Last Updated March 4, 2025

For many companies, accounts receivable collection can at best be described as a chore and at worst as an anxiety-inducing experience, where just one large delinquent customer can put a business in jeopardy. Whether it’s one unreliable customer or several, business owners regularly find themselves asking the question, “how do I get paid faster?”

If you’re a new business owner, understand that customers taking long to pay invoices is likely going to be one of your most regular challenges—73% of business owners have said that their business has been negatively effected by late payments.

Thankfully, if you’re proactive in your approach to your collections, you can drastically reduce the chances of your business becoming part of this statistic.

The Common Challenge of Late Payments

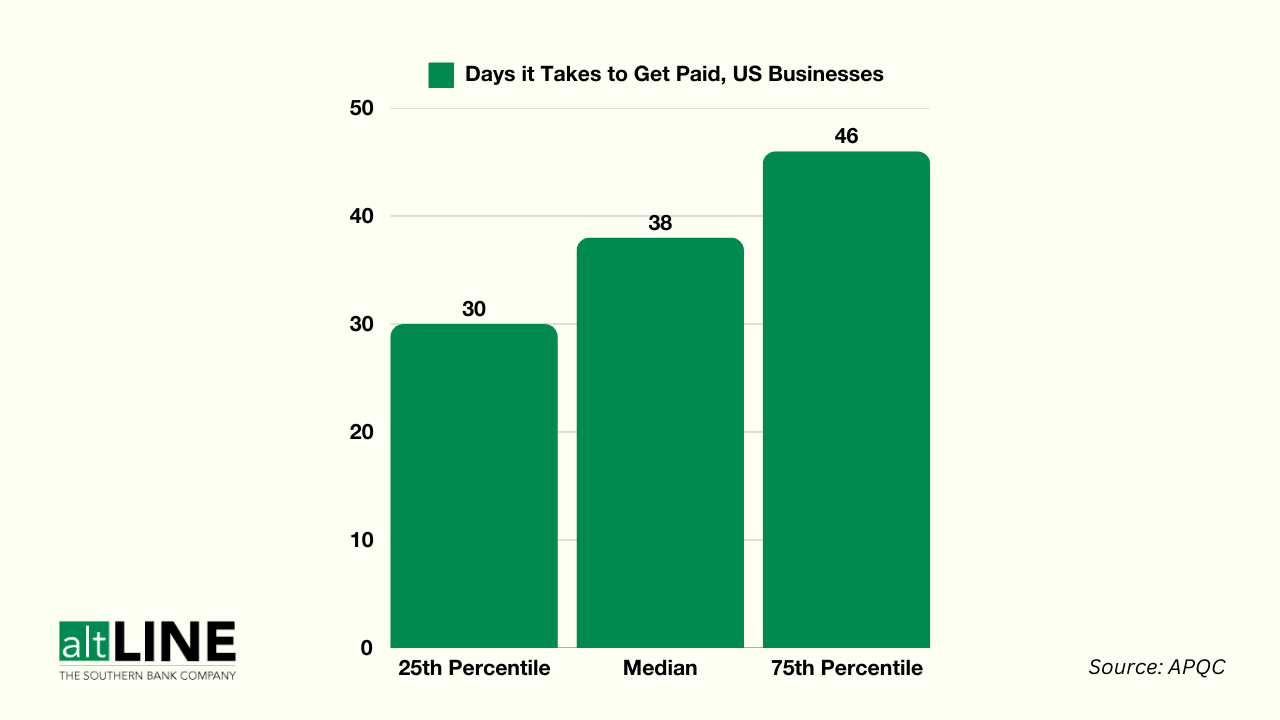

First off, if you find that your business is not getting paid for its work in a timely fashion, understand that you’re not alone. Studies show that, on average, it takes businesses 38 days to get paid.

Fortunately, this means that business owners have already found ways to get creative to accelerate payment that you can draw inspiration from. So with that said, let’s dive into our tips to get your invoices paid faster.

Tips for Getting Your Invoices Paid Faster

There are numerous methods to accelerate invoice payment, whether it be by getting creative with payment discounts or automating accounts receivable processes. Below is a list of 11 tips that can help you get money in the door quicker.

Ensure Invoice Accuracy Through Invoice Verification

You might wonder what this has to do with getting paid faster. That’s a fair question, but in A/R collection, time is truly money. Any delay caused by an error on an invoice can prove costly and hinder cash flow due to the process being paused, leading to being paid later than expected.

Check and double-check invoice accuracy through completing the process of invoice verification. Make sure payment terms, remit to addresses, and invoice destinations are correct. At year-end, further ensure accuracy by matching invoice payments with bank statements, a process called invoice reconciliation. In general, maintain a system that ensures your invoice and payment doesn’t get lost.

Encourage On-Time Payments Through Offering Early Payment Discounts

Have some good customers that always pay on-time? Reward them! Offer them additional services that make them want to continue the behavior, or more specifically, discounts for early payment.

Early payment discounts can also encourage customers who take a while to pay to adjust their habits.

Say you’re working on net 30 terms and the respective customer continuously waits until the final few days of the cycle to fork over the cash. Reach out to them and try offering 2/10 net 30, which denotes a 2% discount if payment is submitted within 10 days. Your unreliable customers should hopefully realize that paying an invoice early is worth it to receive a discount.

