Last Updated January 27, 2026

As a first-time business owner or someone new to accounting, you’re going to come across a plethora of new terminology, such as “net 30.”

Since effectively managing your accounts payable (AP) and accounts receivable (AR) processes goes a long way toward achieving long-term success, you should prioritize learning how net 30 works since it’s one of the most common payment terms.

With this in mind, let’s explore the meaning behind net 30, how net 30 works, when net 30 starts, and the pros and cons of working on this payment cycle.

Key Takeaways

- Net 30 means a customer has 30 days from the invoice date to pay the full balance, making it one of the most common invoice payment terms for businesses.

- Net 30 terms can start from the invoice issue date, receipt date, shipment date, or delivery date, so clear agreements are essential to avoid late payments and fees.

- Net 30 can help build revenue pipelines, attract customers, and strengthen buyer-seller relationships, but it may strain cash flow for small businesses if invoices are paid late.

- Payment discounts like 1/10 net 30 or 2/10 net 30 incentivize buyers to pay early by offering a small discount, improving cash flow for sellers and providing savings for buyers.

- Slow-paying customers can disrupt business cash flow, jeopardize payroll, and delay payments to suppliers, so solutions like invoice factoring can help maintain financial stability.

What Does Net 30 Mean on an Invoice?

Net 30 payment terms on an invoice means the customer has 30 days to pay the full balance of the invoice from when the invoice was issued.

If you don’t already know, invoices contain the date of sale, goods or services purchased, payment terms and conditions, etc. The payment terms refer to the conditions under which a buyer has to pay-off the full value of the invoice.

Invoice Payment Terms Net 30 Example

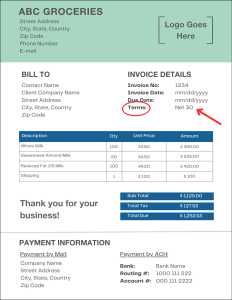

Take a look below at an example of an invoice with net 30 payment terms:

Payment terms (in this case, net 30) are located near the top of the invoice – although invoice layout varies by business – along with items such as the invoice number, invoice issue date, invoice due date, and description of both businesses. Knowing what items belong on an invoice and laying it out on a professional invoice template will ensure your business maintains a professional reputation to your customers.

When Do Net 30 Payment Terms Start?

Establishing clear terms before a contract is signed is one of the easiest ways to improve customer payment, as misunderstandings about specific term details could jeopardize the partnership.

One of those details that should be discussed prior to the transaction is when net 30 payment terms start. Conceivably, the first day could be any of the following:

- The date the invoice was issued to the buyer

- The date the invoice was received by the buyer (if invoicing by mail)

- The date the goods or services were shipped to the buyer

- The date the goods or services were received by the buyer

For example, say a small grocer forms a new partnership with a vendor on net 30 terms. The store receives its first shipment of products from the vendor on April 7 and is invoiced for the products on April 14.

The grocer’s accounts payable handler has a lot on their plate at the time, so they put off submitting payment until a few weeks later. They submit invoice payment on May 11, thinking that date is within net 30, but the contract states that net 30 terms begin once the product is delivered (April 7), not upon issue of the invoice (April 14). Thus, the invoice would be overdue, and the business owner may now owe late fees to the vendor.

A one-off overdue invoice might not seem like a huge deal in the grand scheme of business, but small businesses in particular can be heavily affected by unpaid invoices or late payments as it can halt cash flow and threaten the working relationship between the two parties. Plus, that late invoice usually isn’t just a one-off. Nearly 9 in 10 businesses are commonly paid late, according to a recent study.

Net 30 Payment Terms: Pros and Cons

Net 30 payment terms are one of the longer payment terms you’ll find (although longer terms do exist, such as net 60 and even net 90).

Therefore, net 30 won’t work best for certain types of businesses. For instance, if you’re running a startup or small business, you may find that net 7 or net 15 terms are necessary to maintain positive cash flow. However, if you’re on the receiving end of a product or service while operating on thin margins, these longer payment terms can be very beneficial as it provides extra time to come up with the cash.

Looking into the pros and cons of net 30 should give you a better idea of if net 30 makes sense for your business.

| Net 30: Pros | Net 30: Cons |

| Helps avoid bad debt – provides ample time for the buyer to pay | Can negatively impact cash flow for the seller, especially if payments aren’t made on time |

| Longer terms can improve the relationship between the seller and buyer | Prolonged payment cycles can cause short-term working capital issues |

| Offering longer terms can help attract new customers and retain existing customers | Customers unfamiliar with net payment terms can be confused on exact due date |

| Beneficial for building a revenue pipeline and streamlining operations | Takes longer to become debt free |

| Longer payment terms are ideal for purchasers with cash flow problems | May not be ideal for small businesses or startups acting as the seller, as the long payment cycle reduces already limited working capital |

What Are Other Common Invoice Payment Terms?

Net 30 is the payment term you’ll come across the most, but there are several other net payment terms you’ll often find businesses using.

Other net payment terms include:

- Net 7 Payment Terms: A buyer has 7 days to pay an invoice

- Net 15 Payment Terms: A buyer has 15 days to pay an invoice

- Net 60 Payment Terms: A buyer has 60 days to pay an invoice

Theoretically, any number could come after “net” as this is determined via an agreement between the buyer and the seller before the contract is signed. However, some of the most common payment terms include net 7, net 15, net 30, and net 60.

The length is typically decided by factors such as:

- Size of the job – how much labor goes into completing the sale?

