Last Updated May 20, 2025

Cash flow is the lifeblood of any business. Business accounting is no picnic, but carefully managing your cash is the key to long-term success and profitability. Tracking various metrics will keep you on track, but days sales outstanding (DSO) is a particularly helpful performance indicator.

This financial metric calculates how long it takes to collect payment after a sale. It might sound like a simple calculation, but you can tell a lot about your overall liquidity and cash flow by tracking DSO.

Whether you run a large enterprise or a small business, monitoring days sales outstanding can help you run a tighter ship. Check out this guide to learn what DSO is, how to calculate DSO, and the average DSO for successful companies.

What Is Days Sales Outstanding (DSO)?

So, what is DSO in finance? Simply put, this metric tracks how many days it takes on average for customers to pay invoices. Combined with other financial metrics, this number will tell you how effective your accounts receivable (AR) process is—not to mention it will help you understand customer behavior and habits. DSO often ties into the company’s working capital management alongside other key performance indicators like stock days ratio.

The definition of DSO is straightforward: it reflects how quickly you convert credit sales into cash. The lower the DSO, the faster your company collects receivables. That indicates your collections process is efficient, and customers have good payment habits.

But the reverse is also true. A higher days sales outstanding ratio might mean you have inefficiencies in the business or slow-paying customers, which could hurt your cash flow and operational flexibility.

However, DSO in finance differs by industry and payment terms. If longer payment terms are standard in your industry, longer DSOs are just par for the course. What matters is tracking your days sales outstanding ratio, understanding what’s normal for your industry, and reducing the number as much as possible.

Why Is Calculating Days Sales Outstanding Important?

Calculating and tracking days sales outstanding provides a quick snapshot of company health. Understanding how to calculate DSO allows you to evaluate just how effective your company is at managing cash flow, collecting on accounts receivable, and communicating with clients.

Failing to calculate DSO could leave you unaware of potential issues in the business, such as slow-paying customers or ineffective accounts receivable processes. Either issue can spell catastrophe for your business, making it difficult to pay bills or invest in growing the business. Consistently analyzing the days sales outstanding ratio helps you identify areas where you may need to tighten credit terms, implement more rigorous collection strategies, or engage more closely with slow-paying customers.

Monitoring DSO metrics will help you assess the business’s financial stability. It also forecasts cash needs, helping you pay your debts on time while covering planned expenses. Instead of thinking of DSO computations as just numbers, look at them as a vital indicator of your overall business health—that’s how important they are.

How Do You Calculate DSO?

Some AR accounting software will calculate days sales outstanding for you. However, it’s still good to understand how to calculate DSO manually.

