Last Updated December 2, 2025

For many businesses, net 15 is a go-to payment term. Though it’s important to have a full understanding of what comes with net 15 payment terms before moving forward, especially if you’re new to business accounting.

Both buyer and seller can benefit from utilizing net 15, so let’s take a closer look at the meaning behind these terms, how it works, and the pros and cons of net 15 billing.

Key Takeaways

- Understanding Net 15 Terms: Customers have 15 days to pay an invoice, usually from the invoice date, and clear terms improve cash flow and prevent misunderstandings.

- Net 15 Payment Examples: Terms appear on the invoice with the number, date, and due date, ensuring accuracy and professionalism while allowing for late fees or early payment discounts.

- Other Invoice Payment Terms: Alternatives include net 7, net 10, net 30, net 60, net 90, PIA, EOM, and immediate payment, with longer terms often requiring strategies like invoice factoring to maintain cash flow.

- Net 15 vs. Net 30: Net 15 accelerates cash flow but can stress buyers, while net 30 gives more time, benefiting larger clients, and you should consider job size, cost, and business scale.

What Are Net 15 Payment Terms?

An invoice with net 15 terms means that a customer has 15 days to pay their invoice in full. Typically, the payment is due 15 days from the date that you send an invoice (when invoicing digitally), or 15 days from the date the buyer received the invoice (when the invoice is sent by mail).

In some cases, however, net 15 payment terms begin when goods or services were shipped or received.

When used properly, net 15 terms can improve cash flow and help you avoid miscommunications with your customers by setting a firm deadline for invoice payments.

Net 15 Payment Terms Example

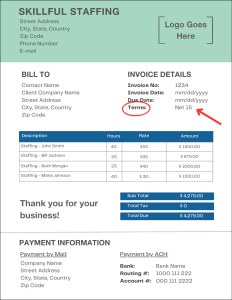

Let’s take a look at an example invoice that uses net 15 terms:

As you can see in this example, the terms (in this case, net 15) are listed near the top of the invoice alongside other key pieces of information that are used for accounts payable management, including the invoice number and date, and the payment due date.

The dates on the invoice should line up with net 15 payment terms. In other words, if the invoice terms are net 15, the due date shouldn’t be 22 days from the invoice date. Make sure your dates and terms line up to avoid confusion.

Using a professional invoice template will ensure that your net 15 terms and payment due date are easily seen by the customer to avoid any miscommunications. This will also provide a professional look for your company, helping you maintain a strong reputation with your customers.

You should also have a standardized practice for how you will collect unpaid invoices and communicate with customers when their net 15 payment due date is approaching. For example, organizations should have a process in place for charging late fees for payments made after the due date. Alternatively, others offer discounts for early payments.

Regardless, this information should be clearly communicated upfront when entering into an agreement with a customer. It should also be reiterated when you send your invoice.

Other Common Invoice Payment Terms

While net 15 is a popular invoice payment term, it is far from the only option available. Here is a closer look at other alternatives your business could consider.

Net [D]

Net 15 is one of several “Net” payment terms that are used by businesses. Other common net invoice terms include net 7, net 10, net 30, net 60, and net 90. Similar to net 15, these other payment terms require payment to be made within the set number of calendar days indicated by the invoice.

Generally speaking, businesses that use longer payment terms like net 60 or net 90 are larger organizations like manufacturing companies. This is because their projects are typically very comprehensive and expensive, so the longer payment terms allow for more time for the buyer to come up with the cash. To avoid cash flow problems, the seller in these instances often rely on invoice factoring, rather than waiting months to get paid.

PIA (Payable in Advance)

Payable in advance (also called payment in advance) is when a customer pays the business upfront — before a product or service is actually provided. This method is often used by freelancers or consultants. Payment is received either before the project begins or after certain project milestones are reached. Sometimes, the funds are paid by the customer and held in escrow until work has been completed, after which it is released to the contractor.

EOM (End of Month)

End of Month invoicing can serve as a more convenient invoicing solution for both customers and businesses. Rather than sending an invoice every two weeks or as individual services are completed, businesses or contractors will send a single invoice covering all work provided during a specific period, with payment due by the end of the month.

While this type of invoicing can streamline paperwork, it requires careful cash flow monitoring, since the bulk of payments sent and received will occur at the end of the month.

Immediate Payment

Finally, some invoices require payment due upon receipt — this is most often seen when buying a product in a store. Customers have to pay then and there. When businesses send these types of invoices, they use payment terms like “payable upon receipt” or “cash on delivery” to indicate that immediate payment is required. This type of invoicing is most common with retailers and businesses that serve everyday consumers, rather than other businesses.

Deciding Between Net 15 vs. Net 30

Many businesses that consider net 15 payment terms for their invoicing also consider net 30. Instead of giving your customers 15 days to pay their invoice, net 30 terms give them 30 days to complete their payment. Though these payment terms are very similar, those extra 15 days to make a payment can make a bigger difference than you would expect!

Let’s break down some of the differences and pros and cons between net 15 vs. net 30, and how they could affect your customers and your own operations. Remember, these pros and cons are aimed toward the selling business – the business receiving payment.

| With these payment terms… | Net 15 | Net 30 |

| Your business gets paid quicker | ✔️ | |

| More stress on buyers who have their own cash flow problems | ✔️ | |

| Higher chance for customers to pay the invoice in full (provides more time to come up with cash) | ✔️ | |

| Your business is more attractive to buyers who are unable to pay in advance or upon receipt | ✔️ | ✔️ |

| You can build consistent revenue pipelines and streamline invoicing processes | ✔️ | ✔️ |

| Small businesses with limited working capital and cash flow can benefit most due to receiving cash quicker | ✔️ | |

| Medium to large businesses that don’t need instant working capital can benefit most due to allowing customers more time to pay | ✔️ |

In-Summary: Net 15 Terms

Still trying to decide whether to use net 15 or net 30 terms? Focus on these factors to determine which payment term is right for you:

- The size of the job

- The cost of the job

- The size of your business

Generally speaking, larger, costlier jobs usually have longer payment terms to allow businesses and their customers to better manage overhead expenses. Smaller jobs (such as work performed by an independent contractor) usually have shorter net terms because the work is less expensive and is completed in a relatively short period.

Remember, there’s not necessarily a one size fits all approach to net payment terms. Your end goal should be improving customer payment and ensuring that you have adequate cash flow for managing your everyday business activities. Find what works best for you and your customers, then ensure good communication and follow up so that all payments are made in a timely manner.

Net 15 FAQs

Are net 15 payment terms standard?

Yes, Net 15 payment terms are a standard invoicing option. Using Net 15 can help standardize invoice reconciliation, tracking payment status, and other accounting activities that can affect your cash flow. Businesses should clearly communicate the payment terms they use when entering a relationship with a new customer to avoid late payments and other potential issues.

What does net 15 mean on an invoice?

Net 15 means that a customer has 15 calendar days to submit payment for the invoice. Depending on the invoice terms, this could be 15 days from the date the invoice was issued, or the date it was received.

Do net payment terms include weekends?

Generally speaking, net payment terms are expected to include weekends. So, if an invoice says, “Net 15,” it means the customer needs to pay the invoice within 15 calendar days. However, businesses and customers may sometimes choose to only include business days in the Net terms. This should be made clear during contract negotiations.

Jim is the General Manager of altLINE by The Southern Bank. altLINE partners with lenders nationwide to provide invoice factoring and accounts receivable financing to their small and medium-sized business customers. altLINE is a direct bank lender and a division of The Southern Bank Company, a community bank originally founded in 1936.