Last Updated January 26, 2026

Staffing companies routinely deal with long invoice payment terms and slow-paying customers. This puts many staffing agencies in the precarious situation of potentially not having enough cash available to pay employees on time.

Fortunately, there’s a type of financing tailored for staffing agencies that struggle to make payroll on time: payroll funding.

Payroll funding for staffing companies allows agency owners to access cash more quickly and immediately improve cash flow. But if you’re new to the industry, you may be unfamiliar with how payroll funding works.

Read on to better understand what payroll funding for staffing companies is, how the process works, the pros and cons of payroll funding services, and if payroll funding is right for your business.

Key Takeaways

- Payroll funding is a type of invoice factoring in which a staffing firm sells its unpaid invoices at a discount in exchange for a cash advance.

- Payroll funding typically costs 1% – 5% of the invoice value, and the cash advance can typically be sent the same day.

- This type of alternative financing allows staffing agencies to access working capital more quickly than their customers are able to pay, bridging the cash flow gap between expenses and incoming payments.

- Staffing companies with slow-paying customers, less than 12 months of operating history, credit under 500, and cash flow issues can all qualify for payroll funding

What Is Payroll Funding?

Payroll funding, also known as payroll factoring, is a type of invoice factoring specific to staffing companies. We’ll overview in more detail how payroll funding for staffing firms works in a bit, but to summarize: payroll funding involves selling outstanding invoices to a third-party payroll funding company, in exchange for an immediate advance against the majority of each invoice value. The staffing company can then use the cash advance to pay operating expenses, including making payroll on time.

Financing payroll is available to all types of staffing companies, from temp staffing agencies to light industrial staffing firms. Even more niche employment companies, such as per diem nursing agencies and locum tenens companies, can benefit from payroll funding.

How Does Payroll Funding Work?

The first real step of payroll funding is to apply to work with a payroll funding company, such as altLINE.

If you’re approved, the payroll funding company will purchase your outstanding invoices and give you 80% – 90% of the cash value, typically within 24 hours. From there, the payroll funding provider will collect the outstanding invoice payments directly from your customer(s). Once collected, the provider releases the remaining 10% – 20% of the invoice value to your business, minus a small payroll funding fee (typically 1% – 5%).

