Last Updated January 22, 2025

Accounting in small business is one of the most important elements of making your company a success. After all, your ability to effectively track and manage your financial activities is what will enable you to keep your business running for years to come, regardless of what types of products or services you sell.

According to DocuClipper, 64% of small business owners believe they aren’t knowledgeable enough when it comes to accounting. And without a bookkeeping background, it can be challenging to figure out where to start acquiring that knowledge.

One of the best ways to do so is to simply familiarize yourself with the most essential small business accounting tips and best practices so you have the blueprint to start building from.

Therefore, in this guide, we’ll offer tips for small business accounting that will help you manage your finances appropriately.

What Responsibilities Come With Small Business Accounting?

Accounting for small business covers a wide range of responsibilities. It includes:

- All general bookkeeping for your small business (such as tracking revenue and expenses)

- Managing your tax obligations

- Creating financial statements

- Setting up payroll (when applicable)

- Making payments to your own suppliers

- Managing invoices with your clients

Essentially, if it is related to managing money, it falls under small business accounting. For busy business owners, this can become an overwhelming task in and of itself, which is why so many rely on accounting software and automation tools to help make these tasks easier.

Depending on the scope of your business, you may find it beneficial to hire an employee to manage your accounting and bookkeeping. However, accounting is something that many small business owners are able to handle on their own—particularly when they follow key small business accounting best practices.

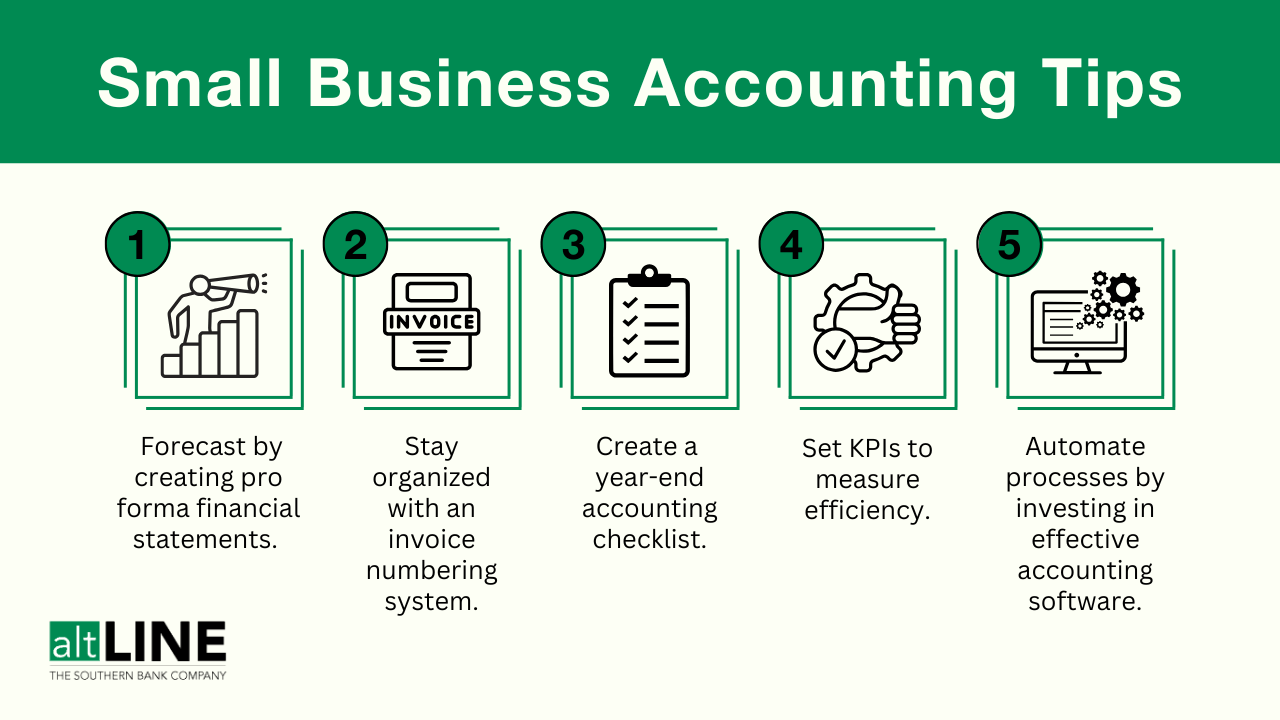

23 Small Business Accounting Tips

The following accounting tips for small business owners cover a wide range of small business accounting best practices, including how you track your finances, manage customer payments, and more. These tips are sure to get you on track for success.

