Last Updated January 27, 2026

By offering early payment discounts, one of the biggest challenges for small and medium-sized business owners can be mitigated: slow-paying customers.

According to the 2025 Intuit QuickBooks Small Business Late Payments Report, 56% of U.S. small businesses are currently owed money from unpaid invoices, with outstanding balances averaging $17,500 per business. These delayed payments are especially impactful for smaller businesses operating on thinner margins, contributing to cash flow challenges that can limit a business’s ability to cover everyday operating expenses.

If you’re a new business owner, you may not be aware of common early payment discounts or understand the impact that offering vendor discounts for early or prompt payment can have on your business’s cash flow. Let’s explore further.

Key Takeaways

- Early payment discounts help small businesses reduce late invoice payments and improve cash flow by encouraging customers to pay faster.

- A 2025 report revealed that 56% of U.S. small businesses are owed unpaid invoices, averaging $17,500 per business.

- Common early payment discount terms like 1/10 net 30 and 2/10 net 30 offer buyers savings while giving sellers quicker access to working capital.

- Early payment discounts can be especially effective for businesses facing cash flow issues, high borrowing costs, or the need to fund short-term operating expenses.

What Is an Early Payment Discount?

An early payment discount is a form of dynamic discounting, which means a supplier includes discounted payment terms on an invoice in order to encourage prompt payment from a buyer. Early payment discounts are commonly used in the supply chain industry, but they can be utilized by businesses across any industry. They are trade credit terms, otherwise known as payment terms, that every business owner should be familiar with before entering into a business partnership.

The goal of offering early payment discounts is to accelerate the payment process. When a supplier is paid in arrears, early payment discounts allow them to get paid quicker, while also giving buyers a chance to receive a discount on their invoice. If an early payment discount is agreed upon between a buyer and a seller, then each invoice the buyer receives from the seller with this vendor discount is a chance for the buyer to save money.

Common Early Payment Discounts on an Invoice

Before exploring early payment discounts, it’s imperative to know the most common invoice payment terms, as this will ensure the formula for early payment discounts is simple to understand.

The most common invoice payment terms are net D terms, in which “D” is a variable for how many days a customer has to pay off an invoice. For example, payment terms net 15 and net 30 mean a buyer has 15 or 30 days, respectively, to pay the full value of an invoice.

Early payment discounts offered by vendors and suppliers are typically variations of these net D terms. Some of the standard early payment discounts include:

- 1/10 net 30

- 2/10 net 30

- 2/10 net 45

If these formulas look foreign to you, that’s OK; as confusing as they may look, they’re actually fairly simple to understand. Let’s break down the first discount listed, 1/10 net 30, piece by piece.

Net 30 = payment terms. This means the supplier and buyer have agreed on net 30 terms, meaning the buyer has 30 days to pay for the goods or services once the supplier has sent the invoice.

1 = the % discount.

10 = the length of the discount opportunity (in days). This means the buyer can receive a 1% discount if they submit the invoice payment within 10 days of receiving the invoice. For this reason, 1/10 can also be read as 1%/10.

So, all together, 1/10 net 30 means that the buyer will receive a 1% discount if the invoice is paid within 10 days. Otherwise, the buyer has 30 days to pay the full invoice value.

For 2/10 net 30, the buyer would receive a 2% discount if they paid within 10 days. Otherwise, the full payment is due within 30 days.

For 2/10 net 45, the buyer would receive a 2% discount if they paid within the first 10 days. If they do not pay within the first 10 days, then the full invoice payment is due within 45 days.

It’s important to note that these aren’t the only early payment discounts that exist. If business partners are working on net 60 or net 90 terms, for example, they could offer discounts such as 2/10 net 60 or 1/10 net 90. Any combination of early payment discounts and net D terms can be offered, depending on what works best for the seller and buyer.

Example of an Early Payment Discount

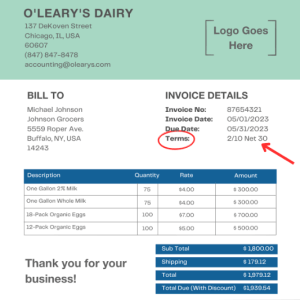

Below, you can see the early payment discount listed on the top right of the invoice.

In this scenario, O’Leary’s Dairy has sent Johnson Grocers an invoice requesting payment of $1979.12 for the listed products.

With the two parties working together on 2/10 net 30 terms, Johnson Grocers would save $39.58 on this particular invoice.

The average business handles up to 500 invoices per month, so while in isolation this discount might not seem very impactful for the buyer, the dollars saved from early payment discounts will eventually add up to a significant amount.

