Last Updated November 13, 2025

You could make a good argument that no financial measure is more important for a business than cash flow.

Cash flow problems are the No. 1 reason behind business’s failing to age beyond three years. Not only is cash flow necessary for a business’ survival, but a certain level of positive cash flow will eventually be required for you to have the financial safeguard in place to strive toward business expansion. This is why any business owner, no matter the size of their company, should practice cash flow forecasting.

By creating a cash flow model, you can project future cash flows to prevent your business from facing unexpected financial challenges. But what is a cash flow model? How do you build one? And what other cash flow-related measures and tools should business owners understand? Continue reading to find the answers to these important questions.

Key Takeaways

- Accurate business cash flow forecasting is essential for survival and helps prevent unexpected financial challenges.

- A cash flow model projects future cash inflows and outflows, including sales, expenses, investments, and market trends.

- Building a cash flow forecast involves setting a forecast period, calculating all inflows and outflows, and determining net cash flow.

- Using a cash flow model supports informed decisions on expenses, staffing, investments, and long-term cash flow planning.

What Is a Cash Flow Model?

A cash flow model is a form of cash flow forecasting, which occurs when business owners predict and visualize future financial performance based on a number of factors that impact the movement of money. These can include assets, liabilities, income, and expenditure. A cash flow model takes into account market trends such as interest rates and wage spikes, and should include historical, real-time, and projected data. The resulting numbers from gathering this information can then be used for investments, sale of equity, or reduction of debt.

Cash flow models will have specific objectives in mind, meaning a business may have several cash flow models in order to accommodate different goals. An optimal cash flow model will be detailed enough to be conducive to meeting set goals, but not to the point of inundating a user with unnecessary information.

Importance of a Cash Flow Model

A well-designed cash flow model allows business owners to accurately forecast future cash flow. Because it takes into account all applicable factors, such as market and economic trends, a business’s future financial well-being is easier to ensure through forecasting cash flow and creating a cash flow model—even when there is a twist in the road ahead.

Cash flow models allow business owners to implement harvested data in planning and enacting necessary changes that will impact liquidity and solvency. These are factors that should be considered before potential economic crises. Creating a cash flow model is not a matter to be postponed until such events occur.

In addition, a cash flow model will highlight the key drivers of cash flow, which ideally leads to a focus on maximizing the impact of these drivers. In this way, cash flow models not only help sustain businesses but assist in improving cash flow, the primary objective of any business.

The more data that is available, the more flexibility business owners possess for investment ventures. The availability of data and the resulting net gain also has a positive impact on investors’ impression of the business, which opens more doors to funding and lower interest rates. These are all positive steps toward reducing debt for the business, thereby reducing liability and building equity.