1. Invest in Accounting Software

Perhaps the most important piece of accounting advice for small business is to invest in quality accounting software. Tools like QuickBooks, FreshBooks, and Zoho Books can help with everything from invoicing to managing taxes, ensuring that none of your financial responsibilities slip through the cracks. These tools make it easier to record and track transactions, and many can help automate key activities to reduce the risk of manual error.

2. Open a Business Bank Account

Opening a separate business bank account is essential for business accounting for small business. Opening a separate account can help ensure you don’t become personally liable for your business debts. This also makes it easier to separate personal and business expenses so you can accurately track your cash flow and transactions. A separate business bank account will also make it easier to manage your tax obligations.

3. Record All Transactions and Keep Them Organized

Recording and organizing your transactions is one of the business accounting basics. All transactions—including your purchases and sales—must be recorded so you can understand your cash flow, profit and loss, and so on. Without some kind of record, you’ll have no idea where your money is going! Accounting software can be set up to automatically record and organize your transactions, though some businesses prefer to create their own digital spreadsheet.

4. Prioritize Budgeting and Forecasting

Another basic small business accounting practice is to prioritize budgeting and forecasting. Your budget is an estimate of your business income and expenses for a set time period, such as a month, quarter, or year. Many businesses will also forecast (or estimate) future income and expenses based on their anticipated growth. Careful budgeting will help you remain profitable while accounting for all relevant business expenses.

5. Regularly Create and Analyze the Three Essential Financial Statements

As part of your budgeting and forecasting process, you should be mindful of the three major financial statements used by businesses: the balance sheet, profit and loss statement, and cash flow statement.

The balance sheet provides a snapshot of your business financials at a given time. The profit and loss statement, also known as the income statement, measures your financial performance over a period of time so you can measure your profitability. The cash flow statement measures cash inflows and outflows during a specific period, showing whether you are using cash and other liquid assets appropriately.

6. Create Pro Forma Financials

With the three essential financial statements in place, you can incorporate another accounting tip for small businesses—creating pro forma financials. A pro forma analysis uses historical data from these statements and hypothetical assumptions to project financial outcomes for different business decisions. This can help you obtain funding for expansion and other activities or assess whether a financial decision would actually be worthwhile for your business.

7. Build an Invoice Numbering System

As part of billing your clients, you should introduce an invoice numbering system. Assigning an invoice number to each transaction improves bookkeeping organization, ensures that each invoice is uniquely identified, and makes it easier to track invoice status and communicate with clients about their payments. Using a sequential number or the date are two easy ways to track invoices. Make sure your system is consistent for each invoice.

8. Use an Invoice Template

An invoice template will also make it much easier to track and manage your billing processes. A business invoice template should clearly outline your company information, your client’s information, the invoice number, the date, the due date, payment terms, a description and cost of each product or service provided, and the total amount due. Using the same template each time will eliminate confusion and streamline payment for your clients.

9. Have Invoice Fraud Prevention Measures in Place

Invoice fraud scams could affect you or your customers. For example, a scammer pretending to be one of your vendors or even a shady vendor overbilling you in comparison to the originally agreed-upon prices. Invoice fraud prevention tactics—such as retaining purchase orders, checking invoice numbers and goods receipts, and verifying payment information—will reduce your risk for fraud.

10. Take Time to Consider Payment Terms

Invoice payment terms dictate how much time your clients have to pay before their invoice is considered late. Payment terms may range from 7 to 90 days. When determining payment terms, consider your own cash flow needs as well as standard practices for your industry. If you need to adjust your payment terms, be sure to proactively communicate this with your clients so they can prepare accordingly.

11. Manage Receivables Wisely: Charge Late Fees and Offer Payment Discounts

One key accounts receivable tip is to incentivize your customers to make their payments on time. The best ways to do this are by charging late fees and offering early payment discounts. With these solutions, you typically charge either a flat rate or percentage fee for late payments and similarly offer a percentage discount when payment is submitted within a certain timeframe (such as within 10 days on a net 30 invoice). Both late fee and early payment discount policies should be clearly communicated to customers and included on your invoices.

