Last Updated October 14, 2025

As home healthcare providers, it can be tough to juggle back-office operations alongside your medical services. And when delayed customer payments lead to a frustrating cycle of negative cash flow and mounting debt, it can become nearly impossible to keep cash flow positive.

This is where home healthcare factoring comes in.

A common alternative financing solution for home healthcare companies, factoring allows you to optimize your working capital so that you have the funds to cover expenses like payroll.

In this article, we discuss how invoice factoring for home healthcare companies works, its benefits, and how it compares to other financing alternatives. Read on to learn how this alternative financing solution can quickly improve your cash flow!

Key Takeaways

- Home healthcare factoring helps providers access fast cash by selling unpaid invoices, turning long payment cycles into quick funding within 1–2 days.

- Factoring gives home healthcare businesses steady cash flow to cover payroll, take on new patients, and pay operating expenses without giving up equity.

- Compared to loans or credit lines, invoice factoring offers flexible funding based on customer credit, making it easier for newer healthcare companies to qualify.

- With typical factoring fees ranging from 1–5%, this financing option provides a more predictable and affordable way to stabilize cash flow and grow sustainably.

What Is Home Healthcare Factoring?

Home healthcare factoring occurs when your business sells invoices to a third-party factoring company (a “factor”) in exchange for cash advances.

Invoice factoring has become a very popular form of alternative financing, particularly for businesses with poor or nonexistent credit, scaling businesses, and seasonal businesses. It is especially useful to deal with customer payment delays, reducing your chances of negative cash flow that can stall your business’s growth. Home healthcare factoring is also used to access working capital when you need it, rather than relying on customer payment timelines.

How Does Home Healthcare Factoring Work?

