Last Updated September 24, 2025

It’s a problem no business owner wants to face, but likely an inevitable one—a debtor invoice going unpaid.

When one of your customers is delinquent on their invoice payment, it can create serious cash flow problems that disrupt your operations. This begs the important question of what to do next, and often, the answer involves sending the customer to a collection agency.

Most of the time, businesses are able to work with their customers to ensure that the payment is collected, even if it comes in late. But in situations where other efforts to collect unpaid invoices fail, you may be left with no choice but to send your client to collections.

This can be a tricky, unfamiliar process for new business owners. What actually happens when a bill is sent to collections? When is the right time to contact a collection agency? And how do you go about sending someone to collections?

Continue reading for a closer look at what you need to know about this process.

Key Takeaways

-

Use collections only as a last resort: Try reminders, late fees, and payment plans before involving an agency.

-

Let collection agencies handle the recovery process after contacting them: They contact the debtor, report to credit bureaus, and may pursue legal action if needed.

-

Wait until invoices are seriously overdue: Most agencies won’t take on accounts until they’re at least 60–90 days past due.

-

Strong documentation improves your chances: Keep contracts, invoices, and communication records ready before you hand a case over.

What Does It Mean to Send Someone to Collections?

Sending someone to collections means that your business is going to hire a collection agency to recover the amount you are owed by the client. It means you will no longer try to collect payment yourself. Instead, you are passing this responsibility on to a debt collection agency that specializes in collecting unpaid invoices.

What Does a Collection Agency Do?

Collection agencies take a variety of steps to recover the funds you are owed by your client. Common steps include calling personal and business phones, mailing late payment notices, confirming contact information with family, neighbors, and others, and even making in-person appearances to encourage payment.

Debt collection agencies also report the debtor’s delinquency to major credit bureaus like Equifax, Experian, and TransUnion. If the client doesn’t pay, the delinquency will be updated to “collection” status, which can significantly damage their credit score.

If the client still doesn’t pay, collection agencies may take them to court. Successful lawsuits could result in property liens, wage garnishment, or other methods to ensure debt repayment.

When Is the Right Time to Send an Unpaid Invoice to Collections?

If it seems like a customer won’t pay for the product or service they received, your first instinct might be to send their invoice to collections right away. However, collection agencies typically won’t take on your case until the invoice is 60-90 days overdue.

Be mindful of your invoice payment terms and due dates, as these will be your guidelines for when you are able to start the process of forwarding a bill to collections. With that said, you shouldn’t instinctively send a bill to collections.

Using a collection agency for unpaid invoices should be seen as more of a last resort. Make sure you’ve already tried multiple times to get in contact with the debtor, giving them ample options to pay. Then, when you’ve lost hope, you can contact the collection agency.

