Last Updated October 22, 2025

Performing a cash flow audit is an essential responsibility that every business owner should have on their year-end accounting checklist. Auditing a cash flow statement can show how your accounts receivable, inventory, and accounts payable line up yearly.

By analyzing these trends, you’ll be better prepared to help your business grow. Falling behind on auditing your cash flow and receivables can cause problems, so it is better to start thinking about managing your auditing tasks as early as possible to avoid any costly mistakes once tax season rolls around. However, new business owners might not be too familiar with this process.

This article will offer insights into how to perform efficient, painless audit procedures for your cash flow.

Key Takeaways

- Regular cash flow audits help spot trends, prevent mistakes, and maintain positive cash flow.

- Using balance sheets, income statements, and cash flow statements together makes auditing simpler and clearer.

- Auditing accounts receivable ensures invoices are accurate and improves short-term cash management.

- Monitoring interest rates, market changes, and receivable discrepancies helps manage financial risks proactively.

What Is Cash Flow?

Cash flow refers to the movement of cash and cash equivalents in and out of a company. Essentially, analyzing cash flow means you’re analyzing how much money your company generates vs. how much it spends. With cash flow, the goal is for cash inflows to outweigh cash outflows, also known as “positive cash flow.” When cash outflow is greater than cash inflow, this leads to negative cash flow.

A positive cash flow is a good indicator of financial health, as it signals that your business has the means to reinvest in the business, cover expenses, and potentially expand operations.

What Is a Cash Flow Statement?

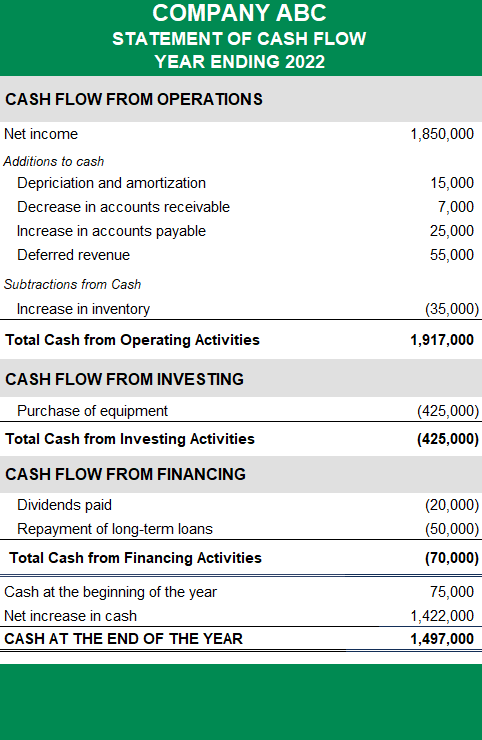

Assessing the timing of how money moves within your company, where it originates, and how it goes in financial reporting is essential in evaluating your company’s liquidity, flexibility, and overall financial performance. You can analyze your cash flow by looking at your cash flow statement, which categorizes your cash flow from three different areas: operations, investing, and financing.

A cash flow statement is created using a balance sheet and profit & loss statement, which together form the three essential financial statements. A balance sheet shows your company’s assets, liabilities, and shareholder equity, while the income statement shows your company’s revenue and expenses during a particular period.

Altogether, this information will be pivotal to have handy in order to perform a cash flow audit.

How to Audit Cash Flow

As long as you’ve assembled your three main financial statements (balance sheet, profit & loss statement, and cash flow statement), auditing your cash flow will be a relatively straightforward process.

1. Create and Audit Your Balance Sheet and Income Statement

The first step in auditing cash flow is to create a balance sheet and a profit & loss statement for the past year and audit both. The figures from these documents will help quicken the process when crafting your cash flow statement.

2. Use These Documents to Help You Create a Cash Flow Statement

Note your opening balance on your balance sheet from the beginning of the period (in this example, the past year) at the top of your cash flow statement. Then, calculate your cash and cash equivalent inflows from each of:

- Operating activities

- Investing activities

- Financing activities

Subtract all cash outflows from the above resulting figures. You’ll then have your net cash flow from operating activities, investing activities, and financing activities, which you can document on your cash flow statement as shown above.

Finally, add (or subtract) together your net cash flow from operating activities, investing activities, and financing activities. The resulting figure will be your closing balance, which you can denote at the bottom of the cash flow statement.

While this example is for an annual cash flow statement audit, it’s good practice to create a cash flow statement each month.

3. Account for Non-Cash Transactions

Make sure you’ve accounted for all non-cash transactions such as hybrid debt transactions or other complex financial transactions that have occurred over the past year.

4. Audit Your Cash Flow Statement

The final step of auditing your cash flow is recalculating all the amounts on your cash flow statement to make sure everything is accurate (auditing your cash flow statement).

Once you’ve completed all these steps, you’ll have successfully completed a cash flow audit!

Common Risks to Be Aware of When Auditing Your Cash Flow

Although most cash flow audits go smoothly, it is worth being aware of some of the possible risks and vulnerabilities most companies face. Here are a few examples:

- Changing Interest Rates – When interest rates vary quickly, companies may have to borrow more, leading to decreased asset values.

