Last Updated May 20, 2025

DSO, also known as days sales outstanding, is one of the most important financial metrics for managing your cash flow. As a measurement of how quickly you’re able to collect payment from clients after making a sale, DSO can provide helpful insight into the effectiveness of your accounts receivable process.

By implementing some key practices to reduce DSO, you’ll be able to improve your cash flow so you can better manage your business’s finances. Here’s how to improve DSO.

What Is DSO?

Days sales outstanding is a metric that describes the average number of days it takes for a company to collect payment on their invoices. This measurement accounts for all invoices for a specific period—those that have been paid, those that are current, and those that are overdue.

DSO can be influenced by the efficiency of a company’s invoicing processes, as well as factors like the quality of their products and services and whether they work with customers with poor credit. Each of these can either increase or decrease DSO, which in turn influences how much working capital is available to the company.

By measuring DSO, companies can have a better understanding of how their payment processes are influencing their cash flow.

How to Calculate DSO

To calculate DSO, use the following formula:

DSO = (Accounts Receivable / Total Credit Sales) x Number of Days

Make sure that the average accounts receivable and total value of credit sales are taken from the same period that you want to measure.

Why Reducing DSO Is Important

Figuring out how to reduce DSO is crucial for your company’s cash flow. In fact, an increase in DSO is an indicator that something is wrong with your business accounting processes or customer satisfaction—and this could eventually lead to significant cash flow problems.

Reducing your DSO essentially means that customers are providing payment on outstanding invoices in a faster time frame. This helps ensure that your business will have sufficient funds to cover its own expenses, such as payroll, rent, and utilities. Businesses that aren’t able to reduce their DSO to a more reasonable level could find themselves struggling to maintain an appropriate cash flow for their needs.

DSO’s Impact on Cash Flow

Reduce DSO, increase cash flow. It’s really that simple! The biggest benefit of reducing days sales outstanding is that it will lead to an immediate improvement in your cash flow. By receiving payments in a timely manner, you will have the cash you need to fund your own operations.

As such, finding ways to reduce DSO should be a top priority for any company experiencing cash flow issues.

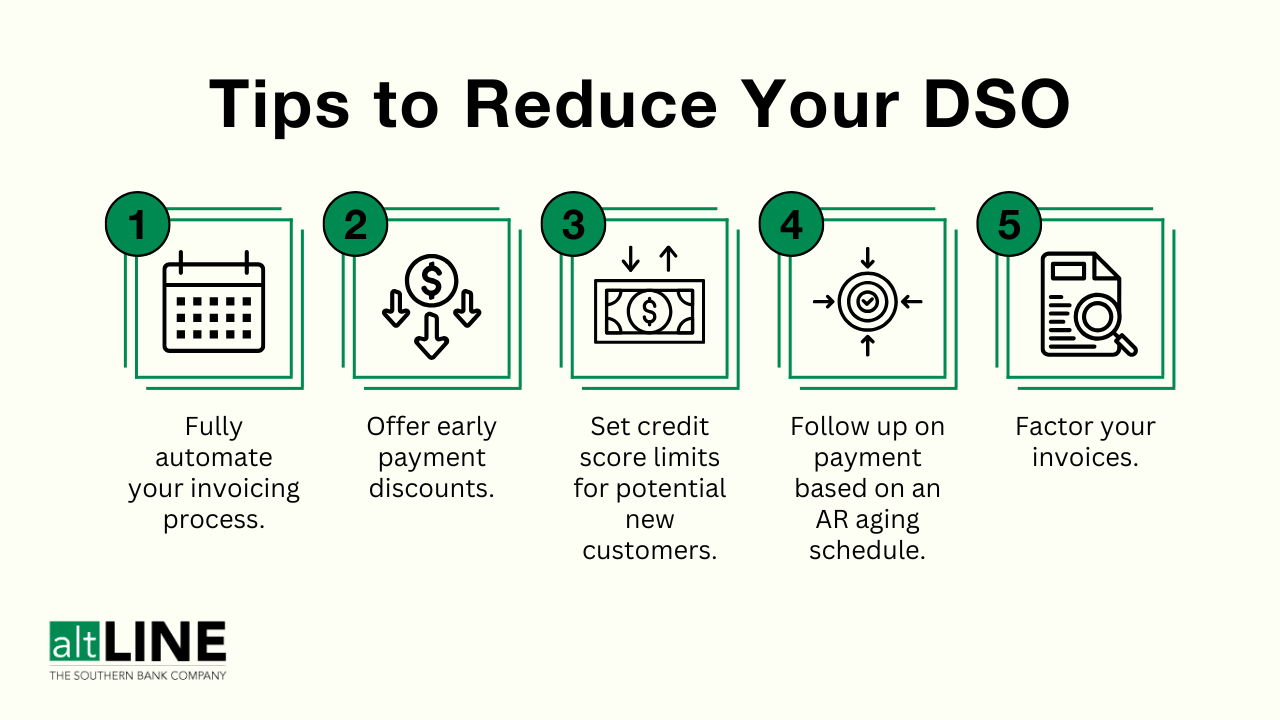

Tips to Reduce DSO

There are several strategies to reduce DSO. Consider using a mix of the following DSO improvement ideas for your own business.

