How to Send an Invoice

Last Updated June 13, 2024

Learning how to send an invoice may not be the most glamorous aspect of running a business. However, the efficiency of a business’ invoicing process can significantly alter cash flow and be a determining factor into whether important growth goals are met.

One survey showed that 49% of B2B invoices become overdue, while a separate study found that late customer invoice payments have prevented growth for 89% of businesses. This high frequency of slow-paying customers highlights the importance of knowing how to send an invoice in a way that gives you the best chance to get paid on time.

By reading further, you will learn how to send an invoice, the different ways to send an invoice, and how to best-ensure your customers pay invoices on-time to prevent your business from becoming a part of these damaging statistics.

What Information Belongs in an Invoice?

If you’re a first-time business owner, you may not know what you need to include in your invoice. Before thinking about invoicing someone, make sure you have the following information laid out in a document:

- At the header, note that it’s an invoice

- Add an invoice number

- Add the date it’s being issued

- Add your or your business’ name, address, and contact information

- Include your client’s name, address, and contact information

- Include the services provided

- Include when the services were provided

- Add the final amount owed, including taxes and fees

- Add invoice payment terms and conditions

- Note your desired invoice delivery method

Having an invoice due date calculator on hand can be beneficial to determine when your customer must pay by before the invoice is considered past due.

Now that you’ve gathered this information, you can start formatting your invoice in preparation to send to your customer.

How to Create Your Invoice

Professionalism is key, so spend the necessary time laying out your invoice in a manner that reflects the quality of your business.

Not every business owner has an eye keen for design, so using a small business invoice template as reference can help. Invoicing software such as Quickbooks also provides free design templates to download onto your computer.

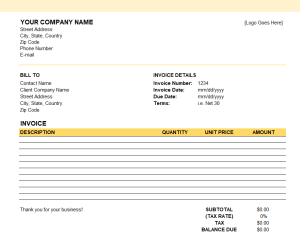

Below is an example of a professional invoice template for a small business:

Small Business Invoice Design Template

Ways to Send an Invoice

Now that you’ve created and formatted your invoice, it’s time to send it to your customer. There are three common methods to send an invoice:

- By email

- By mail

- Through invoicing software

Different methods work for different businesses; you may even realize that using a combination of the three is necessary, depending on your customer. Make sure you clarify how you intend on sending invoices to your customer and their invoice payment options in the early stages of a working relationship. While one client may prefer email, another may be more comfortable sending payment by mail or be used to using invoice software. As we’ll touch on later, offering multiple options is important.

Sending an Invoice by Email

Email is the most common way to send an invoice. Business owners who create an invoice in a Word document, spreadsheet, or design software can simply download it as a PDF and pass it along to their customer via email.

Remember to encrypt your email when sending confidential information like an invoice.

Sending an Invoice by Mail

While sending an invoice by mail may invoke a longer process than sending an invoice by email, it was once the main method to invoice a customer, and companies without email addresses and business owners who prefer physical transactions still send invoices by mail. However, there are some drawbacks such as unpredictable delivery time and potential address changes unbeknownst to the sender.

To send an invoice by mail, print your invoice, fold it into an envelope, include the postage, and deliver it to the mailbox.

Sending an Invoice Using Invoice Software

Invoice software like Quickbooks and PayPal have become increasingly common for small business owners who want to accelerate the payment process. Not only do businesses have access to design templates tailored to their brands, but most invoice software also allow customers to pay with the click of a button.

How to Send an Invoice

While sending an invoice can be achieved in various ways, it’s customary in this day and age to automate the process as much as you can. That means investing in some sort of invoice software (or general accounting software that offers an automated invoicing service) to streamline your efforts wherever possible.

Take the following steps to go about sending an invoice:

- Choose and install your invoice software.

- Enter your transaction info in the generated fields on the invoice template provided by the software.

- Send the invoice. Most software allow you to print the invoice, export the invoice, or send it directly from the software as needed.

- Follow up on the invoice as needed to ensure on-time payment.