The seller would be impacted by losing 2% of each invoice’s value. However, many small business owners use early payment discounts like this because it leads to increased working capital and improved cash flow. Rather than having to wait 30 days to receive cash for these products, O’Leary’s Dairy only has to wait up to 10 days, as long as the customer takes the discount. Those extra 20 days can accelerate cash flow and enable small businesses to easily pay short-term expenses such as employee payroll, office equipment, and overhead costs.

When to Use Early Payment Discounts

A few different situations might call for utilizing specialized trade credit terms with your customers, such as an early payment discount.

You should consider providing an early payment discount if:

Slow-Paying Customers Are Affecting Cash Flow

It’s well documented that an inability to improve cash flow is one of the leading reasons small businesses fail. In fact, the 2025 QuickBooks Small Business Late Payments Report found that small businesses most affected by overdue invoices were more than 1.4x as likely to report cash flow problems compared to those with fewer late payments.

You Need a Boost to Reach Your Working Capital Goals

Even businesses with positive cash flow sometimes need a short-term boost in order to fund upcoming projects or undertakings. Maybe you’ve expanded your business and hired new employees. Therefore, you need quicker access to capital to continue to make payroll.

Working capital goals are always changing. If you think offering an early payment discount would help you reach your goals, don’t be afraid to approach your customers about potential deals.

It Is a Cheaper Option Than Your Borrowing Cost

A quick and easy way to determine if an early payment discount would save you money is to check the rates and fees for your existing lines of credit or alternative funding sources.

To do so, convert the potential discount to an APR (annual percentage rate). You can do so via the following formula:

APR = (discount rate / days paid early) x 365

If the number comes out lower than the rates and fees for any respective lines of credit or funding options you’re currently utilizing, you should strongly consider offering an early payment discount.

You Use Automated Accounting Software

One of the disadvantages of most forms of dynamic discounting is that it adds extra accounting work. If you don’t have automated accounting software, it could take quite a while to calculate the total for each invoice with a discount included.

However, accounting software can take most of this work off your plate. So, if you’re handling all of your accounting responsibilities manually, you may want to think twice about offering early payment discounts.

Advantages and Disadvantages of Providing Early Payment Discounts

Most business owners find that there are more advantages to providing early payment discounts than disadvantages, though some partnerships may benefit more from these dynamic discounts than others, depending on the various circumstances mentioned above.

| Advantages of an Early Payment Discount | Disadvantages of an Early Payment Discount |

| Provides customer an opportunity to save cash | Small markup can quickly add up for businesses with slim operating margins |

| Improves supplier-customer relationship | Customers may not pay within discount terms |

| Encourages customers to pay on time | Potential for extra accounting work for both parties |

| Can increase business cash flow for supplier | For expensive products or services, even a 1% can be a large sum of money, causing a noticeable decrease in the seller’s profit margin |

For business owners, financial decisions are not one-size-fits-all. Ultimately, financial decisions like deciding on payment terms should be made on a case-by-case basis, as each business is different from the next. If your business is running smoothly without implementing dynamic discounting, you might not need to consider offering early payment discounts. On the other hand, if your business is struggling while offering basic payment terms, it may be time to get innovative and explore other options.

In-Summary: Early Payment Discounts

Slow-paying customers remain a major challenge for small and medium-sized businesses, often putting unnecessary strain on cash flow. Early payment discounts offer a practical and flexible solution by incentivizing faster invoice payments without relying on additional financing. When used strategically, these discounts can improve working capital, strengthen customer relationships, and reduce the risk associated with overdue invoices. As with any payment strategy, business owners should evaluate their margins and cash flow needs to determine whether early payment discounts are the right fit.

Early Payment Discounts FAQs

Will offering an early payment discount benefit my cash flow?

In many cases, early payment discounts will indeed benefit a supplier’s cash flow. Since late payments are closely tied to cash flow stress, early payment discounts can be a powerful tool. The 2025 Intuit QuickBooks Small Business Late Payments Report found that businesses most impacted by overdue invoices were more than 40% more likely to report cash flow challenges, making faster payment strategies worth serious consideration.

Can offering discounted options improve customer retention and relationships?

Yes! Customers should appreciate having the option to save a bit of cash when purchasing products or services. While it’s important to discuss and clarify with your customer before an agreement is made, there’s a good chance that customer relationship will improve if you offer an early payment discount.

Are early payment discounts worth it?

In most cases, yes. When customers pay invoices early, it accelerates your cash flow and allows you to obtain working capital quicker than you would under standard trade credit terms.

If your business is in a period of negative cash flow, it can be very beneficial. However, if you feel comfortable with the current financial position of your business, offering early payment discounts may not be required.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.