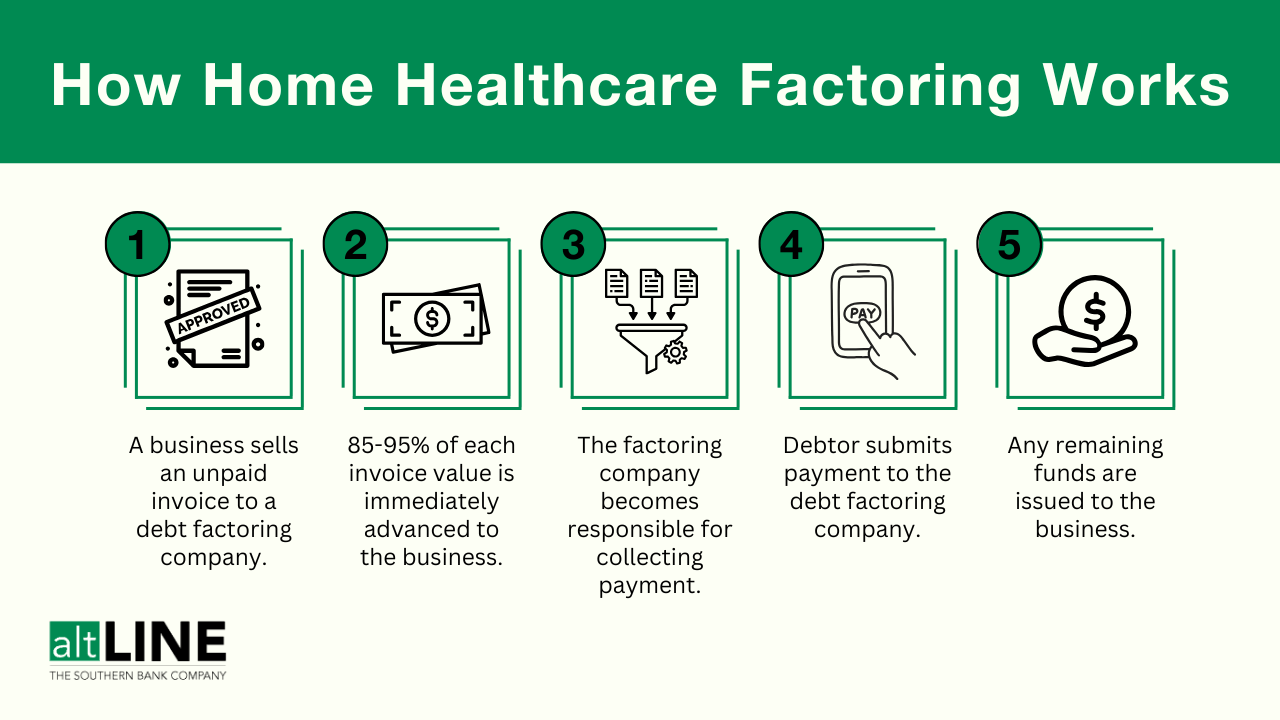

Essentially, any time you invoice your debtor, that invoice is sent to your factoring company as well and you receive a cash advance. Moving forward, the factor assumes collection responsibilities for the invoice. Then, once the debtor submits payment (to the factoring company), any remaining funds are released to your business.

Here’s a more detailed breakdown of the home health care factoring process:

1. Submit Your Unpaid Invoices

Most factoring companies accept all kinds of outstanding customer invoices for factoring, including anywhere from net 30 to net 90 terms, though invoices for debtors who are creditworthy customers and established companies are generally preferred. Additionally, customers who frequently dodge repayment.

If your invoice turnover time is between 30 and 90 days, your receivables are well-positioned for factoring.

2. Receive an 85-95% Advance of Each Invoice Face Value

You can generally expect a factoring advance rate of up to 85-95% of your invoice’s value and to receive the cash advance between 24 and 48 hours of submission to a factoring company. The exact timing of your deposit may vary depending on when the customer marks the job as completed.

3. Factoring Company Helps Collect Payment for Your Outstanding Invoices

A typical factoring company will assist your payment collections team by providing a secure lockbox for the money and report payment progress. The AR management responsibilities that factoring companies take off home healthcare company owners’ shoulders can allow you to instead devote more time to driving sales and directly growing your business.

4. Factoring Company Pays Out Any Remaining Invoice Value

After payment collection, a factoring fee is deducted (typically 1-5% of your invoice value) and any remaining funds are issued to your company.

Benefits Of Invoice Factoring for Home Healthcare Companies

Home healthcare factoring is a great way to accelerate delayed customer payments and unlock growth capital. Check out how invoice factoring can help you access cash when you need it:

Get Your Accounts Invoices Paid in Days, Not Months

The best home care factoring companies fund your invoices within 1 or 2 days. This means you can receive up to 90% of your earnings right away instead of in 30, 60, or even 90 days.

Access Capital to Grow Your Business While Maintaining Equity

Business owners often sacrifice equity to fuel growth opportunities, but invoice factoring can set them up for long-term success. Healthcare factoring provides the cash advance to fund business growth, pay expenses, and meet payroll without sacrificing equity or assets.

Get Cash When You Need It Most

Late customer payments and overdue invoices cause cash flow disruptions that can hurt your business. Accelerating payments through cash advances gives you the money needed to keep your business financially healthy.

Uses For Your Factoring Cash Advance

Receiving cash advances from home healthcare factoring means you do not have to wait on customer payments to fund your business. Instead, you can avoid long payment cycles and unlock growth capital sooner to accelerate business development.

Here are some ways you can use invoice factoring cash advances:

Make Payroll

Doctors, nurses, and aides are the heart of every home healthcare business, and you must pay them on time to maintain productivity and satisfaction. Unfortunately, delayed customer payments cause negative cash flow that jeopardizes your payroll obligations. Invoice factoring provides the cash necessary to pay staff salaries without waiting on invoices to clear.

Take On New Jobs

You should not be forced to wait for customer payments to clear to treat more patients and grow your business. Cash advances from home healthcare factoring pay for the tools and equipment you need to treat patients and accept new work while safeguarding your assets and equity.

Pay Operating Expenses

With negative cash flow, paying for insurance, transportation, and other home healthcare expenses is challenging. Invoice factoring gives you the cash you need to cover these obligations without waiting for customer payments or sacrificing equity.

