Last Updated December 12, 2025

When you start a new business, one of the first tasks you have to learn is how sales invoicing works. Choosing the right type of transaction for your business helps you get paid on time and avoid delays in cash flow. One example of a commonly used transaction is cash on delivery (COD).

Let’s take a closer look at what cash on delivery means, how cash on delivery works, and the advantages and disadvantages of using it.

Key Takeaways

- Cash On Delivery (COD) means the buyer pays when the product is delivered, giving sellers faster payment and more predictable cash flow.

- COD builds customer trust, attracts buyers without credit, and reduces fraud risks for both parties.

- Downsides of Cash on Delivery include delivery refusals, sale amount limits, and potential extra shipping costs if products are returned.

- COD differs from standard invoicing (like Net 30) by requiring immediate payment at delivery, improving cash flow for new businesses.

What Is Cash on Delivery (COD) Payment?

Cash on delivery (COD) means a buyer has agreed to pay for a product at the time of delivery instead of at the time of ordering. Commonly used in online sales, COD can also stand for collect on delivery or cash on demand. It’s most often used across Southeast Asia, but cash on delivery is a term recognized worldwide.

Cash on delivery purchases do not require any payment from a buyer until they receive their purchase. At that time, the payee must pay the entire amount due. Most service providers do not allow partial payments on COD transactions.

Payment does not always have to be in cash. Most service providers accept check and electronic payments, too. A unique tag on the package instructs the delivery person to collect payment at delivery when a customer selects a COD transaction.

How Does Cash on Delivery Work?

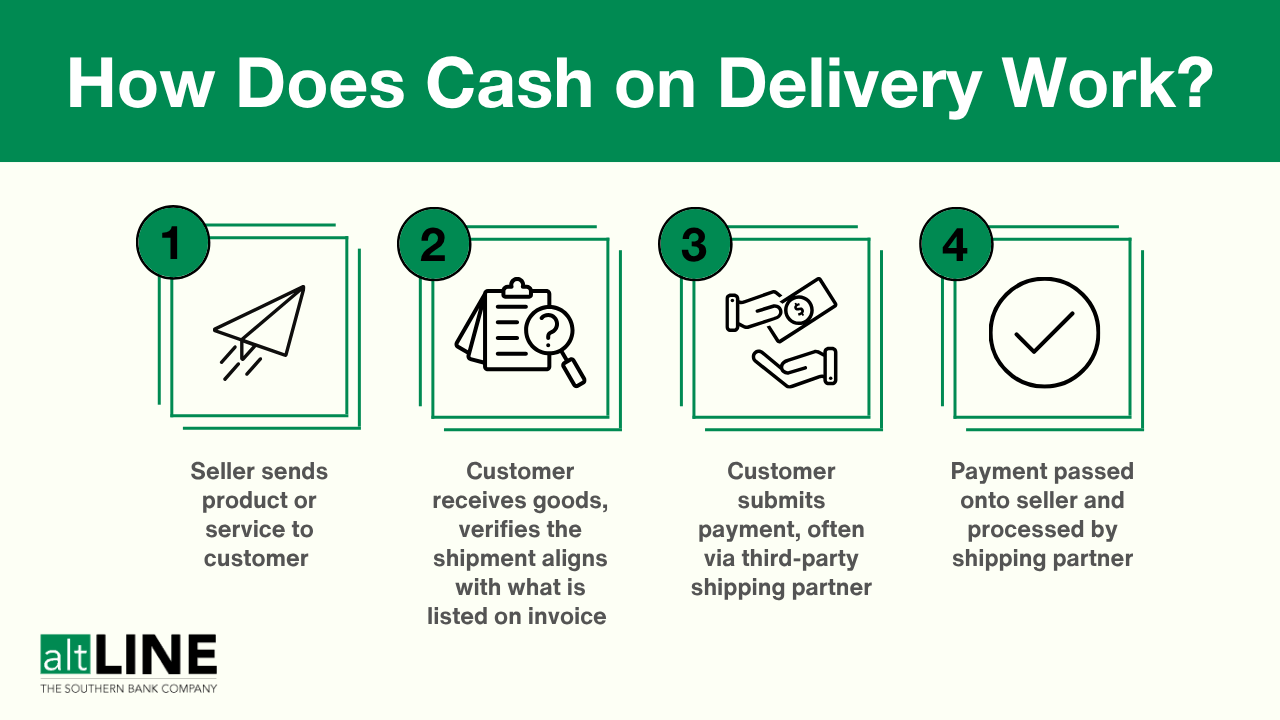

Cash on delivery is a relatively straightforward process. Here’s how it works.

- A seller sends a product or service to their customer, alongside an attached invoice.

- The customer receives product or service (along with the invoice), before verifying what they’re received is accurate and adequate.

- Once the products are reviewed and approved, the customer submits payment, typically via a third-party logistics partner used by the seller.

- With the help of the third-party logistics or shipping partner, payment is passed onto the seller, minus any potential added shipping or handling-related fees.

Why Businesses Offer Cash on Delivery Payment Terms

Cash on delivery offers several benefits for new businesses looking to develop a strong customer base and for companies that want to increase their customer relations. Below are a few primary reasons a business offers cash on delivery transactions.

