Last Updated March 11, 2025

If you’re a small business owner, there’s a good chance you’re often searching for ways to improve cash flow. Sometimes, alternative lending options or new business ideas can provide solutions, but you may first want to look at your business’s cash flow from assets to find opportunities to build up your profit.

While “cash flow from assets” isn’t a standard accounting term, it is important because this measure plays a significant role in the context of financial and investment analysis.

After reading this article, you’ll be able to define cash flow from assets, calculate your own business’s cash flow from assets, and hopefully transfer what you learned to your own business to make the most out of your assets.

What Is Cash Flow from Assets?

Cash flow from assets (often abbreviated as “CFFA”) refers to the total cash flow generated by a company’s assets, not taking into account cash flow from financing activities. It measures a company’s ability to generate cash inflows from its core operations using strictly its current assets and fixed assets.

Examples of Cash-Producing Assets

Cash-producing assets generate a regular and consistent income stream for their owners. Here are some examples:

- Real Estate. Rental properties and Real Estate Investment Trusts (REITs) provide income streams for businesses.

- Bonds. When you buy a bond, you essentially give a loan to the entity issuing it (a corporation, municipality, or government). As compensation, the issuer commits to pay you a predetermined interest rate regularly until the bond matures, at which point they repay the principal amount.

- Mineral Royalties. If your business owns rights to minerals, oil, or gas, you can lease them to companies. In return, you receive royalty payments based on the production and sale of those resources.

- Intellectual Property Royalties. If your company has a patent, you can earn royalties whenever those are used.

- Business Ownership. Owning a share of a profitable business leads to regular distributions or dividends. This includes both traditional companies and franchises.

- Inventory. For retail companies, inventory (when sold) produces cash. Although it’s not a consistent, passive income like rent, it’s still a primary cash generator.

- Machinery and Equipment. For manufacturing companies, machinery, and equipment can be leased to other companies.

Why Is Calculating Cash Flow from Assets Important?

Calculating cash flow from assets is helpful because of the insights it provides into your company’s financial health, efficiency, and operational effectiveness.

By focusing on cash flow generated from core operational assets and sidelining the effects of peripheral activities, you will be presented the clearest picture of your company’s ability to utilize its assets effectively. This core assessment is particularly valuable for internal stakeholders and potential investors looking for a transparent evaluation of the business’s primary functions.

Offers Insights into a Business’s Liquidity

Liquidity is another significant dimension that cash flow from assets highlights. A positive CFFA suggests that a company generates adequate cash to meet its immediate obligations, reducing its dependence on external funding.

For lenders, this metric is a reliable indicator of the firm’s capacity to repay debt, and a higher CFFA generally implies lower lending risks. This underlines the significance of businesses having a high cash flow from assets, as it can lead to lower rates and fees from financial institutions for potential lending options.

Reveals Outcomes of Past Financial Strategies and Decisions

The metric also offers a window into management’s competence. Consistent positive cash flow might be a testament to effective leadership, reflecting the team’s ability to utilize assets for cash generation strategically. Conversely, dwindling or negative CFFA might raise red flags about the company’s operational strategies. As a business owner, you should always aim to avoid negative cash flow; however, note that it’s common for small businesses and startups to deal with intermittent phases of cash flow problems.

Aids in Future Planning and Decision-Making

In addition, CFFA guides strategic capital allocation. Management makes informed decisions about investments, divestitures, or replacements by assessing which assets yield strong cash flows and which don’t. This information is vital for future planning, aiding in accurate budgeting and forecasting.

In the larger industry context, CFFA serves as a benchmarking tool. Comparing this metric across companies within the same sector helps discern a company’s performance relative to its peers, assisting with investment decisions and determining competitive positioning. The importance of cash flow from assets cannot be understated, as it serves as a compass for various stakeholders navigating the financial landscape of a business.

How to Calculate Cash Flow from Assets

The CFFA formula requires the following metrics:

- Operating cash flow

- Capital expenditures

- Changes in net working capital

If you’re not sure how to get each of these numbers, don’t worry. The steps below walk you through how to find them.

1. Determine Operating Cash Flow (OCF)

The first step in calculating CFFA is determining Operating Cash Flow, though you may also see this referred to as cash flow from operations. To find your OCF, look at your company’s statement of cash flows. Locate the “Cash Flow from Operating Activities” section (this is also sometimes called Cash Flow from Operations). The final figure in this section should be your Operating Cash Flow, which represents cash generated (or used) in the business’s core operations.

