How to Write an Invoice in 7 Steps

Last Updated July 19, 2024

While most people are likely familiar with what an invoice is, many have never been faced with the challenge of writing an invoice. Though invoices are relatively straightforward, at first glance they can look complex, leaving many wondering where to start.

Keep reading to gain a better understanding of invoices, including how to write an invoice for your business’s services or your individual contract work.

What Is an Invoice?

An invoice, by definition, is a business document that is given to the buyer from the seller in order to request payment for goods provided or services rendered. And in addition to acting as a request for payment, an invoice is essential to the small business accounting process. They provide a record of transaction for both the buyer and seller, helping businesses track payments, keep the books organized, and accurately report taxes.

What Does an Invoice Look Like?

When writing an invoice, you have a multitude of design and formatting options. For example, you could create a simple invoice that just includes the barebones details, or you could use a B2B invoice template that includes branding and finesse alongside all the necessary invoice elements. Thankfully, this means you don’t need to be a graphic designer to create an invoice.

Additionally, you can create an invoice using the help of a variety of software, including Excel, Word, Canva, and accounting platforms, each of which offer different design elements. Below are a few examples of what an invoice could look like:

What to Include in an Invoice

Invoices outline all the goods and services provided during a specific timeframe and include payment details, such as the total due, invoice due date, and payment terms.

While invoice formats can vary, there’s more of a standard practice for what’s to be included in an invoice.

Specifically, you will typically see the following items on an invoice:

- Your company’s details:

- Name

- Address

- Contact information

- The information of the business you are billing:

- Contact Name

- Company Name

- Company address

- The invoice details:

- Invoice number

- Invoice date (also known as the invoice issue date) and due date

- Invoice payment terms

- Itemized list of the services rendered or goods provided, including the quantity of each, unit price, total amount owed for each item, and a brief description if necessary

- The total amount due (including any tax)

- Payment methods (such as by mail, by ACH, by credit card, etc.)

