Last Updated April 26, 2023

Small Business Invoice Template

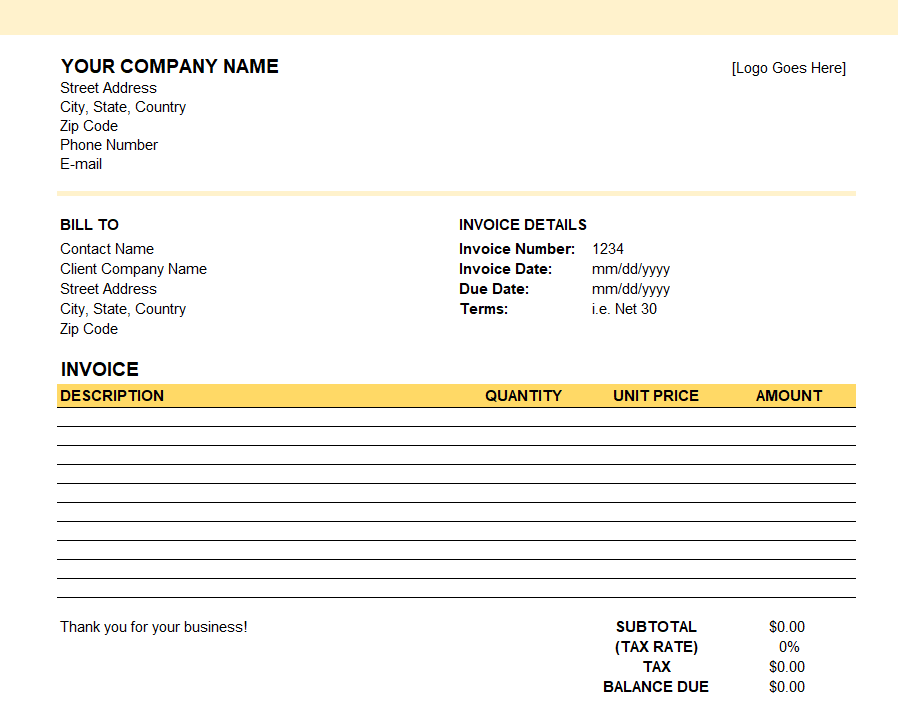

Using an invoice template for your small business billing can make it easier to stay on top of your business operations and ensure you send invoices in a timely manner. You can download our free small business invoice template for Excel or Google Sheets to start billing today. Simply download the invoice template, update the business and invoicing information (like payment terms), and add line items for each billable project. Now you can focus more on growing your small business and less on figuring out how to create an invoice for your products and services.

How to Make Invoices for a Small Business

Creating invoices for your small business is an important step to getting paid for your products and/or services. When creating a small business invoice, you will want to make sure you include the following pieces of information in the invoice:

- Your company information

- Your client’s company information

- Invoice number

- Invoice date

- Invoice due date

- Payment terms

- Description of each of the services/products provided

- Cost of each of the services/products provided

- The total amount due (including any tax that you charge)

If you’re not sure how to calculate the invoice due date, use altLINE’s free invoice due date calculator to quickly and easily see when an invoice is due by.

To create a professional invoice for your small business, follow the steps below:

- Download altLINE’s small business invoice template for Excel or Google Sheets

- Add your company details and logo

- Input your client’s company information in the Bill To section

- Assign the invoice a unique invoice number

- Fill in the invoice date (the date the invoice is sent to your client) and the invoice due date

- Include invoice payment terms to let your client know how long they have to pay

- Include a line item for each billable product or service

- Include a description of the product or service, how many were provided, the cost per unit, and the total cost for that item

- Include the tax rate, if applicable

- Once the tax rate and line items have been added, the subtotal, tax, and balance due will autofill

- Send the invoice to your client

It’s that easy! We recommend sending the invoice to your client as soon as possible to encourage quick payment and to help improve your cash flow. If you’re having cash flow issues due to long payment terms and slow paying clients, check out small business invoice factoring to get access to cash faster.

Angela is the Director of Online Marketing at altLINE where she manages content production, marketing and sales operations, and digital PR. Angela joined altLINE in 2022 after several years of working in digital marketing across various industries including financial services and B2B. Angela loves creating content that helps readers better understand their financing options and helps them make informed decisions about factoring. Her work has been featured in publications like Search Engine Journal and Moz.