2. Calculate Net Capital Spending (NCS)

On your Statement of Cash Flows, move to the section titled “Cash Flows from Investing Activities (also sometimes called Cash Flow from Investing).

Look for “cash spent on capital assets” (often titled “Purchases of property, plant, and equipment”), and subtract any money received from selling capital assets. The resulting figure is your NCS, representing the net cash used for or received from investments in the company’s long-term assets.

3. Calculate Change in Net Working Capital (NWC)

You’ll then need to calculate change in net working capital. To find your NWC, you’ll need the Balance Sheets from two consecutive periods (a period can either be a fiscal quarter or a year). Calculate NWC for each period by subtracting the current liabilities from current assets. Subtract the earlier period’s NWC to find the change in NWC.

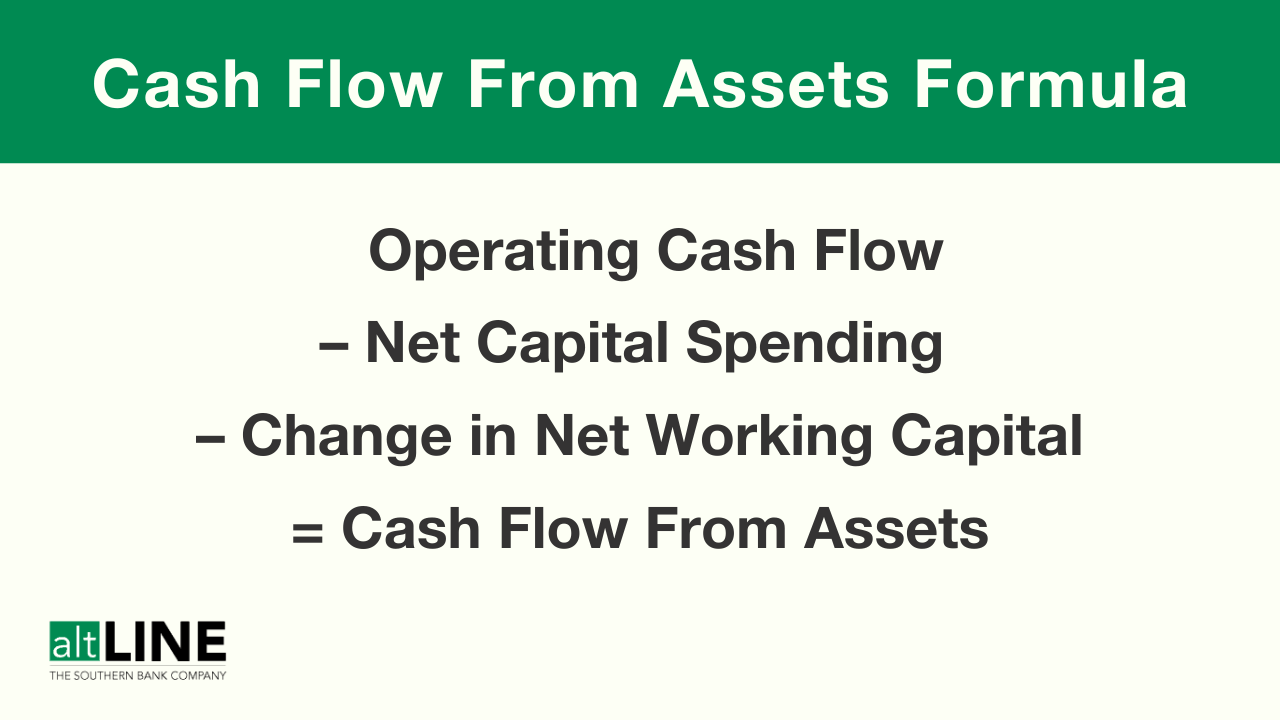

Cash Flow from Assets Formula

Once you have found your operating cash flow, net capital spending, and change in net working capital, you can then calculate cash flow from assets. The formula is as follows:

Cash Flow from Assets = Operating Cash Flow (OCF) – Net Capital Spending (NCS) – Change in Net Working Capital (▵NWC)

The resulting figure is the cash flow from assets, which indicates the total cash generated or used by the company’s assets during the period.