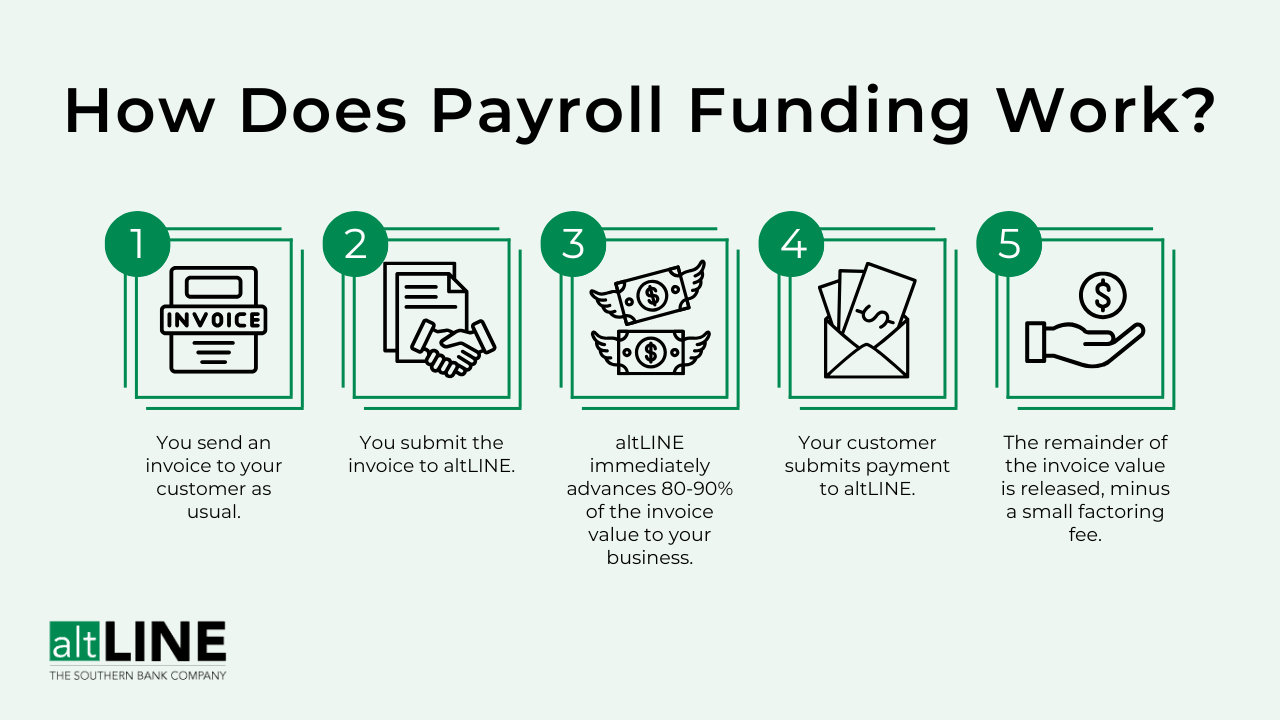

To recap, here are the five steps of the payroll factoring process:

- Invoice your customer

- You submit the outstanding invoice to your payroll funding provider

- The payroll funding provider advances between 80% – 90% of the invoice value to your business

- Your customer makes the payment directly to the payroll funding provider, which goes into a secure lockbox in your name

- The remaining 10% – 20% of the invoice value is released to your business, minus a small payroll funding fee

Need Cash Quickly?

Payroll Funding Rates & Fees

Payroll funding rates and fees can vary depending on your company; however, they are typically 1% – 5% of the invoice value. Several factors influence the rate you receive for payroll funding, including:

- Customer Creditworthiness: The more creditworthy your customers are, the more likely you are to receive a better rate.

- Debtor Concentration: You are more likely to receive a lower rate with a lower debtor concentration, meaning your outstanding accounts receivable are distributed across a higher number of customers.

- Amount You Plan to Factor: The more you plan to factor, the better your rate will typically be.

- Average Outstanding Invoice Age: The longer your invoices remain outstanding, the higher your payroll funding rate will be.

- Your Personal Credit: The better your personal credit, the better rate you will receive. However, many payroll factoring companies, including altLINE, will work with clients that have low personal credit scores, so this does not necessarily exclude you from qualification.

Payroll Funding Rate Structure

Most payroll funding companies use a tiered rate structure, in which a client is charged a base rate (sometimes called an “initial rate” or “discount rate”), and the rate is increased incrementally the longer an invoice remains outstanding.

For example, a client may have a base rate of 2.0% applicable to the first 30-days and an incremental rate of 0.5% that increases every 15 days after the initial 30 day period. In practice, this would mean that the client would pay a rate of 2.0% if the debtor pays the invoice within the first 30 days, and the rate would increase by 0.5% every 15 days after the initial 30 until the invoice is paid. The chart below outlines how the rate is impacted at different invoice ages.

| Invoice Age | Rate |

|---|---|

| 0 – 30 days | 2.0% (base rate) |

| 31 – 45 days | 2.5% (2.0% +0.5%) |

| 46 – 60 days | 3.0% (2.5% +0.5%) |

| 61 – 75 days | 3.5% (3.0% +0.5%) |

| 76 – 90 days | 4.0% (3.5% +0.5%) |

Pros and Cons of Payroll Funding

As with any type of financing, payroll funding comes with its own advantages and disadvantages. Keep reading to see each outlined below.

Payroll Funding Advantages

The primary benefit of payroll funding services is quick access to working capital, which allows staffing company owners to reliably meet payroll and invest in growth sustainably.

Payroll funding is also a highly accessible type of financing that has a more flexible approval process than traditional lending options, such as bank loans or lines of credit. Approval is largely based on a company’s receivables and customer creditworthiness, meaning a business can often qualify for payroll funding with a credit score of less than 500 or as a startup, situations that would typically limit access to traditional financing.

Below we’ve outlined the top benefits of payroll funding through altLINE:

- Quick access to cash for on time payroll

- Reduced reliance on slow-paying customers

- Easier qualification than traditional financing

- Allows staffing agencies to take on new contracts

- Accessible to startup staffing firms and those with poor credit history

- Scales with business growth

- Free debtor credit checks

- Invoice collection support

- A dedicated account manager

- No need to take on debt

- No collateral or equity injection required

Related: Business Development Tips for Staffing Agencies

Payroll Funding Disadvantages

As with any type of business financing, there are some reasons why payroll funding may not be the right fit for your company.

The biggest downside of financing payroll tends to be the cost. Payroll funding rates are typically 1% – 5% of the invoice value, which is usually more expensive than traditional financing; however, the accessibility of payroll funding may outweigh the cost.

