Last Updated September 18, 2024

If you’re new to running a business, you’ll also be a new possessor of a business credit score.

Your initial score as a first-time business owner won’t allow you to obtain all the funding you might want, but the saving grace is that you’re not alone. A common struggle of starting a new business is establishing good business credit. Because of this, company founders often ask themselves the same question: how do I improve my business credit score?

There isn’t some magic formula to establish good business credit as it will take time, organization, and attention to detail. However, know that if you do all the right things, you will see your number rise before you know it.

Understanding what affects your credit score and the steps you must take to obtain the score you want are the keys to unlock doors which will open your business up to funding opportunities. Let’s explore further.

What Is a Business Credit Score?

A business credit score is a measure of your company’s creditworthiness. The score is attached strictly to your business, not you personally — your personal credit score has nothing to do with your business score. In fact, you’ll notice that business credit is not scored like personal credit. Business scores range from 0 to 100, or 100 to 300, while personal scores usually range from 300 to 850.

What Is a Good Business Credit Score?

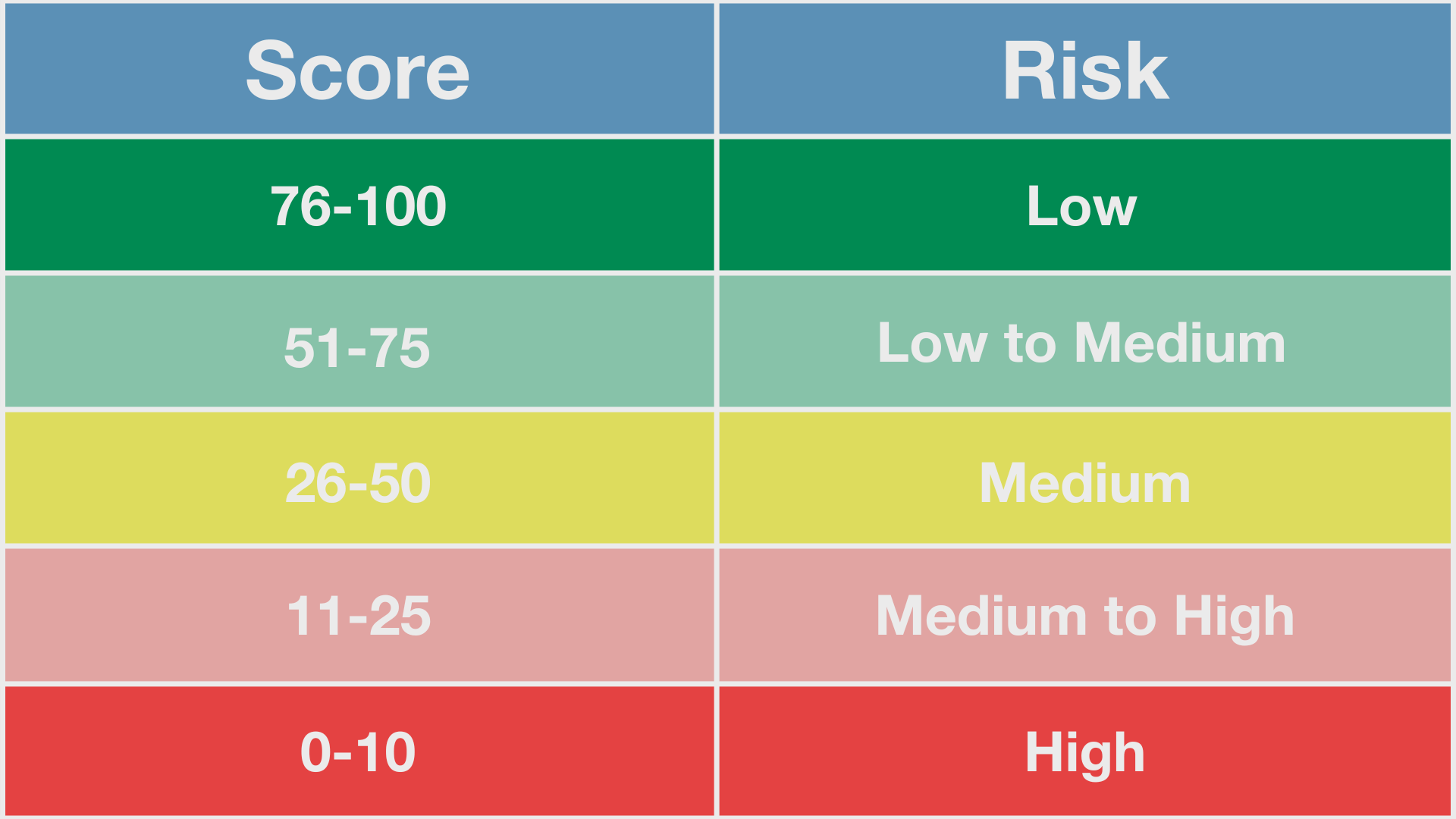

A good business credit score ranges from 76-100, according to Experian’s Intelliscore Plus Index. With a score in this range, lenders will deem your business “low risk.” If your score ranges from 51-75, you might still qualify for loans as a low to medium-risk borrower, albeit with higher rates.

Why Is Business Credit Important?

Business credit is most pertinent when it comes to applying for traditional bank loans. When applying, one of the first things a bank will ask for is your credit history, and they’ll require a good score. If you’re one of those businesses deemed a low-risk borrower, you’ll be offered better loans with better rates.

If you own a new business, you probably won’t meet the minimum credit threshold to qualify for a traditional loan due to limited business credit history. Therefore, you may have to use alternative financing or look into loans that are dedicated to those with poor credit. Rest assured that most others in your position are in the same boat.

If you’re an established business, however, business credit is quite important to manage because, while alternative lending options are flexible, they tend to come with higher financing fees. Eventually, most businesses that leverage alternative financing move away from it and look to traditional borrowing options that come with lower costs. If you want banks to lend a substantial sum of money, you’ll need proof that you can be relied upon to pay them back, which is where your business credit comes into play.

