Last Updated August 28, 2024

Cash flow is something most small businesses struggle with. Around 80% of small businesses have a hard time producing enough cash flow in their first five years. Sometimes you have the customers, but expenses are due, and you don’t have time to wait for unpaid invoices.

Invoice discounting companies offer loans of up to 95% of the total invoice value so that businesses can get the cash within a few days instead of waiting weeks. After the clients pay, the small business pays the loan back.

Some companies use invoice factoring for revenue stability. However, invoice discounting is distinct because it’s more confidential. Your clients don’t need to know that you use invoice discounting to access their payments, whereas invoice factoring is transparent.

What Is the Invoice Discounting Process?

Sending out invoices is a standard procedure whenever a company completes a service or fulfills an order. Companies can send a copy of their invoice to a lender who can deposit an agreed amount of the payment to the business so they can cover expenses like rent, utilities, and salaries.

Small businesses that send out invoices immediately after the work is complete can benefit the most from invoice discounting, as they can receive consistent cash flow throughout the month. Otherwise, they would need to wait until the end of the month for a lump sum payment, which isn’t always a viable option.

Many invoice discounting companies will lend around 80 to 90% of the invoice value. After receiving the upfront loan, you conduct your normal collections process with your clients.

Lenders typically set very clear and transparent fees (usually 1% to 3%). However, things can vary for each situation. Therefore, small businesses should budget everything effectively.

Invoice Discounting Advantages and Disadvantages

Like any financing option, you should explore the pros and cons of invoice discounting before committing to the process. Below we overview some of the most impactful benefits and disadvantages.

| Pros of Invoice Discounting | Cons of Invoice Discounting |

|---|---|

| Confidentiality | Credit checks are necessary |

| Increased cash flow | Risk of becoming dependent on the invoice discounting company |

| No collateral is needed | Can be difficult to find a lender if you are a new business |

| Maintain control over the collection process | |

| Easily scalable |

Advantages of Invoice Discounting

Without a doubt, small businesses can grow much faster with invoice discounting. There are numerous benefits to this financing model, such as the following.

Confidential Invoice Discounting

Confidential invoice discounting is a favorable option for small businesses for several reasons. For starters, it allows companies to obtain capital on unpaid invoices without alerting customers and suppliers. If customers know that a business is receiving a loan from unpaid invoices, they may feel unwanted pressure to pay for their goods or services.

When small businesses go with a confidential invoice discounting lender, they don’t need to worry about troubling existing relationships with their clients.

More Cash Flow

Invoice discounting companies can provide you with cash much faster than your clients can. Whenever a small business struggles to pay bills on time, invoice discounting can stimulate their cash flow to cover expenses while waiting for clients to pay their invoices.

No Asset Collateral Needed

One of the most significant benefits of invoice discounting is that businesses need not offer any assets as collateral to the lender. Companies are only required to submit the client invoices to the lender. If a small business has a considerable invoice value, they can offer them to the lender and receive a large sum of cash seamlessly.

More Control

When you work with a discounting invoice lender, you still maintain control over how you collect your payments. The lender doesn’t contact your clients or control your internal collection structure whatsoever. As a result, you can maintain better relationships with your clients while still benefiting from invoice discounting.

Related: How to Collect Unpaid Invoices

Scalable Funding

Unlike a bank loan that provides companies with a fixed amount of funds, your invoice discounting funding potential can grow with your business. The more clients you get, the more cash you can receive from their unpaid invoices. As a result, it’s a convenient way for small businesses to grow faster.

Disadvantages of Invoice Discounting

While invoice discounting is an easy way for small businesses to get cash quicker, there are a few limitations and risks involved.

Credit Checks

Like other forms of borrowing, lenders will undergo a credit check to see if the company is a liable recipient. Lenders may request several documents to assess before deciding to approve a loan, such as:

- The company’s reputation for paying back previous loans

- Insights from partners about the companies operations

- Financial statements

- Any information in the media about the company

Undergoing a credit check and failing can put your company in hot water. Not only will it make it highly unlikely that you’ll receive a loan from the invoice discounting company, but it could also hinder your chances of getting future financing.

Becoming Dependent on Invoice Discounting

One of the reasons why invoice discounting is an excellent choice can also be a disadvantage; it makes it easier for small businesses to get consistent cash flow. When companies grow from invoice discounting, they may become dependent on the lending to keep growing at the same rate. Companies can easily get trapped in a debt cycle if they don’t budget carefully.