How to Write an Invoice

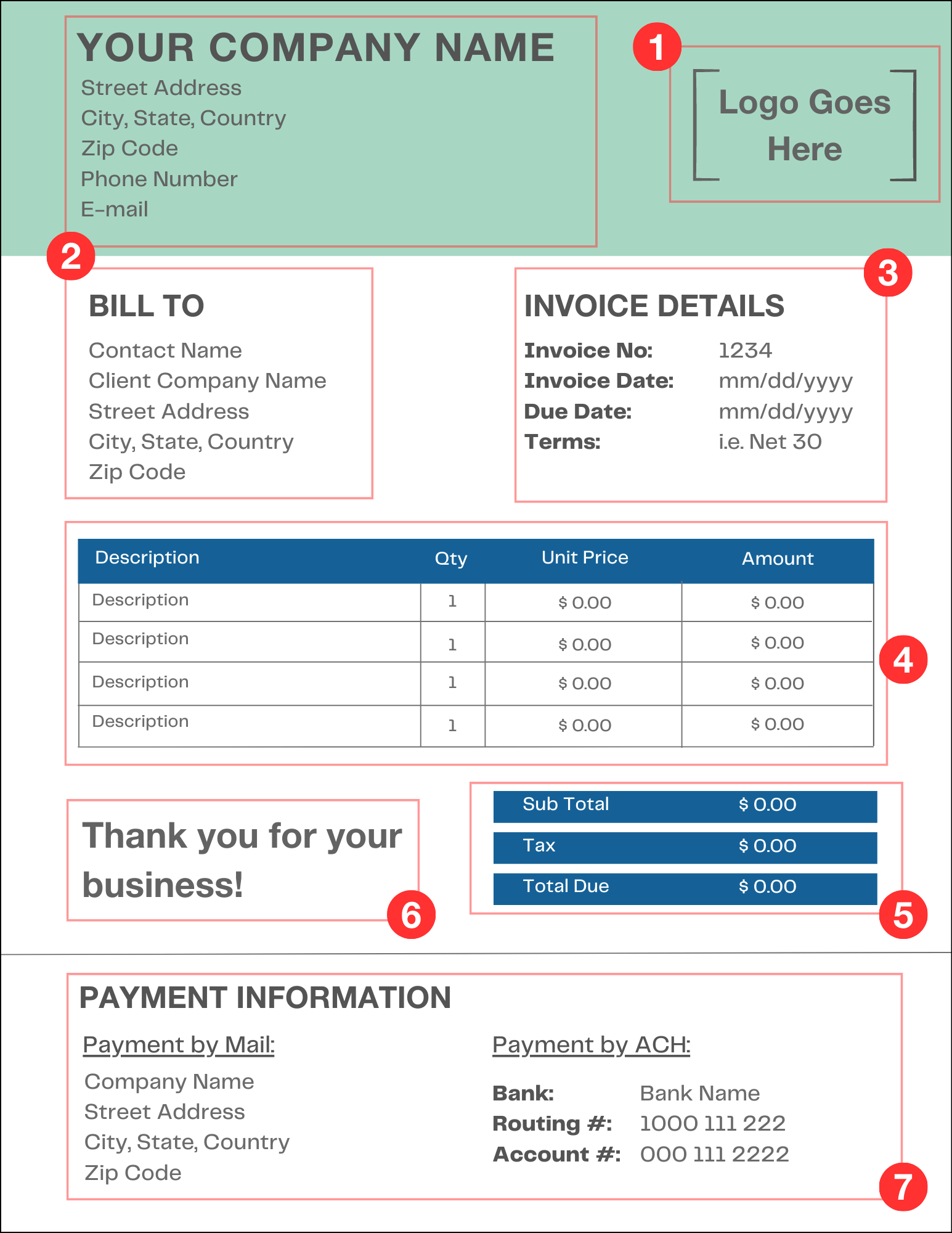

Let’s get into further detail on how to write an invoice, including elements you must include and tips to make it look more professional. Each step aligns with the numerical box shown in the invoice below.

1. Select a Professional Invoice Template and Add Your Branding

Creating a professional and branded invoice can be beneficial for your business. Not only does a clean design help you be taken more seriously as a new company, but adding branding elements such as your logo or company colors can help boost your brand awareness, creating a consistent image across all channels.

To create a professional design, we recommend using and customizing a small business invoice template. You can download a template online, add your logo to it, and adjust the colors and fonts to fit your branding.

2. Add Your Company Information

It’s important to include both your company information and your client’s company information on the invoice. Doing so can help your invoice look more professional, but what’s more is that it makes it very clear who the invoice came from and who is meant to receive it.

When writing an invoice, be sure to include the following company info:

- Your company’s name, address, and contact details

- Your contact’s name

- Your client’s company name and address

3. Include Invoice Details, Including Dates and Terms

Adding the invoice details is an essential step to creating any invoice. This section clearly defines when the amount owed is due, so you want to ensure the invoice details are prominently displayed on the document. Below are the details that should be included on any invoice:

- Invoice number: This is a unique reference number assigned to that particular invoice. Invoice numbers help both you and your client keep accurate records and easily reference different invoices over time.

- Invoice date: This is the date that you sent the invoice to your client.

- Invoice due date: This is when you expect your client to pay the invoice by.

- Invoice payment terms: These are the agreed upon terms that tell your client how long they have to pay the invoice. Some of the most common payment terms include Net 30 (meaning the invoice amount is due within 30 days of the invoice issue date), due upon receipt (meaning the client is expected to pay the invoice amount immediately after receiving the invoice), and Net 60 (meaning the invoice amount is due within 60 days of the issue date).

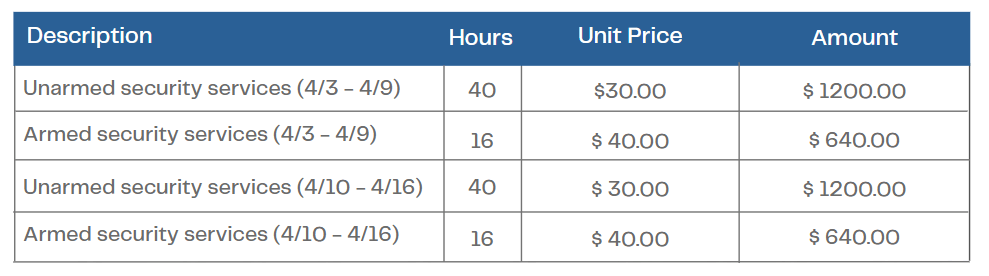

4. Add a Line Item for Each Charge

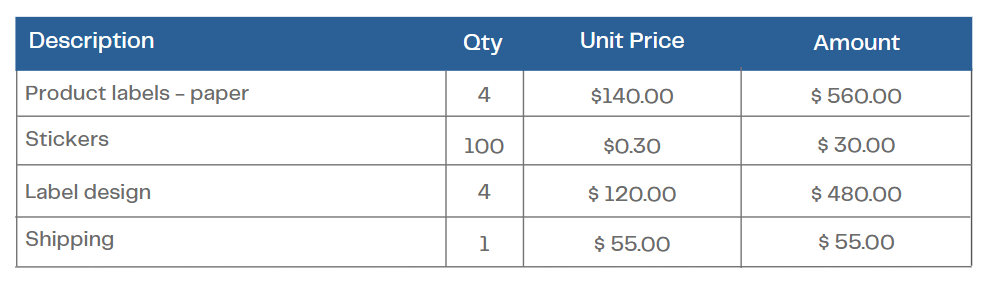

Standard invoices include an itemized list of all the charges that you expect your client to pay. Each line item should include a description of the services or goods provided, the quantity provided, the cost per unit, and the total amount charged for that item.

