Can You Have More Than One Invoice Factoring Company?

Last Updated February 9, 2023

For several years, invoice factoring has been closing the small business financing gap. Sometimes, however, small businesses need more funding opportunities to sustain cash flow, and they are curious to know if they can receive funds from different factoring companies at the same time.

We know invoice factoring is a great financing alternative, and you might just wonder if selling your invoices to two factoring companies can be an even better alternative.

As great as this may sound, you cannot have more than one invoice factoring company at a time.

This article will help you understand why you can only have one factoring company at a time and will show you how you can switch invoice factoring companies if you would prefer to work with a different factor.

Why Can’t I Work With Two Factoring Companies at Once?

There might be a need to change your current factoring company if you’re not satisfied with their services. However, it becomes a problem if you continue to work with them and try to work with another factoring company at the same time.

Working with two factoring companies at once can be unethical, and even though it’s not technically illegal (unless you fraudulently sell the same invoices to two different factors), it can have serious implications for your business and cause complications with the two factoring companies.

There are two primary reasons why you usually cannot work with two factoring companies at once:

- UCC filings

- Factoring contracts

UCC Filings

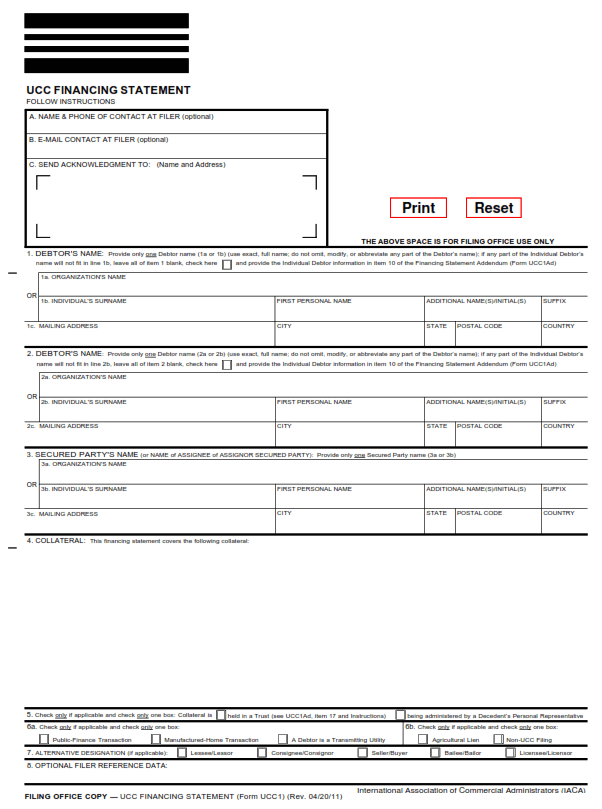

The UCC, which stands for Uniform Commercial Code, is a regulatory model (often thought of as a set of laws) that manage commercial transactions across the United States. When you are approved to receive funding from a lender, that lender typically files a UCC-1, which essentially states that the lender (referred to as the “creditor”) has a security interest in your company (referred to as the “debtor”). This filing announces that the creditor has a lien on some or all of your company’s assets, meaning if you fail to repay what is owed to the creditor, they have a legal right to seize the assets in question.

According to Stanley DeWitt, Account Onboarding Coordinator at altLINE, “UCCs get filed for all sorts of things. When a UCC is filed it ensures that the filer has a secured interest on whatever is listed as collateral from the debtor. For example, when we file our UCC against accounts receivables it provides us with a legally recognized claim of the invoices and protects our investment in the event of default.”

UCC-1 form for Alabama

While multiple lenders can file UCCs on a single company, the order in which these are filed makes a big difference. The first to file a UCC-1 receives the first-position lien, meaning they are first in line to access the company’s assets if it were to default. Other lenders can take a second-position or even a third-position lien, but many will not do so because they do not want to take on the greater risk.

Because lenders typically do not like to have a second-position lien, you will find it is difficult to get multiple factoring companies to work with you at one time because one of them will always have to assume a greater risk of non-payment.

Our Account Onboarding Coordinator Stanley goes on to explain this further, “A factor needs a sole secured interest in all receivables to insure against the advances they send to the client.”

Factoring Contracts

Oftentimes, you will find that factoring contracts include language that prevents a client from working with multiple factoring companies. This contractual obligation is typically included for two reasons:

- To reduce the risk of non-payment to the factoring company

- To avoid the purchase of fraudulent invoices

While the first point is covered above in the explanation of how multiple UCC filings can increase the risk of non-payment, the second point has more to do with the factoring company’s desire to avoid unnecessary legal headaches.

A client can only sell an invoice to a single factoring company; however, some shady clients may try to get double the cash by illegally selling a single invoice to multiple factors. When a business tries to sell the same invoice multiple times, it is committing fraud, so many invoice factoring companies will write into their contracts that you can only work with a single factor to avoid this risk.

How Do I Choose the Best Factoring Company?

Now that you know why you can’t work with more than one factoring company at once, you need to choose the best factoring company that suits your business needs and long-term goals. Different factoring companies have different contract terms, such as factoring fees, payment/contract duration, and funding limits. To choose the right fit for your business, it is important to consider details like:

Source of Funds: A factoring company’s source of funds can impact their factoring fees and how quickly they can send you a cash advance. Factoring with a bank like altLINE means you avoid working with a middleman, resulting in lower factoring fees, faster funding periods, and greater transparency.

Expertise: How long has this factoring company been in business? Do they have more success with businesses in your industry? Knowing the expertise of the factoring company you want to work with provides stability for not just your business but your long-term goals as well.

Customer Relationship: Experience in both customer relations and clientele support is an important requirement for a professional factoring company. Since invoice factoring can affect your customer relationships, it is best to work with a company that has your interests and that of your customers as the central focus of their operations. This will help you retain the trust and loyalty of your customers.

How Do I Switch Factoring Companies?

If you realize that your current factoring company is not meeting your business expectations, it may be time to switch to one that can serve you better. Switching invoice factoring companies requires you to conduct thorough research on the best exit strategy by looking at the termination conditions in your contract. These conditions may include a termination notification period or termination fees, and you will have to follow the specified process before you can switch to another company of your choice.

To switch factoring companies, you need to:

- Understand the cost of termination

- Fulfill the specified agreement terms

- Terminate the existing UCC filing (this can also happen once you are approved with another factoring company but before they file a UCC)

- Research and select a different factoring company that will serve you better

Give altLINE a Call

altLINE is a top-rated factoring company that doubles as a bank, so you can receive lower rates and greater transparency during the factoring process. Our team also has more than 80 years of experience serving customers, and we have an A+ rating by the Better Business Bureau.

At altLINE, we want to help your business succeed by providing the working capital you need to grow your company. To see how we can help your business get the funding it needs, fill out this form, and we will be in touch shortly.

FAQs

Can you have two factoring companies at the same time?

Generally, no, you cannot have two factoring companies at the same time. Most factoring companies include language in their contracts that prevents clients from working with another factor. They often do this to reduce their own risk of both non-payment and buying fraudulent invoices.

Can you switch factoring companies?

Yes, you can switch factoring companies. However, you’ll need to terminate all previous factoring agreements accordingly. Read more about how to switch factoring companies here.

Can you break an invoice factoring contract?

Yes, you can break an invoice factoring contract provided you understand the cost of termination and follow the process laid out in the agreement.

Deborah Sabinus is a content marketing writer who works across B2B SaaS and Finance industries. She specializes in bridging the gap between businesses and their audience through content. She is committed to helping readers understand complex topics and help them make informed decisions with content.