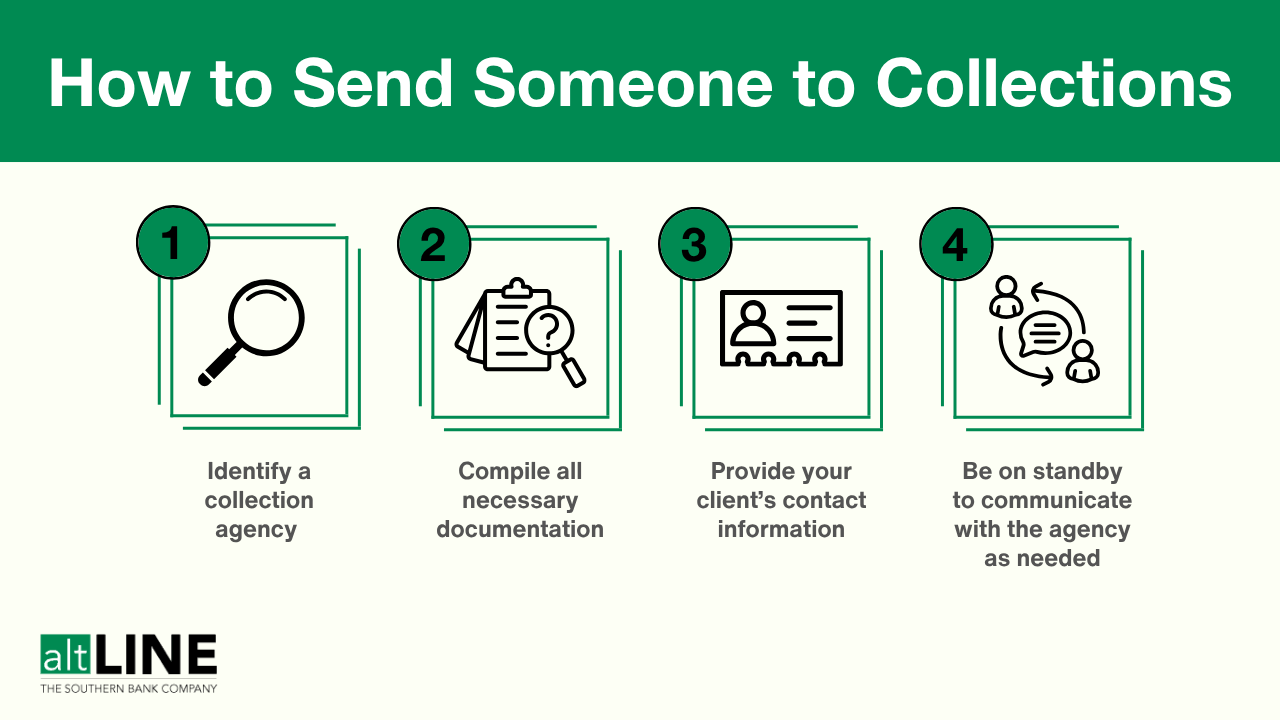

How to Send Someone to Collections

Understanding what information is needed to send someone to collections and finding a reputable collection agency to work with will help this process go smoothly.

1. Find a Collection Agency

When figuring out how to find a collection agency, don’t just select the first agency you come across. Many agencies specialize in working for different types and sizes of businesses. Make sure you select an agency that matches your business profile.

You should also ensure that your agency is properly licensed, bonded, and insured and that they follow the Fair Debt Collection Practices Act. Finally, compare their fees and contingency costs to determine if they are a good financial fit for recovering your debt.

2. Compile All Necessary Documentation

One of the most important aspects of how to send a bill to collections is ensuring you have all the necessary documentation for the collection agency. This includes the original invoice and contractual agreements between you and the client, as well as all follow-up communications regarding the unpaid invoice. If you sent the client updated invoices with added late fees, be sure to include these as well.

3. Provide Your Client’s Contact Info

While you may not have all of your client’s contact information, you should send all the information you do have to the collection agency. This is an important starting point in their efforts to contact your client and their associates.

4. Remain on Standby to Communicate With Your Collection Agency as Needed

While the work is largely in the hands of the collection agency at this point, you should be prepared to provide additional information as needed. Be sure to save the collection agency’s email and phone number so they don’t get marked as spam and you can respond quickly when they reach out to you.

How Much Does It Cost to Send Someone to a Collection Agency?

Collection agencies either charge a contingency fee or a flat rate based on the value of the debt. For contingency fees, most agencies charge 25-50% of the value of the debt. Keep in mind that it will vary between agencies, so explore your options and compare rates before making a decision.

Regardless, you are generally only charged if the agency successfully collects payment on your behalf.

Other Considerations Before Sending a Client to Collections

There are a few considerations to keep in mind before using a collection agency for unpaid invoices.

Give Your Debtor Ample Time and Attempts to Pay

Quite often, a customer won’t pay an invoice because of cash flow problems of their own. Before sending them to an invoice collection agency, you should communicate with them via email and other means to try to get them to pay or to come up with an alternative payment arrangement from what you originally agreed upon. Remain friendly, yet firm, and clearly explain late fees and the potential of getting sent to collections if payment is not made.

Ensure the Claim Is Valid

Has the client refused to pay after repeated attempts to contact them, or has the client attempted to arrange a payment agreement? Does the amount they owe you meet the minimum amount to send to collections for your state? Do you have all the documents related to the invoice and the work you performed for them? Confirming that you have a valid case is what determines whether a legitimate collection agency will work with you.