DSO Formula

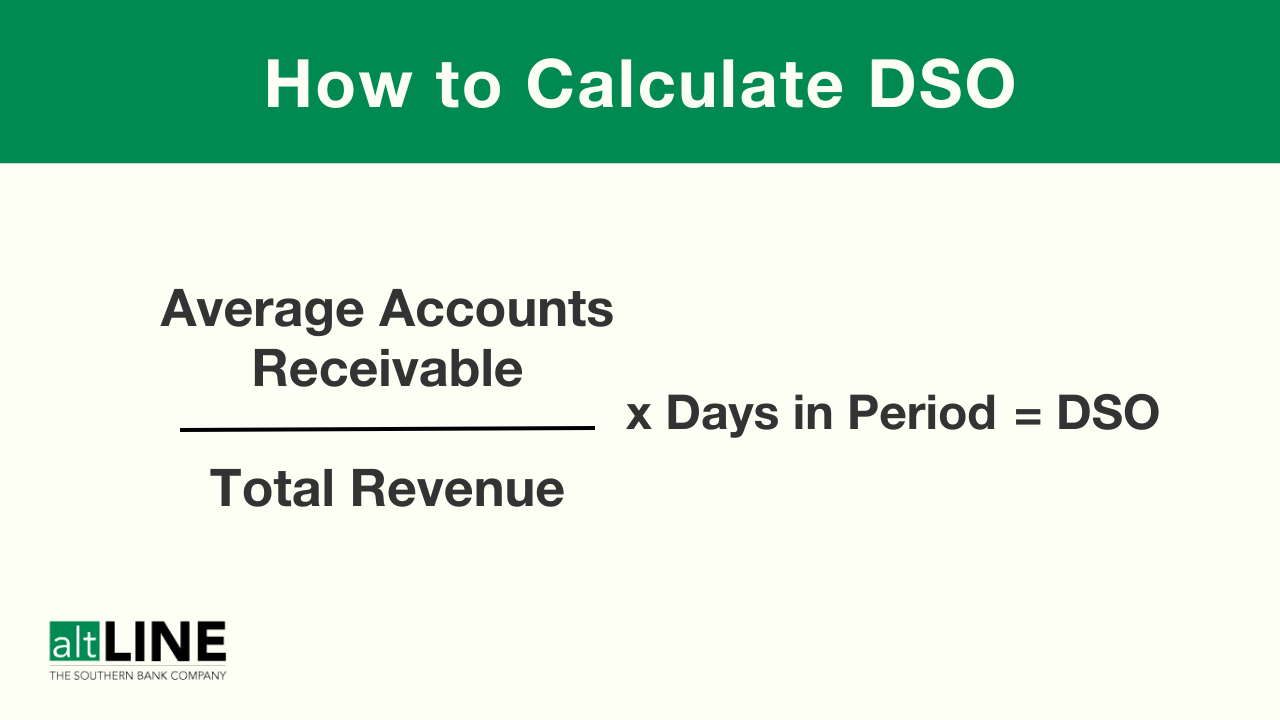

Here’s the formula for days sales outstanding:

(Accounts Receivable / Total Credit Sales) X Number of Days = DSO

- Accounts receivable: This is how much money the customer owes your company.

- Total credit sales: This is the total number of sales made on credit during the same period. It doesn’t include cash payments.

- Number of days: Look at a certain time period, whether it’s a month (30), a quarter (90), or a year (365).

DSO Calculation Example

For example, if your company has accounts receivable of $100,000, total credit sales of $500,000, and you’re measuring over 30 days, here’s the formula:

($100,000 / $500,000) X 30 = 6 days

This DSO calculation means it takes the company six days on average to collect payment.

What Factors Affect DSO?

Several factors affect your average days sales outstanding, including:

- Industry: Industry norms will have a tremendous impact on your average DSO. Some companies, especially those with business-to-business (B2B) models, have longer payment terms because of the nature of their work. For example, if you offer 30-day payment terms, you’ll see a longer average DSO than if you required payment on receipt.

- Credit and billing policies: Generous credit terms retain customers, but being too lax with these policies can increase your DSO ratio because of delayed payments. Inefficient invoicing can also delay payments, resulting in higher days sales in accounts receivable.

- Season: Is your business seasonal? High-volume sales periods can temporarily increase DSO if your accounts receivable team isn’t ready to process a lot of invoices at once.

- Accounts receivable (AR): DSO AR policies can shorten the time customers take to pay invoices. Regular follow-ups, incentives for early payments, and clear communication with customers help lower average DSO. Automated invoicing and payment systems also accelerate payment, as well as AR processes like aging schedules.

- Customer behavior: You don’t have much control over your customers, but their payment habits have a tremendous impact on your days sales outstanding calculation and overall profitability.

- Economy: Market downturns often lead to customer payment delays, which hurts your average DSO.

What Is a Good DSO?

It depends. A “good” days sales outstanding varies based on your business and industry. Generally speaking, the lower the DSO ratio, the better. Many companies aim for a DSO of 30 days or less, which means they collect payments within one month on average.