Cash Flow from Assets Example

To illustrate how CFFA works, we’ll describe a hypothetical scenario for a mock construction company, BrickByBrick Builders. Let’s find the CFFA for BrickbyBrick using the given data:

1. BrickbyBrick’s cash flow from operating activities (OCF) is $100,000.

2. BrickbyBrick spent $40,000 on purchasing new machinery. They also sold an old piece of equipment for $10,000. Therefore, their net capital spending (NCS) is = $30,000

3. Given the balance sheets of two consecutive years:

Year 1

Current Assets = $150,000

Current Liabilities = $100,000

Thus, NWC was $50,000 for year one.

Year 2

Current Assets = $170,000

Current Liabilities = $105,000.

Thus, NWC was $65,000 for year two.

▵NWC = $65,000 – $50,000 = $15,000

4. Now, you calculate Cash Flow from Assets by implementing the three figures into the formula:

CFFA = OCF – NCS – ▵NWC

CFFA = $100,000 – $30,000 – $15,000 = $55,000

Result: BrickbyBrick Builders’s cash flow from assets for the year is $55,000.

In this example, BrickbyBrick Builders generated $55,000 from its core assets during the year. This cash can then be used for various purposes, such as paying off debt, distributing dividends, or reinvesting in the business.

10 Ways to Increase Cash Flow from Assets

Increasing cash flow from assets is pivotal for maintaining liquidity, financing growth, and ensuring long-term sustainability. Here are several strategies a business can employ to enhance CFFA:

Optimize Operations

Streamlining operations reduces waste and inefficiencies. Ways to optimize your operations can include improving supply chain management, reducing downtime in production, and implementing lean manufacturing practices.

Ensure Efficiency of Accounting-Related Processes

Business accounting plays a vital role in the success of every company. You can accelerate the collection of accounts receivables by offering early payment discounts, regularly reviewing credit policies, and swiftly following up on overdue accounts by reaching out to customers who haven’t paid.

Monitor Inventory Levels

Avoiding overstocking and instead focusing on just-in-time inventory systems can reduce holding costs and free up cash. Note why and where you’re overstocking and develop a written plan that makes your process more efficient going forward.

Negotiate Favorable Terms with Suppliers

Securing favorable credit terms as a buyer can help you keep cash on-hand for longer. For example, rather than operating on net 15 payment terms, you could push to operate on net 30 payment terms, giving yourself more time to pay, which can improve your cash flow.

Increase Asset Utilization

You can maximize the use of assets to generate more revenue. This might mean renting out unused space or machinery, ensuring equipment operates at optimal capacity, or diversifying product lines.

Sell Underutilized Assets

Identifying and liquidating assets that aren’t essential to core business operations can create an immediate influx of cash that can be reinvested more productively.

Evaluate Costs and Reduce or Adjust as Needed

Continuously reviewing and cutting unnecessary expenses can help you maintain a better CFFA. This doesn’t have to mean reducing the quality of your products; it could involve finding more cost-effective suppliers or automating manual processes.

Manage Debt Efficiently

Refinancing high-interest debts can reduce interest payments, leading to more cash remaining in the business.

Revise Pricing Strategy

If market conditions allow, consider adjusting prices. Sometimes, even a slight increase in pricing, if justified by value addition, can boost cash flow without affecting demand significantly.

Ensure Assets Are Diversified

Putting all your marbles in a single basket is always a risky business strategy. You don’t want your business’s success to hinge on a single stock or asset. Diversifying your assets can make your profit and revenue more controllable, predictable, and ultimately reduce risk when it comes to your cash flow.

By consistently monitoring and optimizing these areas, businesses can progressively improve their cash flow from assets, ensuring they are poised for growth and resilient in the face of financial challenges.

Cash Flow from Assets FAQs

Can cash flow from assets be negative?

Yes, cash flow from assets can be negative. A negative CFFA indicates that a company has spent more cash on its assets and operations than it has generated from them during a specific time period.

Is cash flow an asset?

No, cash flow is not an asset. Instead, cash flow represents the movement of money into and out of a business over a specific period of time. Cash flow provides insights into a company’s financial health and capacity to generate positive returns for its investors.

Why is depreciation positive in cash flow?

Depreciation itself is a non-cash expense, meaning no cash is actually paid out when depreciation is recorded in the income statement. When analyzing the cash flow from operating activities, particularly under the indirect method, we start with net income and adjust for changes in working capital and non-cash expenses.

While depreciation is an expense that reduces a company’s net income, it doesn’t represent an actual cash outflow. As a result, depreciation is added back into the cash flow statement to determine the real cash generated by operating activities.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.