- Financial Market Changes – If a company’s stock price changes, this could affect the company’s ability to gain capital.

- Commodity Prices – A company might risk trading losses depending on fluctuating commodity prices.

- Risk of Material Misstatement – Cash flow modeling is based on assumptions based on data. These assumptions leave a lot of room for error. If you use the wrong set of data or assume trends incorrectly, you might risk material misstatement.

- Detection Risk – You will be at a detection risk if you miss material misstatements within your audit.

Auditing of Accounts Receivables

Auditing your accounts receivables is equally important as a cash flow audit.

Accounts receivable are the total amount of money that a company is owed for products or services already delivered or given to a customer. Customers would use credit to pay for the product or service. Accounts receivable are the opposite of accounts payable, which is when a company owes money. Some businesses choose to sell their receivables to a third party in exchange for cash up front (also known as accounts receivable financing).

By looking at your receivables, you’ll be able to measure your company’s liquidity and ability to cover short-term obligations through the income you receive from the credit owed.

Since account receivables are generally the most significant asset a company has, auditing can take quite some time due to this fact.

How to Audit Accounts Receivables

- First, you will need to trace the total amount of receivables back to the general ledger.

- You will then calculate the total invoices to verify the accuracy of the receivables in the general ledger.

- The invoice can take the form of any method of documentation informing the customer of the total amount they owe the company.

- This action is called calculating the receivable report total.

- The next step is investigating the reconciling items.

- For more significant amounts of money, you will need to compare any journal entries and the data set to ensure they check out.

- Fully documented journal entries are best when doing this task.

- After investigating the reconciling items, you will need to randomly choose invoices and match the invoices to the paired documentation to ensure the customers were billed correctly.

- To confirm your accounts receivable, you may need to directly get ahold of clients and get a motion of financial confirmation by the latter part for the auditing quarter. Usually, this would only be for those who owe more significant balances.

- Next, check the receiving log and related party receivables.

- The receiving record will show any significant amount of money that was unauthorized to be shipped in the latter part of an audit period.

- Checking this part of the receivables shows whether the amount of money given by the company was adequately authorized.

- Lastly, you will need to look at your financial trends. Checking this part of your audit will guarantee that your business is on the right track. Once you perform this last step, you’ve successfully audited your account receivables.

Common Risks

Here are some risks and vulnerabilities you may face while performing your account receivables:

- Missing receivables – If invoices that don’t exist are created to increase your sales, and receivables are recorded in the current year instead of after the year ends, this can bring up issues.

- Receivables do not reflect their economic value – If allowance for doubtful accounts is not made, the receivables may not be accurate to their economic values.

- Your company might not have control over receivables – If a company pledges collateral for loans from the bank, they may not have as much control over receivables as they’d like.

The Bottom Line

Auditing your cash flow and receivables efficiently and accurately will not only help you become a better business owner, it will also help you recognize trends in your business that will give you a better idea of where you should be putting your money.

Understanding the trends produced by your cash flow statement is also essential. If you don’t have enough cash on hand to pay debts, you’re at risk of going out of business. When you can anticipate when you’ll receive your money, you can better prepare to pay off what you need to in tight financial situations.

Don’t be intimidated by your finances. Start practicing good financial health to take your business to the next level.

FAQs

What is a cash flow audit?

A business’ cash flow is the amount of money moving in and out of a company. A cash flow audit is simply a review of your cash inflows and outflows to help you better understand your finances. Not only does auditing ensure accuracy, but it acts as a cash flow analysis to help your company stay financially health. Additionally, this tool can help you identify areas to improve your cash flow, such as encouraging your customers to pay sooner to reduce the number of outstanding invoices you have or paying your vendors slower to keep more cash on hand to pay your most urgent expenses.

How often should I audit my cash flow and account receivables?

Although it’s tempting to wait until the last minute to start auditing your cash flow and account receivables, it is recommended that you audit your cash flow and receivables every two weeks.

Auditing every two weeks will mean that you’ll be keeping track of fewer factors and, in return, have a higher likelihood of creating a detailed and accurate report. You won’t have to worry about risk as much as if you had put off the auditing until the last minute.

What are the types of cash flow?

There are three types of cash flow: operating cash flows, investing cash flows, and financing cash flows. All three of these cash flows should be included on your Statement of Cash Flows and be a part of your cash flow audit.

How do you improve cash flow?

There are several tactics that you can use to improve cash flow. Some of the simpler methods include paying your vendors more slowly or invoicing your customers more quickly. Depending on your business needs, you may need to take larger steps to enhance your working capital, such as factoring your invoices or increasing the prices of your products or services. Conducting a cash flow audit should help you better understand which solution is the best for your company.

Grey was previously the Director of Marketing for altLINE by The Southern Bank. With 10 years’ experience in digital marketing, content creation and small business operations, he helped businesses find the information they needed to make informed decisions about invoice factoring and A/R financing.