12. Have a “Money-Owed” List

A money-owed or accounts receivable list details all outstanding payments that your clients owe. This list helps you keep track of how much money you have not yet been paid for products or services provided. This list is typically prioritized by how overdue a payment is, though you could also prioritize your money-owed list by the amount of money a client owes.

13. Practice Invoice Verification

Invoice verification should play a key role when you make payments to your vendors and suppliers. This process involves checking invoice details against your purchase orders or goods receipts to ensure the dates and details match. Once an invoice has been properly verified, you can move forward with confidence when making a payment.

14. Always Track Tax Deadlines

Tracking tax deadlines isn’t just a small business bookkeeping tip—it’s an essential practice. Small businesses are required to pay quarterly taxes based on their income. Failure to make estimated payments could result in significant financial penalties during tax season. Accounting software or a certified accountant can help you estimate your tax responsibilities and submit payments on time.

15. Have a Year-End Accounting Checklist

A year-end accounting checklist helps you close out the books on the year. Taking inventory and recording all outstanding payments, payments sent, and payments received will help ensure the accuracy of your financial statements. Businesses with employees or contractors should prepare W-2s or 1099s. You should also calculate and record business expenses from the past year and gather other tax documents.

16. Regularly Take Stock of Inventory

Sometimes overlooked among small business accounting tips and tricks, regularly taking stock of inventory is crucial for managing your own expenses. This practice helps ensure you accurately track inventory levels so that you don’t run out of stock or accidentally overstock certain items. Improved inventory decisions will result in a better customer experience and increased profitability.

17. Utilize Email Templates for Past-Due Invoices

Even with a late fee policy, you will likely have clients that fail to submit payment on time. To ensure timely payment and encourage payment from overdue accounts, one key accounts receivable collection tip is to use email templates for past-due invoices. With a template, you can quickly insert the customer’s name, invoice number, and amount owed to an already-crafted email, helping you save time while ensuring the right message gets sent out. You should create templates for various stages of late payment so you can send multiple emails if needed.

18. Reconcile Your Business Bank Account

Another important basic bookkeeping tip to remember is to regularly reconcile your business bank account. To do this, compare the transactions listed on your bank statement with the transactions that have been recorded in your company accounting records. Amounts and dates should match, and any errors or discrepancies should be investigated and resolved.

19. Continually Monitor Cash Flow

Cash flow management is key to guiding your financial decisions. Monitoring your cash flow (in and out) helps you gauge the overall financial health of the business and determine other spending decisions. For example, periods of negative cash flow aren’t typically the right time to buy new equipment or hire new employees. Monitoring cash flow helps you avoid these types of financial mistakes.

20. Conduct Internal Audits

As a small business, you don’t need to hire an external third party to perform a financial audit like public companies do. However, conducting an internal audit can still be beneficial by helping you identify any discrepancies, concerns, or quality issues. Identifying and correcting financial issues can help you prevent fraud, adjust spending habits, or implement other essential actions.

21. Know How Much Working Capital You Need to Operate

Determining how much working capital you need is important for ensuring you can cover your operating expenses. A good rule of thumb is to measure your current ratio (current assets / current liabilities) to determine if you have sufficient working capital. A current ratio of 1.5 to 2.0 is considered a healthy level of working capital for running your operations.

22. Set KPIs to Track Efficiency

Tracking KPIs—such as gross profit margin, accounts receivable turnover ratio, or days sales outstanding—will help you track the efficiency of your accounting processes and your overall financial practices. Using these KPIs will help you find ways to improve your accounting practices so you can improve your cash flow and working capital and maintain a profitable business.

23. Save Cash in Reserves

Saving cash in reserves provides an essential safety net that helps your business make it through market downturns, address surprise expenses, or even have the funds you need to take advantage of an unexpected opportunity. Maintaining cash reserves will help you avoid taking on debt and continue functioning normally as you navigate these and other similar circumstances.

In-Summary: Small Business Accounting Tips

While this isn’t necessarily a complete, comprehensive guide to small business accounting, we hope that these bookkeeping tips for small businesses will set you on the right course as you try to manage your business finances. As you follow these accounting best practices for small businesses, you’ll be better able to understand where your money is coming from and where it’s going. As you develop and refine your accounting strategies for small business over time, you will be able to make better financial decisions and keep your company in the black.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.