Know Your State’s Statute of Limitations

The statute of limitations for unpaid debt varies from state to state. Creditors can no longer sue in an attempt to collect debt after the statute of limitations is up—and in some states, this is as little as 3 years. While you could still technically try to pursue repayment, the invoice will essentially become uncollectible debt at this point because you will have lost legal leverage to encourage payment.

Do Not Discuss the Matter With Parties Outside the Collection Agency

Legally, debt collectors are not allowed to discuss the unpaid invoice with individuals aside from the debtor, their spouse, and their attorney. Similarly, you cannot make public statements in an attempt to get someone to pay. This could actually open you up to legal liabilities.

Do Not Threaten or Verbally Abuse Your Client

This should go without saying, but you should never threaten or verbally abuse a client in an attempt to get them to pay an invoice. You could get in serious legal trouble and damage the reputation of your own business.

Understand That Not Every Collection Attempt Is Successful

Even with the help of a collection agency, not all collection attempts are successful. In some cases, you will simply be forced to write off the unpaid invoice as a loss—and avoid working with that client again.

How to Prevent Sending Your Client to Collections in the Future

As helpful as it can be to know how to send someone to a collection agency, it is even more valuable to learn how to avoid this dilemma in the first place. Implementing some basic steps to improve your invoicing and accounting processes won’t prevent every payment issue, but it can help streamline your work and ensure you get paid in a timely manner.

Some of the most effective tactics include offering early payment discounts, clearly communicating late fees upfront, using invoice verification to ensure invoice accuracy, and potentially adjusting your invoice payment terms. Offering automated payment and e-invoicing options can further streamline the payment process for your customers.

When a client is late on their payments, be persistent but polite. Consistent communication via email can help you and your clients avoid misunderstandings and find win-win solutions—especially when you start communicating before an invoice becomes overdue. Sometimes, they might have simply forgotten about the invoice!

The Benefits of a Factoring Company

Another future alternative to resort to a collection agency is using invoice factoring to collect payment on your unpaid invoices. This is also commonly referred to as freight factoring when used by trucking companies.

Many companies use invoice factoring to sell their outstanding invoices to a third-party factoring company. The factoring company provides a cash advance based on the value of the invoice and then assumes responsibility for collecting payment. After payment is collected, the factoring company will provide the remaining balance of the invoice, minus their service fees.

However, perhaps the biggest benefit of using factoring companies is that part of their due diligence involves performing complementary credit checks on your debtors. They work to ensure you avoid working with unreliable business partners, which will reduce your chances of dealing with a collection agency.

In-Summary: How to Send Someone to Collections for an Unpaid Invoice

Understanding how to collect money from delinquent customers and how to send an unpaid invoice to collections is crucial for any business owner. With the right approach to sending and following up on invoices, you can hopefully avoid the need for collections altogether.

However, by understanding how to collect a debt from a client, working with a reputable collection agency when needed, providing all necessary documentation, and following the rules of collections, you can greatly increase your chances of getting paid.

Sending Someone to Collections FAQs

Do creditors have to notify a debtor when turning them over to a collection agency?

Technically, sending someone to collections without notice is legal. However, it’s better to notify your debtor before you send them to collections in order to give them a final chance to submit payment. If they pay, you’ll be able to avoid the high fees charged by collection agencies.

What happens when a collection agency fails to validate debt?

If a collection agency cannot validate debt, it cannot pursue payment. It cannot sue the debtor or add the debt to their credit report. This essentially ends the possibility of collections.

What happens to a bill when it is sent to collections?

Once you’ve passed the responsibility on to collections, it is no longer in your hands. The collection agency will use all legal resources to recover the debt for you.

If the collection agency is successful, you will receive the total invoice amount, minus the percentage you agreed upon that goes to the collection agency in exchange for their work.

Does being sent to collections affect your credit score?

Yes. When an account is marked as being in collections, it can significantly damage the debtor’s credit score. This often provides ample motivation for debtors to pay what they owe.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.