However, context matters. What qualifies as a “good” average DSO depends heavily on industry standards. For example, businesses with longer sales cycles, such as construction or manufacturing, may have higher DSOs due to extended payment terms.

It gets trickier if you routinely offer credit to your customers. This strategy is excellent for fostering close customer relationships but can hurt your liquidity if you aren’t careful. Frequently audit your accounts receivables to ensure credit terms aren’t hurting your business.

Benchmarking is key if you’re wondering what a good DSO for your business is. Look at industry averages, your competitors, and your historical DSO metrics to understand whether you’re on track or if something needs to change.

What Your Average DSO Indicates About Your Business

Days sales outstanding is a straightforward metric that tells you how well your business manages cash flow. A low DSO calculation suggests that your company collects payments from customers quickly, providing a steady inflow of cash. This can indicate strong customer relationships, efficient credit policies, and a well-managed accounts receivable team. With solid cash flow, you can reinvest in operations, pay down debts, and pursue growth opportunities more confidently.

Average DSO can also indicate:

- Cash flow issues: A high days sales outstanding ratio is an early warning sign that your business has issues collecting payments. The “why” requires more information, but monitoring DSO will quickly tell you when it’s time to review your accounting processes.

- Changes in customer behavior: Your average DSO can provide valuable insights into customer payment trends. An increasing DSO over time may indicate changing customer payment patterns, potential dissatisfaction, or economic factors affecting their ability to pay.

- Competitiveness: Benchmarking your days sales outstanding in accounts receivable against industry standards assesses whether your business performs better or worse than competitors. A significantly higher DSO formula than industry peers could be a sign that you need to overhaul AR or invoicing processes.

Limitations of DSO

DSO will quickly tell you to look more closely at your cash flow, but it isn’t perfect. Consider these DSO limitations before relying too heavily on this metric:

- Cash sales: DSO calculations only look at credit sales—they don’t consider cash transactions. This figure could skew your sales performance if you frequently deal in cash.

- Natural fluctuations: Every business has busy and slow seasons. During these changes, you’ll see natural changes with your days sales outstanding average, but it won’t reflect your true performance or long-term trends. Always look at DSO in the context of your historical performance to understand what is and isn’t normal.

- Interference: Some accounting teams will artificially lower their DSO ratio by offering temporary incentives for clients to pay early. While this might temporarily reduce DSO, it doesn’t always reflect long-term efficiency or normal customer behavior.

- Industry variation: Average DSO ratios differ across industries and businesses. It’s difficult to draw meaningful conclusions without context and fair comparisons. Different sectors have distinct payment terms, credit policies, and customer behaviors, which can make benchmarking less effective.

How to Improve (Lower) Your DSO

Although days sales outstanding isn’t a perfect metric, it’s a helpful rule of thumb for quickly assessing a business’s financial health. You can’t control all factors contributing to a lower DSO, but you can take action to minimize it as much as possible. Try these tips to lower your average days sales outstanding ratio.

1. Incentivize On-Time Payments and Enforce Late Fees

The faster customers pay, the lower your DSO will be. Incentives like discounts for early payments encourage customers to pay sooner, lowering the average DSO and improving cash flow.

On the flip side, late fees on invoices also penalize customers who frequently pay late. Ensure your contracts include a clause for charging late fees so customers understand what’s at stake when they fail to pay on time.

2. Automate Where Possible

Manual processes and errors can delay payments and increase your DSO. Use automated invoicing systems to streamline the billing process, reduce errors, and ensure customers receive their invoices as soon as they’re available. These solutions can also do the DSO computations for you, which saves even more time.

3. Train Your Accounts Receivable Team

Your accounts receivable team needs to understand how to fulfill their role effectively. Some clients will try to get out of paying on time, and it’s AR’s responsibility to hold these clients accountable. Train your AR team so they know collection policies and best practices.