- Cost of the job – how expensive is the sale?

- Size of the business selling the products or services (smaller businesses selling a product while operating on tight budgets likely require quicker payment terms).

- How long you and your customer have been working together

Net 30 Payment Terms with an Early Payment Discount

You may also come across net 30 terms alongside an early payment discount, which are more complex payment terms reading as something like, “1/10 net 30”.

To simplify, you can view this as, “1%/10 days, net 30 terms”. This means that if the invoice is paid within the first 10 days after it’s issued, a 1% discount is applied. Otherwise, the customer has 30 days to pay.

Payment terms with an early payment discount can vary. Other net 30 payment terms with an early payment discount can include:

| Early Payment Discount | Description |

| 1/5 Net 30 | 1% discount if paid within the first 5 days |

| 1/10 Net 30 | 1% discount if paid within the first 10 days |

| 2/10 Net 30 | 2% discount if paid within the first 10 days |

| 1/15 Net 30 | 1% discount if paid within the first 15 days |

You might be left wondering why a business might be willing to sacrifice 1-2% profit on each invoice. Well, considering recent data shows that more than half of invoices are paid late, it’s a way to encourage customers to submit payment on-time and prevent cash flow issues.

How Businesses Invoicing on Net 30 Can Be Impacted by Late Payments

If you’re a business owner regularly sending invoices, you should be aware of how payment terms, and the ability of the buyer to meet the terms, can impact your business’s finances.

While extending net 30 terms to buyers can improve B2B or B2C relationships, it creates some risk for the seller. If the buyer takes 30 days to pay, or even fails to abide by the terms, it can put the seller in a tough financial position.

Slow-paying customers can also limit a company’s ability to invest in technology and process improvements. Small businesses most affected by overdue invoices were significantly less likely to use accounting software (36% vs. 56%), according to a 2025 QuickBooks report, highlighting how delayed payments can stall modernization and efficiency.

Chas Justice, Business Development Manager at altLINE, noted that business owners working on net 30 are often forced to look into alternative financing solutions to combat slow-paying customers.

“Net 30 is one of the most common payment terms that our customers are working on with their buyers,” Justice said. “While the flexibility that comes with net 30 is often greatly appreciated by debtors, it’s important to have a plan in place in case you start to feel the negative ramifications of implementing these longer terms.”

Now, let’s take a look at how slow-paying customers who fail to meet net 30 terms can impact a business.

Cash Flow Struggles That Hinder Growth

When a business doesn’t receive payments on-time, growth goals can be hindered or entirely impossible due to cash flow problems, especially for small businesses or startups. Recent data shows that small businesses facing significant payment delays are more than 1.3 times more likely to report difficulty hiring skilled workers, illustrating how slow-paying customers can impact not just finances, but long-term growth and staffing stability.

Late invoice payments increase the risk of businesses falling into negative cash flow, which can ultimately jeopardize a small business’s chance of survival if that becomes sustained negative cash flow. This is why it’s so important to analyze which payment terms are right for your business.

Failure to Meet Payroll

Once your business begins dealing with cash flow struggles, the first domino has fallen, and other problems begin to arise. One of the most common problems is the potential to miss payroll.

If your business misses payroll on just one occasion, it can have irreversible effects regarding employee morale. Even if your crisis management skills are strong and you manage to get back on track relatively quickly, how can your employees still have faith going forward that they will be paid on time?

As a business owner, your people are your greatest asset. You don’t want late customer payments to be the reason they lose faith and jump ship.

Inability To Pay Suppliers On Time

Slow-paying customers not only negatively impact the seller’s cash flow, but they can also impact the seller’s other commercial relationships. If you don’t get paid on time, it could put you at risk of paying others late.

Your suppliers won’t like being paid late, just as you don’t like being paid late. Having to chase customers who don’t pay on time is never fun, and you should try to avoid becoming one of those customers that can’t be relied upon to settle invoices on time.

Related: How To Politely Ask For Customer Payment

Need Help Overcoming Long Payment Terms?

If you’re finding that slow-paying customers working on long payment terms are impacting your business growth, an invoice factoring company like altLINE can help. Factoring is the process of selling outstanding customer invoices in exchange for an immediate cash advance. This provides business owners a quick and easy way to improve cash flow and boost working capital.

If you’re looking to improve your cash flow, give altLINE a call at +1 (205) 607-0811 or fill out our free online factoring quote form. We have factored over $1B in invoices and take pride in helping our customers reach their business goals.

Net 30 FAQs

Does net 30 include weekends?

It can be assumed that when an invoice reads “net 30”, it means a customer has 30 calendar days to pay the full balance of their invoice, including weekends. However, it’s possible the seller and the buyer have agreed to not include weekends, highlighting the importance of ironing out these details during contract negotiations.

What are common payment terms for invoices?

The most common invoice payment terms include net 7, net 15, and net 30. Other commonly used terms include payment in advance – in which a customer pays in advance of project completion – or due upon receipt – in which a customer owes payment immediately once they receive the invoice.

How do I offer net 30 payment terms?

Net 30 payment terms appear on an invoice and notify customers that they have 30 days to pay the invoice balance, but there can be different ways to offer net 30:

- 30 calendar days (most common)

- 30 business days

- Net 30 End of Month (net 30 EOM)

Net 30 EOM means payment is due 30 days after the end of the month the invoice was issued or received. For example, if an invoice is issued on April 23, payment would be owed by May 31.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.