The fourth step should be stressed here in particular. You shouldn’t approach sending an invoice with a set-it-and-forget-it mentality.

Once you’ve shipped off the invoice to your customer, you must remain on top of tracking payment status. While this doesn’t mean breathing down your customer’s neck, it does mean kindly reminding them once before payment is due that the due date is approaching, and being quick to reach out once the due date has passed if such situation occurs.

Use Invoice Software to Send Invoices

The best small business invoice software doesn’t just help with formatting and submitting an invoice. It also essentially works as an A/R management tool with features that allow users to track estimates, track billable hours, and monitor payments. Invoicing software is popular for small businesses regardless of industry.

Make sure to take the time to research which invoice software makes the most sense for your business. For example, some invoicing software offers unlimited invoices and payment methods while others do not. Large businesses may need an invoice platform that provides accounting features, while small businesses may have minimal accounting responsibilities and simply need an affordable invoicing solution.

Tips When Sending an Invoice to Help Prevent Late Payments

No business owner wants to spend their time chasing down late invoice payments. While slow-paying customers might be seen as an inevitable aspect of doing business, the following tips will help keep your customers on track.

Subject Lines Matter

It might seem elementary, but a subject line can be the difference between someone opening an email or passing it over when it comes through their inbox.

Always include your business name, the word “invoice,” and the invoice number in the subject line. In the early stages of your working relationship, ask your customer what their preferred time of day and subject line is for receiving an invoice.

It might feel awkward having to remind your customer of their due payment. Whether the due date is approaching or the invoice is already overdue, there are ways to politely remind your customer that they owe you a paid invoice.

Always Follow Up on Invoices You’ve Sent

If you’ve sent your customer an email requesting payment and haven’t heard back in several business days, send a follow-up email or set up automated payment reminders. You can even suggest in this email that the customer sets up automatic payment. Once you’ve done so, your customer has no excuse to fail to send payment promptly.

While not the most popular form of follow up, SMS text messages can be effective in reminding customers to pay their invoices. One study from Chaser even found that sending both SMS and email reminders can increase your chances of getting paid within a week of the invoice due date by 56%.

Use Invoicing or Billing Software

Invoice software takes responsibilities such as sending payment reminders off your plate and usually allows customers to pay with one click of a button. Customers appreciate a simplified process, and business owners appreciate the ease of an automated invoicing process.

Offer Multiple Payment Options

Have you ever gone to a restaurant just to find out they only accept cash, and you don’t have cash on hand? It can be an annoyance and can result in you not returning in the future.

Your clients can feel this same frustration when you only accept one invoice payment option. Don’t let a lack of payment options cause your customers to seek out a competitor. Be as flexible as possible, as long as you aren’t sacrificing too much time for that added flexibility. For example, if you have an international customer, research the ins and outs of international invoicing and allow them to pay in their currency of choice, if possible.

Some invoice payment options to consider offering include:

- Cash

- Check

- Wire transfer

- Credit card

- ACH transfer

- Automated bill pay

If after multiple emails you still haven’t heard from your customer and you’re stuck with figuring out how to collect unpaid invoices, it’s time to get them on the phone.

In-Summary: How to Send an Invoice

When done right, sending an invoice should be a quick and easy process. Yet while it can be a straightforward task, it’s a task worth devoting some thought into, because depending on how you send an invoice can impact how quickly your customer pays.

It’s crucial to automate the process of sending an invoice by investing in software, setting up automated payment reminders, and making online payment super simple for your customer. That way, there’s no excuse for them to not pay on time for the goods or services you worked hard to provide.

Dealing With Slow-Paying Customers? altLINE Can Help

If slow-paying customers are making it difficult to reach your financial goals, a factoring company like altLINE can help. We have factored over $1 billion in invoices for our clients and are always looking to help business owners by taking over time-consuming A/R management responsibilities. If you’re looking to improve your cash flow, give altLINE a call at +1 (205) 607-0811 or fill out our online factoring quote form.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.