What Is a Profit & Loss Statement?

Last Updated May 16, 2024

Pitching to investors. Business loans. Annual tax filing. Financial forecasting.

Running a business means you must wear many different hats. A key document to navigating each element is the profit and loss statement. But what is the purpose of a profit and loss statement?

A holistic understanding of your P&L statement means you can easily evaluate your business’s financial performance. This means you can handle each element of your operations with confidence and clarity. In this article, we outline the profit & loss statement, its value, and how you can use it to steer your business strategy and fuel growth.

What Is a Profit & Loss Statement?

A profit & loss (P&L) statement, also known as an income statement, is a financial report summarizing the revenues, costs, and expenses incurred during a specific period. This document reveals a company’s ability to generate profit by increasing revenue, reducing costs, or both. It is one of three main financial statements, highlighting its importance for business owners and investors alike.

A profit & loss statement provides a clear view of a company’s performance, showing net profit or loss over a quarter or fiscal year. It helps you manage your cash flow. Essential for investors, management, and regulators, the P&L statement serves as a key indicator of financial health. It guides decisions on investments, budgeting, and strategy.

What Is on a Profit and Loss Statement?

A profit and loss statement has several key components. Starting with revenues, it lists the total income generated from sales of goods or services. It then deducts the cost of goods sold (COGS) to calculate gross profit.

Operating expenses—including salaries, rent, and utilities—are subtracted to determine operating profit. Non-operating expenses, interest on debt, and taxes are next. That all leads to the bottom line: net profit or loss.

This streamlined structure tracks profitability while breaking down how revenues are transformed into net earnings. It offers a transparent view of financial performance.

What Is Not Included on a Profit and Loss Statement?

A profit and loss statement does not include several key financial measurements. It omits assets, liabilities, and equity, which are instead detailed on the balance sheet. Investment revenues and expenses outside of the main business operations are also excluded, as are any changes in capital—such as loans taken or repayments made.

Essentially, the P&L focuses solely on operational performance. It leaves the broader financial position and cash flow changes to other reports. It is meant for assessing profitability.

Purpose of a Profit and Loss Statement

The profit and loss statement serves several purposes.

Informing Stakeholders

The profit & loss statement offers important insights into a company’s financial performance over a specific period of time. That is a key communication tool for investors, creditors, and management. It highlights how well the company generates profit. That guides investment decisions and financial strategies.

Performance Analysis

This statement provides a detailed analysis of revenue streams and expense categories. You can identify trends, areas of strength, and potential improvement. By comparing performance over different periods, companies can track their financial progress.

Budgeting and Forecasting

The detailed breakdown of incomes and expenditures on the P&L statement is very important for future budgeting and forecasting. Understanding past performance helps with setting realistic financial goals to prepare for upcoming financial periods. It encourages proactive management of resources.

Taxation

For tax purposes, the P&L statement provides necessary information for compliance. You can calculate taxable income and determine your company’s tax liabilities.

Securing Financing

When seeking loans or investment, the P&L statement shows the company’s financial health and profitability to potential financiers. A strong showing here is a big win for a company’s credibility. Further, it’s the path to financing on favorable terms.

Types of Profit and Loss Statements

Below are the different kinds of profit and loss statements.

Pro Forma Profit and Loss Statement

A pro forma profit and loss statement projects future income and expenses. It forecasts your company’s performance. This type is used for planning purposes, evaluating the financial impact of strategic decisions. It’s utilized to assess future profitability under different scenarios.

Year-to-Date Profit and Loss Statement

The year-to-date profit and loss statement offers an overview of your company’s financial performance from the beginning of the fiscal year up to the current date. It helps you track progress toward goals.

Certified Profit and Loss Statement

A certified profit and loss statement has been reviewed and verified by a certified public accountant (CPA). The certification ensures the accuracy of the information presented. It adds credibility to the financial data. This is crucial for investors, lenders, and regulatory compliance.

Trailing Profit and Loss Statement

This type of P&L statement covers the financial performance of the past 12 months. The trailing profit and loss statement does not track the fiscal year, but rather provides a rolling view of the company’s profitability over the most recent year. It allows for continuous assessment and comparison with previous 12-month periods.