Additionally, not all payroll funding providers are reliable. Because payroll funding is less regulated than bank financing, shady providers can be more prominent. It’s important to read reviews of the payroll funding company, review the contract in-full prior to signing, and ask all of your questions so that you fully understand the agreement. Working with a bank like altLINE can provide greater transparency in the payroll funding process, bringing a sense of security and confidence.

What Types of Companies Can Benefit From Payroll Funding?

Payroll funding services are tailored for staffing firms and can support agencies in a variety of industries and business stages, including:

- Temp staffing

- Startup staffing companies

- Light industrial and warehouse staffing

- IT staffing

- Nurse staffing

- Healthcare and medical staffing

- Locum tenens staffing

- Hospitality staffing

- Security guard staffing

- Staffing for janitorial and facilities maintenance services

- Event staffing

- Seasonal staffing

- Staffing for government contracts, such as VA, DoD, and FBOP contracts

- Clerical and administrative staffing

- Education staffing

- Transportation and logistics staffing

Is Payroll Funding Right for My Business?

While payroll funding can benefit all types of staffing agencies, some companies are a better fit than others. If you own a staffing company and struggle with slow-paying customers, long invoice payment terms (such as net 30 or longer), and other cash flow issues, payroll funding may be the perfect solution.

Here are some common reasons temp staffing agency owners choose to finance payroll as a tool to grow their business:

- A shortage of working capital makes it difficult to make payroll on time

- Cash flow problems are preventing potential business growth opportunities

- Long payment terms are making it tough to take on new business

- Slow-paying debtors are dictating cash flow

- Accounting responsibilities, specifically collections, are tedious and time-consuming, thus cutting into time that could otherwise be spent driving sales and winning new clients

If one or more of these scenarios sound familiar, payroll factoring could be the perfect fit.

What Will I Need to Get Started Factoring Payroll?

Every payroll funding company has its own unique process for approval, but to get started, most simply want to get a better understanding of your business, your customers, and your invoices. They’ll likely request the following for your payroll funding application:

- Proof of personal identification

- A tax ID number

- Accounts receivable aging report

- List of customers

Be prepared to provide information quickly to take full advantage of the fast turnaround time that payroll funding can offer.

Payroll Funding With altLINE

Here at altLINE, we offer top rated payroll funding and invoice factoring services. Not only do we have an A+ rating from the BBB and are highly recommended on Trustpilot, but our team also offers best-in-class customer service to make the payroll funding process as easy as possible for you and your company.

Additionally, altLINE is an extension of the Southern Bank Company, meaning we are a federally regulated bank, letting you rest assured that your financing partner is transparent and trustworthy.

To get started with your application, request a free quote today, or give us a call at +1 (205) 607-0811.

Payroll Funding FAQs

What does it mean to finance payroll?

When a company finances their payroll, it means they’re using funds received from a financing solution directly for paying employees. In fact, there’s a lending solution tailored specifically to address paying employees: payroll funding.

Payroll funding occurs when companies sell their outstanding receivables to a payroll funding company in exchange for an immediate advance against the receivables. Once you invoice your customer, that invoice then gets forwarded to the payroll funding company, who deposits 80% – 90% of the value of that invoice into your account. Then, once your customer submits payment to the payroll funding company, the remaining funds are unlocked.

Should I get a payroll loan or payroll funding?

Payroll loans and payroll funding are similar but service different business needs. Payroll loans are better options for businesses that need temporary support to make payroll, while payroll funding is a long-term payroll solution.

Payroll loans vary in structure depending on the type of loan you get, though short-term loans and MCAs are common choices due to their accessibility. Note that these often come with very high APRs and rigid repayment terms, so borrowers should be sure to read the fine print prior to moving forward with one of these options.

Payroll funding is a more common option for those that regularly need to bridge the cash flow gap between getting paid and making payroll. For example, staffing agencies often need to make payroll on a weekly basis while getting paid on net 30 terms. Payroll funding is designed with staffing agencies in mind, but other industries can benefit from this type of financing as well if they find themselves in need of working capital on a regular basis.

How do staffing companies cover payroll?

Staffing companies need a consistent stream of positive cash flow to afford being able to pay employees on time. This can be particularly challenging for new and small staffing companies, which is why many turn to payroll funding to ensure their workers get paid on time.

Where can I find small business payroll funding?

Payroll funding solutions are available online, including through altLINE. If you’d like to learn more about payroll funding and how it can help your small business fund weekly or bi-weekly payroll, give us a call at +1 (205) 607-0811 or fill out a form to get connected to a representative.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.