Plus, it’s not just financial institutions that will be interested in your credit. Potential investors, crowd funders, and business partners will have a vested interest in your business credit score as well.

Related: Can You Get a Small Business Loan with Bad Credit?

What Affects Your Business Credit?

To refrain from complicating matters, simply think of everything that affects your personal credit score. Paying bills on-time, payment history, credit usage, existing debt, and so on. Your business credit will be affected by the same factors.

Habits and aspects that will affect your business credit include:

- Credit usage

- Submitting bills and invoice payments on-time

- How often you do business

- Business size

- Years doing business

- Outstanding balances

- Any and all payment history

How to Improve Your Business Credit Score

Getting back to the all-important topic of improving your business credit, here is a step-by-step guide which, by the end of reading, you can implement and receive the comfort of knowing you’re doing everything in your power to achieve the highest score.

1. Ensure Credit Is Updated and Accurate with Commercial Credit Bureaus

As with everything in life, knowledge is power. Knowing your credit score is of utmost importance, and knowing how it reached that score would help you gauge what’s important to elevate your number.

Equifax, Experian, and Dun & Bradstreet are the three major commercial credit bureaus that generate business credit scores. A main area of focus should be that your score remains relatively consistent across the three bureaus, although slight variations are likely as each bureau receives slightly different information.

Check your files in these bureaus to ensure accuracy, and if you notice anything hindering your score, do your best to reconcile it immediately. If you notice what you believe to be an error, reach out to the respective bureau.

2. Add Trade References

One simple way to improve your credit score is by asking your trade partners to vouch for you to credit bureaus. You can ask your vendor or supplier to reach out directly, or you can list them as a reference, and the bureau will reach out to them.

3. Review Your Payment Process

Perhaps the strongest indicator of a company’s credit is whether or not they pay on-time. Credit bureaus appreciate reliability and timeliness more than anything else. Just as you expect your customers to meet your payment terms, you should make timely payments as well.

If you have an inefficient payment process that’s causing you to pay late, it’s time to streamline your process. Automating and simplifying wherever possible is crucial. For instance, look into accounting software, specifically automated invoice processing, if you haven’t already (one good option is Quickbooks, since they have a variety of packages and pricing options). If you’re a business owner juggling multiple tasks, lessening manual labor can give you the peace of mind in knowing that paying bills or invoices won’t be a time-consuming process.

