Last Updated December 17, 2025

Turn your unpaid invoices into working capital for your business

For many business owners – and owner-operators in particular – one of the biggest challenges is figuring out how to finance your business and improve cash flow. Quite often, trucking companies struggle to have clients pay invoices in a timely manner, which can lead to major financial difficulties in keeping up with their ongoing expenses.

This is where freight factoring – also known as invoice factoring – can offer a major advantage for trucking companies and others. The benefits of factoring freight invoices are undeniable and can go a long way in helping your business become more sustainable in the long run.

Key Takeaways

- Freight factoring boosts cash flow fast, giving trucking businesses 99% of the value of unpaid invoices within 1–2 days so they can cover expenses without waiting on client payments.

- Approval depends on client credit, not your credit score, making freight factoring accessible even for new or credit-challenged trucking businesses.

- Factoring is not a loan and does not require giving up equity, allowing trucking companies to get cash without debt, interest, or losing control of their business.

- Beyond cash, freight factoring reduces accounting work, provides client and broker credit insights, helps trucking businesses grow, and can improve chances of qualifying for future loans.

What Is Freight Factoring and How Does It Work?

So, how does freight factoring work? Freight factoring is a process in which you sell your unpaid invoices to a third-party factoring company. That company provides a cash advance that is typically worth 80-90% of the value of your unpaid invoice. However, freight factoring often advances more than typical invoice factoring – sometimes as much as 99% of the invoice’s value.

After the freight factoring company purchases your unpaid invoices, they assume the responsibility of obtaining the actual invoice payment from your clients. Once payment has been received, the freight factoring company will supply the remaining balance of your invoice, minus their fees (typically 1-5% of the invoice value).

Invoice factoring for carriers ultimately provides fast access to the cash that is needed to run their businesses while also outsourcing the responsibility of following up with clients on invoice payments.

Unsurprisingly, there are many advantages of freight broker factoring that make it an appealing solution for successful owner-operators.

Benefits of Freight Factoring

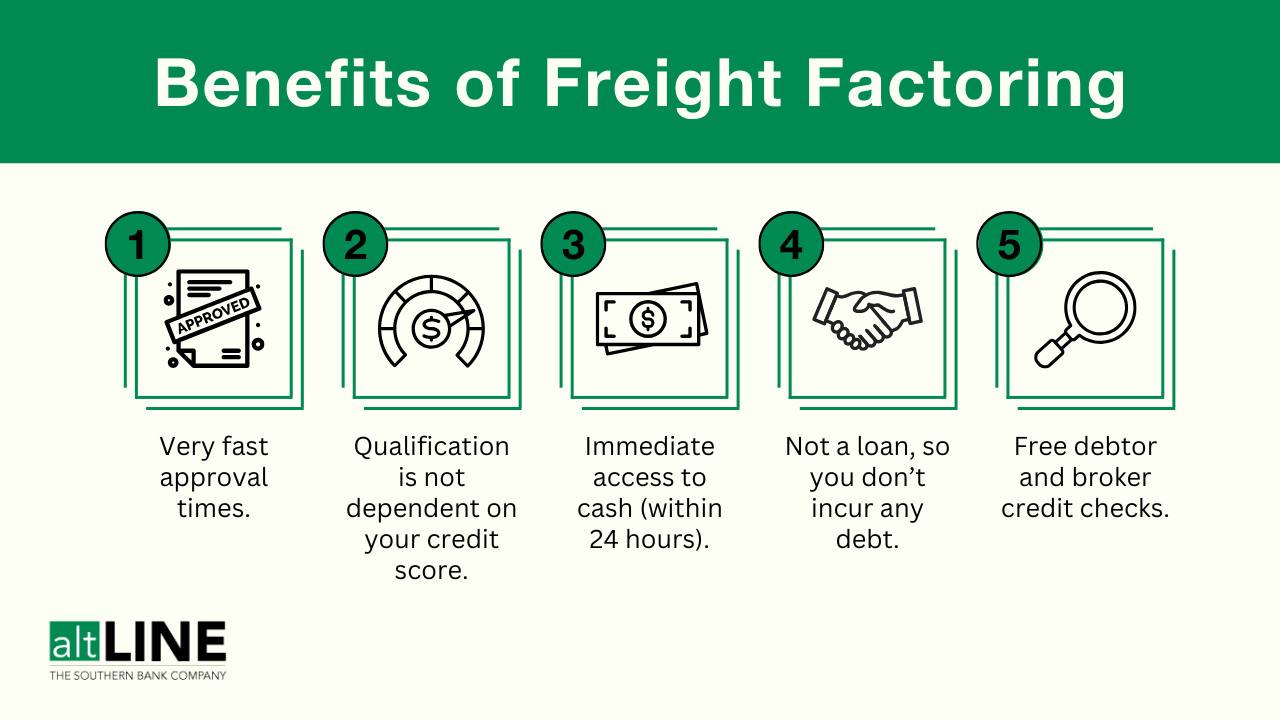

There are many freight factoring benefits that can have a direct impact on your trucking company’s operations and growth. The following are some of the top freight factoring advantages to be aware of as you consider your own financing needs.

Fast Approval

Getting approved for a traditional loan to fund your business activities can be very time consuming. Lenders will want to review your credit history, available collateral, and the financial status of your business before you can get approved for a loan.