1. Automate Your Invoicing Process

One simple way to reduce DSO is to use invoice automation. Invoice automation software pulls data from the business’s accounting system to match purchase orders and receipts with the appropriate invoice numbers. While the finalized invoice still needs to be manually approved, accounts receivable management software can significantly speed up invoice processing by eliminating much of the manual labor associated with preparing invoices. It can also help eliminate the risk of human error, which can lead to disputes and delayed payments as the two sides try to correct the issue.

Choosing quality accounting software to address this need will help your accounting team save valuable time while enabling accurate invoices to get sent out to clients that much sooner—which will naturally result in faster payments.

Related: Best Small Business Accounting Software

2. Adjust Your Payment Terms

Standard invoice payment terms (and DSO) can vary significantly by industry. Industries like retail tend to have shorter payment terms and lower DSOs, while fields such as manufacturing tend to have longer payment terms and higher DSOs.

Keeping the standards and expectations for your industry in mind, you could shorten the payment terms on your invoices to get more timely payments from your clients. Before doing this, however, you should notify your customers about the upcoming change so they won’t be caught off guard.

3. Offer an Early Payment Discount

An early payment discount can be a great way to motivate your clients to submit their payments in a timely manner. This is typically done by offering a 1-2% discount if the invoice is paid within 10 days of receipt. If the invoice is paid after this, the client will pay the full value of the invoice.

For many businesses, the tradeoff of losing a small percentage of the total value of the invoice is worth it because it improves their cash flow and increases their working capital. In addition, the discount can further improve relationships with existing customers and increase your retention rate.

4. Develop a Follow-Up System

The longer your payment terms, the easier it is for unpaid invoices to slip through the cracks. Because of this, businesses should develop an accounts receivable aging schedule that they use to plan follow-up communications with clients who have not yet paid their invoice.

Using email templates to send due date reminders and overdue notices will allow your team to complete this task in just a few minutes. Including a link to a preferred payment method in the email can also enable clients to take care of their payment upon receiving the email.

5. Set Credit Limits

Unpaid invoices are more likely to occur when you extend credit to clients with poor credit scores. Setting credit score limits for who you extend credit to (and how much you’re willing to extend) can help reduce your rate of unpaid or overdue invoices. Analyzing delinquent accounts can help you establish or adjust guidelines as needed.

6. Simplify Payment Solutions

Make payment as straightforward as possible for your clients so they can submit payment right away. The best way to do this is by offering multiple payment options, such as credit cards, bank transfers, checks, or digital transfers through platforms like PayPal. A secure self-service payment portal can also make it easier for clients to pay on time while also ensuring that payment is correctly and securely transferred to your own accounts.

7. Check Your Customer Satisfaction

Issues with your products or services could cause clients to delay payment until their issues are resolved. Be sure to analyze your customer satisfaction scores. If you notice a downward trend in satisfaction, dig deeper to identify and correct specific issues that are contributing to the problem. Taking corrective action won’t just ensure timelier payments—it will also make it easier to attract and retain clients when you fulfill your own promises.

8. Consider Invoice Factoring

Invoice factoring can also be an effective solution for improving your cash flow. Also known as accounts receivable factoring, this solution enables you to sell your unpaid invoices to a factoring company. The factoring company provides a cash advance that is typically worth between 80% and 90% of the full value of the invoice. The factoring company then takes responsibility for collecting payment from your clients.

After the invoice has been paid, the factoring company provides the remaining balance of the invoice minus a relatively small factoring fee.

The advantage of this process is that it provides businesses with fast access to cash while maintaining payment flexibility for clients. Approval is quicker than attempting to get a bank loan, and no collateral is required. Plus, approval for invoice factoring is dependent on the creditworthiness of the clients whose invoices you sell, not your own business’s credit score.

In-Summary: How to Reduce (Improve) Your DSO

DSO is an important metric for any business to measure, as your DSO has a direct influence on your working capital and cash flow. Taking steps to reduce DSO will ensure you have the money you need to keep your business running smoothly.

Taking steps to improve your accounting process—such as automating invoices, adjusting payment terms, offering early payment discounts and multiple payment options, and developing a follow-up system—can all encourage clients to pay in a timely manner. Invoice factoring may also help you get the cash you need in a timely manner.

How to Reduce DSO FAQs

What causes DSO to increase?

DSO measures how much time it takes for your business to collect the payment it is owed. A variety of issues could cause your DSO to increase. For example, poor customer satisfaction could cause customers to take longer to pay. An inefficient accounts receivable process (including invoicing errors) could also lead to payment delays. Offering lengthy payment terms or working with customers with poor credit could also increase your overall DSO.

What does a decrease in DSO mean?

When you reduce DSO, your business will be able to collect payment from its clients faster. This means better cash flow, as you’ll have the money you are owed sooner.

Is it better to have a lower or higher DSO?

A lower DSO is better for businesses, as this helps ensure a positive cash flow that you can use to cover your own business expenses. With a higher DSO, you may be left with insufficient funds as you wait for clients to pay their invoices.

What is considered a good DSO?

A “good” DSO varies by industry. Generally speaking, however, a DSO of 40-45 days or less is considered a good DSO. A DSO over 60 will likely contribute to cash flow problems.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.