What Is an Invoice Number?

Last Updated July 26, 2024

Given the average business owner deals with hundreds of invoices per month, there needs to be a way to easily track and manage one invoice to the next.

Thankfully, there’s an easy solution: implementing invoice numbers.

Even if you haven’t created an invoice numbering system before, you’ve likely seen that string of seemingly random numbers at the top of invoice and simply glossed over it. But invoice numbers play a meaningful role in accounting, particularly when it comes to tracking and verifying invoices and their payment statuses.

This article will provide a brief explanation of why invoice numbers are important, an example of an invoice number, how it’s different from a PO number, and how to create unique invoice numbers.

What Is an Invoice Number?

An invoice number is a unique numerical identifier typically listed at the top of an invoice, included to make transactions easier to identify, track, and record. This number should be included both on the invoice itself and the payment receipt, allowing both parties to easily input and store individual invoices in their record-keeping system.

Why Is an Invoice Number Important?

Adding an invoice number is a critical step when writing an invoice. Beyond being the identifier for a payment transaction, it provides helpful organizational structure, making invoice verification and invoice reconciliation much easier. Below are some of the top reasons why using an invoice numbering system is important for your business:

- Adds Uniqueness to Each Transaction: An invoice number must be unique to each invoice. This uniqueness ensures that no two invoices are mistakenly identified as the same transaction.

- Vital for Bookkeeping Organization: Your business might be involved with numerous transactions daily. When this occurs, invoice numbers help keep transactional records organized. They provide a clear reference point when searching for a specific transaction.

- Tracking: Businesses need to track the progress of their invoices – whether they’re sent, paid, or overdue. For instance, if you notice a delay in payment from one of your customers, you can use the invoice number to track which invoice is causing the delay. They’ll also come in handy for invoice verification, so when your goods or services are delivered, you can easily find the invoice for the respective transaction and match what you received with what was on the invoice.

- Communication: When communicating with clients or vendors about a specific invoice, referring to its unique invoice number ensures clarity and accuracy in discussions.

Invoice Number Example

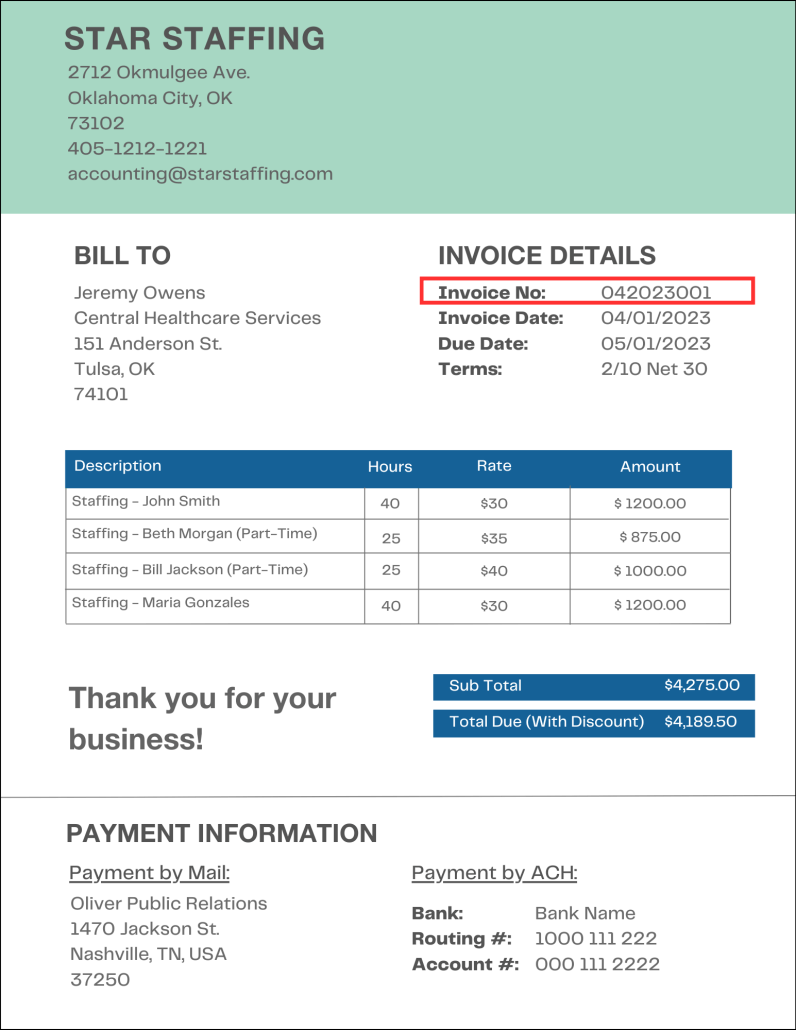

Let’s look at an invoice number example to illustrate this concept further. You can use this as a guide to generate an invoice number for your own transactions.