Control the controllables – pay on-time. Doing so will elevate your score.

4. Obtain a Business Credit Card or Line of Credit

Applying for a credit card or line of credit is standard practice for most business owners. Doing so provides opportunities to prove to your bank that you’re a reliable borrower. The more you pay on-time, the more often you’ll see a credit score uptick.

However, if you’re applying for a business credit card, first make sure that the lending institution reports to one of those three main commercial bureaus. If not, your smart spending and repayment will go unnoticed.

5. Spend Wisely

Speaking of smart spending, if you’re looking to improve your business credit score, it’s always wise to err on the side of caution. A business credit card requires a responsible holder.

This might seem like a tough ask. After all, to grow your business, you have to invest in your business. But don’t invest without doing your due diligence. If you’ve been approved for a business credit card, spend responsibly. A practical way to use a credit card or line of credit is to start off by using it to pay simple, predictable charges, such as utility bills, that you know you’ll be able to repay on or before the due date.

6. Understand (and Decrease) Credit Utilization Ratio

Credit utilization ratios can be a forgotten or even unknown aspect of credit scores. If you don’t already know, your credit utilization ratio is essentially credit used vs. credit available. You should aim to use 15-30% of your credit limit or less per pay period.

The reason you want to decrease your credit utilization is because it tells your bank, and eventually credit bureaus, that you aren’t overly reliant on a credit card. If you do have to spend more than 15-30% of your limit, you can avoid high credit utilization by requesting a higher limit, opening a new line of credit to help you split the spending across multiple financing vehicles, or paying off your balance more than once per month.

Other Tips to Improve Your Business Credit Score

Remember that improving business credit takes time. Don’t get overzealous with establishing credit. Building credit requires you to prove to your lender that you can be trusted, but patience is key.

Don’t be afraid to use your resources and reach out to existing successful small business owners to discuss the topic of business credit. Ask for advice, do’s and don’ts, and even specific lending options available to you as someone lacking credit history.

And remember that simple aspects of doing business like paying invoices on-time will eventually make a difference. Have resources like an invoice due date calculator handy to hold yourself accountable and improve organization.

Utilizing Alternative Lending Options Such as Invoice Factoring to Improve Credit

Invoice factoring and A/R financing are two alternative financing methods you could be a great fit for if you have subpar business credit. Reason being, factoring companies don’t care so much about your credit but that of your customers.

This might sound strange, but if you take a minute to look at how invoice factoring works, you’ll understand why.

Factoring involves selling your unpaid customer invoices to a third-party factoring company (also known as a factor) in exchange for a cash advance. Since the factor owns your customers’ invoices and not your own, they’re relying on the debtor to pay on-time, so they get reimbursed for the cash they advanced to your business. Thus, the factor is far more interested in their payment habits than your own.

If you find that invoice factoring or A/R financing aren’t a good fit for your business, there are a few other options to explore, such as a merchant cash advance, working capital loan, crowdfunding, peer-to-peer lending, and business loans that are meant for people with little or bad credit.

Business Credit Score FAQs

Does personal credit affect business credit?

Personal credit and business credit scores aren’t correlated, so any changes to your business credit will not affect your personal credit, and vice versa. You should do your best to keep them separated so this remains the case, for instance avoiding using personal credit cards for business expenses.

However, keep in mind that if your personal credit is strikingly low, a bank might be more wary about offering financing than if you have strong personal credit, and investors might be put off as well.

Do I need a high business credit score to obtain funding?

Not necessarily, thanks to alternative financing. When it comes to traditional funding through large banks, you’ll find it difficult to qualify if you have limited or poor business credit, but you can explore other courses of action that can be equally beneficial. A couple good options for you include invoice factoring, A/R financing, and a business line of credit.

What is a good business credit score?

What is considered a good business credit score can vary based on the credit bureau. Experian, for example, has a 1-100 range with scores above 75 considered “good” and scores between 50 and 75 considered “fair”.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.