Below is an example of what this could look like for both products and services:

Example for services provided

Example for goods provided

5. Add Tax and Sum All Charges

Tax is not always necessary to include when writing an invoice. For example, most invoices for services rendered will not need tax included. However, if your invoice represents a bill of sale, you may need to add in sales tax.

To clearly show if you are charging your client sales tax, we recommend including a section for the subtotal, a section for the tax amount, and a section for the total amount due. This will help your customers understand what exactly they are being charged for and the breakdown of the costs.

However, the most important item to include in this section is the total amount due so that your client can clearly see how much they need to pay in total.

6. Add a Personal Note

While not a requirement when writing an invoice, adding a personal note can be a nice inclusion. Thanking your customer for their business is a great way to build a positive working relationship over time. You can also include additional notes, such as notifying your client of upcoming sales or inviting them to join your referral program.

7. Add Payment Options

Clearly defining the payment options directly on your invoices can make it very easy for your customers to make their payments, which can lead to getting your invoices paid faster.

There are many payment options for you to consider when creating an invoice, including offering payment by:

- Mail (for cash or check)

- Credit/debit card

- ACH transfer

- Wire transfer

- Online payment (such as PayPal)

- Auto pay

Offering multiple payment options is a good practice to adopt to make it easier for your customers to choose their preferred option. Additionally, providing electronic payment options is a great way to improve your cash flow as these are typically more convenient and can shorten the payment timeline.

In-Summary: How to Write an Invoice

Once you get the hang of writing an invoice, it will become second nature. All you need is a clean-looking template and all of the information required for the invoice and you’ll be set.

But the work isn’t done there. What’s equally important is knowing how to efficiently send an invoice because there are multiple ways to do so. How you’re accustomed to sending invoices, along with whether or not you’re utilizing the benefits of accounting software to assist, can actually play a role in dictating your cash flow.

How to Write an Invoice FAQs

What is an invoice number?

An invoice number is a unique record assigned to each invoice that you send and receive and can help with invoice tracking and management. Invoice numbers can be automatically generated using invoicing software, or you can manually assign invoice numbers. Either way, be sure to use a numbering system that is easy to maintain to avoid any unnecessary confusion.

What should an invoice look like?

Invoice designs and templates vary by business; there’s not one standard invoice design. As long as your invoice looks professional and includes all of the necessary details, such as payment terms and goods or services provided, it doesn’t matter how your invoice is formatted.

How do I invoice a company as an individual?

Invoicing a company as an individual is no different from a company invoicing another company. If you’re writing an invoice for individual contract work, you simply need to design a professional invoice that includes all of the necessary details, such as: payment terms, date of issue, due date, and services or goods provided. Make sure to include your contact information and the company’s contact information before sending the invoice.

What are common invoice payment terms?

Invoice payment terms define how long a customer has to pay the invoice amount. The most common invoice payment terms are Net 30, which means the customer has 30 days after the invoie issue date to pay the total amount due. Other common payment terms include Net 7, Net 10, and Net 60, and you will sometimes also see “due upon receipt,” which means your customer is expected to pay the total immediately upon receiving the invoice.

How do you send an invoice?

There are a few ways that you can send an invoice, including by mail, by email, and by invoicing software. E-invoicing options (i.e. through email and invoicing systems) are the most common these days since they can deliver an invoice to your client quickly, but some businesses still opt to deliver invoices through the mail.

Is an invoice the same as a receipt?

The short answer is no, they are not the same. Some of the key differences between invoices and receipts include:

- Their primary purposes: invoices are a request for payment, while receipts are a proof of payment

- When they are sent: invoices are sent prior to payment, while receipts are sent after

- Manadatory use: invoices are not required to be issued, while receipts are

Angela is the Director of Online Marketing at altLINE where she manages content production, marketing and sales operations, and digital PR. Angela joined altLINE in 2022 after several years of working in digital marketing across various industries including financial services and B2B. Angela loves creating content that helps readers better understand their financing options and helps them make informed decisions about factoring. Her work has been featured in publications like Search Engine Journal and Moz.