Last Updated September 3, 2025

Mastering the art of accounting is one of the most frequent challenges small business owners struggle with tackling. One of the keys of overcoming the accounting hurdle is being able to define as many standard accounting terms as possible, two of which are “payor” and “payee.”

Often mentioned side-by-side, it’s not uncommon for first time business owners to misconstrue these terms. But doing so can cause confusion between the two parties involved in a transaction.

By the end of this article, you will be able to easily understand the difference between a payor and a payee, how to define each term, and see an example of a transaction involving a payor and payee.

Payor vs. Payee: Definitions

To clear up any confusion between these two accounting terms, below are the definitions for “payor” and “payee”:

Payor Definition

The payor (sometimes referred to as the “payer”) is the party in a financial transaction that is making payment, whether it be in exchange for goods or services, to settle a claim, or to satisfy another financial obligation.

Payee Definition

A payee is the party to whom money is to be paid—they are the one getting paid by the payor. For example, on a check, the payee is the party to whom the check is made payable.

What Is the Payor?

As defined above, the payor is the person or business sending payment to another party, typically in exchange for goods or services.

You might wonder, why is this question written as, “what is the payor,” rather than, “who is the payor?” The answer lies in the definition of payor. It is not always a person receiving payment; it can also be a party, whether that be a business, government entity, nonprofit organization, etc.

Think about paying your monthly water bill. Ultimately, it won’t be one person who is receiving and pocketing your payment, rather it’s your area’s water utility supplier. Therefore, when paying your utility bills, you are the payor, and your water supplier, which you are making the check payable to, is the payee.

Within any business or organization, there are two sides of accounting: accounts payable and accounts receivable. The accounts payable team is expected to handle payor-related responsibilities, while accounts receivable handles payee-related tasks.

What Is the Payee?

The payee is the party that receives payment, usually in exchange for a product or service but also to settle other financial obligations. The payee can be paid via credit card, cash, check, direct debit, wire transfer, and more. For example, each time a customer orders food at a restaurant, the restaurant is the payee when the customer (the payor) hands over the check.

One important note regarding payor vs. payee is that the payee is the only party that can tell the bank or financial institution to transfer funds into an account. The payor is not allowed to influence where or when cash is transferred or deposited.

There are many cases where the same entity can be both a payor and a payee, depending on the transaction. Take the government during tax season, for instance. When citizens are filing taxes, the government is collecting payment; in this case, the government is the payee. However, when it comes time for the government to issue rebates to citizens, the government is the payor, and the citizens are the payees.

Differences Between a Payor vs. Payee

The ideal transaction involves a payor and payee working in unison to benefit both of their respective businesses or entities. Now, you know how they are defined, so let’s recap how the two parties differ and what roles they play in a financial transaction:

| Payor | Payee |

| The person or party sending payment to another party, typically in exchange for goods or services. | The person or party being paid, typically in exchange for their goods or services. |

| The payor is the drawer of a check. | The payee is the recipient of a check, or who the check is made payable to. |

| The payor is not permitted to deposit a check to a bank or financial institution. | The payee can deposit a check; they can influence where or when cash is transferred or deposited. |

| The payor on an invoice is the person or party paying an invoice. | The payee on an invoice is the person or party sending the invoice. |

Example of a Payor vs. Payee

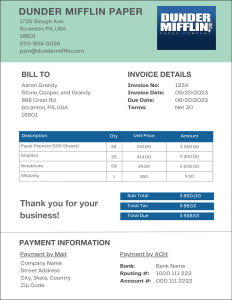

Take a look at the below example of a standard invoice for a visual illustration:

Based on the information provided on this invoice, Dunder Mifflin is the payee and Aaron Grandy is the payor.

In this example invoice, Dunder Mifflin is requesting payment from Aaron Grandy on Net 30 payment terms for the paper, staplers, and notebooks provided (plus shipping and tax). Thus, once payment is processed, Dunder Mifflin is the payee, and Aaron Grandy is the payor.

Related: How To Write An Invoice

Payor vs. Payer

Don’t get confused by payor and payer when you see the terms used interchangeably. Despite the minor spelling difference, both payor and payer mean the same thing. Like a payor, a payer is any party sending payment to another party in exchange for goods.

Payor vs. Payee FAQ

Here are some commonly asked questions surrounding payor vs. payee:

What is the meaning of payee?

Payee means the person who is receiving a sum of money, typically following B2B or B2C transactions. The person who sends the money is considered the “payor.”

Who is the payee of a check?

The payee of a check is the party the check is made out to or the person receiving payment. Regardless of if a financial transaction is made via check or another method, such as cash or credit card, the payee is the person receiving payment.

Is payee the person paying?

No, the party sending payment is the payor. The payee is the party receiving payment.

Is the payee the person receiving the money?

Yes, the payee is the person receiving the money.

What is the opposite of payee?

The opposite of payee is payor—also known as the party responsible for sending payment.

What does payee address mean?

Payee address is simply the address of the person or party to whom you are sending payment. Be sure you include the full address, remembering ZIP code, apartment number, and PO box, if necessary.

Is ‘payor’ or ‘payer’ correct?

Both payor and payer reference the same party in a transaction: the party making payment. Dictionaries and writing manuals vary in terms of preferred spellings, so just stick to one and remain consistent. You’ll see these words spelled differently but know that they mean the same thing.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.