Heavy Restrictions

While invoice discounting can provide some small businesses with a decent amount of upfront cash, new companies may struggle to obtain appealing loans. Companies that process small transactions will have difficulty finding a reliable lender. Invoice discounting is typically only a viable solution for businesses that have a long transaction history.

Invoice Discounting vs. Invoice Factoring

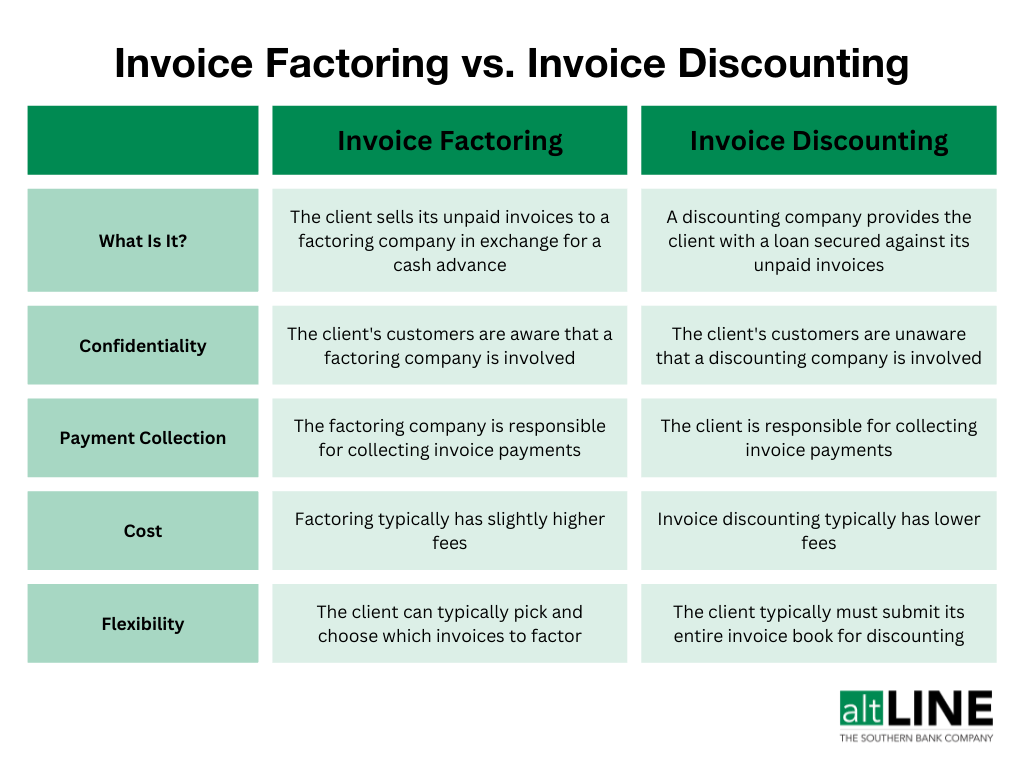

Invoice factoring and invoice discounting both allow companies to use their unpaid invoices as leverage. However, the two financing options differ in several aspects. In short, invoice discounting is a form of lending where invoice factoring is when a third party company purchases your invoice value.

For starters, invoice factoring companies act as creditors who chase up your clients for unpaid goods and services. As a result, the companies can interact directly with your customers and control your collection protocol. While this can be advantageous for companies with massive amounts of unpaid invoices, it can also hinder client relations.

Another advantage invoice factoring has over invoice discounting is that some companies offer non-recourse plans. With these financing options, the invoice factoring company doesn’t require the small business to pay back the loan if they can’t obtain client payments. However, these packages typically come with much higher fees to offset the risk.

Invoice discounting works similarly to a loan from the bank. The small business must pay back the loan regardless of whether they can collect payments from their clients.

How to Start Doing Invoice Discounting

First, you need to determine whether you want invoice discounting on all of your unpaid invoices. You can choose to receive a loan on your total invoice value or just a portion of it. However, more recent businesses or those not generating much revenue may not receive selective invoice discounting since lenders want to offset as much risk as possible.

Next, you need to search for an invoice discounting lender with favorable fees and regulations. This step is crucial, so make sure you do quality research to determine which lenders are the most reliable. After choosing a lender, the invoice discounting company will walk you through their specific process.

Take some time to ponder the above points and consider whether invoice discounting is the right step for your company.

Grey was previously the Director of Marketing for altLINE by The Southern Bank. With 10 years’ experience in digital marketing, content creation and small business operations, he helped businesses find the information they needed to make informed decisions about invoice factoring and A/R financing.