Last Updated February 3, 2026

Every business needs funding at some point. Some need it just to get started, others need it to meet payroll, and others need it for business expansion purposes. But not every type of funding will be available to business owners. If you run a small business, you may be restricted to alternative financing due to strict qualification requirements including a high business credit score and significant collateral. Luckily, alternative financing provides a solution, with one option in particular growing in popularity amongst business owners – invoice factoring.

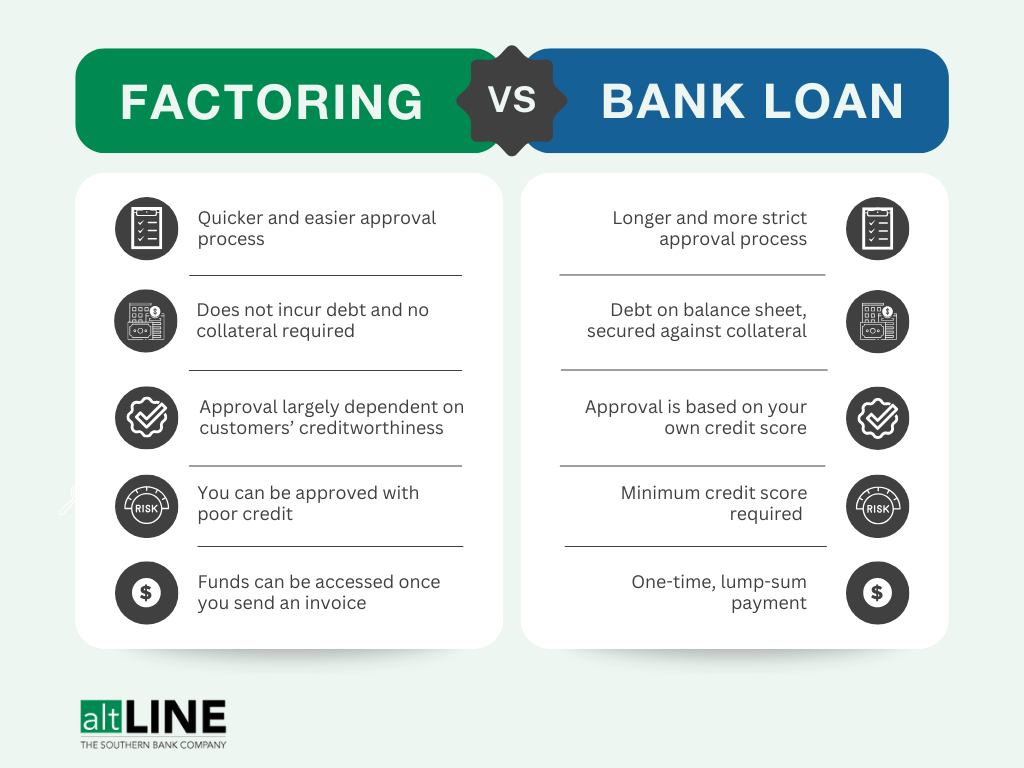

New business owners probably aren’t as familiar with factoring as they are with traditional financing options, so let’s break down the differences between factoring vs. bank loans.

Key Takeaways

- Invoice factoring and bank loans both provide businesses with access to capital, but factoring involves selling invoices for immediate cash, while loans involve borrowing funds that must be repaid.

- Factoring offers quick approval, no collateral requirements, and flexibility, making it ideal for small or new businesses with limited credit or assets.

- Bank loans typically require strong credit, collateral, and longer approval processes, but they tend to be more affordable in the long term for established businesses.

- Businesses that need fast, scalable funding or have poor credit are good candidates for factoring, while those with strong credit histories and significant assets are better suited for bank loans.

- If a bank declines a loan application, factoring through a bank-affiliated provider like altLINE can offer an alternative source of financing without incurring debt.

What Is Invoice Factoring?

Invoice factoring is an alternative financing option in which a business sells its outstanding invoices to a third-party factoring company (often referred to as a factor) for a discounted rate. The factor provides a cash advance to the business that sold the invoice (typically 80 to 90% of the invoice face value) and works with their customers to collect the invoice payment. Once payment has been collected, the factoring company pays out the remaining invoice value, minus a small factoring fee.

Factoring is not a loan, as no collateral is required aside from the accounts receivable involved in the transaction. Instead, the factor simply provides an advance to your business against the accounts receivable you choose to factor.

Invoice Factoring vs. Bank Loans

While factoring and bank loans both inject much needed capital into a business, the two options are more different than alike.

| Invoice Factoring | Bank Loans |

|---|---|

| Quicker and easier approval process | Longer and more difficult approval process |

| No collateral is needed | Loans are secured against collateral |

| Factoring is not debt | Debt is incurred |

| More flexible financing and funding limits | Funding potential is limited |

| Approval is largely based on your customers’ creditworthiness and reliability | Approval is based on your credit and business operations |

| You can be approved with poor credit | You need to have strong credit to be approved |

| Tends to be more expensive in the long run | Tends to be more affordable in the long run |

Approval Process

- Factoring: Getting approved for a factoring line can happen in as soon as a day. Qualification requirements are lenient.

- Bank Loans: Traditional bank loans can take weeks to complete the application process, and banks tend to be stricter on who is approved.