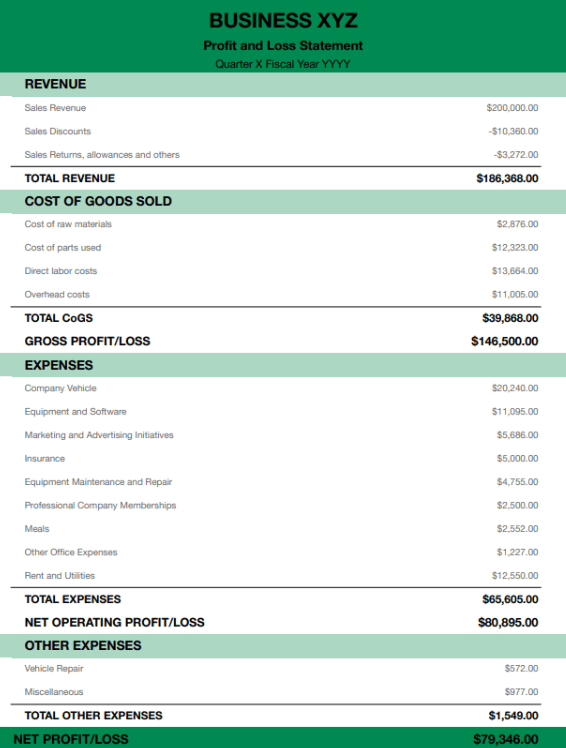

Example of a Profit and Loss Statement

Below can be used as a blueprint for how to make your own profit and loss statement:

How to Analyze a Profit & Loss Statement

Follow these steps to analyze your profit and loss statement:

- Assess Gross Profit Margin: Calculate and evaluate the gross profit margin, which indicates the efficiency of cost management relative to sales.

- Evaluate Operating Profit Margin: The operating profit margin shows profitability from core operations before finance costs and taxes.

- Analyze Net Profit Margin: Determine the net profit margin by dividing net profit by total revenues. This offers you insight into your company’s ability to turn sales into profit after all expenses.

- Compare Trends Over Time: Look at figures across multiple periods of time. This information illustrates financial performance. It informs strategy, taking into account market conditions and guiding internal decisions.

- Investigate Revenue Streams and Expenses: Break down individual revenue sources and expense categories. Understand any shifts or unexpected figures. Uncover issues or opportunities for improvement.

In-Summary: What Is a Profit & Loss Statement?

Profit and loss statements are a cornerstone of business planning and financial analysis. By learning what goes on P&L statements, the different types of statements, and they purpose they serve, you are playing the role of a responsible business owner who deeply cares about your business’s trajectory.

Once you master learning about and analyzing profit and loss statements, you can begin working toward linking your main financial statements together.

Profit & Loss Statement FAQs

What is another name for a profit and loss statement?

A P&L statement is also known as an income statement. It provides a summary of a company’s revenues, expenses, and profits or losses over a particular period of time.

What’s the difference between a profit and loss statement and an income statement?

When it comes to a profit and loss statement vs. income statement, there is no difference. They are two terms to refer to the same financial document.

What does a profit and loss statement show?

The P&L statement shows a company’s revenues, costs of goods sold (COGS), gross profit, operating expenses, and net profit or loss. It details how revenue is turned into net income.

How often are profit and loss statements prepared?

Profit and loss statements are typically prepared monthly, quarterly, and annually. This frequency helps businesses track their financial performance closely and make timely adjustments to their strategies.

What’s the difference between a cash flow statement and a profit and loss statement?

The main difference lies in what they report. A cash flow statement shows the actual inflows and outflows of cash. That shows liquidity. Meanwhile, a P&L statement displays the company’s revenues, expenses, and profitability, regardless of when cash transactions occur.

What’s the difference between a balance sheet and a profit and loss statement?

A balance sheet is a snapshot of a company’s financial point in time. Conversely, a P&L statement reports on a company’s financial performance over a period. It details income and expenses to show net profit or loss.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.