Invoice Factoring and Invoice Discounting: What’s the Difference?

Last Updated October 24, 2023

The rising popularity of invoice factoring as a no-fuss, no-muss funding source for businesses has spawned an entire industry of factoring companies offering a range of options to address the varying types, needs, and preferences of businesses. But factoring isn’t the only alternative financing solution you’ll come across – you’ll also see factoring companies offer what’s called “invoice discounting.”

But what’s the difference between invoice discounting vs. invoice factoring?

While they are both designed to achieve the same objective – making capital available for businesses quickly and easily – they differ in the way they achieve it. And the differences are significant enough to require breaking down the two financing options side-by-side, along with why one might be preferred over the other, so let’s get started.

What Is Invoice Factoring?

With small business invoice factoring, a business sells its unpaid invoices to a factoring company in exchange for an advance on those invoices. The amount of advance typically ranges from 80% to 90% of the face value of the invoice. The factoring company retains the balance in a temporary reserve account until the invoices are paid when it then remits it to the business minus a fee.

For example, Stan’s Fertilizer Company ships 10 tons of fertilizer to ACME Farms and then prepares an invoice for $5,000 payable in 30 days. Stan’s then sells the invoice to a factoring company which then advances $4,000 to Stan’s. The factoring company then sends its own invoice to ACME for payment.

After 25 days, ACME pays the $5,000 to the factoring company. The factoring company then transfers $800 to Stan’s bank account, withholding $200 to cover its fees. As a result of this factoring transaction, Stan’s received immediate access to funds owed by ACME to use in its business and it ultimately collected 96% of the original invoice.

Related: Invoice Factoring for Startups

Benefits of Invoice Factoring

Factoring provides many benefits to small business owners in particular, including:

- Immediate access to working capital

- Improved cash flow

- Easier and faster approval than traditional loans (approval is not contingent on your credit score)

- No impact on your credit score

- Will make it easier to qualify for a traditional bank loan in the future

What Is Invoice Discounting?

As with invoice factoring, invoice discounting is a straightforward transaction in which a factoring company provides a cash advance based on the face value of an invoice. The major difference is that the business receiving the cash advance retains the responsibility for collecting payment. It works this way:

Instead of sending a copy of the invoice to the factoring company, Stan’s sends the invoice directly to ACME Farms. When the invoice is prepared on Stan’s accounting program, it is shared with the factoring company, which then transfers the cash advance of 70% to 90% of the invoice face value. A trust account is established with the factoring company for receiving the payment from ACME Farms. When the payment is received in full, the factoring company transfers the remainder of the invoice value less the factoring fee.

Benefits of Invoice Discounting

The benefits of invoice discounting vs. invoice factoring are similar, including:

- Immediate access to working capital

- Improved cash flow

- Easier and faster approval than traditional loans

- No impact on your credit score

- Retain control of invoice collection

Invoice Discounting vs. Invoice Factoring

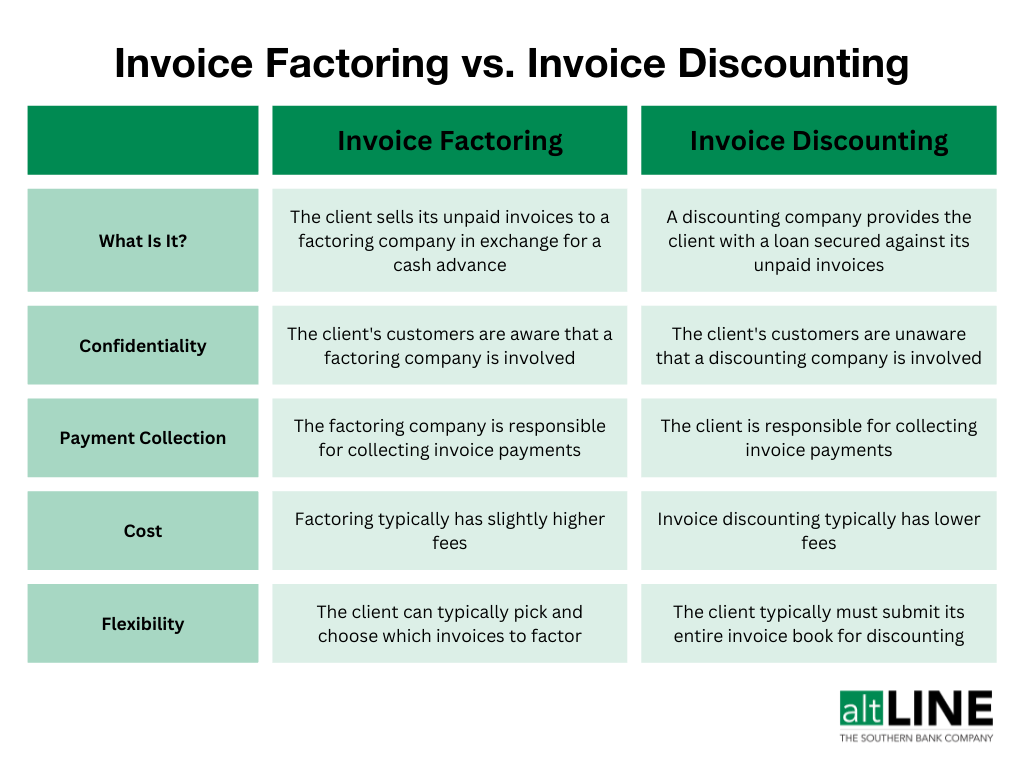

The big difference is who maintains responsibility for collecting payment. With invoice factoring, the factor is responsible for collection. With invoice discounting, the business is responsible for collection, so the customer is unaware a factoring company is involved (this is sometimes referred to as “confidential invoice discounting” or non-notification factoring).

If you ever hear of non-notification factoring, know that this is extremely similar to invoice discounting. “Non-notification” means your customer is not notified about any third-party involvement, whereas with factoring, customers are notified via a Notice of Assignment.

The other significant difference is the fees for invoice discounting are typically less than the fees for invoice factoring because the factoring company is not responsible for collecting the payment. Fees for invoice factoring tend to range from 1% to 5% while fees for invoice discounting can range from 1.5% to 2.5%.

One more major difference is the level of commitment required by the factoring company. With invoice factoring, a business can select which invoices it wants to sell to the factoring company. With invoice discounting, the factoring company typically requires that the business submit its entire invoice book.

Invoice Discounting vs. Invoice Factoring – Which Should You Choose?

- You might prefer factoring if you have a smaller business with limited resources for collecting invoice payments. Some businesses use factors specifically for that reason.

- Factoring might make sense if you don’t care whether your customers know you are using a factor. Some businesses use it as a selling point – i.e., more resources can be used to service the customer.

- Factoring would be the better option if you want more flexibility in choosing which invoices to factor.

- Discounting may be more preferable for companies that have the resources to perform their own collections. The fees are smaller so they can save on financing costs.

- Discounting is preferred by companies that would rather not let their customers know they are factoring their invoices.

We invite you to take advantage of altLINE’s 80 years of experience working with small- and medium-sized businesses to explore funding options for your business. Request a quote today.