With freight factoring, on the other hand, getting approved for a cash advance is much quicker. The factoring company simply verifies the creditworthiness of the clients whose invoices you wish to sell. Creditworthy customers are likely to pay back the invoice, and that’s generally all a factoring company needs to agree to provide the cash advance and purchase the invoice.

Qualification Isn’t Dependent on Your Credit Score

If you have bad credit or limited credit history (as is often the case when first starting a trucking company), you’ll have a very hard time qualifying for a loan to fund your business. A poor credit score could result in much higher interest rates that make it harder to repay your loan – or you might not qualify for a loan at all.

With freight factoring, your credit score doesn’t play any role in qualifying for a cash advance. It all comes down to the value of your invoice and the creditworthiness of your clients.

Faster Access to Cash Than Quick Pay

While quick pay also allows carriers to be paid faster than their standard invoice terms, brokers’ payment times and processing fees can vary significantly. And since brokers only offer quick pay for their own loads, this means your ability to quickly access cash will depend on the load and broker.

On the other hand, freight factoring provides the cash you need in just one to two days. Invoices can be factored from any customer or broker, so you can always get fast access to cash.

Related: Quick Pay vs. Freight Factoring

Improves Cash Flow

The most immediately obvious benefit of factoring invoices is that it can drastically improve your cash flow. By getting a cash advance on your invoices, you’ll immediately have access to funds that will allow you to take care of common owner-operator expenses like trucking insurance, fuel costs, truck payments, maintenance and repairs, business taxes, and more.

By maintaining a positive cash flow, you will have the money you need to keep your trucking business running smoothly, rather than trying to delay your own payments while waiting for an invoice to get filled.

Don’t Have to Give Up Equity

To obtain financing for their business, carriers are often forced to give up equity. This can occur by using the company’s assets as collateral to obtain a loan, or simply selling equity in the business to get needed funds. By selling ownership of your business to get needed cash, you also lose control over how you operate.

Since freight factoring is a cash advance, there’s no equity involved – you maintain full control of your business.

Allows You to Haul More Loads

With additional capital through freight factoring, you’ll have more cash available to grow your business. By enabling you to make investments like hiring additional drivers and upgrading your equipment – or simply covering the costs of hauling an extra load – you’ll be able to take on additional work and grow your business.

Interested in Factoring?

Turn your unpaid invoices into working capital so you can keep growing your trucking business.

Free Customer and Broker Credit Checks

As part of the freight factoring approval process, the factoring company checks the credit of the customer or broker whose invoice they are purchasing. A better understanding of business credit scores can help you determine which brokers are worth partnering with or which customers you can count on to follow through with payment responsibilities.

Factoring Is Not a Loan, So No Debt Is Incurred

Funding your business without taking out a loan is understandably a key priority for many trucking companies. While a loan can provide a lump sum of cash that will help you start or grow your business or cover immediate expenses, it is ultimately a type of debt. As a result, that loan might help a lot at the beginning, but in the long run, it represents a long-term financial obligation for your business.

Factoring, on the other hand, is not a loan. It is a cash advance tied to the value of your unpaid invoices. This means that you don’t have to repay the money you receive from the freight factoring company. They receive payment on the invoice from your clients. You won’t have to worry about racking up interest charges or ongoing monthly payments.

Reduces Accounting Responsibilities

Another reason trucking companies use freight factoring is to reduce their accounting and back-office responsibilities. You already have a lot on your plate with delivering shipments and finding loads. By selling unpaid invoices to a freight factoring company, they take over key accounting responsibilities like processing invoice payments and following up with clients to ensure payment.

This gives you more time to focus on other activities that will help you grow your business.

Increases Chances of Qualifying for a Traditional Bank Loan in the Future

New businesses often have a harder time qualifying for a traditional bank loan, which is why they use freight factoring in the first place. However, the ability to demonstrate a past successful partnership with a financial institution via factoring can help a business’s chances of qualifying for a more traditional trucking business loan in the future.

For those situations when a bank loan may be necessary, a prior history of factoring can be a point in your favor that makes it easier to qualify for the funds you need.

In-Summary: Why Carriers Choose Freight Factoring

While there are many financing options available to trucking business owners, the benefits of freight factoring make it impossible to ignore. Freight factoring is a straightforward process that provides a cash advance on your unpaid invoices with minimal fees removed from your total payment.

Freight factoring allows carriers to quickly obtain the cash they need, regardless of whether they are a new business or have bad credit. Cash can be provided in as little as one day, ensuring sufficient cash flow to carry out normal business operations or to invest in opportunities to grow the business. Most importantly, freight factoring isn’t a loan, so you don’t have to take on additional debt or give up equity to get the funds you need.

Freight factoring also reduces much of the administrative work of running a trucking business, since the factoring company will take responsibility for tracking down outstanding invoice payments.

In exchange for a small fee, freight factoring ultimately helps carriers streamline their operations and ensure they have the cash they need to keep their business running smoothly. It’s easy to see why so many choose this option!

Factor Your Freight Invoices with altLINE

If you’re interested in freight factoring to help fund your trucking business, altLINE can help! Apply today using our online form to get a free quote, or give us a call at (205) 590-9471. We offer cash advances of up to 99% of your invoice value with factoring rates as low as 0.50%. Fast approval with same-day funding is available, and there are no application fees.

Our representatives will be happy to help you determine if freight factoring is the right solution for your current business needs. Contact us today to get started.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.