factoring?

Factoring is often used by companies that need help managing their cash flow and require immediate funding for activities like payroll, monthly business expenses, purchasing inventory, and so on. Depending on the value of the invoices, factoring may also be used to fund expansion activities.

Despite its usefulness, factoring may not be an option before starting a business or if you don’t have many clients. To use factoring, you need to have clients whose invoices can be factored!

What Are the Differences Between Asset-Based Lending vs. Factoring?

Asset-based lending vs. factoring isn’t a winner-take-all debate. Both can be valuable in different circumstances. By carefully evaluating how these options work, as well as the type and amount of funding you need, you can select the option that works best for your current situation.

| Asset-Based Lending | Factoring |

| Can be used when you won’t qualify for a traditional loan | Can be used when you won’t qualify for a traditional loan |

| Loans are secured by business assets that are used as collateral | Cash advance is provided by selling unpaid invoices to a factoring company |

| Receive a loan as a lump sum or access to a line of credit, typically worth around 85% of the value of the assets used for the loan | Receive 80-90% of the value of the invoice up front, and get the rest after payment is collected from the client |

| Charges include interest rates, monitoring fees, unused line fees, and commitment fees | Factoring companies deduct a percentage fee from the total value of the invoice |

ABL vs. Factoring: Which Is Best for Your Business?

Whether asset-based lending or factoring best-suits your business ultimately comes down to your specific situation, particularly how much funding you need

Generally speaking, you might be able to get a larger lump sum of cash through asset-based lending, since your business assets are likely worth more than your unpaid invoices. However, asset-based lending comes with high interest rates and fees along with high risk. Failure to pay will result in the lender seizing the asset that was used as collateral.

Invoice factoring is ideal when you need cash quickly to fund essential business expenses like payroll or facilities overhead. The size of the cash advance is strictly dependent on the total value of the invoices you factor.

Factoring is especially popular for:

- New businesses

- Small businesses

- Rapidly growing businesses

- Seasonal businesses

You don’t take on any debt with factoring, which can make it easier to improve your cash flow for the long-term without stressing about paying back a loan or losing a hard asset.

Ready to Start Factoring?

altLINE has been rated a top factoring company of 2025 by NerdWallet, Forbes, Investopedia, and more. Since we’re bank-affiliated, our rates are competitive and funds are more secure than independent factoring companies. Plus, we offer complimentary customer credit checks, same-day funding, and quick approval times.

If invoice factoring seems like a good option or you have any questions about how the process works, feel free to reach out to one of our representatives at +1 (205) 607-0811. Or, fill out our free factoring quote form.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.