Imagine you own a small business and provide a client with a consulting service. You create an invoice to bill them for this service. You assign it a unique invoice number, such as “042023001” This code not only identifies this particular invoice but also helps your client distinguish it from previous and future invoices.

If you don’t have experience creating an invoice, you can start by using our small business invoice template or standard B2B invoice template.

How Do I Create an Invoice Number?

Sure, adding a number to your invoice is mundane, but it’s an absolutely pivotal detail that assists both parties.

The good news is that creating an invoice numbering system is a straightforward process, though the most important aspect to remember is consistency. While each system is unique to each individual or business, it should remain consistent for every invoice you write. Below are some options to consider when creating your invoice numbering system:

- Start with a Prefix: It’s common to use a prefix to denote specific details about an invoice. For example, you could include the customer’s name as a prefix to the invoice number. Example: JSMITH001.

- Use a Sequential Number: Assign a unique sequential number to each invoice. This number can start at “001” and increase with each new invoice.

- Consider the Date: Including the date in your invoice number can help you organize invoices chronologically. For example, you could start each invoice number with the month and year, followed by a sequential number. Example: 012023001. With this format, we can easily see that this invoice was created in January of 2023.

- Be Consistent: If you write invoice numbers in a different format than shown above, that’s OK – just remember to make sure to maintain consistency in your system to avoid confusion.

How to Track Invoices

Even after creating your unique invoice numbering system, you still need a way to track all of these invoices.

The solution is simple: invest in accounting software.

There are numerous easy-to-use AR automation software available for a reasonable price that include simple invoicing systems, such as QuickBooks Online, FreshBooks, BILL, and Xero. These platforms typically have tiered plans based on businesses’ needs, with many plans below $50 per month.

Jeff Mains, CEO of Champion Leadership Group, urges business owners to be proactive in this sense.

“Invest in a good invoicing system that alerts you to things like late payments, and don’t shy away from following up on late payments promptly,” Mains said.

Healy Jones, Vice President of Financial Strategy at Kruze Consulting, mandates that all of their small business clients utilize QuickBooks Online. Jones noted that a business’s first-time generating revenue is a “great moment,” and, “QuickBooks Online has everything built in to allow business owners to enjoy those moments, rather than stress about how to track and manage those first customer accounts.”

In recent years, modernizing processes has been the No. 1 AR-related goal for business owners. It’s critical for business owners to stay on top of these trends so they aren’t spending time on efforts that can be automated.

In-Summary: What Is an Invoice Number?

Every business should have a straightforward invoice numbering system in place. Whether you’re handling 10, 100, or 1000 invoices per month, there’s no reason to not have unique identifiers attached to each bill you’re issuing. Doing so adds a layer of organization to your invoicing process, allowing you to more efficiently stay on top of accounts receivable.

Invoice Number FAQs

How many digits are in an invoice number?

The number of digits in an invoice number varies by business. It can be a short sequence like “001” or a longer one, depending on the business’s needs and the volume of transactions. If your business completes hundreds of transactions per month, you should probably create numbers that are at least five digits, so you don’t run into a scenario where you’ve used up all of your available numbers.

Where do I find an invoice number?

You can usually find the invoice number at the top of the invoice document, but it can vary. Regardless, it’s a prominent identifier for the transaction.

Where is the invoice number on a receipt?

On a receipt, the invoice number is often placed near the top along with essential information related to the transaction.

Can you track an invoice number?

Yes, an invoice number is essential for tracking an invoice’s progress. It helps businesses keep records and ensure that payments are received.

Does an invoice have to have a number?

Yes, almost all invoices have a unique invoice number. This number is crucial for efficient tracking and record-keeping. It helps businesses stay organized and ensures clarity in financial transactions.

What is the difference between an invoice number vs. PO number?

You may have heard of a PO number and are now wondering, what’s the difference between a PO number and an invoice number?

The term “PO number” stands for “Purchase Order number.” While both an invoice number and a PO number serve to identify and track transactions, they differ in their purpose and when they are used.

- Invoice Number: This is used by the seller to bill the client after goods or services have been delivered. It’s more closely related to the financial aspect of the transaction.

- PO Number: This is used by the buyer when making an initial request for goods or services. The purchase order is typically created before the invoice, and it outlines the details of the desired products or services. The PO number is more focused on the ordering process.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.