New Businesses Accruing Customer Confidence

For new companies that do not already possess a loyal customer following, cash on delivery services can increase customer confidence in the business. COD helps the customer feel more secure in their purchase since they know the company will not take their money without first delivering the product.

Can Help Attract New Customer, Particularly Those with Poor Credit

Cash on delivery may help draw in new customers who previously could not make purchases because they do not have reputable credit. With COD, customers can order online and then pay in cash at the time of delivery, meaning they can sidestep the necessity of a credit card.

Cash on delivery may also attract customers who do not trust online payments. Some buyers are wary of entering their credit card information into an online purchase form in fear that someone will steal their information or take their money without delivering the product, but COD eliminates this risk.

General Preference for Cash on Delivery Instead of Credit Payments

Businesses may offer cash on delivery if they are interested in eliminating the fees associated with processing electronic credit purchases. This way, the sellers receive full payment without additional charges. COD also helps a business avoid several of the risks related to credit payments, like identity fraud.

Customer Request

Requests from customers may lead a business to offer cash on delivery transactions. If customers know they will be home for a delivery, they may prefer to handle payment at that time. Customers interested in more discreet methods of payment may also request COD since it does not leave a trace in their credit or bank account history.

Pros and Cons of Cash on Delivery

Cash on delivery comes with some risks. But there are significant benefits to using it, too. Here is an in-depth look at the pros and cons of COD transactions.

| Pros of Cash on Delivery | Cons of Cash on Delivery |

| Shorter Payment Period | Risk of Delivery Refusal |

| Protects Cash Flow from Slow-Paying Customers | Limits on Sale Amounts |

| Protects Against Fraud | Possibility of Additional Shipping Costs |

| A Rise in Impulse Purchases | Complications if Buyer Does Not Accept the Goods |

Pros of Cash on Delivery (COD)

First, let’s examine the advantages of using cash on delivery.

- Shorter Payment Period: The most beneficial aspect of COD is the shorter payment period that leads to a briefer accounts receivable period and improved efficiency. The seller gets a more immediate payment since it is due at delivery instead of within the 30 days usually specified by standard invoicing.

- Protects Cash Flow from Slow-Paying Accounts: If your business has accounts that frequently go into arrears or are consistently late with payments, you can require COD transactions on all future purchases. This way, you can continue selling to the client, but with guaranteed payment since the client must pay first before receiving the product.

- Protects Against Fraud: COD helps both sellers and buyers defend against fraud. The customer feels comfortable knowing they do not have to pay before they receive their product. Whereas the seller knows they will receive payment before turning over their products. Since there is a better guarantee that the seller will receive their money, cash flow is predictable and dependable, making it easier to budget.

- A Rise in Impulse Purchases: The rise in impulse purchases is both an advantage and a disadvantage. On the one hand, since payment is not due immediately at the time of the order, buyers may be more tempted to make a purchase whose payment is not due until a later date. However, impulse buying may also lead to more frequent delivery refusals, which results in lost delivery and shipping fees.

Cons of Cash on Delivery (COD)

Unfortunately, cash on delivery is not risk-free. There are two primary disadvantages to using COD.

- Limits on Sale Amounts: Many service providers restrict the amount of money accepted per delivery or day through COD transactions. The limit imposed by your service provider may prevent your customers from making large purchases.

- Risk of Delivery Refusal: The risk of delivery refusal increases with COD transactions. When a buyer makes a purchase and selects COD, there is no absolute commitment that the buyer will accept the delivery and make the payment when the time comes.

- Possibility of Additional Shipping Costs: In the case where a buyer isn’t available to sign and receive the goods, or if they refuse to accept the goods due to inaccuracies or damage, sellers are prone to additional shipping costs with the product returned to them. For vulnerable sellers, any additional costs can be frustratingly impactful. Not only miss out on the profit from the sale but may even lose money.

- Complications if Buyer Does Not Accept the Goods: When the buyer doesn’t accept products or services for whatever reason, next steps can become tricky. If the two parties disagree on whether or not the goods were produced sufficiently, it can be a difficult situation to navigate given that the seller has already spent time and money to make the goods or create the product.

Cash on Delivery FAQs

What does COD stand for?

In business, COD stands for “cash on delivery,” which is also sometimes referred to as, “cash on demand.” COD is a payment term where sellers ship products to buyers before collecting payment.

What does COD mean on an invoice?

You might see “COD” on an invoice. This means, “cash on delivery,” which is a common invoice payment term.

How is cash on delivery (COD) different from standard invoicing?

The difference between cash on delivery and standard invoicing is in the payment terms. In standard invoicing, the most common payment term is net 30, which means that the customer must pay the business within 30 days of receiving the invoice. In a COD transaction, the payment term is cash on delivery, and the total payment is due at delivery.

So, with COD, you get paid faster than with standard Net 30 invoices. The primary distinction between COD and standard invoicing is this shorter time frame to delivery, which leads to more immediate payment and improved cash flow.

On a COD invoice, you will want to be clear on payment terms and conditions, so the customer knows payment is due at delivery.

Why do people use cash on delivery?

For new and small businesses, COD payment terms can be beneficial to their cash flow. Rather than waiting the traditional 30 days for payment that’s standard with Net 30 terms, a supplier or vendor can receive payment much more quickly if they select COD.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.