Be Persistent, But Patient with Slow-Paying Customers

Collecting payment can at times be difficult no matter how solid your process; this is an inevitable aspect of running a business and selling products or services.

It’s easy to ignore and hope for the best when faced with delayed payments. While no one likes to face the likelihood of a write-off, the sooner you communicate concerns with a delinquent customer, the sooner you will resolve the issue. Don’t let a bad customer put you out of business, monitor all your customers’ payment behaviors and be prepared to respond to any negative trends.

However, remember that your customers likely have other vendors, their own delinquent customers, and their own cash balance to work with – smiling, maintaining a positive attitude, and listening goes a long way in facilitating payment.

However, just as they need to stay on top of making payments, you should stay on top of their progress and send reminders when needed.

Create an Email Template to Politely Remind Customers About Payment

One way to stay persistent is by having an effective communication plan. For instance, creating email templates to politely ask for payment will save you time in the long run and assist in avoiding having to charge your customers further late fees.

Invoice reminders are critical. Everyone forgets things once in a while, and your customers are no different. Make sure your business sends consistent reminders, not only after a payment is late, but also leading up to the due date. These reminders should be polite and informative, ensuring your customer sees them as both important and helpful.

Reduce Your Payment Terms

If your business operates on Net 60 or Net 90 terms and you’re struggling to keep cash on hand, you need to reduce your payment terms; a few reasonable alternatives being Net 15 or Net 30. This means the payment turnaround will be reduced, and you won’t be stuck waiting months for the cash to arrive. This can also keep your invoices more top-of-mind for your customers.

If long payment cycles or accounts receivable collection remains a challenge for your business, you might be a good candidate for altLINE’s invoice factoring or AR financing program. Contact us today and we’ll fill you in on how we help businesses accelerate payment and improve their financial health.

Offer Automated Payment

Automation can help your business stay on top of invoicing your customers, while decreasing the amount of time your team spends on collection. 80% of business owners who utilize AR automation software have said that it’s considerably boosted effiency.

Using automation tools like Quickbooks, you can set up automatic invoicing, reminders, fees and more. These tools are affordable and usually supported by 24/7 tech support.

In general, business owners should explore automating and digitizing processes wherever possible to reduce manual labor and boost efficiency. Running your own business comes with juggling multiple tasks and responsibilities.

Use E-Invoicing Software

Speaking of boosting efficiency, electronic invoicing reduces manual labor, accelerates the payment process, and lessens the chances of human error. E-invoicing software is aimed to take this a step further by automating the invoice matching and validation processes.

E-invoicing software is cloud based, so no need to worry about downloading large files onto your computer. Some of the most common software utilized are Quickbooks, Freshbooks, and BILL.

Charge Late Fees

No matter how much effort and thought you’re devoting to optimizing accounts receivable, you’ll eventually deal with a customer who doesn’t abide by payment terms.

Rest assured that late fees are common, and your business should leverage them if you have late-paying customers. These fees incentivize on-time payment and help ensure your customers meet their due dates. However, before charging late fees, make sure you’ve notified your customers up front of the financial risk involved in late payment.

Have a Good Invoice Template

If you’re following all of these steps and you still feel like you’re dealing with an abnormally high number of unreliable customers, it’s time to get back to the basics.

Your invoice template is important. Ensure that it’s branded, professional and easy to read. You want your customers to take your invoices seriously, but also fully understand the bill. You can find pre-built templates for free online, or you can leverage your invoice automation tool to create custom templates.

Here are a few invoice templates that might be relevant to your business to help you get started:

Get in the Habit of Dedicating Time to Payment Collection

All too often, business owners ship products, or provide the service, then cross their fingers and hope for the best.

This is more of a general tip, but blocking off time every day (or couple of days) to review collections and track payment progress on your outstanding invoices can ensure no invoice is forgotten about. If you fail to monitor progress, you might not realize an invoice payment is late until it’s already affected your cash flow.

Jeff Mains, CEO of Champion Leadership Group, urges proactiveness—having systems in place that monitor individual payment statuses before they become problematic.

“I implemented a system that flags accounts approaching their payment terms, allowing us to engage with customers before payments become overdue,” Mains said. “This preemptive communication strategy helps identify potential issues early on and maintain healthy cash flows.”

The more you’re on top of collection, the lower the chance your cash flow is affected by slow-paying customers.

Try Invoice Factoring

Invoice factoring is a form of alternative financing that converts your outstanding invoices into cash by selling them to a third party, or factoring company, in exchange for a cash advance. It’s a particularly popular financing method for small business owners looking to get paid faster and improve cash flow in the process.

For more information, fill out our free factoring quote form or give us a call at +1 (205) 607-0811.

In-Summary: How to Get Your Invoices Paid Faster

Unfortunately, there’s no tip that can guarantee invoices will always be paid timely. If a customer is struggling with cash flow problems and can’t come up with the funds to pay for a service after it’s been provided, the situation is effectively out of your hands.

However, implementing as many of these tips to get invoices paid faster as possible will increase the likelihood that you’re getting paid on-time. If nothing works, it might be time to finance your invoices by using invoice factoring.

Grey was previously the Director of Marketing for altLINE by The Southern Bank. With 10 years’ experience in digital marketing, content creation and small business operations, he helped businesses find the information they needed to make informed decisions about invoice factoring and A/R financing.