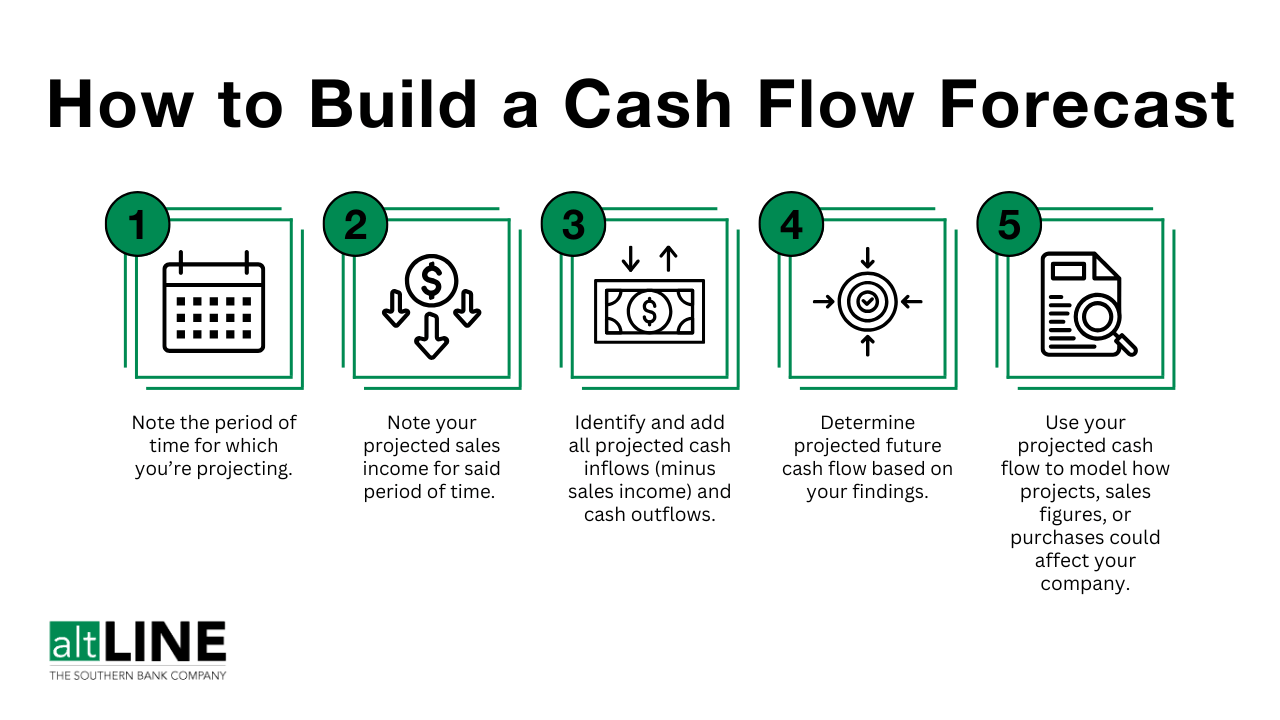

How to Build a Cash Flow Model to Forecast Your Future

Each business owner might create a cash flow model a bit differently from the next, but here’s a walkthrough of how to simplify the process of building a cash flow model:

1. Determine the Period (Length of Time) for Which You’re Projecting

The first essential step of building a cash flow model is determining the length of time for which you’re forecasting cash flow. It could be one month, one fiscal quarter, one year, or more than one year.

Newer businesses might have a more difficult time projecting than established businesses, given there’s less historical data to rely on. If you run a new, small business, it might be wise to map out your future cash flows monthly or quarterly at first, rather than annually.

2. Note Your Sales Income

For the period you’re using, denote all of the money you foresee coming in through sales. While not necessary, it can be helpful to separate sales income from non-sales cash inflows as this might be less predictable, especially if you run a new business and you’re not confident your sales projections will be entirely accurate.

3. Identify and Add All Cash Inflows (Non-Sales Income)

Now it’s time to identify all cash inflows for the given period. Aside from sales, typical cash inflows for a business might include:

- Investments from shareholders

- Royalties

- Tax refunds

- Interest income

- Loans or other funding

Add up these cash inflows to get your total income.

4. Identify and Add All Cash Outflows

Next, identify and add all known and projected cash outflows to your cash flow model. Examples of common cash outflows include:

- New equipment and other one-time purchases

- Any other payments to suppliers

- Maintenance and upkeep

- Payroll

- Dividends to pay out shareholders

- Payments to clear debt (such as from loans)

- Transport costs

- Insurance costs

- Rent

- Marketing and advertising expenses

5. Determine Projected Future Cash Flow

Once you add up these outgoings, you’ll be able to compare with your incomings to determine your net cash flow over the given period.

To calculate your cash flow, simply subtract your cash outflows from your cash inflows. If the resulting figure is positive, that means you project to have a positive cash flow. If negative, that equates to negative cash flow.

This isn’t the final step, as it will merely be your point of reference once you begin modeling how making certain changes or decisions will affect your cash flow.

6. Begin Modeling

Once you have that point of reference (projected cash flow figure), you’ll have your cash flow model set and you can begin forecasting. You’ll be able to determine how an expense, project, market trends, or future sales numbers might affect your cash flow over time—and if you’ll have enough additional cash to sustain your business.

Example of How to Model Cash Flow

After completing the steps listed out above, you can start projecting how tweaks to your business or finances will affect your cash flow. Below is an example.

Let’s imagine a scenario where the owner of Business XYZ is considering hiring an accountant, but market and economic trends have revealed that she might see a downtick in business sales over the next year. She needs to know if she can afford to bring on this additional employee. After researching, she’s deduced that the cost of hiring an accountant with the experience she’s looking for will be about $100,000 annually. Therefore, she decides to create a cash flow forecast to determine if she can afford bringing on this accountant.

She calculates that her predicted cash outflows for the next year equate to $400,000, while her cash inflows equate to $580,000 (taking into account projected lessened sales income). After subtracting her cash outflows from cash inflows, she’s left a (positive) cash flow of $180,000.

This means that, despite a possible decrease in sales income, she still estimates $180,000 worth of funds to work with. Considering a new accountant would cost $100,000, she finds that her business is secure enough to make the hire.

In Summary: How to Forecast Cash Flow by Building a Cash Flow Model

Cash flow is vital to the well-being of a business, whether you run a small to mid-sized business or a corporate giant. Neglecting this vital aspect of a company’s finances leads to the downfall of many businesses.

Having a well-made cash flow model allows you to foresee potential obstacles in your future and opens up new opportunities for growth. This holds true even when economic crises may loom on the horizon.

An important note to keep in mind: remember that estimations are estimations. Your numbers won’t be precisely accurate, especially if you’re modeling cash flow for a brand-new business. However, you should still be diligent when adding up all cash inflows and outflows in order to provide the most accurate depiction of where your business is headed. Rest assured your hard work and diligence will pay off.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.