Last Updated December 12, 2025

Before arranging a transaction with a buyer, your prospective customers will likely want to negotiate the critical terms of the arrangement, such as any potential discounts, delivery timelines, and price. When this stage of the negotiation is complete, it’s typically considered good practice for your business to send an initial draft of the invoice to your buyer that presents the agreed-upon terms. This document is called a pro forma invoice.

Read on to learn more about pro forma invoices, how they are used in business, and what makes them different from commercial invoices. You’ll also find an example of a pro forma invoice template.

Key Takeaways

- A pro forma invoice is an initial draft sent to buyers before delivering goods or services that shows quantities, prices, shipping, and terms without requesting payment.

- Pro forma invoices help buyers plan finances, obtain internal approvals, arrange credit, and support customs or trade documentation.

- Pro forma invoices are similar to commercial invoices in layout and details but are not legally binding, whereas commercial invoices finalize the sale and request payment.

- Both pro forma and commercial invoices include descriptions of goods or services, buyer and seller information, shipping details, and are often used in international trade.

What Is a Pro Forma Invoice?

A pro forma invoice can be defined as an initial bill of sale you send to buyers before delivering your goods or services. It usually includes the same details found in a standard invoice, such as the quantity and description of goods, prices, transportation charges, and terms of sale.

What does “pro forma” mean on an invoice?

The term “pro forma” means “as a matter of form,” or “for the sake of form,” which means the intent of this document is to provide information, rather than requesting payment.

Pro forma invoices give the buyer an idea of what their final invoice will look like so that they get the most accurate sense of the transaction terms, can better-arrange their finances, and can match items against their purchase orders. A pro forma invoice is also often used in international trade agreements to help the customs process or when your goods are pre-sold before production or shipment.

The name pro forma invoice shouldn’t confuse you with other types of invoices that are intended to request payment for goods or services. Instead, sending a pro forma invoice is your commitment as the seller to supply your services or goods at specified prices and terms. Once those services or goods are delivered, you would send the standard invoice.

What Is a Pro Forma Invoice Used for?

A pro forma invoice is typically sent to customers after they’ve committed to a purchase, but when details still need to be confirmed in writing. Once your customer receives and approves of the invoice, you can then deliver the services or goods and send a basic invoice.

Pro forma invoices enable clients to see how much your services or goods cost before deciding to finalize their purchases. There are many reasons why a pro forma invoice can be beneficial:

Quotation or Estimate. A pro forma invoice provides a detailed estimate to your buyers, including a description of goods, quantities, prices, and costs related to insurance and shipment. It helps give your buyer a better understanding of the costs they can expect.

Customs Documentation. In international trade, they are used by customs authorities to ascertain the value of goods when they’re assessing taxes and duties.

Documentation For Obtaining Licenses or Permits. Some goods require special licenses or permits to import or export. You can present a pro forma invoice to relevant authorities to obtain the necessary documents.

Pre-sales Approval. In some cases, your buyer may require internal approval in their organization before they can make a purchase. A pro forma invoice allows them to present the potential purchase for approval.

Arranging Credit. Pro forma invoices can be presented to banks or other financial institutions to arrange a letter of credit or other forms of trade financing.

What to Include on a Pro Forma Invoice

Your main purpose in sending your customer a pro forma invoice is to show them the details of the proposed purchase. As a result, it will likely include much of the same information as a standard invoice, including:

- Invoice number

- Contact details, including your company name and address

- The customer’s name and address

- Date of issue

- How long the prices are valid

- Description of goods or services

- Links to any terms and conditions

- Payment terms, including due date

- Expected VAT amount, and any other taxes that might apply

- Shipping fees

While similar to the final sales invoice, your invoice should designate that it is not a final sales invoice by including, “pro forma invoice,” somewhere near the top of the document.

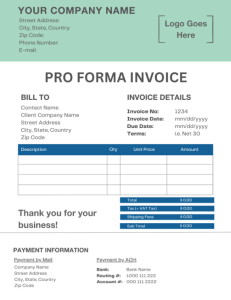

Pro Forma Invoice Template

Now that you understand what information should be included, you’re probably wondering how to design or where to find a pro forma invoice template.

We’ve created an easy-to-use template to help get you started and serve as a pro forma invoice example:

Pro Forma vs. Commercial Invoice

If you’ve used commercial invoices before, you may be wondering what the differences are between a commercial vs. pro forma invoice. Here are some key differences and similarities between the two:

Differences Between Pro Forma Invoice vs. Commercial Invoice

Purpose. Pro forma invoices are preliminary documents providing information about what will be included in the invoice.

Commercial invoices describe the transaction after the delivery of goods and officially request payment.

Content. Pro forma invoices contain detailed descriptions of goods or services, prices, quantities, and total costs. Typically, it also has delivery and payment terms. However, it’s not legally binding.

Commercial invoices include important details like invoice numbers, dates, and information about the sellers and buyers. It’s a legally binding document that requires payment.

Legal Status. Because they are not legally binding documents, the terms and conditions on pro forma invoices are subject to change. It’s closer to a draft than an actual invoice.

Commercial invoices are legally binding documents. Once the buyer receives it, they must pay the amount due according to the terms and conditions stated.

In short, pro forma invoices are essential during the transaction process, but the commercial invoice finalizes the sale and triggers the payment process.

Similarities Between Pro Forma Invoice vs. Commercial Invoice

Pro forma invoices must be similar to commercial invoices so that your customers get an accurate estimate. While they each serve distinct purposes in a business transaction, pro forma invoices and commercial invoices both contain similar information.

Some of their commonalities include:

Description of Goods or Services. Both types of invoices include detailed lists of what goods or services you provide. That could mean item descriptions, unit prices, quantities, and total cost.

Seller and Buyer Information. Your pro forma and commercial invoices should have seller and buyer information, including names, addresses, and contact information.

Shipping information. Both invoices should contain relevant shipping information, such as delivery method, shipping costs, and expected delivery date.

Use in International Trade. Your pro forma and commercial invoices are often used during international trade. Pro forma invoices provide information to customs or to secure trade financing, while commercial invoices also serve as primary documentation for customs valuation.

Format. Both invoices follow a similar format, with sections for the sender’s information, the recipient’s information, list of services or goods, and the total cost.

Remember that while these invoices have similarities, their primary purpose and legal weight differ. Pro forma invoices serve as an estimate, while commercial invoices are final bills and requests for payment.

As a full-time writer and programmer, Christian spends most of his time typing away for clients around the world on different projects. Christian has several years of experience writing content that addresses financing solutions and accounting methodologies geared toward small and medium-sized businesses. In his free time, he enjoys traveling and learning new skills.