Credit

- Factoring: Your personal and business credit scores are not a priority when a factor is reviewing your application. Instead, they evaluate the creditworthiness of your customers. This makes factoring an appealing option for individuals without a strong credit history.

- Bank Loans: In-depth credit analysis provides banks a risk profile for the individual and business seeking traditional loans. Credit standards are tough to meet and often prohibit borrowers from receiving funding.

Structure

- Factoring: As the business grow and receivables grow, so does the availability for working capital. This gives the business greater borrowing flexibility.

- Bank Loans: The structure of a bank loan or line of credit requires a predetermined dollar limit. Once that level is reached, trying to gain additional capacity (i.e. working capital) is difficult.

Cost

- Factoring: Invoice factoring rates are relatively low, but they can add up over time. Rates are typically anywhere between 0.50% and 3.0% of the invoice face value. Additionally, the quicker a customer pays, the lower your rates typically are with factoring.

- Bank Loans: Depending on the interest rates, bank loans can be a cost-effective financing solution for businesses with good credit. However, if you don’t have an excellent business credit history, rates become less affordable.

Should I Choose Factoring or a Bank Loan?

Now that you understand some of the key differences between invoice factoring and bank loans, you may be wondering which you should choose. We’ve broken down some of the top considerations for each below.

Business That Are a Fit for Factoring

Invoice factoring can be an excellent financing solution for certain types of businesses, especially startups and small businesses, staffing companies, trucking companies, and various industrial companies. Still, all sorts of companies can benefit from factoring.

You may want to explore factoring as a funding option if:

- You need quick cash

- You need ongoing and scalable financing

- You’re a new or small business lacking creditworthiness

Additionally, you can greatly improve your chances of qualifying for a traditional bank loan down the road by utilizing factoring and forming a healthy working relationship with a bank factors. Lenders appreciate borrowers who have proven reliable to work with, and your factor can further endorse your business. This is one reason why it can be beneficial to work with a bank factor rather than an independent company.

Businesses That Are a Fit for a Bank Loan

Traditional bank loans are a tried-and-true financing solution for businesses across the country. This option may be great for your business if:

- You have been in operation for years

- You have large assets to your name

- You have excellent business credit

If you meet the requirements for a traditional bank loan, this may be your best option. However, for many businesses who have poor credit, limited operating history, or limited assets to borrow against, those loans and lines of credit may simply not be an option.

For those businesses, we recommend learning more about invoice factoring and finding out how it might be a more efficient, affordable and reliable alternative form of cash flow financing.

If the Bank Tells you “No”

While a business should explore traditional options, business owners should not get discouraged if the bank comes back with a “no” for a loan or line of credit request. It is not uncommon for a business to be turned down. Even if the bank can’t extend a traditional bank loan, the bank can provide a referral for an alternative type of funding if one is not available in-house.

Here at altLINE, we maintain the unique position of serving businesses as a factoring bank. When a primary banking partner can’t help, we step in as a FDIC-insured factoring partner to help the business in need.

If you’ve applied for a bank loan and have been turned down, fill out our quote form to see if we can finance your business through factoring instead.

In-Summary: Factoring vs. Bank Loans

Some might think view factoring as a type of loan, but loans and factoring are two different financing solutions.

When a business factors its invoices, it sells those invoices to a third-party factoring company. There’s no lending involved in factoring, as funds don’t need to be repaid. Bank loans, on the other hand, involve lenders forwarding secured funds to a business that are to be repaid based on the terms of the contract.

Though a bank loan is a more widely recognized form of financing than factoring, that doesn’t necessarily mean it’s better. Factoring can be hugely beneficial for small businesses that don’t have hard assets who need to improve cash flow and businesses in industries with notoriously long payment terms, like trucking.

Because factoring doesn’t require collateral (aside from the outstanding AR being factored) and companies with poor credit can still qualify, it can be a saving grace for many business owners.

Need Cash Quickly?

Factoring vs. Bank Loan FAQs

Still have questions? Check out some commonly asked questions about invoice factoring and bank loans below:

What is a factoring loan?

A factoring loan is a way for businesses to secure funds by using outstanding AR as collateral. It involves a third-party invoice factoring company purchasing a company’s unpaid AR, immediately advancing 80-90% of the value of each invoice to the company. Once the debtor submits payment (to the factoring company), the remaining funds from each invoice are unlocked, minus a small factoring fee.

It’s important to note that while “factoring loan” is sometimes used interchangeably with “invoice factoring,” it’s not a loan by definition. A factoring company actually purchases the invoice, and there’s no repayment aspect of factoring.

Is factoring considered debt?

Factoring is not considered debt. Instead, invoice factoring is the process of selling outstanding invoices at a discounted rate in return for a cash advance. The funds from this advance do not have to be repaid; instead, there’s a small factoring fee that’s yielded to the factoring company in exchange for immediately being advanced the majority of the value of each invoice.

Why would a company choose factoring instead of a bank loan?

Invoice factoring has many advantages, especially for those who may struggle to get approved for a traditional bank loan. The factoring approval process is typically much quicker and less strict than the loan approval process, making it easier for businesses to qualify and get funding when they need it most. Additionally, funding tends to be more flexible with factoring than with bank loans, which can be helpful for a growing business.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.