Last Updated August 18, 2025

Cash Flow Statement Template

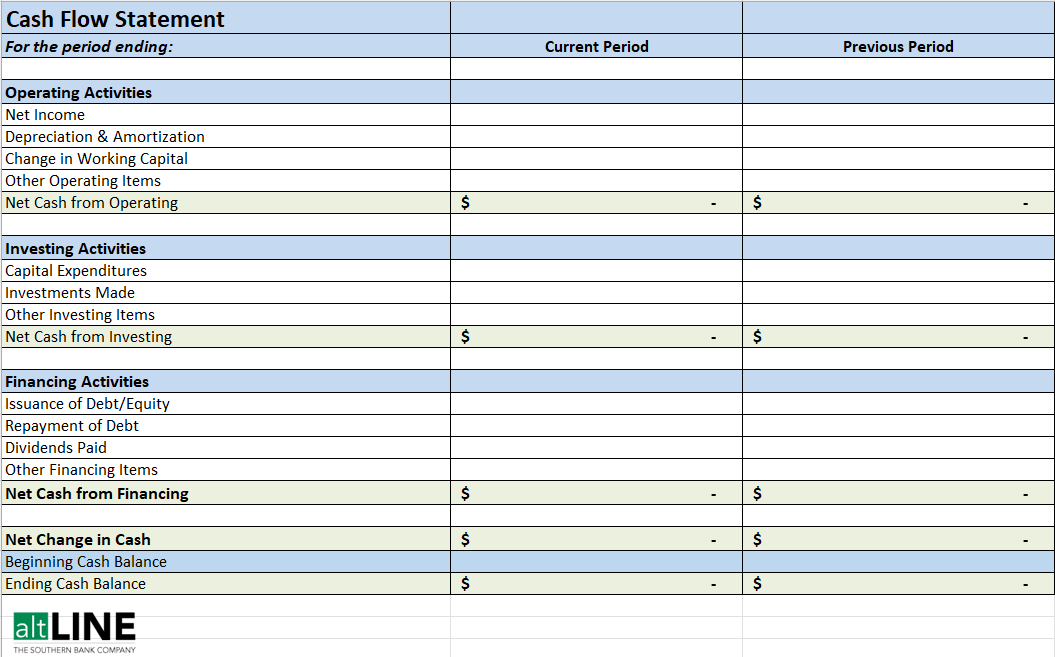

Cash flow statements are pivotal for small business owners when it comes to tracking the movements of funds. Having a cash flow statement template handy will go a long way toward not just tracking progress, but also identifying areas of opportunity to prevent prolonged periods of negative cash flow.

You can download our free cash flow statement template for Excel or Google Sheets to get started immediately. Simply download the template, categorize your spending into operating, investing, or financing activities, and begin tracking. A separate “previous period” column is included in case you want to use this template to compare with past periods and analyze your cash flow even more effectively.

How Often Should I Create a Cash Flow Statement?

It’s common practice to create a cash flow statement once per quarter. New business owners might feel the need to do so more often, perhaps monthly. Ultimately, it’s up to you to decide what makes most sense for your company.

What Signals Healthy Cash Flow?

The goal here should be to have your net change in cash to be a positive figure. If it’s below zero, that means you have a negative cash flow for the period.

It’s important to note that many new businesses deal with periods of negative cash flow. Obviously, it’s tough to generate a profit when you’re first opening your doors. It takes time to find clients, win new contracts, and form relationships with buyers. All the while, you’re investing cash into your business with long-term success in mind.

Issues arise when these periods become too prolonged. If you’re constantly struggling with negative cash flow, you might need to explore external funding to stay afloat. And since new businesses have a tough time qualifying for traditional loans, this might require alternative financing. One common lifeline is invoice factoring, though there are many forms of alternative lending.