Healthcare Businesses That Can Benefit From Factoring

Factoring services are available for various businesses in the healthcare sector. Here are just some of the businesses that can benefit from invoice factoring:

- Childbirth services

- Nutrition clinics

- Medical equipment suppliers

- Medical records management centers

- Physical therapy centers

- Diabetic care centers

Factoring Your Home Healthcare Invoices vs. Other Funding Options

In addition to home care factoring, you have a few other financing options to improve your cash flow. What are these options, and are they better than invoice factoring? Here is a comparison between home care factoring and alternative lending methods:

Home Healthcare Factoring vs. Bank Line of Credit

Many home healthcare businesses choose a bank line of credit as their first financing solution. While many companies can qualify for one, a bank line of credit may not supply enough funds to grow your business.

Banks typically approve your line of credit application by looking at your fixed assets. If you do not have many fixed assets because you are a new healthcare company, you may not get a high credit limit or have a harder time qualifying for a line of credit.

Home healthcare factoring is typically better for new healthcare companies because factoring companies look at your customers instead of fixed assets to provide funding. If you work with an established customer base, factoring companies will give you enough working capital when banks cannot.

Home Healthcare Factoring vs. ACH/MCA Loans

ACH (automated clearing house) and MCA (merchant cash advance) loans offer easy qualification through online bank statement reviews. Additionally, they provide quick funding with one or two days turnaround time.

However, their ease and speed are offset by high interest and lender fees that can cost 60% of your original loan. If you cannot repay these loans before they are due, you can land in serious financial trouble.

Home healthcare factoring is usually safer for your finances because customers will pay your invoice, thus repaying your cash advance. While invoice factoring is not debt-free, you are much more likely to repay a factoring cash advance, so you do not have to stress over debt repayments.

Home Healthcare Factoring vs. Quick Pay Discounts

You can offer discounted rates to customers who pay invoices early, accelerating your cash flow when needed. However, this method almost entirely depends on your customers’ needs.

If they prioritize having more cash on hand or good cash flow, they may skip your discount offer and pay when the invoice is due, leaving you low on cash and unable to grow your business.

Therefore, quick pay discounts should only be used when you’re sure that customers will take your offer.

Home healthcare factoring is generally more reliable because you will receive a cash advance as long as your invoices are approved.

Typical Factoring Rates and Fees

Invoice factoring rates depend on how much you plan to factor and how long customers take to pay. You will usually get lower rates by factoring more amounts and getting customers to pay faster.

We also consider additional criteria like your business tenure, customer base diversity, and overall customer credit quality.

Two types of factoring fees are charged:

- Initial fee: This fee covers our invoice processing expenses for a set initial duration (typically the first 30 days). Your initial fee generally costs 0.75-3.50% of your invoice’s total value.

- Incremental fees: These fees cover invoice processing expenses beyond the initial fee period Your incremental fees cost 0.25-1.50% of your total invoice face value.

Requirements to Apply for Home Health Care Factoring

You need to apply to be eligible for home healthcare factoring cash advances. Here are the documents most factoring companies require:

1. List Existing and Potential Customers

As part of your qualification process, your factoring company will likely need the addresses and contact information of all your existing and potential customers. A factor needs this list to review their credit quality and decide factoring eligibility.

2. Submit Your Factoring Application

Enclose these documents alongside your factoring application:

- Business ownership identification

- Personal identification

- Employer Identification Number

- Customer contracts

- Articles of incorporation and other relevant corporate documents

3. Accounts Receivable Aging Report

An accounts receivable aging schedule records all your invoices based on their due dates. This report helps factoring companies research customer payment behaviors and allows them to examine whether you are eligible for factoring.

Home Healthcare Factoring FAQs

Here are some typical questions about healthcare factoring answered:

Do factoring companies need to run a credit check before getting started?

Many factoring companies will run a credit check and background check for security purposes, however, there are no minimum credit thresholds for approval. Background checks are strictly reviewed for financial-related crimes or felonies. The debtor’s background is more important than your business’s, so their credit history will instead be prioritized.

Is home healthcare factoring a debt or loan?

Home healthcare factoring is neither debt nor a loan. Invoice factoring is the sale of your invoices to a third party. The money advanced against these invoices will be repaid by your customers.

Do you offer non-recourse home healthcare factoring?

altLINE does not offer home healthcare factoring. However, we do offer invoice factoring services for businesses in various other industries.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.