Policy training matters, but training employees on proper client communication will also reap dividends. Regular reminders, emails, or calls to customers regarding outstanding payments can significantly reduce the DSO ratio by keeping your receivables top of mind.

4. Offer More Payment Options

The more hoops customers have to jump through to pay you, the longer it will take. To speed things up, provide multiple payment options, such as credit cards or online payment portals. There’s no need to write and mail a check, which saves everyone hassle and time.

5. Consider Factoring Invoices

It won’t necessarily improve your average DSO, but invoice factoring can bridge gaps in cash flow. In many cases, providers like altLINE provide same-day cash, helping you make ends meet without the stress of a loan. Best of all, the factoring company handles client payment for you, taking another task off your plate.

Other Helpful Accounts Receivables Metrics to Track

Days sales outstanding is a helpful metric, but it doesn’t tell the whole story. Monitor additional accounting performance indicators to better understand your business’s long-term profitability.

Cash Conversion Cycle (CCC)

Your cash conversion cycle (CCC) measures how long it takes to convert investment in inventory on the balance sheet into cash. In other words, the cash conversion cycle tells you how well your company converts costs into cash flow. This metric looks at the AR process as a whole, as well as sales and supplier payments. Tracking CCC alongside days sales outstanding gives you a better understanding of overall cash flow efficiency.

Accounts Receivable Turnover Ratio

Your AR turnover ratio measures how well you collect customer debt. You’ll see how often your team collects debts from a customer over a certain period, usually calculated by dividing net credit sales by average accounts receivable. A higher turnover ratio means faster collections and a lower DSO, while a lower turnover ratio may suggest inadequate collection processes or lax credit policies.

Average Collection Period (ACP)

Average collection period ratio (ACP) measures how many days it takes to collect payment from a customer. That may sound the same as days sales outstanding, but this concept is slightly different. ACP looks at average daily sales and accounts receivable. This metric helps businesses gauge the effectiveness of their receivables processes and determine whether they’re collecting debts quickly enough to maintain healthy cash flow. A lower average collection period indicates efficient payment collections, which are crucial for maintaining liquidity.

In-Summary: What Is DSO and How Is it Calculated?

Days sales outstanding is a helpful tool for measuring how many days it takes to collect payment from a customer on average. The shorter your DSO, the more effectively your business manages cash flow. Longer DSOs usually indicate issues with cash flow, AR practices, or customer behavior. However, every business and industry has different payment norms, so it’s best to analyze DSO in context. Know what your normal is and follow the tips in this guide to reduce your average DSO as much as possible. That’s the key to optimized cash flow and better long-term stability.

DSO FAQs

What does the acronym “DSO” stand for?

DSO stands for days sales outstanding. It’s a financial metric that tells business owners how many days it takes to collect payment on credit sales. DSO tells you how efficiently a company manages accounts receivable and cash flow.

What is DSO in accounting?

In accounting, DSO is the average time it takes to collect payment after a sale. It’s an accounts receivable task that assesses how effectively a company can turn invoices into cash on hand. Accountants monitor DSO to better understand liquidity and the effectiveness of company credit policies.

What is the difference between DSO and DPO?

Days sales outstanding measures how long it takes to convert invoices into cash. On the other hand, days payable outstanding (DPO) tracks how long it takes a business to pay its suppliers after buying something. DSO focuses on receivables while DPO deals with payables.

Should DSO be high or low?

DSO should be as low as possible. The average DSO is around 30 days. A high DSO, on the other hand, suggests ineffective collections, AR, or cash flow problems in the business. However, every industry has a different definition of a good DSO. Benchmarking is crucial for understanding whether your DSO is in a healthy range.

Is days sales outstanding the same as receivables turnover?

They sound similar, but they aren’t the same. DSO measures the average number of days it takes to collect payment after a sale while the receivables turnover ratio indicates how many times a company converts receivables into cash over a period. The receivables turnover ratio focuses on the frequency of collections while DSO shows you the average collection period.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.